Is Inflation Out of Control? June’s Shocking Spike Explained! — inflation news June 2025, rising costs economic impact, tariff effects on prices

Breaking news: Inflation Rises in June

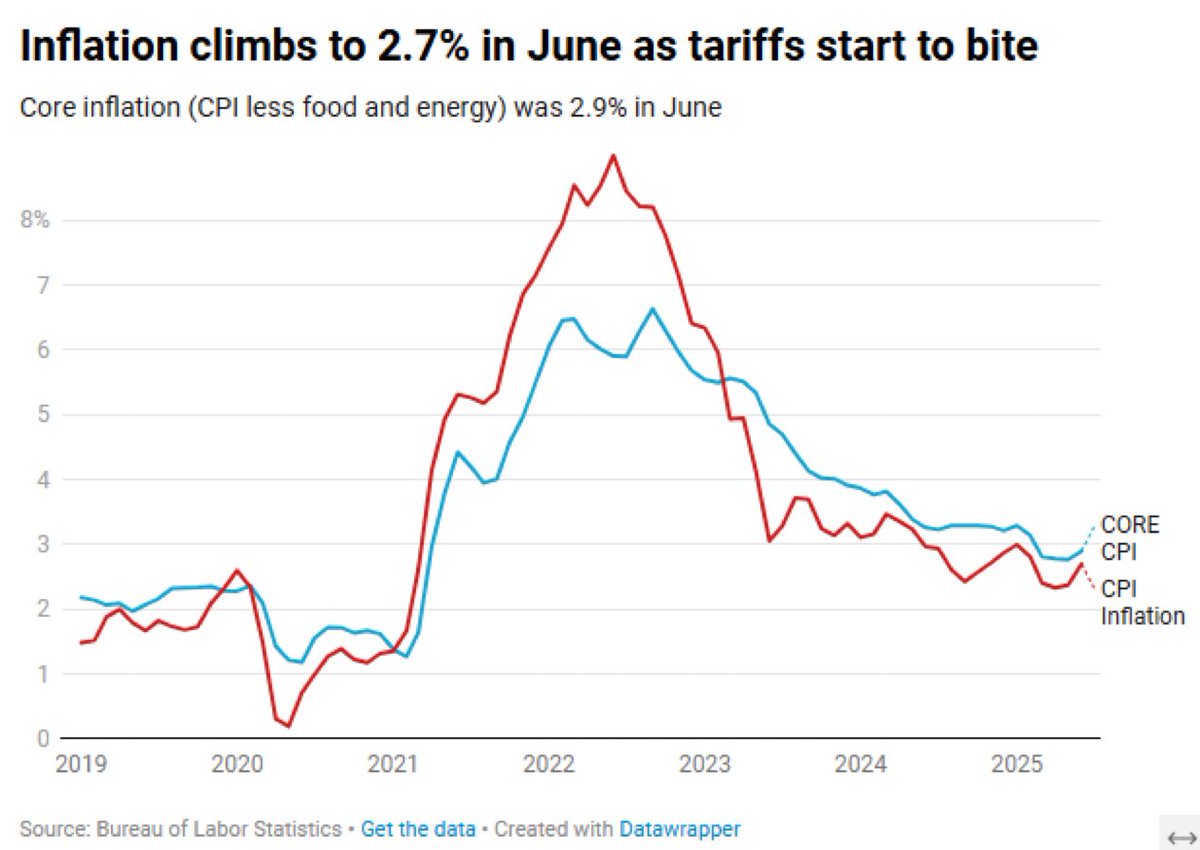

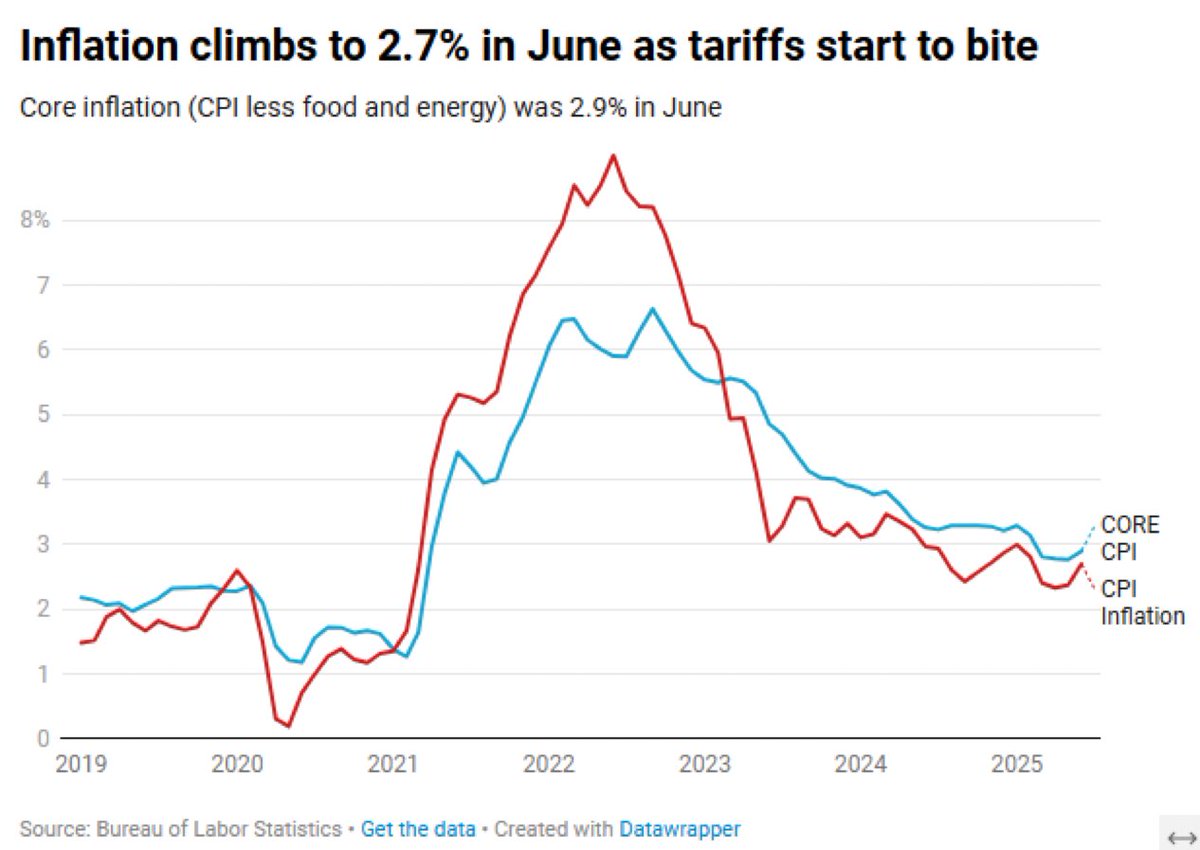

In June, inflation rates have increased, reaching an annual rate of 2.7%, a rise from 2.3% in April and 2.4% in May. This surge is primarily attributed to tariffs that are driving up prices across various sectors, notably food, energy, and rent. Core inflation, which excludes volatile food and energy prices, has also seen a significant increase, climbing to 2.9%. This trend indicates ongoing economic challenges as consumers face higher costs of living. Stay informed on the latest inflation news to better understand its impact on your finances and the economy.

BREAKING: INFLATION RISES IN JUNE.

As expected: It’s here.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

-Tariffs are starting to raise prices.

-Annual rate climbed to 2.7%. That’s up from 2.3 % in April and 2.4% in May.

-Food, energy & rent contributors.

-Core inflation (which excludes food and energy) rose 2.9% pic.twitter.com/xxLSVl0F94

— Maine (@TheMaineWonk) July 15, 2025

BREAKING: INFLATION RISES IN JUNE

Inflation is back in the spotlight, and it’s not too surprising given the recent economic climate. As expected, inflation has risen, sending ripples through the economy. The annual inflation rate climbed to 2.7% in June, a noticeable increase from 2.3% in April and 2.4% in May. This uptick in inflation deserves our attention, especially since it’s influenced by a few key factors.

As Expected: It’s Here

It’s hard to ignore the impacts of tariffs, which are starting to raise prices across various sectors. These tariffs have been a hot topic in economic discussions, and it appears they are beginning to hit consumers where it hurts—our wallets. With rising prices, it’s crucial to stay informed about how these changes might affect your daily life. Understanding the dynamics of inflation can help you navigate these economic waters with more confidence.

