ETH ETF Inflows Hit $726.6M: What’s Driving This Surge? — $ETH institutional investment, cryptocurrency ETF surge, Ethereum market trends 2025

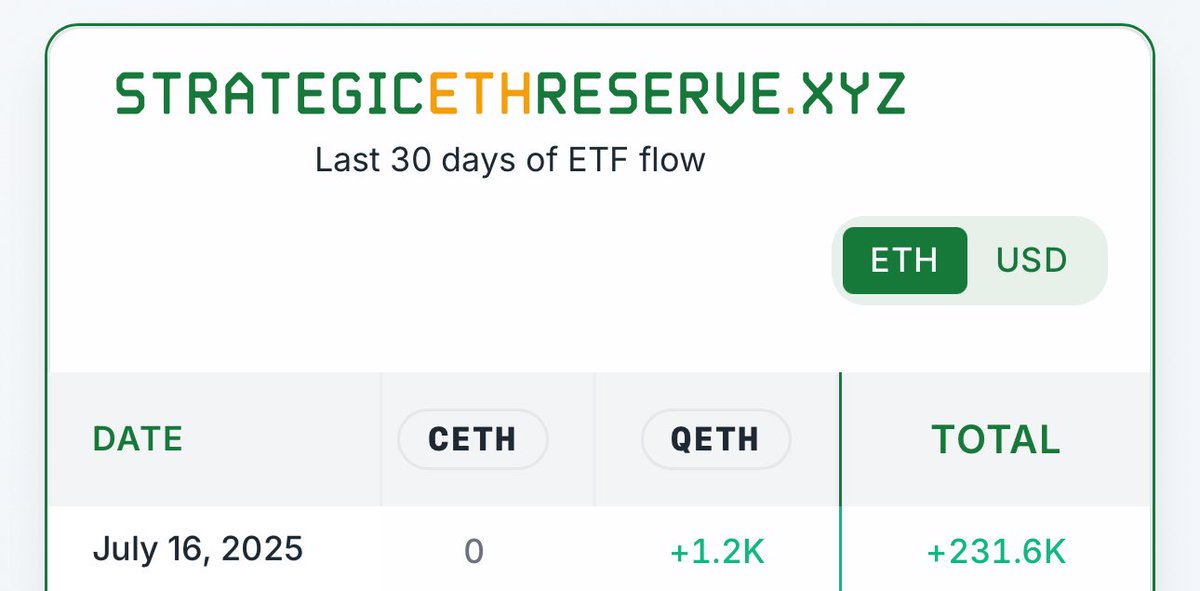

On July 16, 2025, Ethereum ($ETH) experienced a historic surge in ETF inflows, totaling $726.6 million, marking a record-breaking day for institutional investments. This significant influx highlights the growing institutional demand for Ethereum and reflects a broader trend of increasing interest in cryptocurrency assets. As more investors recognize the potential of Ethereum, the landscape of digital finance continues to evolve. This surge in ETF inflows not only underscores Ethereum’s market strength but also signals a positive outlook for the future of cryptocurrencies. Stay informed about the latest trends and developments in the Ethereum market for investment opportunities.

JUST IN: July 16 was a record day for $ETH ETF inflows – $726.6M

Institutional demand is increasing pic.twitter.com/CP2ZJhhb9m

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Elisa (@eeelistar) July 17, 2025

JUST IN: July 16 was a record day for $ETH ETF inflows – $726.6M

If you’ve been keeping an eye on the cryptocurrency market, you probably noticed a significant surge in Ethereum ($ETH) ETF inflows recently. On July 16, 2025, the market saw a staggering $726.6 million in inflows, making it a record day for Ethereum ETFs. This uptick in institutional interest is hard to ignore, and it raises some important questions about the future of Ethereum and the broader cryptocurrency landscape.

Institutional demand is increasing

What does this record day mean for Ethereum? Well, it’s a clear indicator that institutional demand is on the rise. Major players in the financial sector are starting to embrace Ethereum as a viable investment option, and that’s a big deal. Institutions have long been hesitant to dive into the world of cryptocurrencies due to volatility and regulatory concerns, but the increasing inflows suggest they are now more comfortable with the asset class.

So, why this sudden surge in interest? One reason could be the growing acceptance of cryptocurrencies in mainstream finance. With more financial institutions offering crypto products, it’s becoming easier for investors to access and invest in Ethereum. Additionally, Ethereum’s transition to a proof-of-stake model has generated excitement about its scalability and sustainability, making it a more attractive option for institutional investors.

What does this mean for the future of Ethereum?

The record inflows could suggest a bullish trend for Ethereum’s price. As institutional buyers continue to pile in, we may see increased price stability and growth potential. It’s also worth noting that institutional investment can lead to greater market maturity and less volatility, which is a win-win for everyone involved.

Moreover, with Ethereum being the backbone of many decentralized finance (DeFi) applications and non-fungible tokens (NFTs), its utility continues to grow. The more institutional money flows into Ethereum, the more it validates the network’s potential and drives innovation.

How can investors capitalize on this trend?

For those interested in getting involved, it’s essential to stay informed about market trends and developments. Keeping an eye on the inflows and outflows in Ethereum ETFs can provide valuable insights into investor sentiment. Additionally, considering a diversified investment strategy that incorporates Ethereum could be beneficial.

Investors should always do their homework and understand the risks involved in cryptocurrency investments. Consulting trusted financial advisors or utilizing reputable platforms for buying and trading Ethereum can help navigate this complex market.

In summary, July 16 marked a significant milestone for Ethereum ETFs, with $726.6 million in inflows showcasing the increasing institutional demand. As the landscape continues to evolve, Ethereum’s future looks promising, and it’s an exciting time to be involved in the world of cryptocurrencies.

You can check out more details regarding this record day on Elisa’s Twitter [here](https://twitter.com/eeelistar/status/1945772151438479694?ref_src=twsrc%5Etfw).