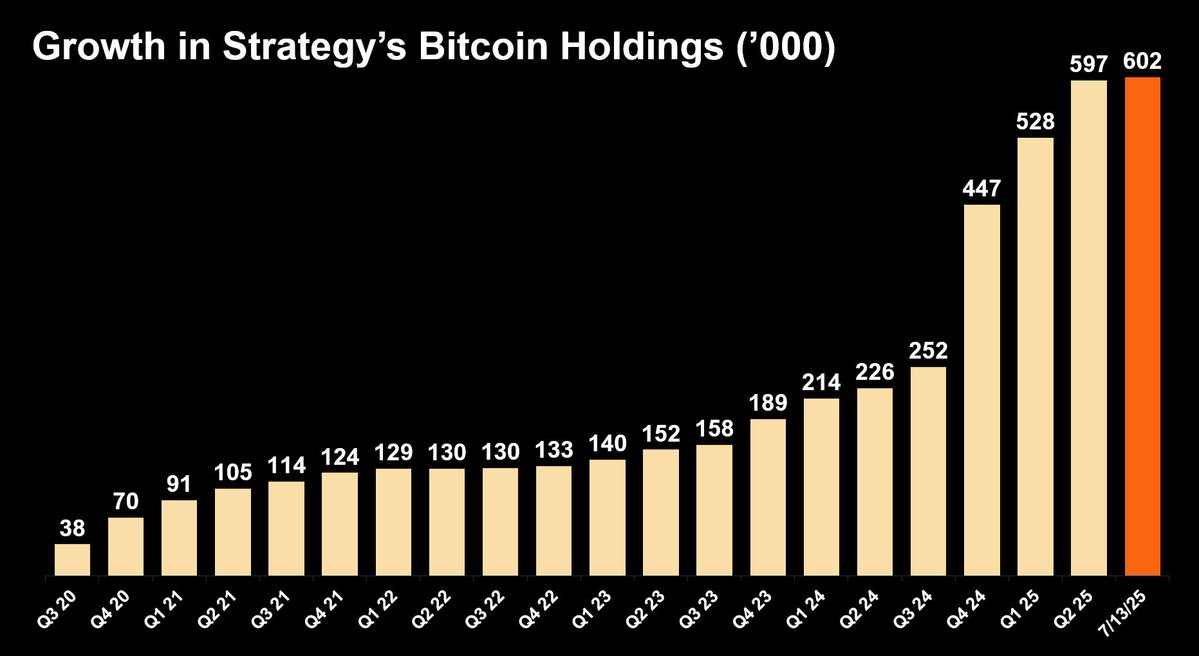

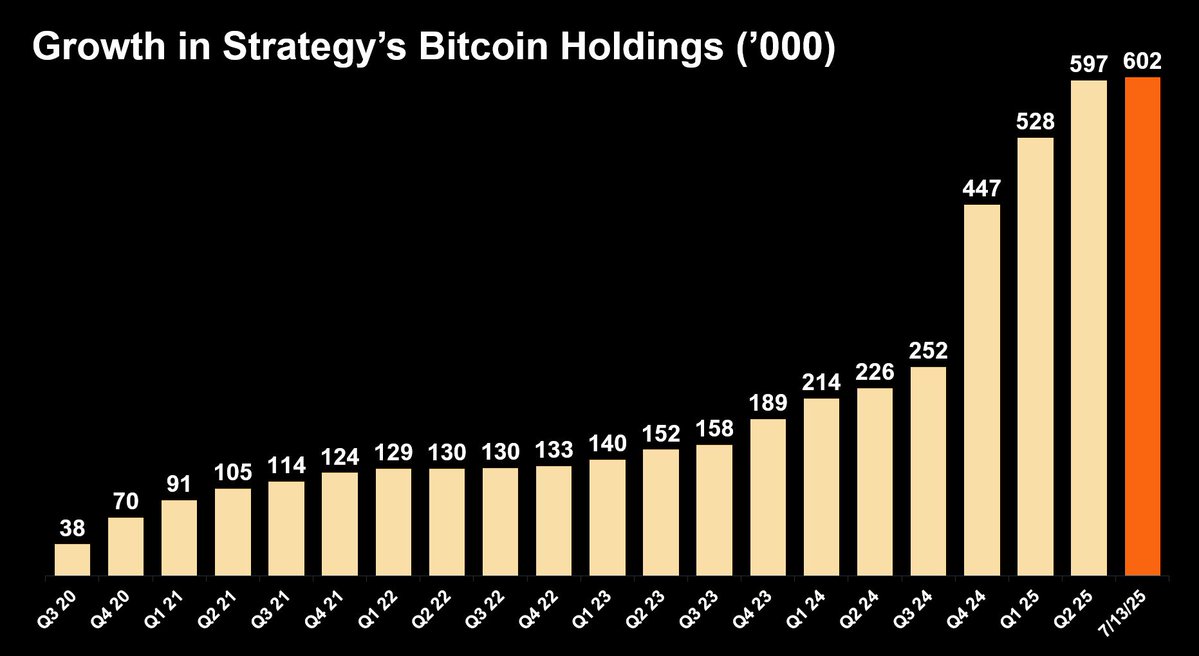

Michael Saylor’s Bold Move: 3% of All Bitcoin? — Bitcoin market strategy, Michael Saylor investment tactics, cryptocurrency hedge fund 2025

Michael Saylor, a prominent figure in the cryptocurrency world, has successfully implemented a strategy that now allows his holdings to account for 3% of all Bitcoin in circulation. This significant achievement highlights Saylor’s foresight in the crypto market, as he effectively front-ran Wall Street investors. His approach underscores the growing influence of institutional investors in Bitcoin, positioning Saylor as a key player in the digital currency landscape. As Bitcoin continues to gain traction, Saylor’s strategy could serve as a blueprint for others looking to capitalize on cryptocurrency investments. Stay updated on Bitcoin trends and strategies to maximize your investment potential.

BREAKING: Michael Saylor’s STRATEGY now holds 3% of all Bitcoin in circulation.

Saylor successfully front-ran Wall Street. pic.twitter.com/90qAmT30cb

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Bitcoin Archive (@BTC_Archive) July 15, 2025

BREAKING: Michael Saylor’s STRATEGY now holds 3% of all Bitcoin in circulation

In a stunning move that’s making waves across the cryptocurrency landscape, Michael Saylor’s strategy has positioned him as a significant player in the Bitcoin market. Holding a whopping 3% of all Bitcoin currently circulating is no small feat, and it highlights Saylor’s keen understanding of the financial landscape. If you’re curious about how this strategy unfolded and its implications, you’ve come to the right place!

Saylor successfully front-ran Wall Street

Michael Saylor, the co-founder of MicroStrategy, has been vocal about his belief in Bitcoin as a revolutionary asset. By acquiring such a large portion of Bitcoin, Saylor has managed to outpace traditional Wall Street investors. This bold move has set a precedent, showcasing the potential for cryptocurrency to disrupt conventional finance. Saylor’s foresight into the value of Bitcoin, especially during market fluctuations, is something that many investors are now looking to replicate.

