BlackRock’s Crypto ETF: A $14B Surge Amid Market Decline! — crypto investment trends, BlackRock ETF performance, digital asset growth 2025

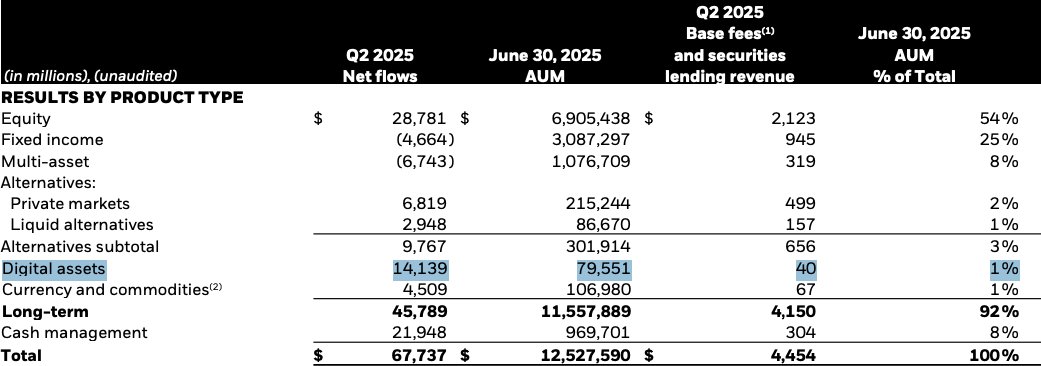

BlackRock’s crypto ETF has seen a remarkable resurgence, with inflows skyrocketing by 370% in Q2, reaching $14 billion. This surge now accounts for 16.5% of total ETF inflows, showcasing the growing interest in cryptocurrency investments despite an overall decline of 19% in net ETF flows. As investors increasingly turn to digital assets, BlackRock’s strong performance underscores the potential of cryptocurrency ETFs in a volatile market. This trend highlights the appetite for innovative investment vehicles and positions BlackRock as a leading player in the evolving financial landscape. Stay updated on crypto trends and ETF developments for strategic investment insights.

JUST IN: BlackRock’s crypto ETF inflows surged 370% in Q2 to $14B, now 16.5% of total ETF inflows, despite overall net flows dropping 19%. pic.twitter.com/itmRRMKg6t

— Cointelegraph (@Cointelegraph) July 15, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

JUST IN: BlackRock’s crypto ETF inflows surged 370% in Q2 to $14B

BlackRock, one of the world’s largest asset management firms, has made headlines recently with its impressive surge in cryptocurrency ETF inflows. During the second quarter alone, BlackRock’s crypto ETF experienced a staggering **370% increase**, bringing in a whopping **$14 billion**. This remarkable growth accounts for **16.5% of total ETF inflows**, signaling a significant shift in investor interest and market dynamics, even as overall net flows across the ETF landscape dropped by **19%**.

Understanding the Implications of BlackRock’s Growth

For those unfamiliar, an ETF, or Exchange-Traded Fund, is a type of investment fund that holds a collection of assets—like stocks or cryptocurrencies—and trades on stock exchanges. The rise of BlackRock’s crypto ETF is particularly noteworthy because it showcases a growing acceptance of digital assets among traditional investors. With BlackRock’s strong reputation and extensive resources, this surge may encourage even more institutional investors to dip their toes into the crypto waters.

What’s even more fascinating is how this growth contrasts with the broader ETF market. While many funds are seeing decreased inflows, BlackRock’s crypto ETF is thriving. This divergence suggests that there’s a robust appetite for crypto investments, likely driven by the increasing mainstream adoption of cryptocurrencies and blockchain technology. You can read more about this trend in detail on [Cointelegraph](https://cointelegraph.com).

Why Are Investors Flocking to Crypto ETFs?

The question on many minds is: why are investors flocking to crypto ETFs now, despite the downturn in other areas? One reason might be the perceived stability and security that comes with investing through a well-established fund like BlackRock’s. Unlike buying cryptocurrencies directly, which can be volatile and risky, ETFs offer a more regulated and structured approach to investing in digital assets.

Furthermore, the surge in interest can be attributed to the increasing number of institutional players entering the crypto space. As companies and financial institutions start embracing blockchain technology, the demand for regulated investment vehicles that provide exposure to cryptocurrencies is becoming clear.

The Future of Crypto ETFs

As we look ahead, it’s exciting to think about what this might mean for the future of crypto ETFs. If BlackRock’s crypto ETF continues to perform well, it could pave the way for more financial institutions to launch their own products. This growing competition could lead to lower fees, better services, and more innovative offerings for investors.

Moreover, the success of BlackRock’s crypto ETF might influence regulatory bodies to create clearer frameworks for cryptocurrency investments, which could further boost investor confidence.

In summary, BlackRock’s crypto ETF inflows are not just a fleeting trend; they represent a significant shift in the investment landscape. As the interest in cryptocurrencies continues to grow, BlackRock’s impressive figures serve as a beacon for potential investors looking to navigate this new and exciting market. For continuous updates and insights, you can follow the latest news from [Cointelegraph](https://cointelegraph.com).