BREAKING: CBO Shocks Nation with Bill Cost Revision! — CBO Budget Update, Economic Impact of Spending Bills, Federal Borrowing Costs 2025

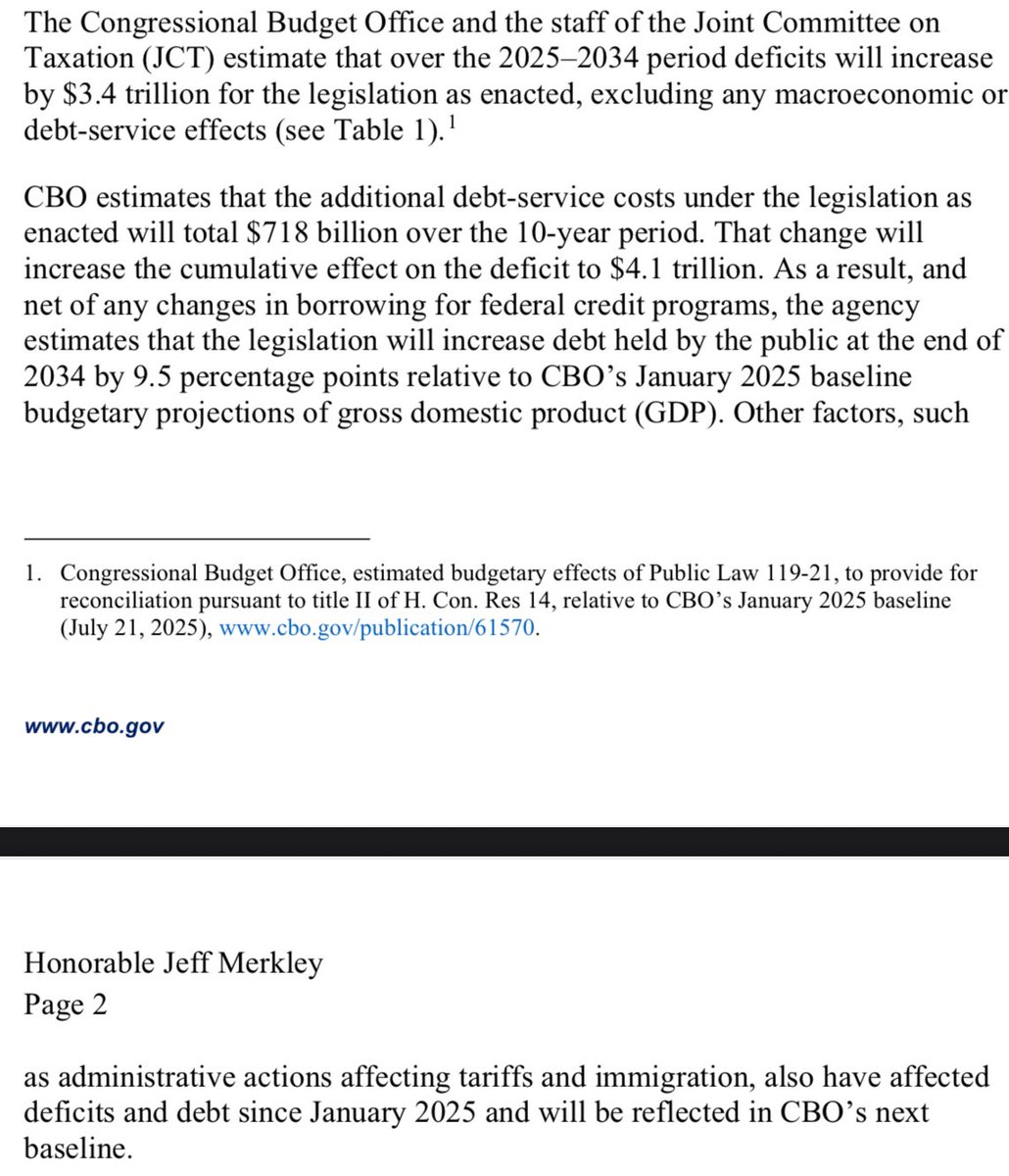

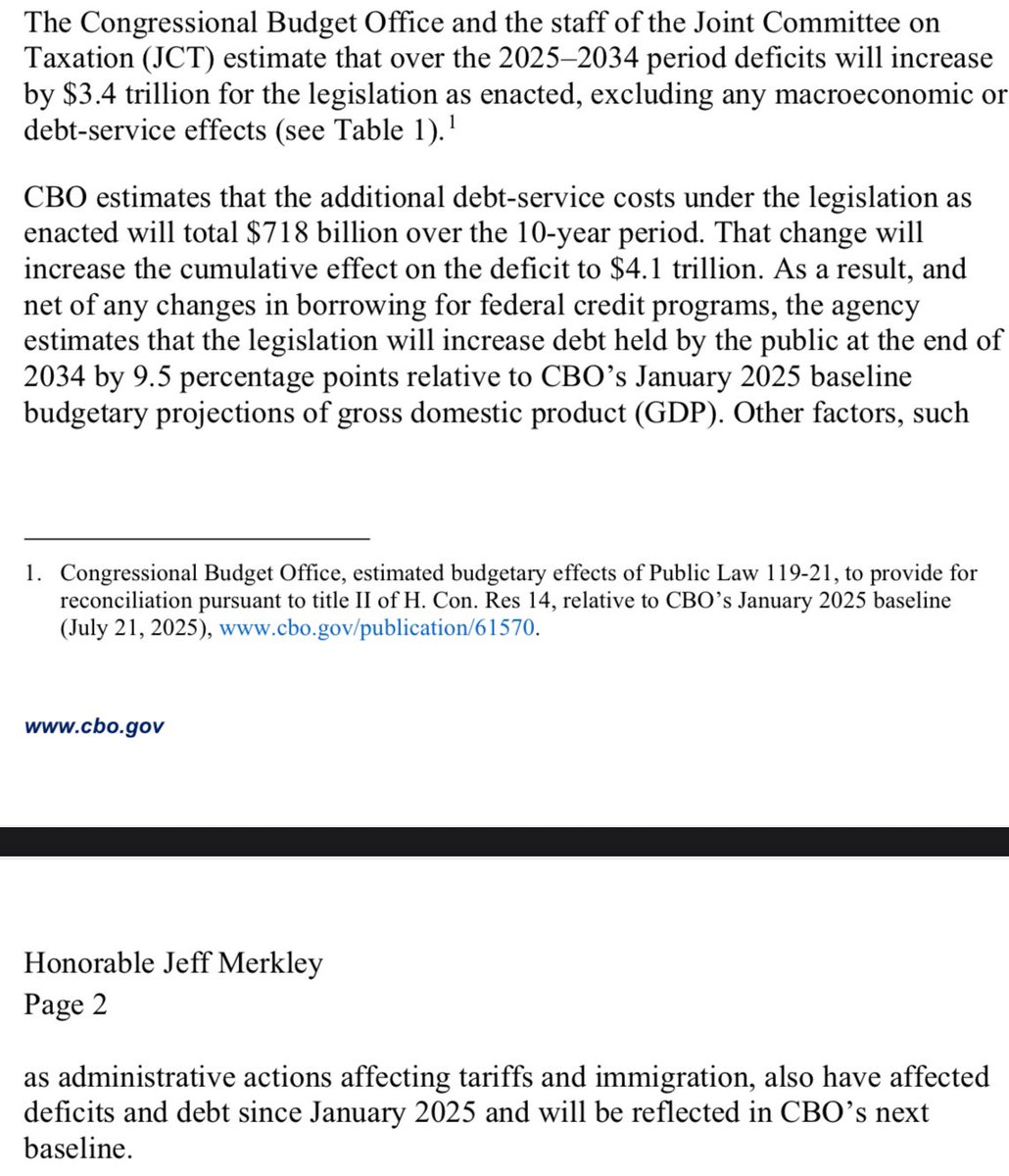

The Congressional Budget Office (CBO) has revised the estimated costs of the “Big Beautiful Bill,” reflecting increased borrowing costs. This adjustment highlights the ongoing economic implications and financial burdens associated with significant government spending. As discussions around fiscal policy continue, understanding the impact of such revisions is crucial for taxpayers and policymakers alike. This update serves as an important reminder of the complexities involved in budgetary decisions and the potential for rising costs. Stay informed on the latest developments regarding government spending and fiscal responsibility. Follow for more insights on economic policies and their effects on the public.

BREAKING: CBO REVISES COST OF BIG BEAUTIFUL BILL TO ACCOUNT FOR INCREASED COSTS OF BORROWING. pic.twitter.com/dFGQmwH2Cw

— Maine (@TheMaineWonk) August 4, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

BREAKING: CBO REVISES COST OF BIG BEAUTIFUL BILL TO ACCOUNT FOR INCREASED COSTS OF BORROWING

In an unexpected twist, the Congressional Budget Office (CBO) has revised the estimated costs associated with the much-discussed Big Beautiful Bill. This revision primarily accounts for the increased costs of borrowing, which could have significant implications for the federal budget and taxpayers alike. If you’ve been following the developments surrounding this bill, you might want to take a closer look at what this means for the economy and future legislations.

Understanding the Impact of Increased Borrowing Costs

When the CBO announced this revision, it sent ripples through the political landscape. Increased borrowing costs can stem from various factors, including rising interest rates and economic uncertainties. Essentially, when the government needs to borrow more to fund initiatives, those rising costs translate into larger deficits. This can lead to tougher decisions down the line about where to allocate resources and how to manage public spending.

What Does This Mean for the Big Beautiful Bill?

