Bitcoin Loans Surge: $1B Collateral Shakes Finance World! — Bitcoin collateral loans, cryptocurrency lending surge, Coinbase loan services 2025

Bitcoin-Backed Loans Reach $1 Billion on Coinbase

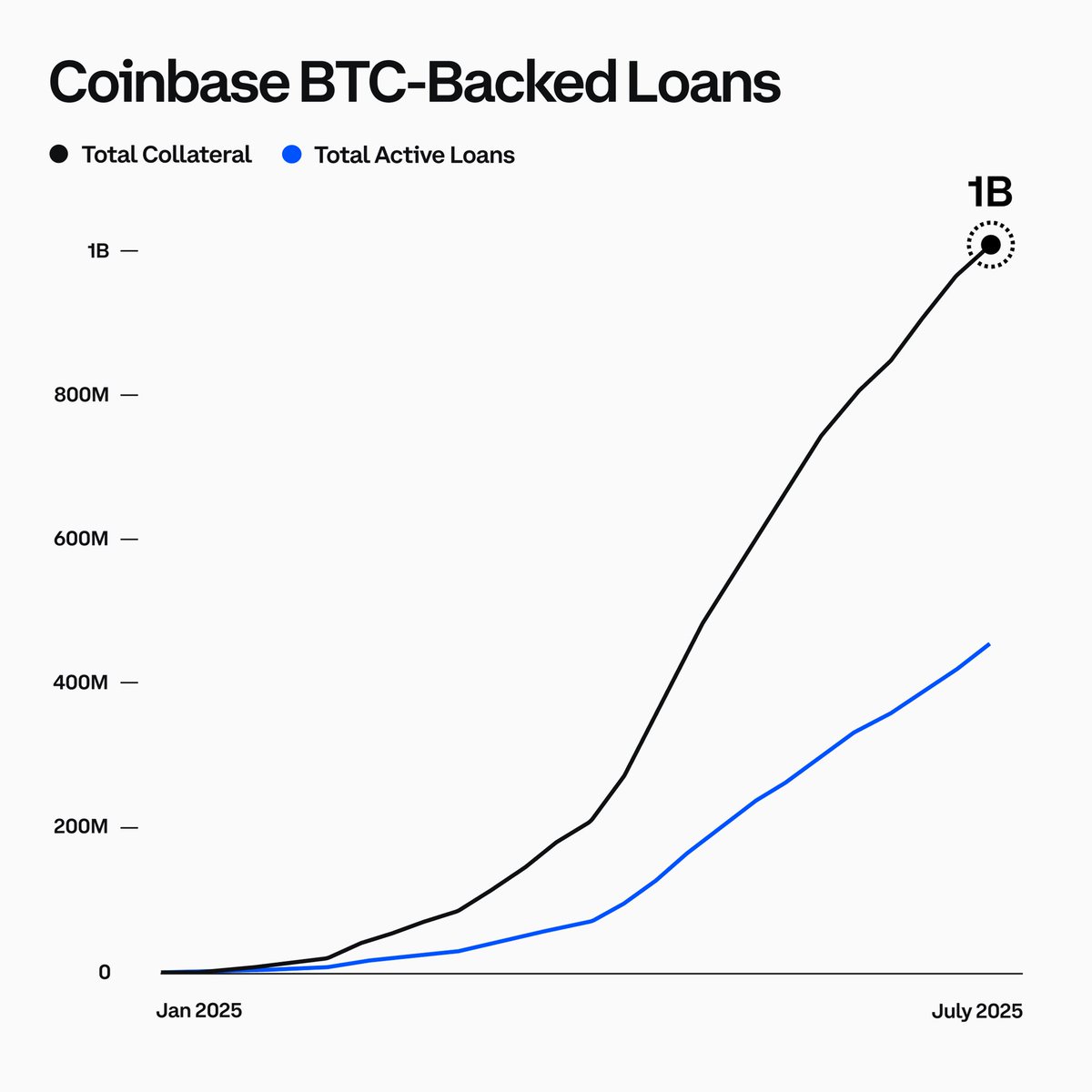

In a significant milestone for the cryptocurrency market, Bitcoin-backed loans have surpassed $1 billion in collateral on Coinbase, as reported by Watcher.Guru. This surge highlights the growing confidence in Bitcoin as a viable asset for securing loans. With increasing adoption of crypto-backed financing, users are leveraging their Bitcoin holdings to access liquidity without selling their assets. The rise in Bitcoin-backed loans reflects the evolving landscape of digital finance and the importance of cryptocurrencies in modern lending practices. Stay informed about the latest trends in cryptocurrency and blockchain technology for investment opportunities.

JUST IN: Bitcoin-backed loans cross $1,000,000,000 in collateral on Coinbase. pic.twitter.com/jEWkV0lyXL

— Watcher.Guru (@WatcherGuru) July 15, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

JUST IN: Bitcoin-backed loans cross $1,000,000,000 in collateral on Coinbase

Recent news has stirred excitement in the cryptocurrency world, as Bitcoin-backed loans have crossed a staggering $1 billion in collateral on Coinbase. This milestone reflects the growing adoption of Bitcoin as a viable asset for securing loans, showcasing the evolving landscape of digital finance. With platforms like Coinbase leading the charge, more users are recognizing the potential of leveraging their Bitcoin holdings for immediate financial needs.

The Rise of Bitcoin-Backed Loans

Bitcoin-backed loans are not just a trend; they represent a significant shift in how individuals and businesses approach financing. By using Bitcoin as collateral, borrowers can access liquidity without needing to sell their assets. This method allows crypto enthusiasts to maintain their investments while still benefiting from cash flow. Coinbase, a leading cryptocurrency exchange, has made this process seamless and accessible, attracting a growing number of users interested in harnessing the power of their Bitcoin.

Understanding the Mechanics

