HYPERLIQUID WHALE ALERT: $4.62M XRP Long Sparks Conspiracy!

Hyperliquid Whale Alert: A $4.62 Million Long Position on XRP

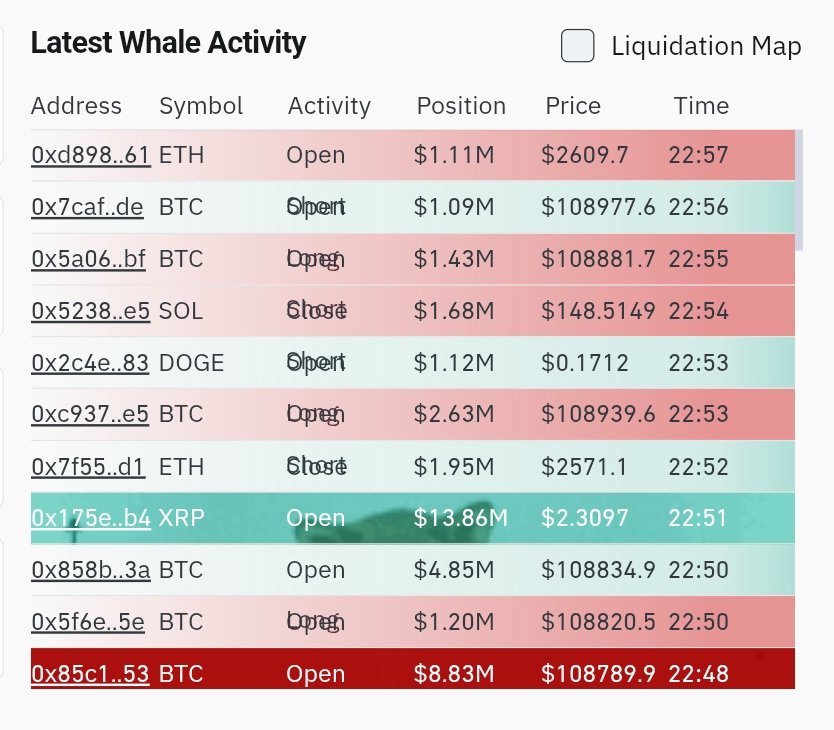

In the fast-paced world of cryptocurrency trading, significant movements by large investors, commonly referred to as "whales," often signal important trends or shifts in the market. A recent tweet from a notable crypto analyst, 𝕓aif| (@Xaif_Crypto), has drawn attention to a substantial transaction involving XRP, a prominent cryptocurrency in the market. On July 8, 2025, whale wallet 0x175e opened a long position worth an astonishing $4.62 million on XRP using 3x leverage on the Hyperliquid platform. This bold move has sparked speculation among crypto enthusiasts regarding the potential implications for XRP and the broader cryptocurrency market.

The Details of the Trade

The whale’s entry price for this significant long position was set at $2.3061. Utilizing 3x leverage means that the whale is effectively amplifying their potential gains (or losses) by three times, reflecting a high level of confidence in XRP’s price action. Leveraged trading can be a double-edged sword; while it can lead to substantial profits if the market moves in the trader’s favor, it can also result in significant losses if the market takes a downturn.

Understanding Whale Activity in Cryptocurrency

Whale transactions are often closely monitored by traders and investors within the crypto space. These large orders can create ripples in the market, leading to price volatility. When a whale makes a significant move, it can indicate insider knowledge or a strong belief in the future price movement of a particular asset. In this instance, the whale’s decision to invest heavily in XRP could be interpreted as a bullish signal, leading other traders to evaluate their positions on XRP.

Why XRP?

XRP, the native cryptocurrency of the Ripple network, has been a subject of intense scrutiny and speculation, particularly due to its legal battles with the U.S. Securities and Exchange Commission (SEC). Despite the regulatory challenges, XRP has maintained a loyal following and has seen various phases of price fluctuations. The recent whale activity may suggest that there are positive developments on the horizon for XRP, prompting this large-scale investment.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Market Reaction and Speculation

The news of this substantial long position has understandably stirred excitement within the crypto community. Traders are left to speculate on the reasons behind this whale’s move. Some potential factors include:

- Market Sentiment: Positive news or developments surrounding XRP could be influencing whale behavior. Traders often react to news, and significant bullish sentiment can lead to increased buying activity.

- Technical Analysis: Traders may be relying on technical indicators that suggest XRP is poised for upward movement. The entry price of $2.3061 could have been identified as a favorable point based on previous price action.

- Upcoming Events: The cryptocurrency market often reacts to upcoming events such as regulatory decisions, partnerships, or technology upgrades. If there are anticipated developments for Ripple or XRP, this could explain the whale’s confidence.

The Role of Hyperliquid Platform

Hyperliquid is a decentralized exchange (DEX) known for its advanced trading features, including leverage trading, which allows users to amplify their positions. The platform caters to sophisticated traders who seek to capitalize on market movements. The decision to execute this massive trade on Hyperliquid also highlights the growing acceptance and usage of decentralized finance (DeFi) platforms for large-scale trading activities.

Implications for Traders

For retail traders and investors, the whale’s activity serves as a reminder of the importance of staying informed and analyzing market trends. While it is essential to conduct individual research and not solely rely on the actions of whales, significant trades can provide valuable insights into potential market directions.

- Monitoring Whale Movements: Keeping an eye on whale activity can offer clues about market sentiment and potential price movements. Tools and platforms that track whale transactions can be invaluable for traders looking to make informed decisions.

