BREAKING: Fed Allows Banks to Custody Bitcoin! Shockwaves! — Federal Reserve crypto custody regulations, Bitcoin banking services 2025, cryptocurrency custody solutions

The Federal Reserve, alongside two regulatory bodies, has officially announced that banks are now permitted to provide Bitcoin and cryptocurrency custody services. This pivotal development marks a significant step toward the mainstream adoption of digital assets within traditional banking systems. By enabling banks to offer custody solutions for cryptocurrencies, the move is expected to enhance security and accessibility for investors. This regulatory approval is a game changer in the crypto landscape, potentially attracting more institutional interest in Bitcoin and other digital currencies. Stay updated on this evolving situation as it shapes the future of cryptocurrency in finance.

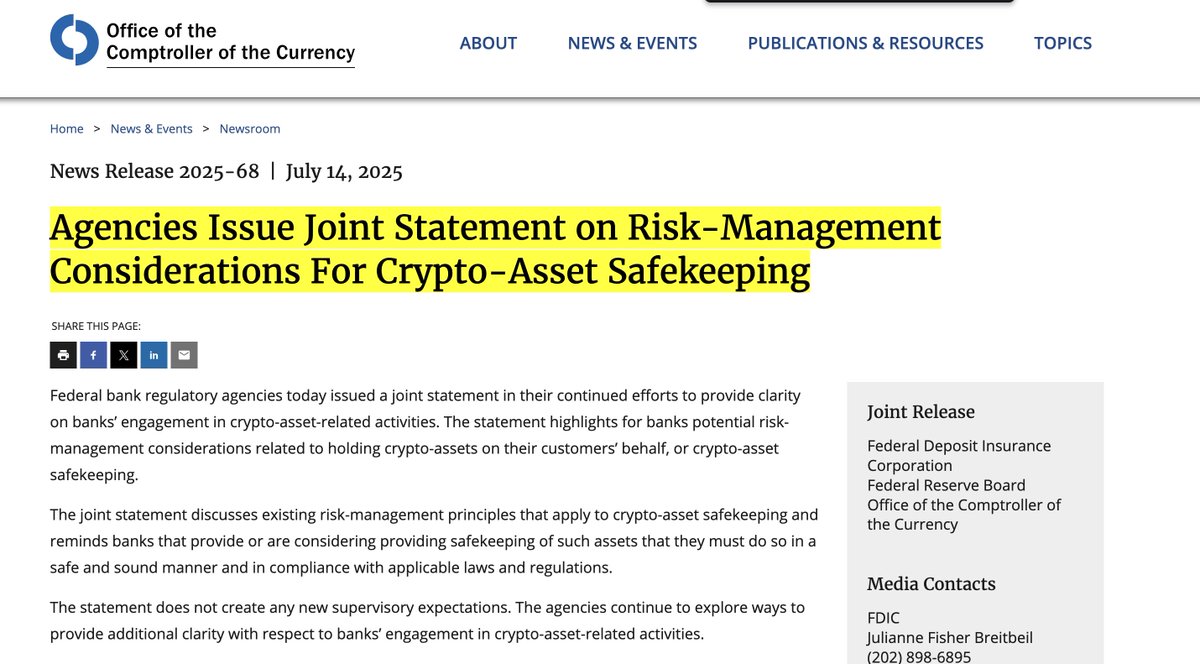

BREAKING: Federal Reserve just issued a joint statement with 2 regulators confirming that banks can offer Bitcoin and crypto custody. pic.twitter.com/jS66zlGNUn

— Bitcoin Archive (@BTC_Archive) July 14, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

BREAKING: Federal Reserve just issued a joint statement with 2 regulators confirming that banks can offer Bitcoin and crypto custody

Have you heard the latest buzz from the world of finance? The Federal Reserve, alongside two key regulators, has just dropped a bombshell announcement: banks are now permitted to offer custody services for Bitcoin and other cryptocurrencies. This news is significant for both traditional banking and the crypto landscape, and it raises a lot of exciting possibilities for the future of digital assets.

Understanding the Announcement

The statement from the Federal Reserve marks a pivotal moment in the intersection of cryptocurrency and traditional banking. For years, the relationship between banks and cryptocurrencies has been fraught with uncertainty. Many banks have hesitated to engage with crypto assets due to regulatory concerns and the lack of clear guidelines. However, this new joint statement seems to clear the air, allowing banks to provide custody solutions for Bitcoin and other digital currencies. This means that banks can now securely hold customers’ crypto assets, giving them a level of confidence and security that was previously lacking.

The Implications for Banks and Consumers

So, what does this mean for banks and their customers? For banks, this is a golden opportunity to tap into the growing market of cryptocurrency. As more people invest in Bitcoin and other digital assets, banks can now offer services that cater to this demographic. By providing secure custody solutions, banks can attract tech-savvy customers who might have previously opted for crypto exchanges or wallets instead of traditional banking institutions.

For consumers, this announcement could lead to greater trust in cryptocurrencies. With banks handling custody, users may feel more secure about their investments, knowing that these institutions are subject to regulatory oversight. This could potentially lead to a surge in crypto adoption, as more individuals feel comfortable investing in digital assets.

Regulatory Landscape and Future Prospects

The joint statement from the Federal Reserve and regulators is also indicative of a shifting regulatory landscape. As governments and financial institutions begin to embrace cryptocurrencies, we may see more comprehensive regulations that could further legitimize the space. This could pave the way for even more financial products and services involving cryptocurrencies, such as loans and interest-bearing accounts.

With traditional banks stepping into the crypto arena, we might also witness increased competition among financial institutions. This competition could lead to better services and lower fees for consumers, as banks strive to attract and retain crypto-savvy clients.

Final Thoughts

In essence, the Federal Reserve’s announcement about banks offering Bitcoin and crypto custody is a game-changer. It opens the door for greater integration between traditional finance and the world of digital assets, potentially leading to broader acceptance of cryptocurrencies in everyday transactions. As we move forward, it will be fascinating to see how this development unfolds and what it means for the future of both banking and cryptocurrency.

For more details, you can check out the original tweet from [Bitcoin Archive](https://twitter.com/BTC_Archive/status/1944850844853395502?ref_src=twsrc%5Etfw) and stay updated on this exciting evolution in finance.