Nvidia CEO’s Shocking $35.6M Stock Sale Raises Insider Trading Concerns!

Nvidia Insider Trading Alert: CEO Jensen Huang Sells $35.6 Million in Shares

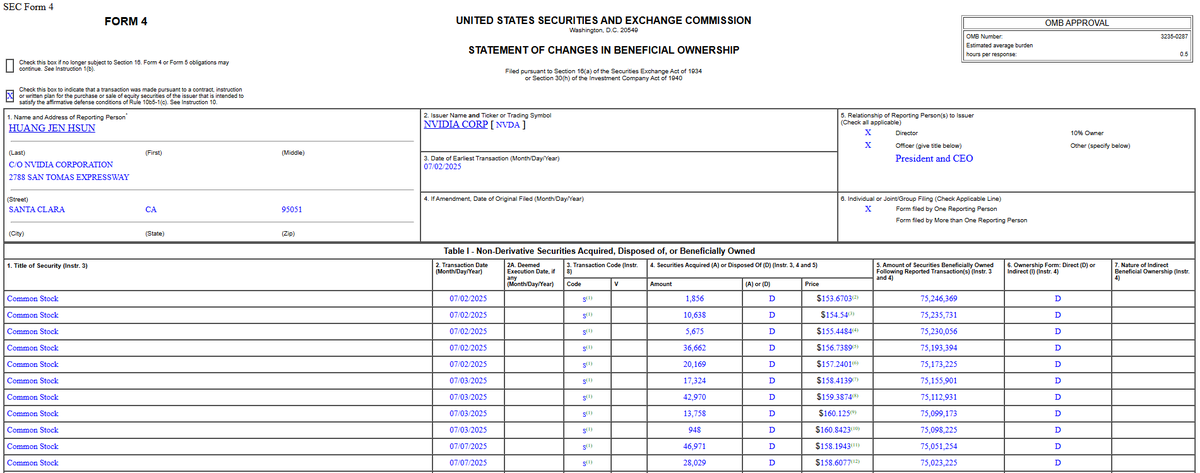

In a recent development that has sent ripples through the financial community, Jensen Huang, the CEO of Nvidia, has executed a significant sale of company shares amounting to $35.6 million. This transaction is part of a larger trend, as Huang has reportedly sold over $115 million worth of Nvidia shares in just the past two weeks. Such insider trading activities raise eyebrows, prompting discussions among investors, analysts, and industry observers regarding the implications for Nvidia and its stock ($NVDA).

Understanding Insider Trading

Insider trading, the buying or selling of a company’s stock based on non-public information, is a practice that can significantly influence market perceptions and stock prices. While legal when conducted transparently and in accordance with regulations, it can also raise ethical concerns. When a high-ranking executive like Huang sells a substantial amount of shares, it can lead investors to question the future outlook of the company.

The Context Behind Huang’s Sales

Jensen Huang’s recent sales come at a time when Nvidia is navigating a rapidly evolving tech landscape. The company has been at the forefront of innovations in artificial intelligence (AI), machine learning, and graphics processing units (GPUs). With the increasing demand for AI technologies, Nvidia’s stock has experienced substantial growth over the past few years. However, the timing of Huang’s sales raises questions about whether these sales are indicative of his confidence in the company’s future performance.

Market Reactions to the Insider Trading Alert

The market’s reaction to Huang’s insider trading has been mixed. Some investors may perceive the sales as a sign of potential volatility ahead, while others may view it as a strategic move by the CEO. Historically, large insider sales have sometimes preceded declines in stock prices, leading to caution among investors. However, it is also essential to consider that executives may sell shares for various reasons unrelated to the company’s performance, such as personal financial planning or tax liabilities.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Nvidia’s Financial Performance

To understand the significance of Huang’s insider trading, it’s crucial to look at Nvidia’s financial performance. The company has consistently reported strong earnings, driven by high demand for its GPUs, particularly in gaming, data centers, and AI applications. Despite the impressive growth, market analysts often scrutinize executive trading activities as potential indicators of future performance. The recent sales by Huang could signal a need for investors to reassess their positions in Nvidia.

The Broader Implications for Investors

For investors considering Nvidia, Huang’s recent sales may merit closer examination of their investment strategies. While insider trading can provide signals about a company’s health, it should not be the sole basis for investment decisions. Investors should also consider other factors, such as market trends, competitive landscape, and overall economic conditions.

Additionally, long-term investors might choose to focus on Nvidia’s growth potential rather than short-term fluctuations in stock prices. The company’s robust portfolio in AI and GPU technologies presents significant opportunities for future revenue growth, and many analysts continue to have a bullish outlook on Nvidia’s stock.

Conclusion: What’s Next for Nvidia and Investors?

As Jensen Huang continues to sell Nvidia shares, both the company’s performance and broader market conditions will be critical in shaping future developments. Investors should remain vigilant, keeping an eye on insider trading activities while also considering the company’s fundamentals. Nvidia’s leadership in AI and technology innovation positions it well for the future, but fluctuations in executive trading can serve as a reminder of the inherent risks involved in stock market investments.

