KindlyMD’s $51.5M Bitcoin Bet Sparks Heated Debate! — NASDAQ Investment News, Cryptocurrency Funding 2025, Bitcoin Market Update

KindlyMD Secures $51.5 Million Investment in Bitcoin

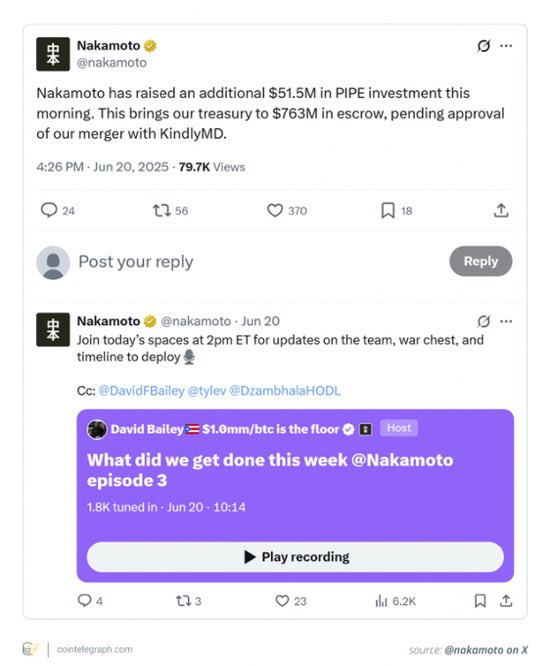

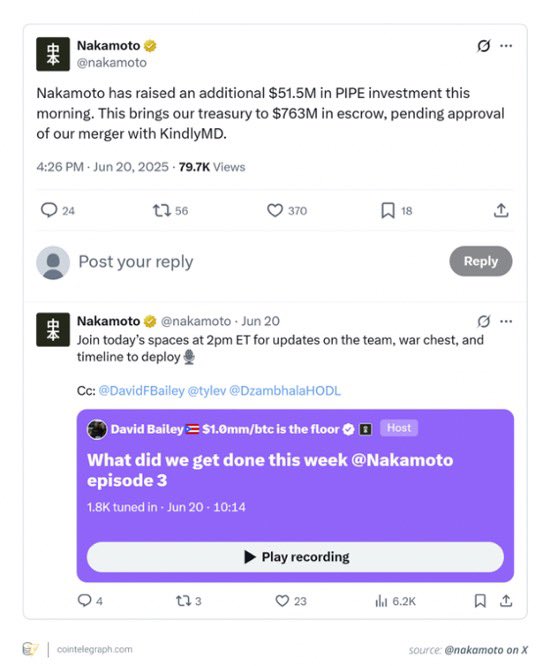

In a remarkable development, NASDAQ-listed KindlyMD has successfully raised $51.5 million within just 72 hours to invest in Bitcoin. This significant funding highlights the growing interest in cryptocurrency and the potential for innovative healthcare solutions intertwining with blockchain technology. As more companies recognize the benefits of digital assets, KindlyMD’s strategic move positions it at the forefront of the evolving financial landscape. This investment not only underscores the company’s commitment to leveraging cutting-edge technology but also reflects the increasing acceptance of Bitcoin as a viable investment option. Stay tuned for more updates on KindlyMD’s journey in the crypto space.

BREAKING NASDAQ-LISTED KINDLYMD SECURES $51.5M IN 72 HOURS TO INVEST IN BITCOIN pic.twitter.com/JS1XwxcFff

— That Martini Guy ₿ (@MartiniGuyYT) July 16, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

BREAKING NASDAQ-LISTED KINDLYMD SECURES $51.5M IN 72 HOURS TO INVEST IN BITCOIN

Have you heard the latest buzz? KindredMD, a company that’s making waves on the NASDAQ, has just pulled off a remarkable feat: they secured a whopping $51.5 million in just 72 hours! And what are they planning to do with all that cash? You guessed it—they’re diving headfirst into the world of Bitcoin. This news has everyone talking, and for good reason. It’s a bold move that could set the stage for future investments in the crypto space.

What Does This Mean for Bitcoin?

So, why is this significant? For starters, KindredMD’s investment signals a growing acceptance of Bitcoin among traditional financial institutions. As more companies like KindredMD explore cryptocurrencies, it could lead to increased legitimacy for Bitcoin as an investment vehicle. Investors are always looking for signs of stability and growth, and this move could encourage others to follow suit, potentially creating a snowball effect in the market.

Why KindredMD Chose Bitcoin

You might be wondering, what’s the rationale behind KindredMD’s decision to invest in Bitcoin? The company likely sees the potential for high returns in the rapidly evolving crypto market. Bitcoin has experienced significant fluctuations in value, but many experts believe it is on an upward trajectory. By investing in Bitcoin, KindredMD is positioning itself to capitalize on these potential gains, while also diversifying its investment portfolio.

The Process of Securing Funds

Now, let’s talk about how KindredMD managed to secure $51.5 million so quickly. In the fast-paced world of finance, timing is everything. The company likely tapped into its existing network of investors, showcasing the potential benefits of investing in Bitcoin. With a clear strategy and a solid pitch, KindredMD was able to attract funds rapidly. This kind of agility is crucial in today’s market, especially when it comes to cryptocurrency investments.

Reactions from the Crypto Community

The reaction to this announcement has been electric. Investors and crypto enthusiasts are buzzing with excitement, eager to see how this investment will play out. Many see it as a positive sign that mainstream companies are not just acknowledging Bitcoin, but are also willing to invest substantial amounts into it. This could lead to a more stable and mature crypto market, which is something everyone can get behind.

Looking Ahead: The Future of KindredMD and Bitcoin

What’s next for KindredMD? This investment is just the beginning. The company will likely explore further opportunities in the crypto space, potentially expanding its portfolio to include other cryptocurrencies as well. For Bitcoin, this could mean increased visibility and support from traditional finance sectors, paving the way for further investment and growth.

In summary, KindredMD’s bold move to invest $51.5 million in Bitcoin within just 72 hours is a game-changer. It not only showcases the growing acceptance of cryptocurrencies but also sets a precedent for other companies looking to enter the market. As we watch this story unfold, it’s clear that the intersection of traditional finance and cryptocurrency is becoming more relevant than ever.