Retail Investors Crush Hedge Funds in Shocking Upset! — Hedge Fund News, Retail Investor Trends, Hedge Fund Performance 2025

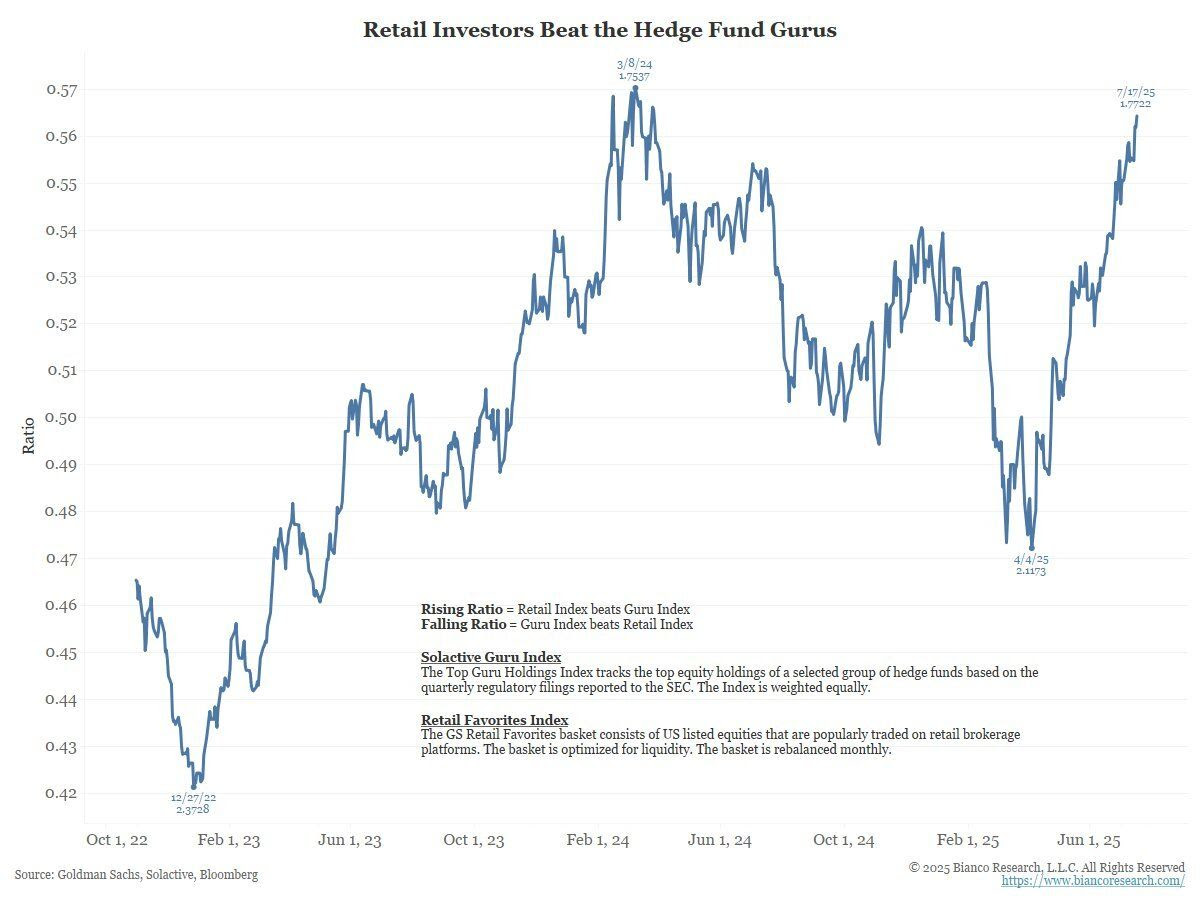

Retail investors are outpacing hedge funds by the largest margin since early 2024, according to a breaking tweet from Barchart. This significant trend highlights the growing influence of retail investors in the financial markets, showcasing their ability to generate impressive returns and challenge institutional investors. The tweet, which includes a compelling image, emphasizes the excitement surrounding this shift and celebrates the successes of individual investors. As retail participation continues to rise, the dynamics of the market are shifting, allowing everyday investors to make substantial impacts. Stay informed about this evolving landscape and its implications for future investments.

BREAKING : Hedge Funds

Retail Investors absolutely smashing hedge funds by the biggest margin since early 2024 pic.twitter.com/jNMZlL4EJC

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Barchart (@Barchart) July 18, 2025

BREAKING : Hedge Funds

If you’ve been keeping an eye on the stock market lately, you might have stumbled upon some electrifying news: retail investors are absolutely smashing hedge funds by the biggest margin since early 2024! This isn’t just a minor blip; it’s a significant moment in the financial landscape, and it’s got everyone buzzing. With retail investors flexing their muscles, we’re witnessing a shift in how the investment game is played.

Retail Investors Absolutely Smashing Hedge Funds

So, what does it mean when we say retail investors are dominating hedge funds? Essentially, more everyday individuals are stepping into the stock market and making some serious gains. With platforms like Robinhood and E*TRADE simplifying trading, more people are dipping their toes into investing. They’re not just dipping; they’re diving in headfirst and coming out on top. You can see the excitement in the [Barchart tweet](https://twitter.com/Barchart/status/1946188852441276624?ref_src=twsrc%5Etfw) that announced this thrilling news, and it’s hard not to feel the energy!

The surge of retail investors isn’t just about numbers; it’s about strategy. Many are now armed with advanced tools, online communities, and information sharing, which allows them to make informed decisions fast. They’re no longer just following the traditional playbook that hedge funds typically rely on. Instead, they’re finding innovative ways to analyze stocks and trends, often leading to impressive returns.

By the Biggest Margin Since Early 2024

This is where things get even more interesting. The margin by which retail investors are outperforming hedge funds is significant. In fact, it’s the biggest gap we’ve seen since early 2024. It’s like watching an underdog team take the championship title against all odds. Retail investors are not just competing; they’re leading the charge, and it’s a testament to their resilience and ambition.

The shift in market dynamics also reflects a growing confidence among the retail crowd. Gone are the days when hedge funds were seen as the titans of the investing world. Now, regular folks with a smartphone and a keen eye for trends are shaking things up. This democratization of investing is not just a trend; it’s a revolution. The more people engage in investing, the more diverse the market becomes, which can ultimately lead to healthier economic growth.

What This Means for the Future

As we look forward, the implications of this trend are profound. If retail investors continue to perform well, we could see a major shift in how hedge funds operate. They might need to rethink their strategies and adapt to a new reality where individuals are just as powerful as institutional investors. This could lead to more transparency, better fees, and overall a more equitable market for everyone involved.

In the end, the surge of retail investors smashing hedge funds is more than just a headline; it’s a movement. It signifies a new era in investing where knowledge, community, and determination can level the playing field. So, if you’re a retail investor, keep your head up! The future looks bright, and your contributions are changing the game for the better.

Stay tuned for more updates and insights as this exciting narrative unfolds!