- Risk Management: Given the nature of leveraged trading, it is crucial for traders to implement robust risk management strategies. Understanding the risks involved in trading on leverage is essential, especially when following the movements of larger investors.

- Adapting to Market Changes: The cryptocurrency market is known for its volatility. Traders must be prepared to adapt their strategies based on market conditions. The whale’s long position could signal a shift in market dynamics that traders should consider.

Conclusion

The recent whale alert involving a $4.62 million long position on XRP has generated significant buzz in the cryptocurrency community. As traders and investors analyze this move, it serves as a reminder of the intricate dynamics of the crypto market and the influence of large investors. While it is essential to approach trading with caution and perform thorough analysis, monitoring whale movements can provide valuable insights into potential market trends. As the cryptocurrency landscape continues to evolve, the actions of influential players like this whale will undoubtedly shape the future of assets like XRP and the broader market.

In the ever-changing world of cryptocurrency, staying informed and adaptable is key to navigating the complexities of trading and investment successfully.

HYPERLIQUID WHALE ALERT

Whale wallet 0x175e just opened a $4.62 MILLION LONG on $XRP using 3x leverage on Hyperliquid!

Entry Price: $2.3061

Someone knows something… pic.twitter.com/mVJGaZnFzz

— 𝕏aif| (@Xaif_Crypto) July 8, 2025

HYPERLIQUID WHALE ALERT

If you’re deep into the world of cryptocurrency, you’ve probably heard the buzz around whale movements. Recently, a significant event caught the attention of traders and investors alike: Whale wallet 0x175e just opened a whopping $4.62 million long position on $XRP using 3x leverage on Hyperliquid. This kind of activity raises eyebrows, and for good reason. When whales make moves, it’s often a signal that something big might be brewing in the market.

What Does This Mean for $XRP?

So, what does a $4.62 million long position mean for $XRP? Essentially, this whale is betting that the price of XRP will rise. They entered the trade at an entry price of $2.3061, which suggests they believe that XRP is undervalued at the moment. But why is this significant? In the crypto world, whales often have insights, access to information, or trading strategies that the average investor might not have. When they make moves like this, it can influence market sentiment and potentially lead to price rallies.

Understanding Leverage in Crypto Trading

Before diving deeper into the implications of this whale alert, let’s talk about leverage. Leverage in trading allows investors to control a larger position than they could with just their own capital. In this case, the whale is using 3x leverage, meaning they are effectively borrowing funds to amplify their position. If $XRP rises, the profits can be substantial. However, it’s important to note that leverage also increases risk. If the market moves against the position, losses can quickly pile up. This is why understanding leverage is crucial for anyone looking to trade cryptocurrencies.

Hyperliquid: A Brief Overview

Hyperliquid is gaining traction in the crypto world as a trading platform that offers advanced trading features, including leveraged trading. It provides a user-friendly interface and is designed to cater to both novice and experienced traders. The fact that a whale is making a significant move on this platform speaks volumes about its credibility and the opportunities it presents. If you’re considering trading on Hyperliquid, it’s wise to familiarize yourself with its features and how leverage works in this unique environment.

Whale Activity: What Should Retail Investors Do?

When a whale makes a move, it can create a ripple effect in the market. Retail investors often wonder if they should follow suit. While it’s tempting to ride the coattails of these big players, it’s crucial to do your own research. Following whales blindly can lead to losses if the market turns unexpectedly. Instead, consider this whale alert as one piece of a much larger puzzle. Analyze market trends, study technical indicators, and keep an eye on news that might influence $XRP’s price.

The Role of Market Sentiment

Market sentiment plays a critical role in the crypto space. When a whale makes a large purchase, it can create a sense of optimism among other investors. This optimism can lead to increased buying pressure, potentially driving the price higher. Conversely, if the market reacts negatively or if the whale’s position doesn’t pan out, it could lead to panic selling. This volatility is something every trader should be prepared for. Keeping an eye on social media platforms and crypto news outlets can help gauge sentiment and make informed trading decisions.

Potential Implications of the Whale Alert

The recent whale alert involving a massive $4.62 million long position on $XRP could have several implications. First, it might indicate that the whale expects a significant upward movement in XRP’s price. This could be due to upcoming news, regulatory developments, or broader market trends. If other investors catch wind of this whale’s confidence, we might see a surge in buying activity, pushing the price higher.

Moreover, this kind of activity can lead to increased media coverage and social media discussions, further amplifying market interest. For investors, this is an opportunity to analyze the situation, consider potential entry points, and strategize on how to approach $XRP in the coming days.

Keeping an Eye on the Charts

As a trader, it’s essential to keep an eye on the charts. After such a significant whale alert, technical analysis becomes even more relevant. Look for support and resistance levels, patterns, and other indicators that can provide insights into potential price movements. Tools like Moving Averages, RSI, and MACD can be particularly useful in understanding where the market might head next.

These indicators can help you make informed decisions about entering or exiting positions. Remember, in the world of crypto, prices can be highly volatile, and having a solid strategy can make all the difference.

Conclusion: The Importance of Staying Informed

In the fast-paced world of cryptocurrency, staying informed is key. The recent whale activity on $XRP is just one of many events that can shape market dynamics. While it’s exciting to see large players entering the market, it’s essential to approach such information with a level of caution. Always conduct thorough research, analyze trends, and create a trading strategy that suits your risk tolerance.

The world of crypto is filled with opportunities, and keeping tabs on whale movements can provide valuable insights. Whether you’re a seasoned trader or just starting, understanding these dynamics can help you navigate the ever-changing landscape of cryptocurrency trading. So, keep your eyes peeled and your strategies sharp—it’s a wild ride out there!