JUST IN: 140K Bitcoin Hoarded This July – Who’s Behind It? — Bitcoin market surge, July cryptocurrency trends, fresh Bitcoin investments 2025

New Bitcoin entrants have made a significant impact in July 2025 by accumulating 140,000 Bitcoin, indicating a surge in new investment. This influx of capital showcases the growing interest in Bitcoin as a digital asset. As more individuals and institutions enter the market, the demand for Bitcoin continues to rise, potentially driving prices higher. The trend suggests a bullish outlook for Bitcoin’s future, as new money stacks up rapidly. For those looking to invest in cryptocurrency, this movement represents an exciting opportunity to engage with one of the most dynamic financial assets in today’s market.

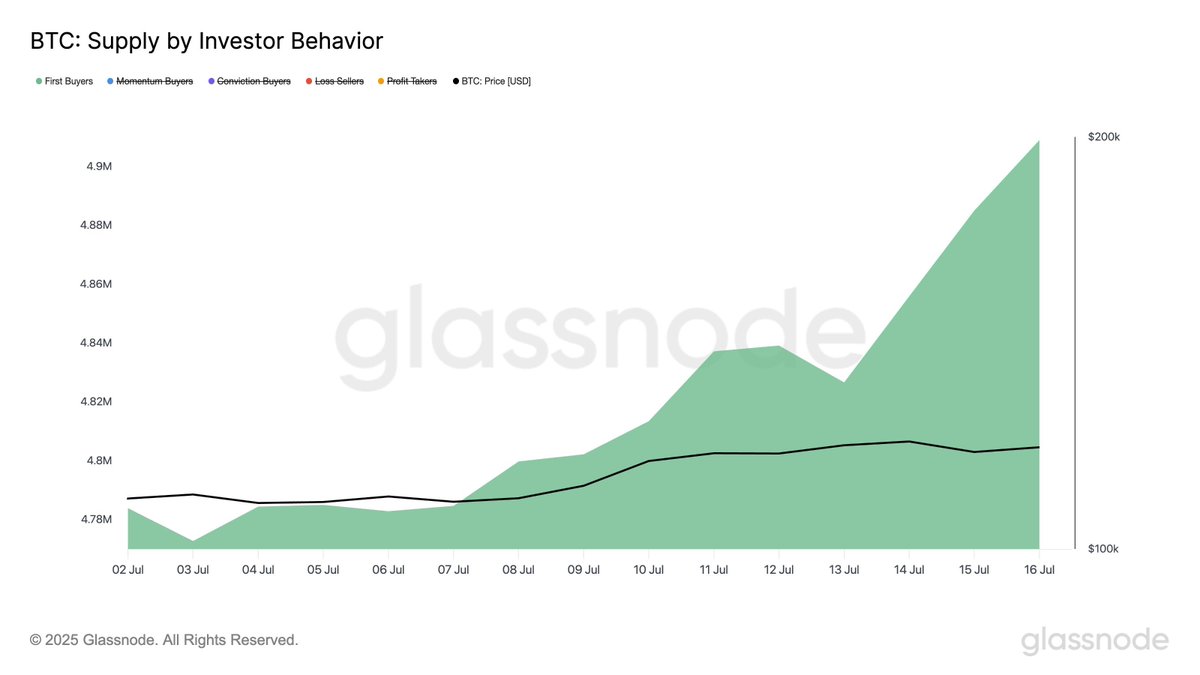

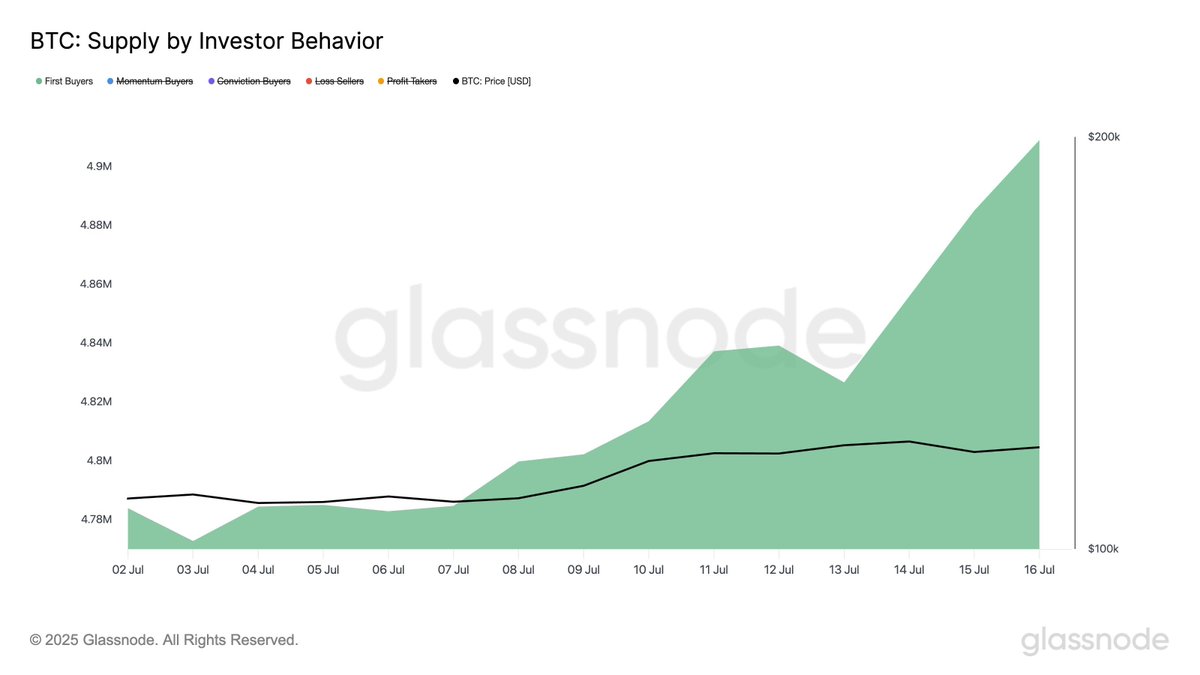

JUST IN: New Bitcoin entrants have accumulated 140,000 Bitcoin in July so far

New money is stacking fast pic.twitter.com/rHgiBoRZIE

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Bitcoin Archive (@BTC_Archive) July 17, 2025

JUST IN: New Bitcoin Entrants Have Accumulated 140,000 Bitcoin in July So Far

Exciting news is buzzing around the cryptocurrency world! As reported by [Bitcoin Archive](https://twitter.com/BTC_Archive/status/1945829774581985644), new Bitcoin entrants have stacked up an impressive **140,000 Bitcoin in July**. This surge in accumulation indicates that fresh capital is flowing into the Bitcoin market at an unprecedented rate. If you’re curious about what this means for the future of Bitcoin, you’re in the right place.

New Money Is Stacking Fast

When we talk about **new money stacking fast**, we’re not just referring to a casual increase. This influx of Bitcoin is a sign of growing interest and confidence in the cryptocurrency space. Investors are recognizing Bitcoin not just as a digital currency, but as a valuable asset class. With **140,000 Bitcoin** being accumulated in such a short time, it’s clear that many are betting on the future of this digital gold.

