Michael Saylor’s Shocking Bitcoin Hoard: $73.4B Revelation! — Bitcoin investment strategy, cryptocurrency market analysis, digital asset management

Michael Saylor’s Bitcoin Holdings Reach Over 600,000

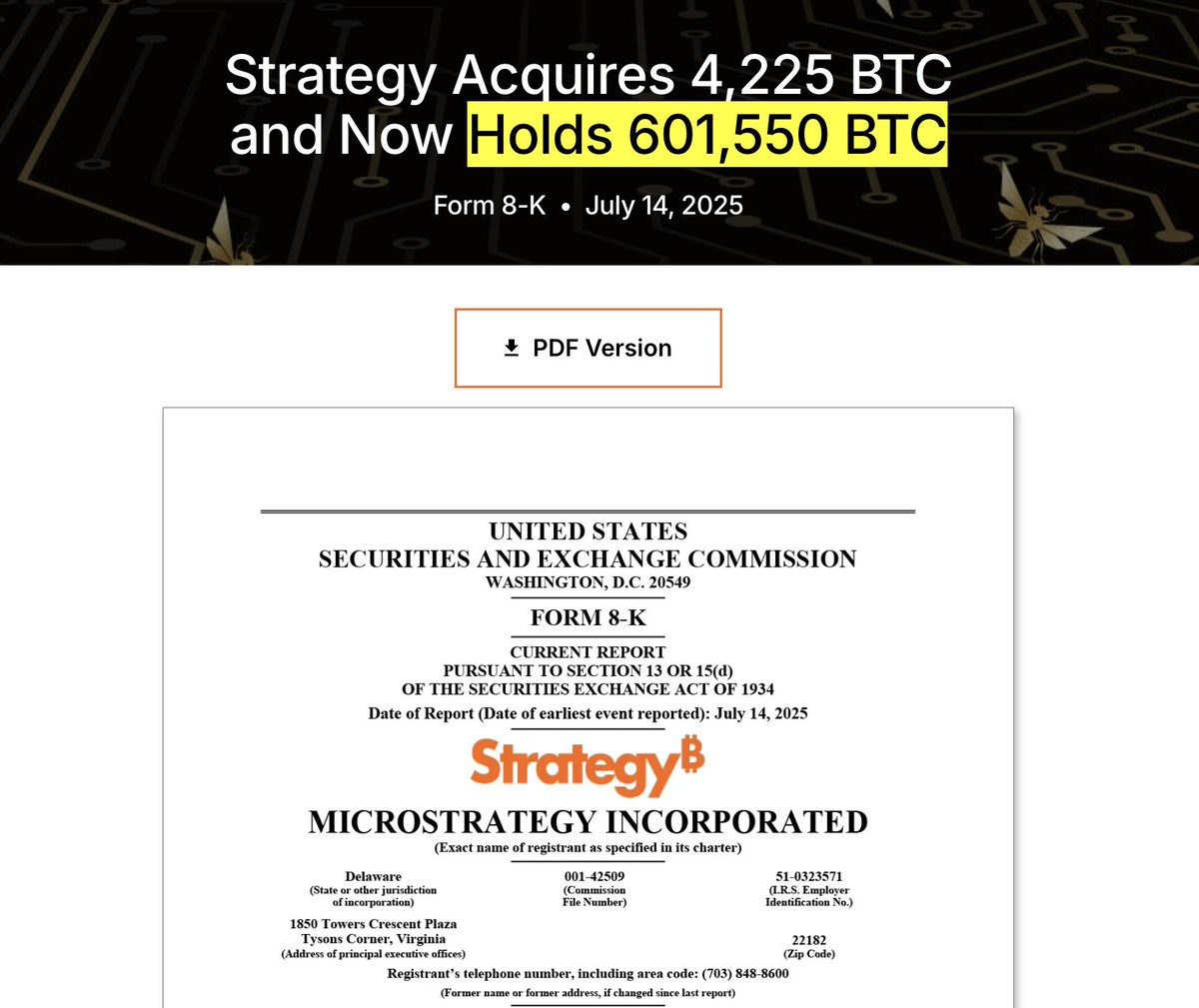

Michael Saylor’s investment strategy has officially amassed over 601,550 Bitcoin, valued at approximately $73.4 billion. This significant holding represents 2.86% of the total Bitcoin supply, highlighting Saylor’s commitment to cryptocurrency. His strategic approach to Bitcoin investment has garnered attention in the financial world, making him a prominent figure in the crypto space. As Bitcoin continues to gain traction as a digital asset, Saylor’s substantial holdings could influence market trends and investor behavior. Stay updated on Bitcoin developments and Saylor’s strategies to understand the future of this leading cryptocurrency.

JUST IN: Michael Saylor’s STRATEGY officially holds over 600,000 Bitcoin now worth $73.4 BILLION

601,550 $BTC (2.86% of total supply) pic.twitter.com/vT4nNZtwxy

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

— Bitcoin Archive (@BTC_Archive) July 14, 2025

JUST IN: Michael Saylor’s STRATEGY officially holds over 600,000 Bitcoin now worth $73.4 BILLION

Michael Saylor, the co-founder and executive chairman of MicroStrategy, has been making headlines lately with his bold Bitcoin strategy. As of July 14, 2025, Michael Saylor’s strategy officially holds over 600,000 Bitcoin, which is now valued at an astonishing $73.4 billion. This massive accumulation represents 2.86% of Bitcoin’s total supply, highlighting Saylor’s unwavering commitment to the cryptocurrency. For those invested in Bitcoin or just following the crypto space, this news is monumental and reflects a significant shift in the landscape of digital assets.

601,550 $BTC (2.86% of total supply)

The numbers are staggering: Saylor’s holdings of 601,550 $BTC not only demonstrate his deep confidence in the cryptocurrency but also position MicroStrategy as a major player in the Bitcoin arena. This strategy isn’t just about holding Bitcoin for the long term; it’s a well-planned approach that aims to leverage Bitcoin as a primary treasury reserve asset. Saylor’s vision has been clear from the start—he believes that Bitcoin is the future of money, and his actions are speaking volumes.

