Bitcoin Surpasses Giants: Is It the Future of Wealth? — Bitcoin market surge, cryptocurrency investment trends 2025, global asset rankings 2025

Bitcoin Surpasses Major Assets

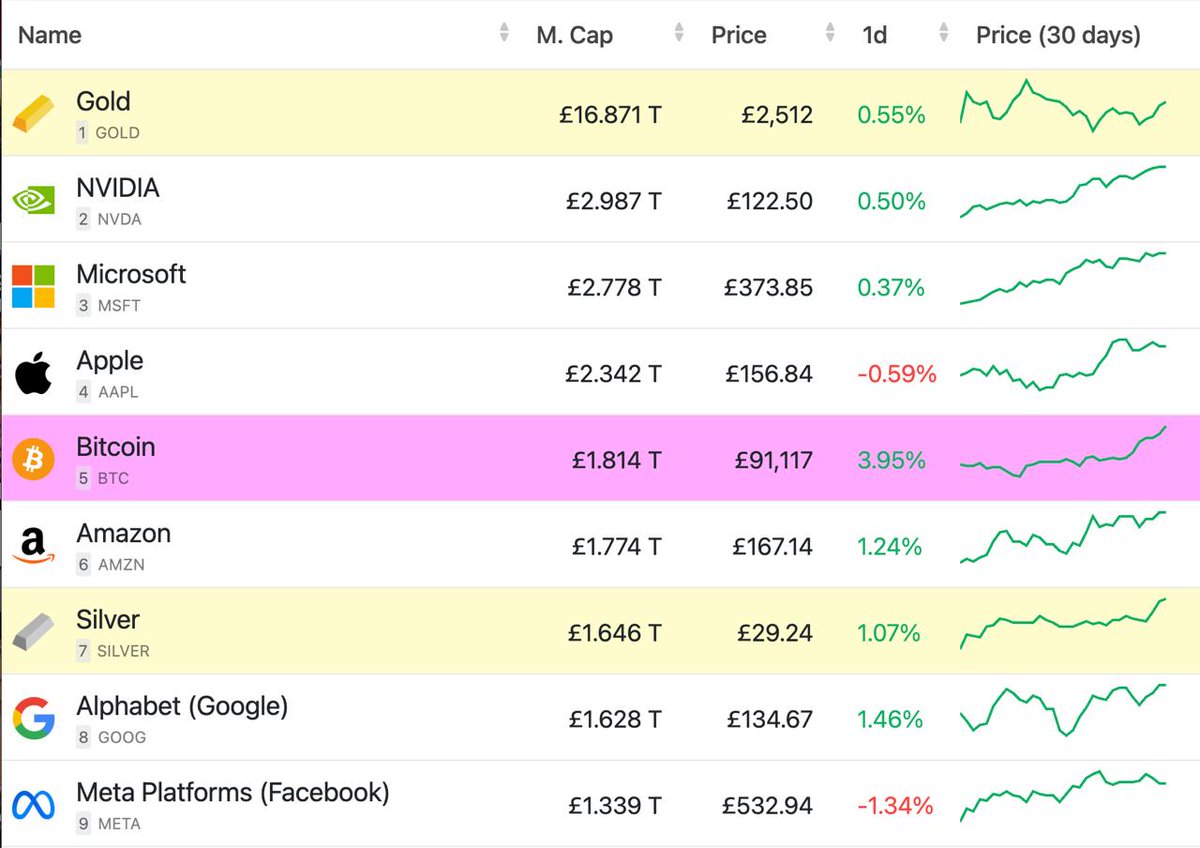

In a remarkable development, Bitcoin has soared to become the 5th-largest asset globally, overtaking giants like Amazon, Silver, and Google. This groundbreaking achievement highlights Bitcoin’s increasing prominence in the financial landscape, attracting attention from investors and analysts alike. As cryptocurrencies continue to evolve, Bitcoin’s market capitalization reflects its growing acceptance and potential as a digital asset. The surge in Bitcoin’s value not only underscores the shift towards digital currencies but also positions it as a significant player in the global economy. Stay updated on Bitcoin’s journey and its impact on traditional financial markets.

BREAKING: Bitcoin is now the 5th-largest asset in the world, surpassing Amazon, Silver, and Google. pic.twitter.com/er1Bwu9ElJ

— Cointelegraph (@Cointelegraph) July 14, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

BREAKING: Bitcoin is now the 5th-largest asset in the world, surpassing Amazon, Silver, and Google.

When it comes to the world of finance and investment, Bitcoin has certainly made waves. Recently, it was reported that Bitcoin has officially become the fifth-largest asset globally, overtaking major players like Amazon, Silver, and even Google. This incredible milestone signifies a shift in how we perceive and value digital currencies. With Bitcoin’s rise, many are left wondering what this means for investors and the future of cryptocurrency.

What Does This Mean for Bitcoin?

Bitcoin’s ascension to the fifth-largest asset spot isn’t just a statistic; it reflects a growing acceptance of cryptocurrencies in mainstream finance. As more individuals and institutions invest in Bitcoin, its market capitalization has surged, solidifying its place among the giants of the financial world. This shift opens up numerous possibilities for crypto enthusiasts and casual investors alike. It may indicate that Bitcoin is becoming a safe haven asset, similar to gold, as people look for alternatives amidst economic uncertainty.

Why Is Bitcoin Surpassing Traditional Assets?

One of the fundamental reasons Bitcoin is outpacing traditional assets like Amazon and Silver is its decentralized nature. Unlike stocks or commodities, Bitcoin operates on a peer-to-peer network, which means it isn’t controlled by any single entity. This decentralization can be attractive to investors seeking to avoid the volatility and regulatory issues associated with traditional financial markets. Furthermore, Bitcoin is often viewed as a hedge against inflation, especially as central banks around the world continue to print money.

The Role of Institutional Investment

Another factor contributing to Bitcoin’s rise is the influx of institutional investment. Major corporations and financial giants are now dipping their toes into the crypto market, significantly impacting its legitimacy. Companies like Tesla and MicroStrategy have made headlines for their substantial Bitcoin investments, showing that even traditional businesses see value in this digital currency. As more institutions back Bitcoin, it not only bolsters its credibility but also encourages everyday investors to explore this asset class.

Future Implications for Investors

For those looking to invest, the news of Bitcoin’s ranking should be both exciting and cautionary. While the potential for high returns is alluring, investing in cryptocurrency also comes with risks. The volatility of Bitcoin’s price means that significant fluctuations can happen overnight. Therefore, it’s crucial to do thorough research and consider your financial situation before diving into the crypto market.

Staying Informed About Bitcoin’s Journey

As Bitcoin continues its journey to reshape the financial landscape, staying informed is key. Regularly checking sources like [Cointelegraph](https://cointelegraph.com) can provide you with the latest updates on Bitcoin and other cryptocurrencies. These insights can help you navigate the complexities of crypto investing, ensuring you make informed decisions.

Bitcoin’s rise to become the fifth-largest asset in the world marks a pivotal moment in the financial realm. It signifies a growing acceptance of digital currencies and could very well pave the way for a future where cryptocurrencies play a central role in global finance. Whether you’re a seasoned investor or just curious about the crypto space, the developments surrounding Bitcoin are definitely worth watching.