Egypt and China Ditch SWIFT: Is the Dollar’s Reign Over? — financial de-dollarization, local currency trade agreements, CIPS payment system 2025

Breaking news: Egypt and China Ditch SWIFT System

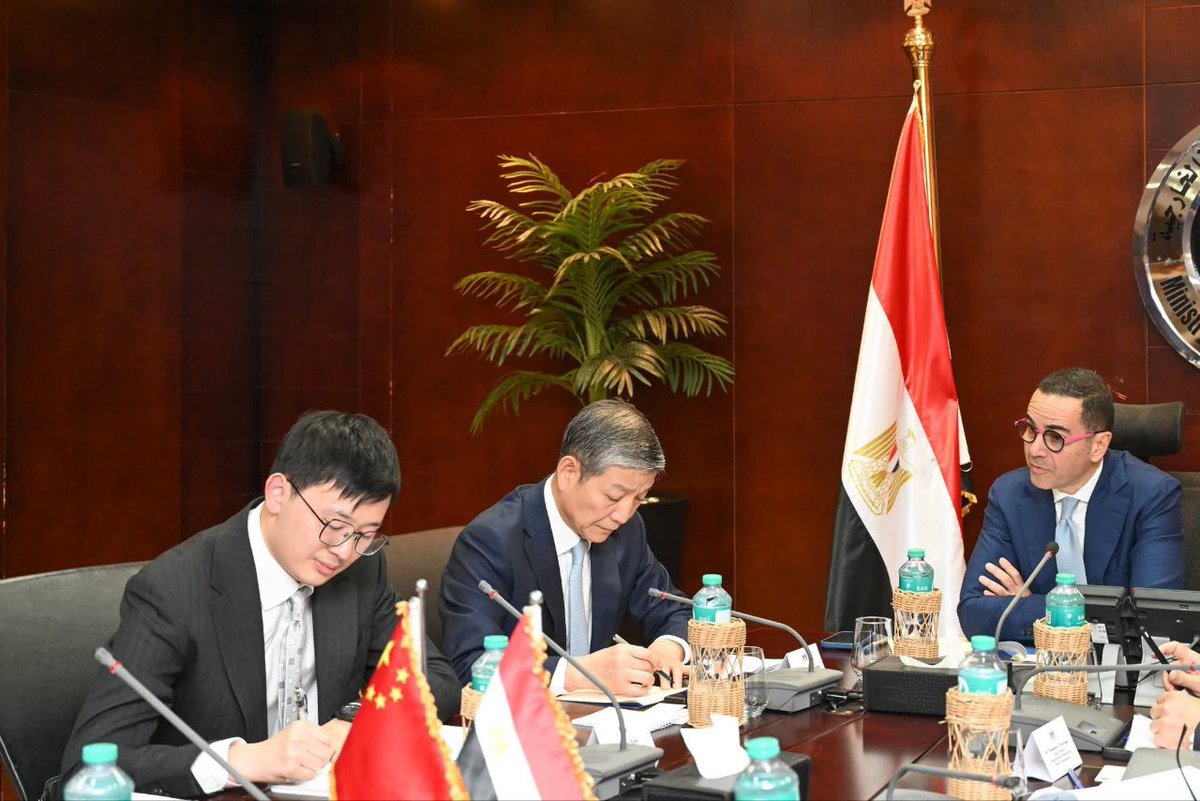

In a significant move towards financial de-dollarization, Egypt and China have announced their decision to abandon the SWIFT system. Instead, these nations will settle trade transactions using local currencies through China’s Cross-Border Interbank Payment System (CIPS). This agreement marks a pivotal shift in international trade practices, emphasizing the growing trend of countries seeking alternatives to traditional financial systems dominated by the U.S. dollar. As global economic dynamics evolve, this collaboration between Egypt and China highlights the increasing importance of local currency settlements in international trade. Stay tuned for more updates on this developing story.

BREAKING:

The central banks of Egypt and China have agreed to ditch the SWIFT system, opting instead to settle trade in local currencies via China’s Cross-Border Interbank Payment System (CIPS) — marking a major shift toward financial de-dollarization. https://t.co/HuINW5B1MB

BREAKING:

The financial landscape is shifting dramatically as the central banks of Egypt and China have made a groundbreaking decision. They have agreed to ditch the traditional SWIFT system, choosing instead to settle trade in their local currencies. This new approach will be facilitated through China’s Cross-Border Interbank Payment System (CIPS). This move is more than just a technical change; it’s a significant step toward financial de-dollarization.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The End of SWIFT?

For years, the SWIFT system has been the backbone of international banking, allowing for secure and swift transactions worldwide. However, Egypt and China are challenging this status quo. By opting for local currencies, they are reducing their reliance on the US dollar and the SWIFT network, which has long been dominated by Western financial institutions. This transition could have ripple effects across global trade, as more countries might consider similar paths toward financial independence.

Understanding CIPS

So, what exactly is China’s Cross-Border Interbank Payment System (CIPS)? In simple terms, it’s a payment system designed to facilitate international trade and investment using the Chinese yuan. This system is gaining traction as countries look to streamline their trade processes without involving the US dollar. For Egypt, utilizing CIPS means faster, more efficient transactions and reduced exposure to foreign exchange risks. It’s a win-win situation for both nations, enhancing their economic collaborations.

Financial De-Dollarization: A Growing Trend

The move by Egypt and China reflects a broader trend of financial de-dollarization that is gaining momentum worldwide. Countries are increasingly exploring alternatives to the US dollar in international trade. This shift is driven by various factors, including geopolitical tensions and a desire for greater monetary sovereignty. As more nations join the de-dollarization movement, we could see a significant transformation in global trade dynamics.

The Implications for Global Trade

What does this mean for global trade? Well, the implications could be profound. As Egypt and China take this bold step, they pave the way for other nations to follow suit. This could lead to a more multipolar world where multiple currencies play significant roles in international transactions. Additionally, businesses engaged in trade with these countries might need to adapt to new payment systems, potentially reshaping the way global commerce operates.

Looking Ahead

As this story unfolds, it will be fascinating to see how other nations respond to this shift away from the SWIFT system. Will we see more countries jump on the bandwagon, or will the SWIFT system hold strong? The next few years will likely provide answers to these questions as the global financial landscape continues to evolve.

In the meantime, keep an eye on the developments surrounding Egypt and China’s agreement. The decision to use CIPS could be a game-changer in how countries conduct trade, signaling a new era of financial transactions that prioritize local currencies over the US dollar.

Stay informed and engaged, as this is just the beginning of a potentially revolutionary shift in international finance!