Bitcoin Skyrockets to $123K, $468M Shorts Obliterated! — Bitcoin price surge news, leveraged trading risks 2025, cryptocurrency market volatility

Bitcoin has recently surged past $123,000, leading to significant market disruption, with $468 million in leveraged short positions liquidated. This dramatic price increase has left many short sellers rekt, highlighting the volatility and unpredictability of cryptocurrency trading. As the market continues to evolve, investors are urged to stay informed and exercise caution. This event underscores the importance of risk management strategies in the crypto space. Keeping an eye on Bitcoin’s price movements can help traders make informed decisions. For the latest updates and analysis on Bitcoin and cryptocurrency trends, follow leading financial news sources and market analysts.

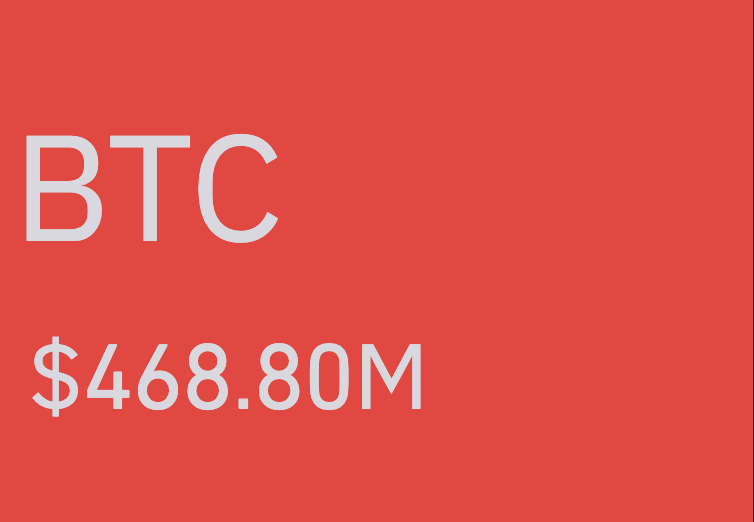

JUST IN: $468m leveraged short positions rekt as Bitcoin surged above $123,000. pic.twitter.com/9GQEgYHeL3

— Bitcoin Archive (@BTC_Archive) July 14, 2025

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

JUST IN: $468m leveraged short positions rekt as Bitcoin surged above $123,000

Bitcoin has once again made headlines, and this time it’s creating quite a stir in the trading community. Just recently, a staggering $468 million in leveraged short positions was liquidated as Bitcoin’s price surged past $123,000. This dramatic price action highlights the volatility and unpredictability of the cryptocurrency market, reminding traders of the risks associated with high-leverage trading.

What Happened with Bitcoin?

When Bitcoin soared above $123,000, it sent shockwaves through the market. Many traders who bet against Bitcoin using leveraged short positions found themselves on the losing end. Simply put, when you “short” Bitcoin, you’re betting that its price will drop. But when the price skyrockets, as it just did, those positions get liquidated, which means traders lose their initial investment—and then some. This situation often leads to a cascading effect, where liquidations trigger further buying, pushing the price even higher.

The recent surge was notable not just for its magnitude but also for the sheer volume of liquidations. According to reports, the $468 million in leveraged short positions rekt is a clear indicator of how quickly fortunes can change in the crypto space. Traders who were confident in their bearish positions must now reevaluate their strategies in light of this unexpected price movement.

The Implications of Liquidations

Liquidations have significant implications for the market. They can create a feedback loop where the price continues to rise as more shorts get liquidated, leading to even more buying pressure. This is a phenomenon traders refer to as a “short squeeze.” In the case of Bitcoin, this situation could potentially lead to further increases in price as bullish sentiment builds among investors.

Moreover, the massive amount of liquidated short positions underscores the importance of risk management in trading. Experienced traders know that using leverage can amplify both gains and losses, and the recent events serve as a cautionary tale for those looking to dip their toes in the crypto waters. As always, it’s crucial to do your research, understand the market dynamics, and never invest more than you can afford to lose.

Why Bitcoin’s Price is Surging

Several factors contribute to Bitcoin’s price surges. Institutional adoption, technological advancements, and macroeconomic trends all play significant roles. Recently, there has been a growing interest from institutional investors, which adds a layer of legitimacy to Bitcoin and can drive prices upward. Additionally, developments in blockchain technology and increasing acceptance of Bitcoin as a payment method contribute to its appeal.

The current economic landscape, including inflation concerns and geopolitical tensions, has also prompted many to seek refuge in decentralized assets like Bitcoin. As traditional markets face uncertainty, Bitcoin continues to attract attention as a potential hedge against economic instability.

Final Thoughts on Bitcoin’s Future

The recent liquidation of $468 million in leveraged short positions highlights the unpredictable nature of Bitcoin trading. As the cryptocurrency market continues to evolve, traders must remain vigilant and adaptable. Whether you’re a seasoned trader or just starting, understanding the risks and dynamics of this market is essential. Keep an eye on Bitcoin, as its journey is far from over, and who knows what the next surge will bring?

For more insights and real-time updates on Bitcoin and the cryptocurrency market, stay tuned to reliable sources like [Bitcoin Archive](https://twitter.com/BTC_Archive).