Is Nvidia’s $4.2 Trillion Valuation Justified? — Nvidia stock news, semiconductor market surge, H20 chip sales update

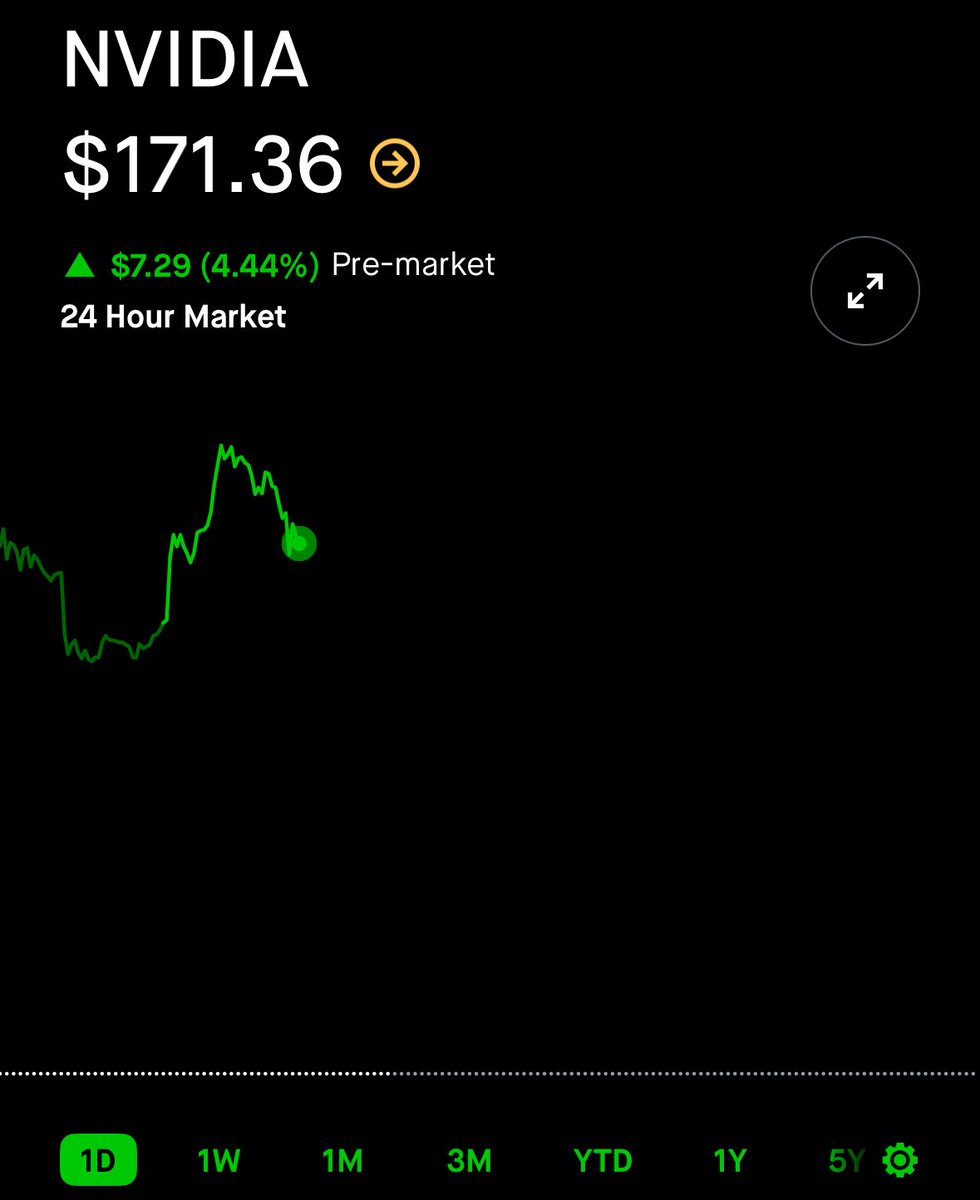

Nvidia stock ($NVDA) has experienced a remarkable surge, rising +5% to reach an all-time high, following the announcement that H20 chip sales to China will resume. This significant development has propelled Nvidia’s market valuation to an astounding $4.2 trillion. Investors are optimistic about the company’s growth prospects, fueled by the resumption of chip sales in the lucrative Chinese market. As one of the leading players in the semiconductor industry, Nvidia continues to innovate and expand its reach. Stay updated on Nvidia’s stock performance and market trends for investment opportunities.

BREAKING: Nvidia stock, $NVDA, surges +5% to a new record high as the company announces H20 chip sales to China will resume.

Nvidia is now worth a whopping $4.2 TRILLION. pic.twitter.com/eDubEQkUqG

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— The Kobeissi Letter (@KobeissiLetter) July 15, 2025

BREAKING: Nvidia stock, $NVDA, surges +5% to a new record high as the company announces H20 chip sales to China will resume

Big news is making waves in the tech world! Nvidia stock, known by its ticker symbol $NVDA, just surged by an impressive 5%, reaching a new record high. This surge comes on the heels of Nvidia’s announcement that they will be resuming sales of their H20 chips to China. If you’ve been following the stock market, you know how significant this development is.

Nvidia is now worth a whopping $4.2 TRILLION

That’s right! The tech giant is now valued at a staggering $4.2 trillion. This valuation underscores Nvidia’s pivotal role in the semiconductor industry and its growing influence within the global technology landscape. Investors are clearly reacting positively to this news, which has sparked discussions about the company’s growth potential and its future in an increasingly competitive market.

What Does This Mean for Investors?

For those of you who are invested in Nvidia or considering jumping in, this is an exciting time. The resumption of H20 chip sales to China could significantly boost the company’s revenue and market share. China has been a critical market for Nvidia, and the ability to resume sales can mean a lot for their bottom line. If you’re looking to diversify your portfolio, keeping an eye on Nvidia stock might be a smart move.

The Impact of the H20 Chip Sales

The H20 chip is designed for high-performance tasks, making it perfect for applications in AI, gaming, and data centers. With China being a massive consumer of technology, this resumption could lead to increased demand and sales volume. As a result, Nvidia might see a significant uptick in its profitability, making it a potentially attractive option for those looking to invest in tech stocks.

Why Investors Are Bullish on Nvidia

There’s a lot of excitement surrounding Nvidia right now, and for good reason. The company’s innovative approach to graphics processing and AI technology has positioned it as a leader in the tech industry. The recent surge in stock price reflects a broader confidence in Nvidia’s ability to adapt to market demands and drive growth. With a solid pipeline of products and a commitment to innovation, Nvidia has become a favorite among tech investors.

Looking Ahead

As we look to the future, it will be interesting to see how Nvidia navigates the ongoing challenges in the global supply chain and competition from other tech giants. However, with the recent news of H20 chip sales to China, it seems like Nvidia is well-positioned for continued success. Whether you’re a seasoned investor or just starting, this news is worth keeping an eye on!

For those who want to stay updated, follow financial news outlets and platforms where stock movements are reported. Keeping tabs on Nvidia’s developments can give you the insight you need to make informed investment decisions.