BREAKING: Jeff Bezos Shocks World with $665M Amazon Stock Dump!

Breaking news: Jeff Bezos Sells Amazon Stock Worth $665.9 Million

In a significant development in the financial world, Jeff Bezos, the founder of Amazon, has made headlines by selling a staggering $665.9 million worth of Amazon stock. This transaction involved the offloading of 927,863 shares, marking one of the most substantial sales in recent memory. The news, which was first reported on July 8, 2025, has sparked widespread discussion and analysis among investors, analysts, and the general public alike.

The Details of the Sale

The sale took place in a single transaction, indicating a strategic decision by Bezos. While the exact reasons for this sale remain speculative, it’s not uncommon for high-profile executives to divest shares for a variety of reasons, including tax planning, funding charitable endeavors, or simply reallocating personal wealth. The timing of this sale is particularly noteworthy, as it comes during a period of fluctuating stock prices and market dynamics.

Market Reactions

Immediately following the announcement, Amazon’s stock experienced a ripple effect, with many investors reacting to the news. Historically, when major company executives sell large volumes of stock, it can lead to concerns about the company’s future performance. However, analysts argue that Bezos’s sale does not necessarily indicate a lack of confidence in Amazon’s long-term prospects. Instead, it could be viewed as part of a broader financial strategy.

Jeff Bezos: A Brief Overview

Jeff Bezos, who founded Amazon in 1994, has consistently been at the forefront of innovation in e-commerce and technology. Under his leadership, Amazon grew from an online bookstore to a global powerhouse, expanding into various sectors such as cloud computing, digital streaming, and artificial intelligence. Bezos’s vision and business acumen have earned him a place among the wealthiest individuals in the world.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Speculation Surrounding the Sale

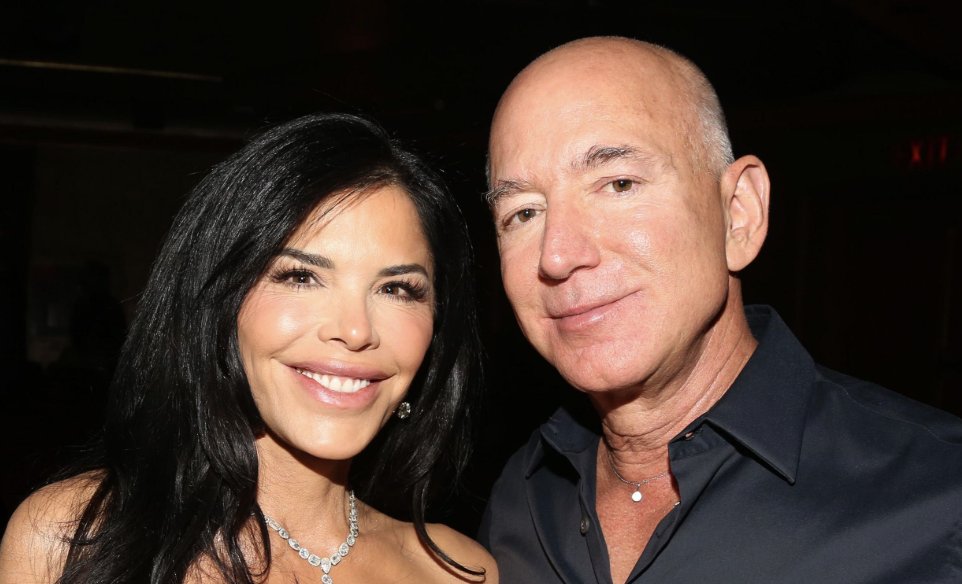

The tweet accompanying the announcement humorously suggests that the sale might have been confused with an action taken by Lauren Bezos, implying that the transaction is somehow more mundane due to its scale. This lighthearted commentary underscores the absurdity often associated with large financial transactions in the tech industry. While the specific motivations behind Bezos’s sale remain undetermined, various theories abound, ranging from personal financial management to philanthropic intentions.

