BREAKING: Fed’s Shocking Crypto Rules Could Upend Banking! XRP — crypto regulations 2025, Federal Reserve crypto guidelines, banks cryptocurrency compliance

The Federal Reserve has unveiled new regulations allowing banks to treat cryptocurrencies as conventional assets, a significant shift in the financial landscape. This groundbreaking development enables financial institutions to integrate digital currencies, such as XRP, into their operations more seamlessly. As the crypto market continues to evolve, this regulatory framework is expected to foster innovation and enhance the legitimacy of digital assets in the banking sector. Investors and financial professionals should stay informed about these changes, as they could impact market dynamics and investment strategies. For more updates on XRP and cryptocurrency regulations, follow industry news closely.

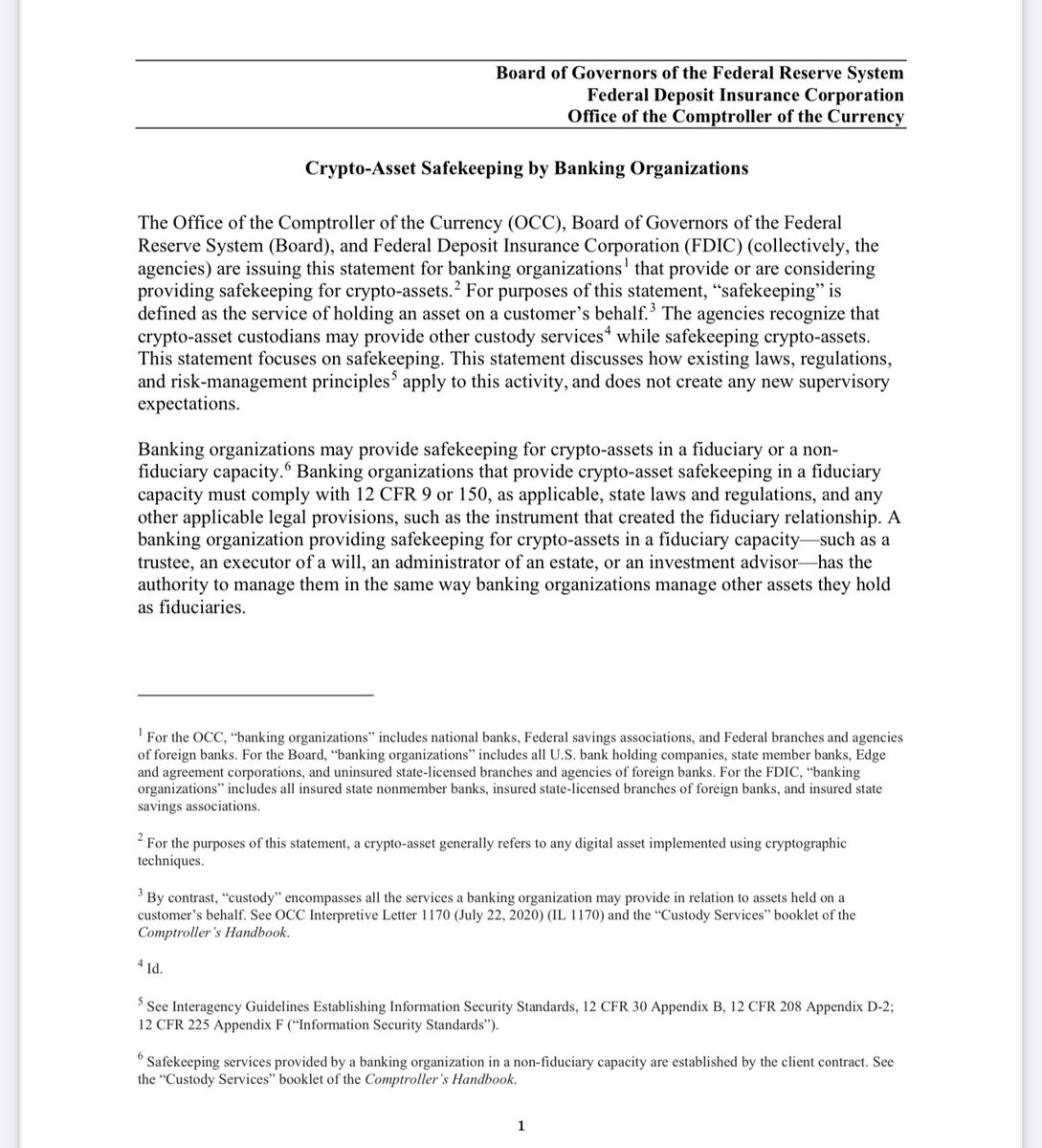

BREAKING: The Federal Reserve just released a document outlining the regulations for banks to operate with crypto, allowing them to treat them as any other asset! #XRP pic.twitter.com/vS4Ar6dPJC

— JackTheRippler © (@RippleXrpie) July 14, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

BREAKING: The Federal Reserve just released a document outlining the regulations for banks to operate with crypto, allowing them to treat them as any other asset!

Exciting news is shaking up the financial world! The Federal Reserve has just unveiled a groundbreaking document that lays out new regulations allowing banks to operate with cryptocurrencies. This shift means that cryptocurrencies can now be treated like any other asset, which is a game changer for both banks and crypto enthusiasts alike. With the rise of digital currencies, this regulation opens the door for a more mainstream acceptance of cryptocurrencies in the traditional financial system.

Understanding the New Regulations

So, what does this new regulation mean? Essentially, banks can now hold and manage digital assets just like they do with stocks, bonds, and other financial instruments. This is a huge step towards legitimizing cryptocurrencies in the eyes of many skeptics who have been wary of their volatile nature. The Federal Reserve’s decision signals that they recognize the importance of digital assets and are ready to incorporate them into the financial landscape. You can read more about this development on Forbes.

Impact on Banks and Consumers

For banks, this new regulation offers an opportunity to expand their services and attract tech-savvy customers. By being able to offer crypto-related services, banks can compete with fintech companies that have already made significant inroads into the crypto space. This also means that consumers will have more options for buying, selling, and holding cryptocurrencies through their banks, which could lead to increased adoption.

What It Means for Cryptocurrency Investors

Investors in cryptocurrencies, especially those who are fans of assets like XRP, should feel optimistic about this development. With banks now able to engage with cryptocurrencies, the market could see increased stability and growth. The more mainstream adoption of crypto could lead to higher prices, making it an exciting time for investors. Additionally, as banks start to offer crypto services, we might see lower transaction fees and better security measures for holding digital assets.

The Future of Crypto and Banking

This regulatory change is just the beginning. As banks start to adapt to this new landscape, we can expect to see more innovation in how cryptocurrencies are used in everyday transactions. Imagine a world where you can easily pay for your morning coffee with your digital wallet or use your crypto assets for various financial services. The possibilities are endless, and it’s an exciting time to be part of the crypto revolution!

Stay Informed

As always, staying informed is crucial. Keep an eye on updates from the Federal Reserve and financial news outlets to understand how these regulations will evolve. Engaging with communities on platforms like Twitter can also provide insight and perspectives from other crypto enthusiasts as the landscape changes. For continuous updates, follow conversations around #XRP and other cryptocurrencies. This is not just a shift in regulations; it’s a transformation in how we view money in the digital age.