Saylor’s approach isn’t just about accumulating Bitcoin. It’s about creating a financial strategy that leverages the unique advantages of digital currency. According to [Bitcoin Archive](https://twitter.com/BTC_Archive/status/1945093541731950634?ref_src=twsrc%5Etfw), Saylor’s strategic acquisitions have not only made headlines but also sparked discussions about the future of Bitcoin as a store of value and a hedge against inflation.

The Implications of Holding 3% of Bitcoin Circulation

So, what does it mean for Saylor to hold 3% of all Bitcoin? For starters, it demonstrates the growing acceptance of Bitcoin among institutional investors. This shift could lead to increased legitimacy for Bitcoin as a serious asset class. When a figure like Saylor publicly backs Bitcoin to this extent, it encourages others to follow suit, potentially leading to increased demand and value appreciation over time.

Moreover, Saylor’s strategy could inspire other companies to reconsider their treasury management practices. If MicroStrategy can thrive while holding a significant amount of Bitcoin, why can’t others? This could potentially lead to a domino effect, encouraging even more companies to explore cryptocurrency investments.

What’s Next for Michael Saylor and Bitcoin?

As Saylor continues to advocate for Bitcoin, many are left wondering what his next move will be. Will he keep accumulating? Will he diversify into other cryptocurrencies? One thing is for sure: the cryptocurrency community will be watching closely. Saylor’s ability to read market trends and act quickly is a lesson for all investors.

In a world where financial stability can feel uncertain, Bitcoin’s appeal as a digital asset continues to grow. With leaders like Saylor at the helm, the conversation around Bitcoin is evolving, and it’s becoming increasingly clear that this isn’t just a passing trend.

In summary, Michael Saylor’s strategy of holding 3% of all Bitcoin in circulation signals a significant shift in the financial landscape. By successfully front-running Wall Street, Saylor not only enhances his portfolio but also contributes to the broader acceptance of Bitcoin as a valid investment vehicle. The future of cryptocurrency looks promising, and with Saylor leading the charge, it’s bound to be an exciting journey.