Implications for Investors

For investors, Bezos’s decision to sell such a significant portion of his shares raises questions about the future of Amazon and its stock performance. While some may interpret this as a bearish signal, others believe that Bezos’s actions could ultimately pave the way for new growth opportunities within the company. As Amazon continues to evolve and adapt to changing market conditions, investors are closely monitoring how these developments will impact the company’s trajectory.

The Bigger Picture: Bezos’s Philanthropic Endeavors

In addition to his role at Amazon, Bezos has been increasingly involved in philanthropy in recent years. Through initiatives like the Bezos Day One Fund and the Bezos Earth Fund, he has committed substantial resources to address pressing social issues, including homelessness and climate change. This philanthropic focus may provide additional context for his recent stock sale, as it could indicate a desire to fund these initiatives.

Conclusion: What Lies Ahead for Amazon and Jeff Bezos

As the news of Jeff Bezos’s stock sale continues to reverberate through the financial markets, it serves as a reminder of the complexities and intricacies of corporate finance. While the motivations behind such significant transactions can often be shrouded in speculation, the implications for investors and the broader market are clear.

Bezos’s actions may ultimately reflect a calculated move to secure his financial future while also enabling him to further his philanthropic goals. As Amazon continues to navigate the ever-changing landscape of technology and e-commerce, the world will be watching closely to see how these developments unfold.

In summary, Jeff Bezos’s recent sale of $665.9 million in Amazon stock raises important questions about the future of the company and the motivations behind such a significant transaction. Whether viewed as a strategic financial decision or a precursor to new philanthropic initiatives, this event has undoubtedly captured the attention of investors and the media alike. As always, the world of finance remains dynamic, and Bezos’s next moves will be closely scrutinized by those eager to understand the implications for Amazon and the tech industry at large.

BREAKING: LAUREN BEZOS JUST SOLD $665.9 MILLION IN AMAZON STOCK – 927,863 SHARES DUMPED

Sorry… JEFF did.

Definitely Jeff.Totally different person. Definitely still married. Just a casual half-billion move. Definitely not weird at all. pic.twitter.com/74DNH8dzxn

— HustleBitch (@HustleBitch_) July 8, 2025

BREAKING: LAUREN BEZOS JUST SOLD $665.9 MILLION IN AMAZON STOCK – 927,863 SHARES DUMPED

It’s not every day that you hear about a major stock sale, especially one that involves a staggering amount like $665.9 million. This news has sent ripples through the financial world and left many scratching their heads. So, let’s dive into the details of this remarkable transaction, which, as it turns out, was not executed by Lauren Bezos but rather her husband, Jeff Bezos. Yep, you heard it right—definitely Jeff.

Sorry… JEFF did.

When big names in the stock market make moves, everyone pays attention. Jeff Bezos, the founder of Amazon and one of the wealthiest people on the planet, has always been a focal point in the financial news landscape. The recent sale of 927,863 shares has raised eyebrows for more reasons than one. First off, let’s clarify that the sale happened within a context of larger financial strategies. Jeff’s decision to divest such a significant quantity of Amazon stock might seem puzzling initially, but it’s essential to dig deeper into the motivations behind this move.

Definitely Jeff.

There’s a tendency to mix up names in the Bezos household; after all, both Jeff and Lauren have made headlines in their own right. But this particular action was purely Jeff’s. The context surrounding his stock sale is crucial. Jeff Bezos has a history of selling shares, often to fund various initiatives or investments outside of Amazon. For instance, his Blue Origin space venture has been a significant recipient of his financial backing, and it’s likely that this recent sale could relate to similar future ambitions.

Totally different person. Definitely still married.

It’s fascinating how people respond to news like this. Many assume Lauren Bezos is the one making financial decisions due to her recent visibility and influence. However, Jeff is still at the helm of these financial maneuvers. Their marriage, while often in the spotlight, is a partnership where both contribute significantly, albeit in different arenas. The dialogue around their partnership brings about interesting questions regarding role dynamics in high-profile relationships, especially when money and business are involved.

