BREAKING: SEC Shakes Wall Street with Anson Funds Subpoenas! — SEC litigation updates, Anson Funds subpoena news, GTS Securities legal developments

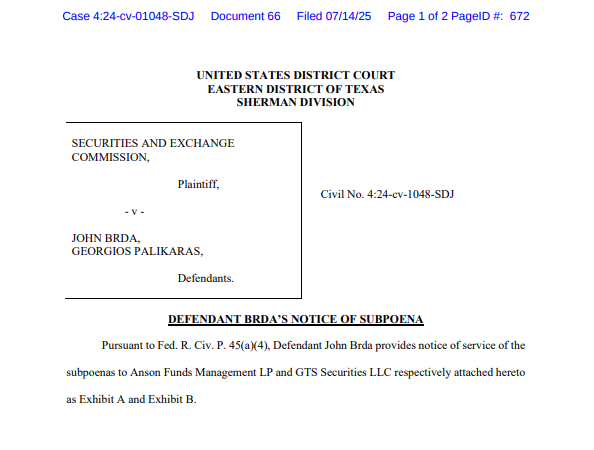

In a significant development in the SEC v. John Brda and Georgios Palikaras case, subpoenas have been issued to Anson Funds and GTS Securities by the defendants. This legal action follows ongoing motions to dismiss and to exclude evidence, with no decisions made yet. Investors and followers of stocks like $MMTLP, $MMAT, and $TRCH should stay updated on this evolving situation. The SEC’s involvement underscores the importance of regulatory compliance in the financial sector. For the latest updates on this case and related securities issues, follow @johnbrda, @palikaras, and @SECgov on Twitter.

BREAKING news

SUBPOENAS SERVED TO ANSON FUNDS AND GTS SECURITIES BY DEFENDANT IN SEC V. JOHN BRDA & GEORGIOS PALIKARAS. NO DECISION REGARDING DEFENDANTS’ MOTIONS TO DISMISS OR MOTION TO EXCLUDE EVIDENCE. $MMTLP $MMAT $TRCH@johnbrda @palikaras @SECgov #AnsonFunds… pic.twitter.com/kvviU8PdeO— JunkSavvy (@JunkSavvy) July 14, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

BREAKING NEWS

In a significant development in the ongoing case of $MMTLP, subpoenas have been served to Anson Funds and GTS Securities by the defendants, John Brda and Georgios Palikaras. This legal maneuver adds another layer of complexity to the already intricate case being overseen by the SEC. As the legal proceedings unfold, there has been no decision made regarding the defendants’ motions to dismiss or their motion to exclude evidence, leaving many onlookers eager for the next steps.

SUBPOENAS SERVED TO ANSON FUNDS AND GTS SECURITIES BY DEFENDANT IN SEC V. JOHN BRDA & GEORGIOS PALIKARAS

The subpoenas served to Anson Funds and GTS Securities come as no surprise, considering the high stakes involved in this case. With the SEC’s scrutiny intensifying, both Brda and Palikaras are strategically maneuvering to establish their defenses. The subpoenas are essential as they aim to gather more information and evidence that could be pivotal in their arguments against the SEC’s claims.

For those who may not be familiar, this case has been closely followed by investors and analysts alike, particularly concerning the stocks involved, like $MMAT and $TRCH. The implications of this case are profound, as it could potentially redefine legal precedents regarding securities trading and investor rights.

NO DECISION REGARDING DEFENDANTS’ MOTIONS TO DISMISS OR MOTION TO EXCLUDE EVIDENCE

The fact that there has yet to be a decision on the motions to dismiss or exclude evidence adds a layer of uncertainty to the proceedings. Legal experts suggest that this delay could be indicative of the complexity of the case, where both sides have substantial arguments to present. The judges involved are likely weighing their options carefully to ensure a fair ruling that upholds the integrity of the legal system.

Many investors are watching closely, as the outcome of these motions could significantly impact the stock prices of companies like $MMTLP, $MMAT, and $TRCH. The volatility surrounding this case has already led to some wild fluctuations in these stocks, causing both excitement and anxiety among investors. It’s a classic example of how legal battles in the financial sector can ripple through the markets.

@johnbrda @palikaras @SECgov

As more updates emerge, the involvement of key figures such as John Brda and Georgios Palikaras will remain in the spotlight. Their public profiles continue to grow, and they are actively engaging with followers on social media platforms. You can keep up with the latest from them directly through their Twitter handles: @johnbrda and @palikaras.

Additionally, the SEC’s official account, @SECgov, is another valuable resource for updates related to this case. With the legal landscape constantly shifting, staying informed is crucial for anyone invested in the outcome of this case.

#AnsonFunds

The developments surrounding Anson Funds and their role in this case will continue to be a major point of discussion. Investors and analysts will be keen to see how this unfolds, especially with the potential for significant legal repercussions that could affect market behavior. As the situation evolves, it’s vital to stay updated and engaged with credible sources to navigate the complexities of this case.