Fedwire’s ISO 20022 Shift: XRP’s Controversial Future? — ISO 20022 adoption, U.S. payment systems 2025, cryptocurrency interoperability

BREAKING: Fedwire has officially transitioned to ISO 20022 today! This significant milestone marks the adoption of the new global standard for all U.S. payments, enhancing interoperability across financial systems. This shift is expected to provide a massive tailwind for

XRP

, positioning it favorably in the evolving landscape of digital currencies and payment solutions. As institutions adapt to this new standard, the implications for efficiency and transaction speed are profound. Stay informed on the latest developments in payment technology and cryptocurrency by following updates on this transition and its impact on the financial sector.

BREAKING:

Fedwire officially transitions to ISO 20022 today!

All U.S. payments now flow through the new global standard —

A major milestone for interoperability, and a massive tailwind for #XRP. https://t.co/qLnuGvJAza

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

BREAKING: Fedwire officially transitions to ISO 20022 today!

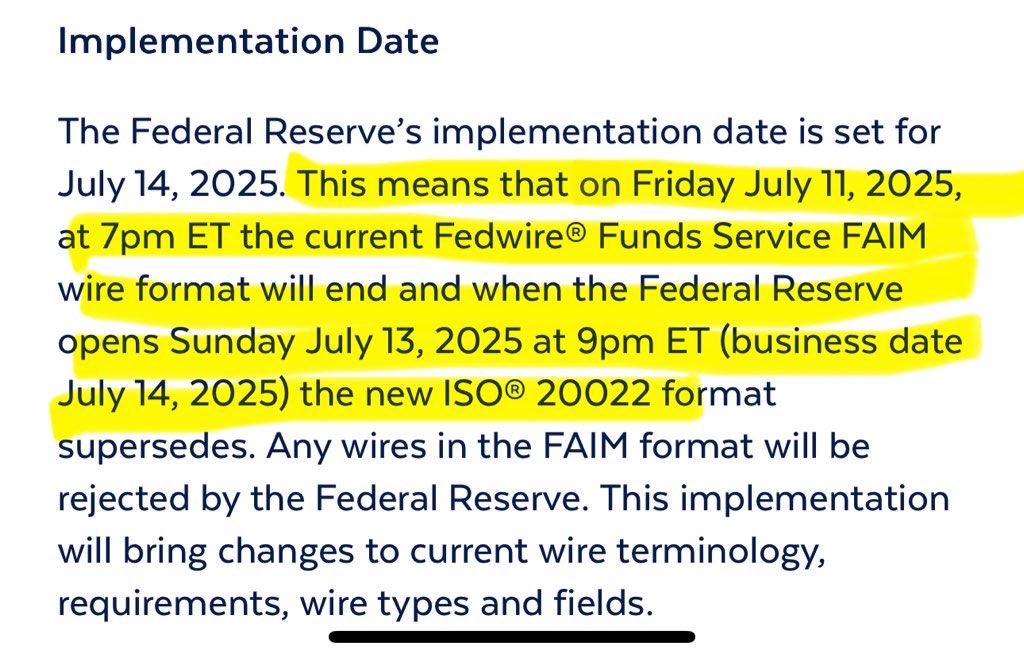

Today marks a significant shift in the world of finance as Fedwire officially transitions to ISO 20022, a new global standard for electronic payments. This transition is not just a technical upgrade; it represents a major milestone for interoperability in the payment landscape. With all U.S. payments now flowing through this new standard, we are witnessing a transformation that has the potential to reshape the way we think about money transfers.

All U.S. payments now flow through the new global standard —

The adoption of ISO 20022 means that payment data can now be structured in a more meaningful way, making it easier for financial institutions to process transactions. This new format allows for richer data to accompany payments, which can enhance the customer experience and lead to faster processing times. For consumers and businesses alike, this means a smoother, more efficient payment process. You can read more about the implications of this transition on Finextra.

A major milestone for interoperability, and a massive tailwind for #XRP.

This transition is especially significant for digital currencies, particularly XRP. As interoperability becomes more robust with ISO 20022, the case for using XRP as a bridge currency strengthens. XRP’s ability to facilitate cross-border payments efficiently aligns perfectly with the goals of the new standard. As financial institutions adapt to this new framework, it’s likely that we’ll see an increased adoption of cryptocurrencies, particularly those designed for seamless integration into traditional financial systems.

Why ISO 20022 Matters

ISO 20022 is more than just a technical standard; it is a game changer for the financial industry. By allowing for standardized, rich data formats, it opens up avenues for innovation in payment processing. Financial institutions can streamline operations, reduce costs, and enhance compliance with regulations. Additionally, this standard is designed to be future-proof, accommodating technological advancements that are yet to come. The transition to ISO 20022 is set to redefine how money moves globally. For deeper insights, check out ISO 20022’s official site.

The Future of Payments

As we embrace this new era of payments with ISO 20022, the implications are profound. Expect to see a more interconnected financial ecosystem where digital currencies and traditional banking systems work together harmoniously. This not only benefits consumers but also encourages financial inclusion across the globe. The transition is a clear indication that the financial sector is evolving, and those who adapt quickly will thrive in this new environment.

In Summary

The transition of Fedwire to ISO 20022 is a groundbreaking development that signifies a leap forward in payment interoperability. As all U.S. payments now operate under this global standard, we can anticipate a more efficient, transparent, and innovative financial landscape. For those keeping an eye on digital assets like XRP, this represents a promising future, one that aligns with the ongoing evolution of finance.