Michael Saylor’s Bitcoin Gamble: $30B Profits or a Trap? — BREAKING: Michael Saylor Bitcoin Profits Surge, Bitcoin Investment Strategies 2025, Michael Saylor Cryptocurrency Moves

Michael Saylor’s Bitcoin Strategy

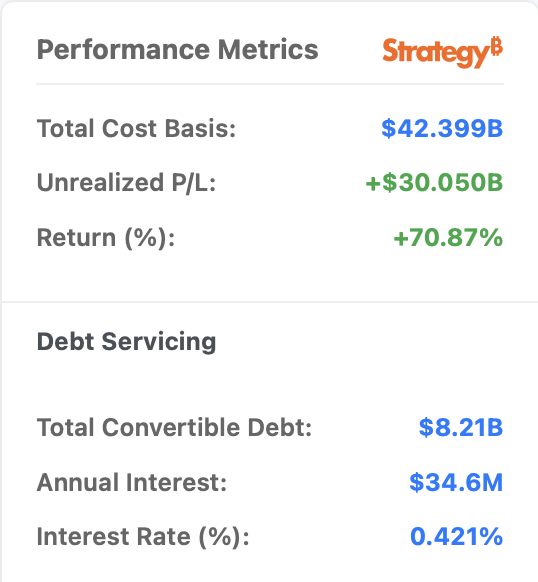

In a groundbreaking update, Michael Saylor’s Bitcoin holdings have realized profits exceeding $30 billion. This significant profit margin positions Saylor to leverage his assets, allowing him to borrow more and potentially expand his Bitcoin investments further. The news has sparked speculation about a major buy-in on the horizon, as Saylor continues to demonstrate confidence in Bitcoin’s long-term value. Investors and crypto enthusiasts are closely monitoring his next moves, as they could have substantial implications for the cryptocurrency market. Stay tuned for updates on Saylor’s investment strategies and their impact on Bitcoin’s future.

BREAKING:

MICHAEL SAYLOR’S STRATEGY UNREALISED PROFITS ON BITCOIN HOLDINGS NOW EXCEED $30B.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

THIS MEANS HE CAN BORROW MORE AND BUY EVEN MORE BITCOIN.

BIG BUY INCOMING TODAY? pic.twitter.com/iGhvUacEjz

— Crypto Rover (@rovercrc) July 14, 2025

BREAKING:

There’s some electrifying news buzzing through the crypto community! Michael Saylor, the co-founder of MicroStrategy, has reached a monumental milestone with his Bitcoin holdings. The unrealized profits from these holdings have now soared past a staggering $30 billion. If you’re a fan of Bitcoin or just keeping an eye on the market, this should definitely catch your attention!

MICHAEL SAYLOR’S STRATEGY UNREALISED PROFITS ON BITCOIN HOLDINGS NOW EXCEED $30B.

For those unfamiliar, Michael Saylor has been a vocal advocate for Bitcoin, famously betting big on the cryptocurrency. His strategy has not only paid off but has also positioned MicroStrategy as one of the largest corporate holders of Bitcoin. With these unrealized profits exceeding $30 billion, Saylor’s investments showcase the incredible potential of Bitcoin. This success isn’t just a number; it opens up a world of possibilities for MicroStrategy and Saylor himself. It’s a testament to the growing belief in Bitcoin as a store of value and a hedge against inflation.

THIS MEANS HE CAN BORROW MORE AND BUY EVEN MORE BITCOIN.

So, what does this mean for Saylor and his future investments? It means he can borrow against these unrealized profits. By leveraging this impressive amount, Saylor can secure loans to buy even more Bitcoin. This kind of financial maneuvering is common in the world of crypto and stocks, but Saylor seems to be taking it to the next level. The potential to increase his Bitcoin holdings even further could lead to even greater profits down the line. The question on everyone’s mind is: how much more Bitcoin will he buy, and when will it happen?

BIG BUY INCOMING TODAY?

There’s a buzz going around that there might be a big buy on the horizon. With Saylor’s track record and the current market dynamics, many are speculating that he might make a significant purchase soon. If he does, it could send ripples through the market, impacting Bitcoin’s price and influencing other investors. Saylor’s moves are always closely watched, and with this latest news, everyone is eager to see what his next steps will be.

For those keeping tabs on the crypto market, this development is worth monitoring. Saylor’s approach to Bitcoin investment could serve as a blueprint for other corporations looking to enter the cryptocurrency space. His confidence in Bitcoin reflects a broader trend where institutional investors are increasingly embracing digital assets.

In summary, Michael Saylor’s unrealized profits exceeding $30 billion not only highlight the success of his investment strategy but also hint at potential future moves that could shake up the market. Whether you’re a seasoned investor or just curious about cryptocurrency, Saylor’s next steps will be crucial to watch. Stay tuned, because if history is any guide, when Saylor makes a move, the crypto world takes notice.