Trump’s $29.6B Tariff Windfall: Time to Abolish the IRS? — Record Tariff Revenue, End the IRS Debate, Trump Economic Impact 2025

Donald trump Achieves Record Tariff Revenue

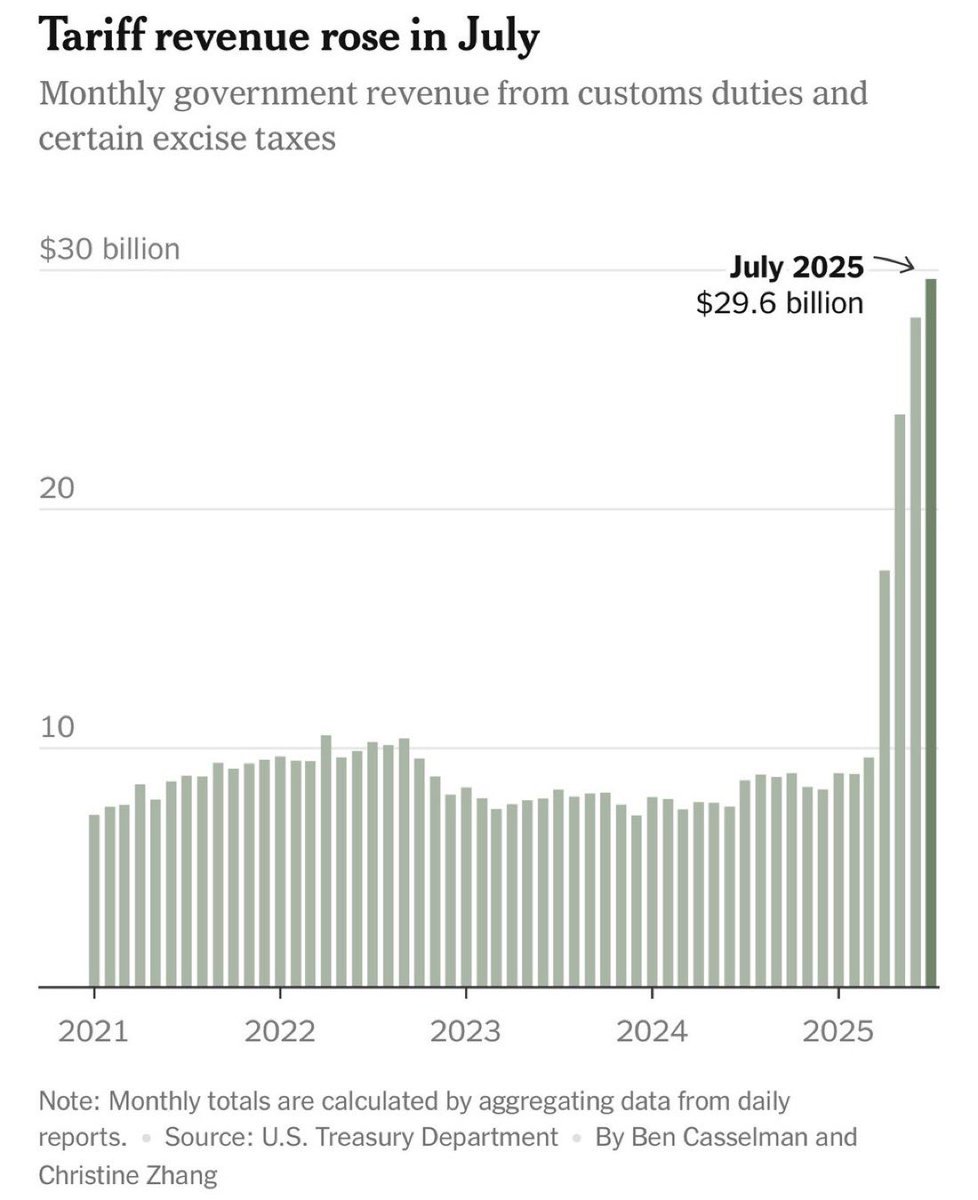

In a groundbreaking announcement, Donald Trump reported a record-breaking $29.6 billion in tariffs for July 2025. This impressive financial milestone underscores the effectiveness of his administration’s trade policies. Advocates are calling for the abolition of the IRS, arguing that with such substantial tariff revenue, the agency is no longer necessary. This significant development has sparked discussions among supporters, emphasizing its potential impact on the economy. As Trump continues to push for reforms, the implications of this tariff revenue could reshape fiscal policies and the American financial landscape. Stay informed on the latest updates and economic insights.

BREAKING Donald Trump brought in ANOTHER Record breaking month, July $29.6 billion in tariffs

ABOLISH THE IRS. WE DON’T NEED IT ANYMORE

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

THIS IS HUGE pic.twitter.com/8ISqp27Cce

— MAGA Voice (@MAGAVoice) August 3, 2025

BREAKING Donald Trump brought in ANOTHER Record breaking month, July $29.6 billion in tariffs

July has proven to be a remarkable month for the economy, particularly under the leadership of former President Donald Trump. The announcement that the country brought in an astounding $29.6 billion in tariffs has stirred considerable conversation. This figure not only showcases significant revenue generation but also highlights the ongoing impact of Trump’s trade policies. Many supporters see this as a testament to the effectiveness of his administration’s approach to international trade.

ABOLISH THE IRS. WE DON’T NEED IT ANYMORE

The call to abolish the IRS has gained momentum, especially among those who believe that the current tax system is outdated and burdensome. Trump’s supporters argue that with such substantial tariff revenues, the need for a complicated tax agency diminishes. The idea is that a simplified system could streamline collections and alleviate the financial pressure on average Americans. The conversation surrounding tax reform is evolving, and many are eager to explore alternatives to the traditional structure.

THIS IS HUGE

The implications of these tariffs and the subsequent discussions about the IRS are huge. For many, it signals a shift not just in economic policy but in how the government interacts with its citizens. The record-breaking revenue from tariffs could lead to a reevaluation of federal funding and spending priorities. It’s a hot topic that evokes strong feelings across the political spectrum, with supporters claiming it benefits American workers and critics raising concerns about the long-term effects on trade relationships.

As discussions continue, it’s essential to stay informed about how these changes could affect everyday life. The potential for a more straightforward tax system could mean more money in the pockets of Americans. However, understanding the broader implications of tariff revenues is equally crucial. These tariffs can impact consumer prices, trade negotiations, and the overall economy.

In this dynamic political climate, it’s essential to engage with these topics thoughtfully. Whether you support Trump’s policies or not, the economic outcomes are significant and merit discussion. With the potential for further changes on the horizon, now is the time to voice your opinion and stay engaged in the conversation about America’s fiscal future.

For those keen on exploring more about the implications of tariffs and the IRS, following credible sources and analysts can provide deeper insights. Engaging with the news and participating in discussions can help shape a more informed perspective on these critical issues.

“`