BREAKING: FedWire’s ISO 20022 Shift Sparks XRP Controversy! — ISO 20022 adoption, U.S. payment system upgrade, XRP market impact

The Federal Reserve has officially transitioned to the ISO 20022 standard for Fedwire, marking a significant milestone for U.S. payments. This upgrade enhances the efficiency and clarity of electronic transactions, paving the way for advanced payment solutions. The shift to ISO 20022 is particularly impactful for digital currencies like

XRP

, as it supports seamless integration with modern financial systems. The adoption of this new standard not only improves cross-border payments but also aligns with global financial messaging standards. Stay informed about the latest developments in the cryptocurrency space as this transition unfolds.

BREAKING:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

FEDWIRE SWITCHES TO ISO 20022 TODAY!

ALL U.S. PAYMENTS MOVE TO NEW STANDARD.

THIS IS MASSIVE FOR #XRP pic.twitter.com/7gKOYvAndw

— STEPH IS CRYPTO (@Steph_iscrypto) July 14, 2025

BREAKING:

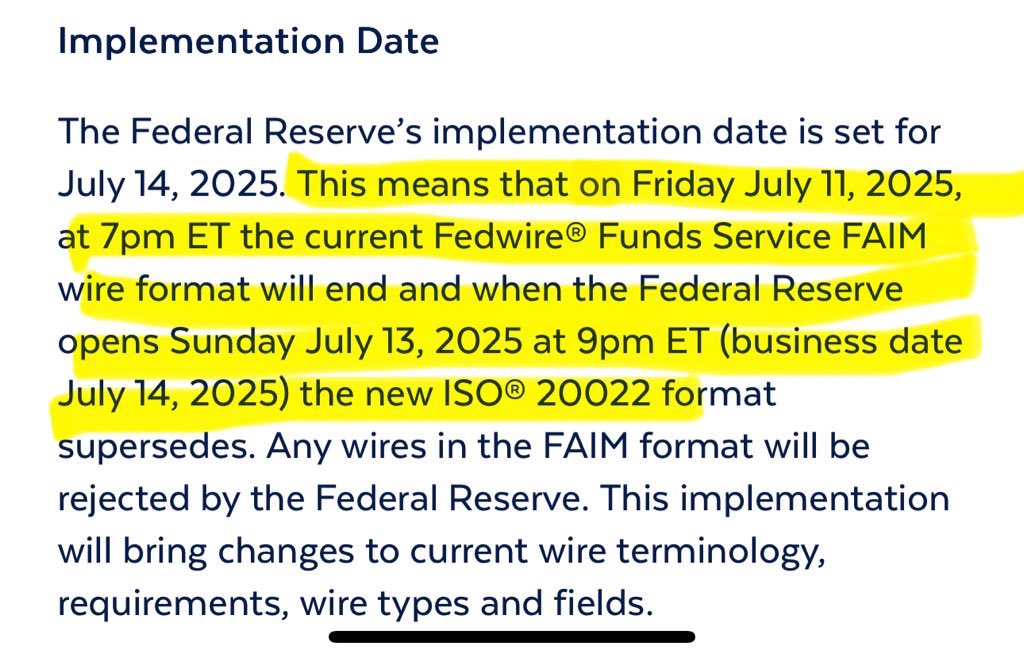

In an exciting twist in the world of finance, Fedwire has officially switched to ISO 20022 today. This monumental shift means that all U.S. payments are now moving to a new standard, paving the way for more efficient and detailed transactions. If you’re in the financial sector or just keeping an eye on the evolving landscape of digital payments, you’ll want to pay attention to this change!

FEDWIRE SWITCHES TO ISO 20022 TODAY!

ISO 20022 is not just a fancy term thrown around in financial circles; it represents a global standard that allows for richer data to be included with payment messages. This means that transactions can now carry more information, which is vital for compliance, fraud detection, and enhancing customer experiences. With the switch to ISO 20022, Fedwire is stepping up its game to provide a more robust infrastructure for U.S. payments.

ALL U.S. PAYMENTS MOVE TO NEW STANDARD.

The transition to ISO 20022 is significant for various reasons. First, it aligns the U.S. payment systems with international standards, making cross-border transactions smoother. Financial institutions can now exchange payment information more seamlessly, reducing delays and errors. This is especially important as the global economy becomes more interconnected. ISO 20022 is already widely adopted in Europe and other regions, so this move brings the U.S. up to speed.

THIS IS MASSIVE FOR #XRP

Now, let’s talk about the implications for cryptocurrencies, particularly XRP. This switch is being hailed as massive for XRP enthusiasts and investors. With the enhanced capabilities of ISO 20022, XRP, which is designed for fast cross-border transactions, could see increased adoption in mainstream financial systems. The more efficient payment processing could make XRP an attractive option for banks and payment providers looking to leverage the new standard.

Moreover, the integration of cryptocurrencies into existing financial frameworks is becoming increasingly plausible as traditional systems upgrade to accommodate modern technologies. XRP’s ability to facilitate quicker and cheaper transactions aligns perfectly with the goals of ISO 20022.

What’s Next?

So, what can we expect moving forward? Financial institutions will need to adapt to this new standard, and we may see a surge of innovations as they develop new products and services that utilize the enriched data capabilities of ISO 20022. For consumers, this could mean faster payment processing times and better transaction tracking features.

As the industry evolves, staying informed about these changes is crucial. Following updates from reliable sources, such as Steph is Crypto, can help you keep your finger on the pulse of these developments. The financial landscape is shifting, and being aware of these changes can provide valuable insights into the future of payments.