In summary, while Huang’s recent sales of $35.6 million and over $115 million in two weeks may raise concerns, it is essential for investors to balance these insights with a comprehensive understanding of Nvidia’s performance and market trends. As the tech landscape continues to evolve, Nvidia’s strategic direction and innovation will play a pivotal role in determining its long-term success and stock performance.

Nvidia Insider Trading Alert

CEO Jensen Huang just sold $35.6 million worth of $NVDA shares He’s now sold more than $115 million worth over the last 2 weeks pic.twitter.com/KdP4eOevWg

— Barchart (@Barchart) July 8, 2025

Nvidia Insider Trading Alert

Big news is swirling around the tech world, especially for those of us keeping an eye on Nvidia! Recently, a tweet from Barchart caught everyone’s attention, revealing that CEO Jensen Huang has just sold a staggering $35.6 million worth of $NVDA shares. This isn’t just a one-off incident; he has now sold more than $115 million worth of shares over the last two weeks! So, what does this mean for investors and the tech industry? Let’s dive into it!

The Impact of Insider Trading on Nvidia

Insider trading can be a tricky topic. While it’s not illegal for executives to sell shares, it often raises eyebrows among investors. When someone like Jensen Huang, who is at the helm of a massive company like Nvidia, sells such a significant amount of shares, it can signal various things. For some, it might indicate a lack of confidence in the company’s future performance, while others might see it as a strategic move to capitalize on the current stock price.

In the case of Nvidia, Huang’s recent sales have left many wondering about the company’s trajectory. Nvidia has been a powerhouse in the tech industry, especially with its advancements in AI, gaming, and data center technologies. However, when the CEO sells off such a large chunk of his holdings, it definitely raises questions. Is he cashing out before a potential downturn? Or is he simply reallocating his wealth?

Understanding Nvidia’s Stock Performance

To get a clearer picture, let’s look at Nvidia’s stock performance leading up to these sales. Over the past few years, Nvidia has seen incredible growth, largely driven by the booming demand for GPUs in gaming and AI applications. This surge in demand has propelled Nvidia’s stock, and many investors have profited handsomely from their investments. The question now is whether these recent sales by Huang signal a peak in the stock price.

Investors often look at insider selling as a potential warning sign. According to Investopedia, when executives sell shares, it can sometimes indicate that they believe the stock is overvalued or that they have concerns about future performance. However, there can be many legitimate reasons for selling shares, such as personal financial planning, taxes, or even diversification of investments.

What Analysts Are Saying

After Huang’s sales, analysts have weighed in on the implications for Nvidia and its stock. Some analysts argue that such insider trading does not necessarily mean that the fundamentals of the company are weakening. They point out that Huang’s sales could simply be a matter of personal finance. It’s important to remember that even the most successful CEOs have to manage their wealth in a way that makes sense for them personally.

On the flip side, there are others who caution investors to take note of these transactions. A report from Bloomberg highlights that significant insider selling can lead to bearish sentiment among investors. This could potentially impact Nvidia’s stock price if other investors start to panic or lose confidence based on Huang’s actions.

What Should Investors Do?

For those holding Nvidia shares, the question on everyone’s mind is, “Should I sell or hold?” As always, the best decision depends on your investment strategy and risk tolerance. If you believe in Nvidia’s long-term potential, this may be a good time to hold onto your shares, focusing on the company’s fundamentals rather than short-term movements. On the other hand, if you’re concerned about market volatility or Huang’s recent sales, it might be worth considering taking some profits off the table.

Investors should also keep an eye on upcoming earnings reports and industry news. Nvidia has been consistently releasing innovative products and expanding its market reach, which could offset any negative sentiment caused by insider selling. Remember, the tech industry is notoriously volatile, and being informed is key to making smart investment decisions.

Broader Market Implications

Huang’s insider trading isn’t just a story about Nvidia; it could have broader implications for the tech sector as a whole. When high-profile executives sell shares, it can trigger a wave of reactions across the market. Investors begin to question other tech stocks and may start to pull back on their investments, leading to a broader market sell-off.

Moreover, this kind of news often attracts media attention, which can amplify fears or misconceptions about the company or industry. A deeper analysis from Forbes emphasizes that the perception of insider trading can sometimes lead to panic selling, which may not always reflect the actual performance or potential of the company.

The Bottom Line on Nvidia and Insider Trading

As we digest this latest Nvidia Insider Trading Alert and the implications of Jensen Huang’s recent sales, it’s crucial to remember that insider trading is a complex issue. While it can raise valid concerns, it doesn’t always indicate that a company is headed for trouble. Nvidia has a strong position in the tech market, and as long as they continue to innovate and adapt, they could remain a solid investment.

For now, keeping abreast of news and market trends related to Nvidia will be essential. Whether you decide to buy, sell, or hold, make sure your decision aligns with your investment goals and risk tolerance. The tech landscape is ever-evolving, and staying informed is your best defense against market fluctuations.