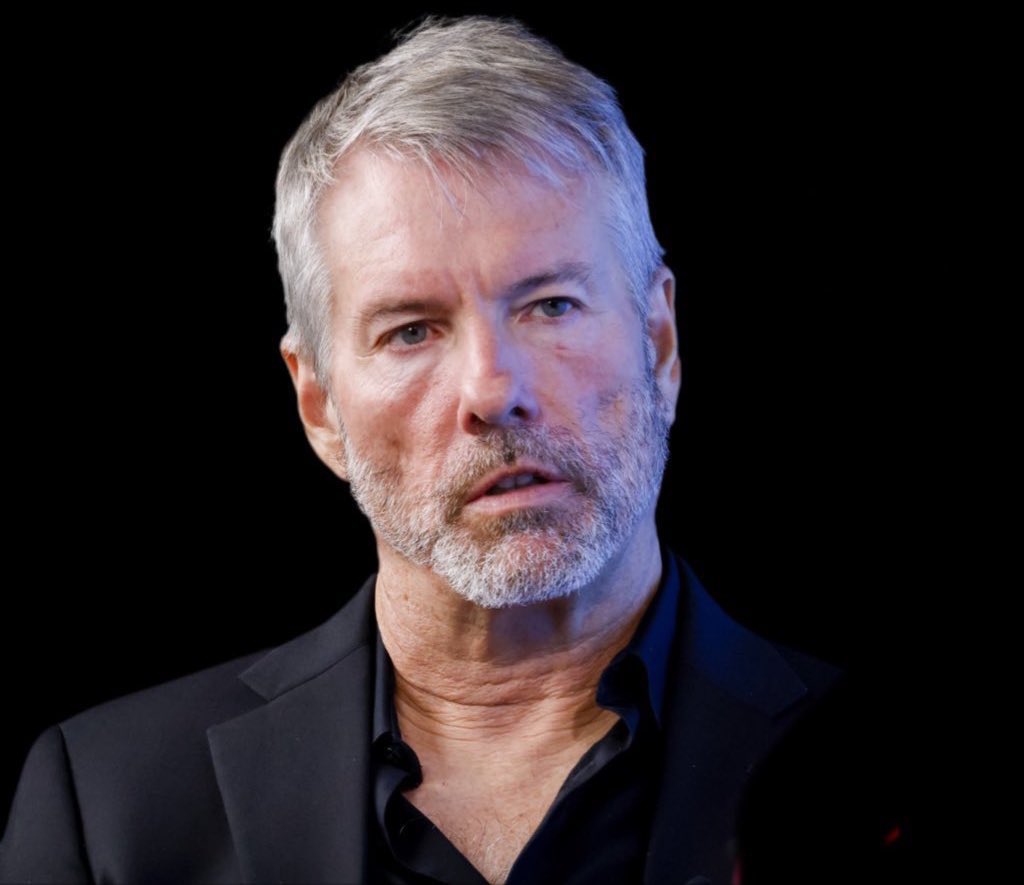

Michael Saylor’s Bitcoin Bet: $30B Profit or Bubble? — Michael Saylor Bitcoin strategy, Bitcoin investment profit 2025, cryptocurrency market gains

Michael Saylor, a prominent figure in the cryptocurrency space, has reportedly amassed an astounding $30 billion in unrealized profits from his Bitcoin investments. This significant financial achievement highlights Saylor’s strategic approach to investing in Bitcoin, reinforcing his reputation as a visionary in the digital asset market. As the cryptocurrency landscape continues to evolve, Saylor’s success serves as a compelling case study for investors looking to navigate the complexities of Bitcoin trading and investment. With Bitcoin’s price fluctuations, understanding investment strategies like Saylor’s can provide valuable insights for both novice and seasoned investors in the crypto market.

JUST IN: Michael Saylor’s ‘Strategy’ now has $30,000,000,000 unrealized profit on its Bitcoin investment. pic.twitter.com/q3iC9WYZ1i

— Watcher.Guru (@WatcherGuru) July 14, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

JUST IN: Michael Saylor’s ‘Strategy’ now has $30,000,000,000 unrealized profit on its Bitcoin investment

If you’ve been keeping an eye on the cryptocurrency market, you might have come across the latest buzz surrounding Michael Saylor. According to a tweet by [Watcher.Guru](https://twitter.com/WatcherGuru/status/1944606058170777923?ref_src=twsrc%5Etfw), Saylor’s strategy has led to a staggering $30 billion in unrealized profits from Bitcoin investments. That’s right—$30 billion! This news has caused quite a stir in both crypto circles and financial news.

Understanding Michael Saylor’s Strategy

Michael Saylor, co-founder and executive chairman of MicroStrategy, has been a vocal advocate for Bitcoin. His approach involves buying and holding Bitcoin as a primary treasury reserve asset. This strategy has proven exceptionally lucrative, especially as Bitcoin’s value has surged over the years. Saylor’s unwavering belief in Bitcoin as “digital gold” has drawn both admiration and skepticism.

Saylor’s company has accumulated over 100,000 Bitcoins, and at current prices, the unrealized profits are monumental. This bold move has not only positioned MicroStrategy as a leader in corporate Bitcoin adoption but has also caught the attention of institutional investors. The question on many minds is: how did Saylor manage to turn his Bitcoin investments into such an impressive profit?

The Bitcoin Market’s Volatility

Bitcoin is notorious for its volatility. Prices can fluctuate dramatically in a matter of hours, which makes investments both thrilling and risky. Saylor’s strategy, however, is built on the premise of long-term holding. By refusing to sell during downturns, he has weathered the storm of Bitcoin’s price swings. With Bitcoin hitting record highs at various points, Saylor’s patience has seemingly paid off.

For investors, this raises an important discussion about the nature of holding versus trading. Many traditional investors might find it hard to resist the urge to cash in during a market spike. Yet, Saylor’s approach highlights the potential rewards of a steadfast commitment to a long-term investment strategy.

The Implications of Saylor’s Success

Michael Saylor’s success with Bitcoin has significant implications for other companies and investors. His bold stance encourages a growing number of corporations to consider Bitcoin as a viable asset class. As more companies follow suit, the legitimacy and acceptance of Bitcoin continue to grow, which can lead to further adoption and investment in the cryptocurrency space.

Moreover, Saylor’s success could inspire individual investors to rethink their strategies. Many may begin considering Bitcoin not just as a speculative asset but as a strategic investment for the future.

The Future of Bitcoin Investments

As we look ahead, the question remains: what’s next for Bitcoin and for Michael Saylor? With $30 billion in unrealized profits, Saylor’s strategy seems to be working, but the crypto market is ever-changing. New regulations, technological advancements, and market dynamics will all play a role in shaping the future of Bitcoin investments.

If you’re intrigued by Saylor’s approach and the potential of Bitcoin, now might be a great time to dive deeper into understanding this digital currency. The world of crypto is full of opportunities, and who knows what the next big news might be?