The Big Beautiful Bill, which aims to address several critical areas, including infrastructure, healthcare, and education, is now facing a more daunting financial outlook. With the CBO’s revised estimates, stakeholders need to reassess the feasibility of the bill in its current form. This might prompt lawmakers to reconsider certain components or even the overall funding strategy. The implications of this revision could affect everything from how quickly projects can be funded to the types of taxes that might need to be implemented to cover the costs.

Political Reactions and Future Considerations

Reactions to the CBO’s revision have been mixed. Supporters of the Big Beautiful Bill argue that the long-term benefits outweigh the short-term costs, while opponents are quick to point out the potential for increased national debt. The debate is likely to intensify as lawmakers grapple with how to proceed. Will they push for amendments to reduce costs? Or will they double down on their commitment to the bill’s objectives, believing that the investment is worth the risk?

The Broader Economic Implications

This situation is not just about one piece of legislation; it reflects broader economic realities. The CBO’s updates serve as a reminder of how quickly things can change in the fiscal landscape. As we navigate these economic waters, it’s essential for everyone—from policymakers to everyday citizens—to stay informed about how such changes can impact personal finances, public services, and the economy as a whole.

Stay Updated on Legislative Changes

As more details emerge regarding the Big Beautiful Bill and its financial implications, staying informed is crucial. For those interested in the specifics of the CBO’s revision and its potential impacts, resources like the official [CBO website](https://www.cbo.gov/) can provide thorough insights. Engaging with a variety of news sources will also offer a well-rounded perspective on this evolving story.

In the end, understanding how these revisions affect both current and future policies is vital. Whether you’re a taxpayer, a policy enthusiast, or someone simply curious about government spending, the CBO’s revision signals a turning point worth paying attention to.