BREAKING: Banks Get Crypto Green Light—Is XRP Next? — “crypto banking regulations 2025, digital asset compliance framework, XRP market surge potential”

The Federal Reserve has officially approved new regulations allowing banks to operate with cryptocurrencies, treating them as standard assets. This groundbreaking decision opens the door for financial institutions to engage more fully in the crypto market, significantly impacting the future of digital currencies. With this green light, many are anticipating a surge in interest and investment in cryptocurrencies like

XRP

. As banks adapt to these new guidelines, the crypto landscape is poised for transformation, promising exciting opportunities for investors and financial entities alike. Stay tuned for more developments on this evolving story and its implications for the crypto economy.

BREAKING:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

GREEN LIGHT FOR BANKS:

THE FED RELEASED A DOCUMENT OUTLINING THE REGULATIONS FOR BANKS TO OPERATE WITH CRYPTO, ENABLING THEM TO TREAT THEM AS ANY OTHER ASSET!

THE TIME FOR #XRP IS COMING! https://t.co/nfXJHrSUEy pic.twitter.com/GozFisYffe

— 𝓐𝓶𝓮𝓵𝓲𝓮 (@_Crypto_Barbie) July 14, 2025

BREAKING:

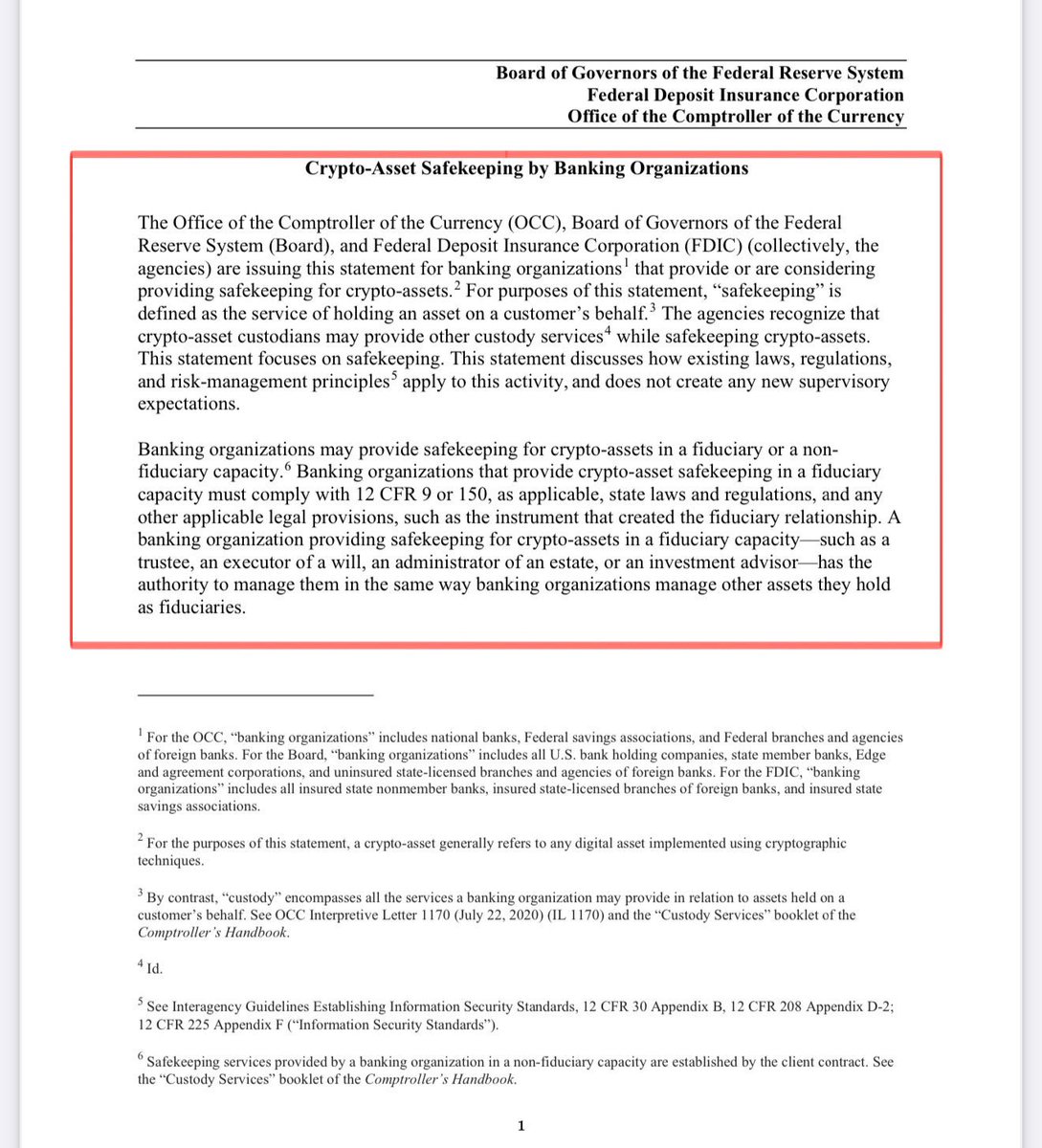

Big news has just dropped in the financial world! The Federal Reserve has given the green light for banks to operate with cryptocurrencies. That’s right, folks! This means that banks can now treat crypto assets just like any other asset. This groundbreaking regulation is set to reshape the landscape of banking and investing as we know it.

GREEN LIGHT FOR BANKS:

The Fed’s recent announcement has stirred up excitement among investors and crypto enthusiasts alike. With the new regulations in place, banks will be able to hold, trade, and manage cryptocurrencies in a manner similar to traditional assets. This opens up a world of possibilities for both consumers and financial institutions. Imagine walking into your local bank and being able to manage your crypto assets alongside your regular savings and checking accounts!

THE FED RELEASED A DOCUMENT OUTLINING THE REGULATIONS FOR BANKS TO OPERATE WITH CRYPTO, ENABLING THEM TO TREAT THEM AS ANY OTHER ASSET!

This document outlines specific guidelines for banks to follow when it comes to handling cryptocurrencies. It aims to ensure that banks can safely and effectively integrate digital assets into their operations while also protecting consumers. For instance, banks will need to implement robust security measures to safeguard these assets from potential threats. This is crucial, considering the increasing number of cyberattacks targeting cryptocurrency exchanges and wallets. You can read more about the specifics of these regulations in detail on [CoinDesk](https://www.coindesk.com) and other reputable financial news sources.

THE TIME FOR XRP IS COMING!

Now, let’s talk about XRP. With these new regulations, many believe that the time for XRP is now. As banks start to embrace cryptocurrencies, XRP’s utility as a bridge currency for cross-border transactions could see significant growth. The ability for banks to treat XRP as a legitimate asset means that it could become more widely adopted in financial institutions around the globe.

This is a huge moment for the crypto community, especially for XRP holders who have been waiting for clarity and acceptance in the banking sector. The potential for increased liquidity and use cases for XRP is exciting. Already, investors are buzzing about what this could mean for the price of XRP and its future as an essential player in the crypto market.

As we stand on the brink of this new era, it’s essential to stay informed and engaged. The world of cryptocurrencies is evolving rapidly, and understanding these changes can help you navigate your investments effectively. Keep an eye on market trends, and don’t hesitate to explore how these new banking regulations might impact your financial strategy.

In summary, the Fed’s announcement marks a pivotal shift in the way banks will interact with cryptocurrencies. With the potential for growth in assets like XRP, the future looks bright for both investors and the crypto industry as a whole. Get ready, because the crypto revolution is just getting started!