So, how do Bitcoin-backed loans work? Essentially, when you take out a loan using Bitcoin as collateral, the lender holds onto your Bitcoin until you repay the loan. If you default, the lender has the right to seize your collateral. This arrangement is beneficial for both parties: the borrower gets access to cash while the lender mitigates risk through collateral. With the value of Bitcoin continuing to fluctuate, the collateral requirement is closely monitored, ensuring that the loan remains secure.

The Coinbase Advantage

Coinbase has positioned itself as a leader in this innovative space by providing an easy-to-navigate platform where users can quickly understand the terms and conditions of Bitcoin-backed loans. The company’s reputation for security and reliability adds an extra layer of confidence for borrowers. Furthermore, Coinbase’s user-friendly interface ensures that even those new to cryptocurrency can engage with these financial products without feeling overwhelmed.

Why This Matters for the Crypto Community

The fact that Bitcoin-backed loans have surpassed $1 billion in collateral on Coinbase is a clear signal of the growing trust in cryptocurrency as a legitimate financial instrument. It opens up new possibilities for individuals looking to leverage their assets without having to liquidate them. This trend not only benefits crypto investors but also enhances the overall legitimacy of the cryptocurrency market, paving the way for more financial institutions to explore similar offerings.

A Bright Future Ahead

As the cryptocurrency ecosystem continues to mature, we can expect to see more innovative financial products emerge, particularly in the realm of lending. The success of Bitcoin-backed loans on Coinbase could very well lead to other exchanges and financial institutions following suit, further integrating cryptocurrency into mainstream finance. This evolution not only empowers investors but also creates a more dynamic financial landscape, ripe with opportunities.

The excitement surrounding the increase in Bitcoin-backed loans showcases the potential for cryptocurrencies to revolutionize traditional financial practices. With platforms like Coinbase leading the way, the future of financing with Bitcoin looks promising. To stay updated on the latest in cryptocurrency and financial technology, keep an eye on developments and consider how you might leverage your digital assets in this thriving market.