But why now? The global economic landscape is changing, and many are looking for alternatives to traditional investments. Bitcoin often serves as a hedge against inflation and economic instability, making it an attractive option for savvy investors. As traditional markets fluctuate, Bitcoin’s appeal continues to rise, prompting more people to enter the space.

What Does This Mean for Bitcoin’s Future?

So, what does this accumulation mean for the future value of Bitcoin? Generally speaking, when demand increases and supply remains limited, prices tend to rise. This could potentially lead to a bullish trend in the coming months. Investors will be watching closely to see how this new influx of **Bitcoin accumulation** plays out in terms of price action and market trends.

Moreover, as more individuals and institutions invest in Bitcoin, the conversation around cryptocurrency is shifting. We’re seeing more mainstream adoption, and this can lead to further validation of Bitcoin as a legitimate investment. With companies and even some governments starting to embrace digital currencies, the future looks bright for Bitcoin enthusiasts.

Stay Informed with Bitcoin Trends

Keeping an eye on Bitcoin trends is crucial if you’re invested or considering investing. Whether you’re a seasoned trader or a newcomer, understanding these dynamics can significantly impact your investment strategy. Following reliable sources like [Bitcoin Archive](https://twitter.com/BTC_Archive) and other market analysts can provide you with valuable insights and updates.

As we move deeper into July 2025, the cryptocurrency market will undoubtedly continue to evolve. New entrants and their accumulation of Bitcoin signal a shift that could lead to exciting developments down the line. So, if you’re keen on staying ahead of the curve, make sure to stay updated on the latest news and trends!

It’s an exhilarating time to be involved in the world of Bitcoin. The enthusiasm and commitment displayed by new entrants are shaping the landscape of cryptocurrency. As they accumulate their share, the question remains: how will this impact the broader market? Only time will tell, but one thing is for sure—Bitcoin is here to stay!