Annual Rate Climbed to 2.7%

The rise in the inflation rate to 2.7% is significant. It’s not just a number; it’s a reflection of the increasing costs we all encounter. For instance, the costs of basic necessities like food, energy, and rent have been climbing. These are areas where most of us feel the pinch, and as these prices continue to rise, it’s essential to consider how you manage your budget. Keeping an eye on inflation trends can help you make better financial decisions moving forward.

Food, Energy & Rent Contributors

When we talk about inflation, three major contributors come to mind: food, energy, and rent. All of these have seen noticeable increases recently. For many households, food prices have spiked, making grocery shopping a more significant expense than it used to be. Energy costs, especially with fluctuating gas prices, have also contributed to the overall inflation picture. And let’s not forget rent—housing costs continue to put pressure on many families. Keeping tabs on these contributors can give you a clearer picture of where your money is going and help you plan accordingly.

Core Inflation Rose 2.9%

Core inflation, which excludes food and energy prices, rose by 2.9%. This is particularly noteworthy because it indicates that inflation isn’t just a temporary blip driven by volatile prices. When core inflation rises, it suggests that underlying economic conditions are pushing prices higher across the board. It’s a signal that we should all pay attention to, as it can affect everything from interest rates to wage growth.

In summary, the rise in inflation is an important indicator of our current economic health. With tariffs influencing prices, and essential expenses like food, energy, and rent rising, it’s vital to stay informed. Understanding these trends can help you make smarter financial choices and prepare for what lies ahead. So, keep an eye on the numbers and stay engaged with the discussions surrounding inflation. For more insights on this topic, check out [The Maine Wonk’s tweet](https://twitter.com/TheMaineWonk/status/1945116771431674344?ref_src=twsrc%5Etfw) for the latest updates.