Just a casual half-billion move.

I mean, when you think about it, $665.9 million might seem like just another Tuesday for someone like Jeff Bezos. But for the average person, that’s an astronomical sum! It’s essential to recognize that these transactions, while massive, are often part of larger financial strategies rather than impulsive decisions. Jeff’s approach to his wealth has always been calculated. He’s not just dumping stock for the sake of it; there’s a plan behind those moves.

To put this in perspective, Bezos has sold shares multiple times over the years, totaling billions of dollars. This is not a new trend for him. In fact, [CNBC](https://www.cnbc.com) reported in the past that such stock sales are often pre-planned and can be part of a broader strategy to diversify investments or fund other projects.

Definitely not weird at all.

While it might sound strange to the average Joe, this kind of stock movement is relatively normal for someone in Jeff’s position. Wealthy individuals often sell shares to reallocate their investments. Sometimes, it’s about cashing in on gains, while other times, it’s about managing risks. The tech market, particularly, can be volatile, and having a diverse investment portfolio can be a smart move.

Moreover, Jeff Bezos’s wealth isn’t just tied to Amazon. He has significant investments in various sectors, including space travel, media, and even healthcare. His ability to pivot and make large financial moves is a testament to his entrepreneurial spirit and understanding of market dynamics.

The Implications of the Sale

So what does this mean for Amazon and its stockholders? A sale of this magnitude can influence stock prices, at least temporarily. When a major shareholder sells a significant amount of stock, it can trigger concerns about the company’s future performance. However, it’s essential to understand the context behind the sale. Jeff’s actions are not necessarily indicative of a lack of confidence in Amazon’s future; rather, they could be strategic moves to fund other ventures.

The impact of stock sales by insiders can vary. For instance, [Yahoo Finance](https://finance.yahoo.com) discussed how such transactions can lead to fluctuations in stock prices but emphasized that they often reflect personal financial strategies rather than the underlying health of the company.

What’s Next for Jeff Bezos?

With this latest sale, many are left wondering what Jeff Bezos’s next move will be. Is he gearing up for another big investment? Or perhaps he’s looking to expand his portfolio even further? One thing is for sure: Jeff is not one to sit idle. His reputation as a forward-thinking entrepreneur precedes him, and it’s likely he has something exciting up his sleeve.

Moreover, as he continues to step back from his role at Amazon, focusing on other ventures like Blue Origin, the landscape of his investments will likely evolve. The sale could signify a shift in focus, and it will be interesting to see how this plays out in the coming months.

The Bigger Picture

This stock sale raises broader questions about wealth, power, and influence in the tech industry. When individuals like Jeff Bezos make moves like this, it’s not just about their personal finances; it’s about the ripple effects on the market, investors, and even the economy at large. The tech sector is one of the most dynamic fields, and the actions of its leaders can set trends that impact countless stakeholders.

In a world where social media amplifies every move, Jeff’s stock sale quickly became a topic of discussion on platforms like Twitter, where users reacted with humor and skepticism. The tweet that broke the news highlighted the absurdity of such a transaction, sparking conversations about the nature of wealth and the perception of billionaires.

Conclusion

The recent news about Jeff Bezos’s stock sale is a reminder of the complexities of wealth management and the intricacies of the stock market. While a sale of nearly $666 million might seem outrageous, it’s just another day in the life of one of the world’s richest individuals. The context, motivations, and implications of such decisions are vital to understanding the larger financial picture.

As we watch this story unfold, it’s clear that Jeff Bezos continues to be a formidable force in the business world. Whether you view his actions as strategic genius or something else entirely, one thing remains certain: he’s not done making waves anytime soon. Keep your eyes peeled—there’s always more to come from Jeff Bezos and the Amazon empire.