Saylor’s aggressive accumulation strategy began in August 2020 when MicroStrategy became the first publicly traded company to adopt Bitcoin as its primary treasury reserve asset. Since then, the company has continued to add to its Bitcoin holdings, even amid market fluctuations. His belief in Bitcoin as a hedge against inflation and a store of value is becoming increasingly validated, especially as more institutional investors enter the market.

The sheer scale of Saylor’s Bitcoin holdings raises questions about the implications for the overall cryptocurrency market. With a single entity controlling such a significant portion of Bitcoin’s supply, there are concerns about market manipulation and the potential for price volatility. However, Saylor has repeatedly expressed his long-term vision for Bitcoin, suggesting that he is in it for the long haul rather than short-term gains.

In recent years, Bitcoin’s reputation has shifted from a speculative asset to a legitimate store of value, and Saylor has been at the forefront of this change. His public appearances, interviews, and social media presence have helped to educate new investors and promote Bitcoin as a viable investment option. This has contributed to the growing acceptance of Bitcoin among institutional investors and the broader public.

As Bitcoin continues to gain traction, Michael Saylor’s strategy may serve as a roadmap for other companies looking to diversify their treasury reserves. The success of MicroStrategy’s investments could inspire more corporations to follow suit, leading to increased demand for Bitcoin and potentially driving up its price even further.

In summary, Michael Saylor’s commitment to Bitcoin is reshaping how we think about digital assets and corporate treasury strategies. His significant holdings not only reflect his confidence in Bitcoin but also signal a broader trend toward institutional adoption. As the cryptocurrency market evolves, it will be fascinating to see how these developments play out and what they mean for the future of Bitcoin and the financial landscape as a whole.

For more insights and updates on Bitcoin and cryptocurrency investments, follow [Bitcoin Archive](https://twitter.com/BTC_Archive).