US Government Shocks Market with $200K ETH Transfer to Coinbase!

Overview of the Recent U.S. Government Ethereum Deposit to Coinbase

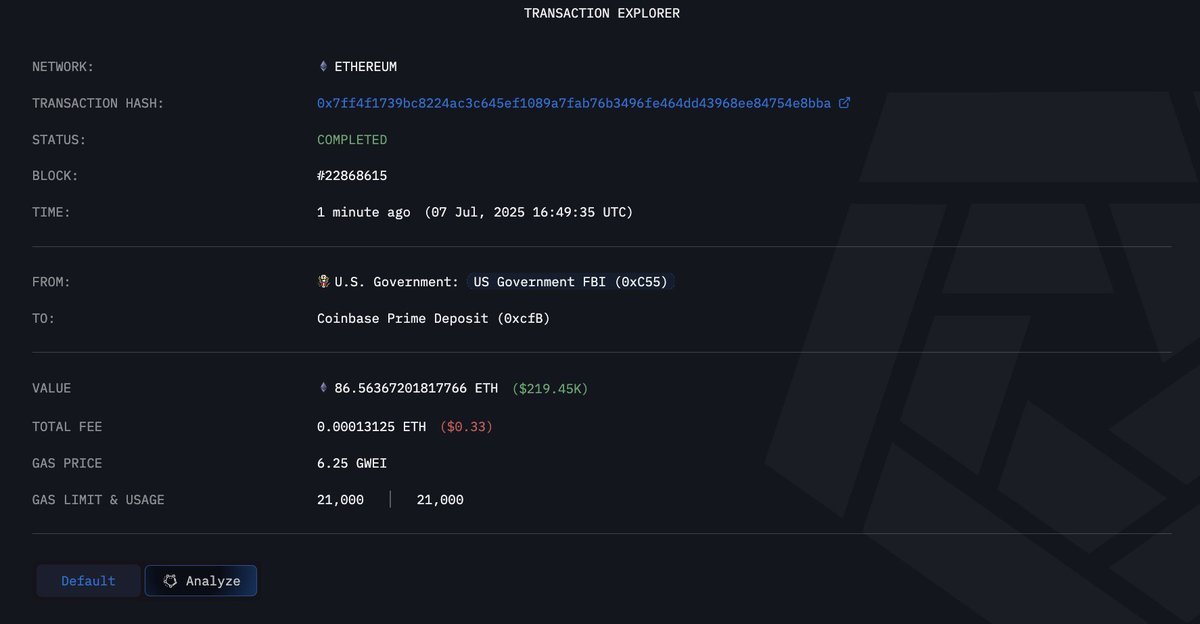

In a significant development within the cryptocurrency landscape, the U.S. government recently transferred $200,000 worth of Ethereum (ETH) to Coinbase, a major cryptocurrency exchange. This transaction was first reported by Arkham, a blockchain intelligence platform, on July 7, 2025. The move has stirred considerable interest among crypto enthusiasts and market analysts alike, particularly due to its implications for government involvement in the crypto space and the nature of seized assets.

The Transaction Details

The transaction in question involved a government wallet that executed a transfer of $200,000 worth of ETH to a Coinbase Prime Deposit account. Prior to this larger transaction, a smaller test transaction of $10 was conducted to verify the process. This meticulous approach suggests a careful oversight by governmental authorities in managing digital assets, especially when dealing with substantial amounts.

Origin of the Seized Ethereum

The Ethereum being transferred to Coinbase was originally seized from an individual named Chase Senecal back in October 2022. The seizure likely stemmed from legal actions taken by the government against illicit activities associated with cryptocurrencies. Such seizures underscore the government’s ongoing efforts to regulate and control the cryptocurrency market, particularly in relation to criminal activities such as fraud, money laundering, and other illicit financial transactions.

Implications of the Transfer

The transfer of a significant amount of ETH to a public exchange like Coinbase raises several critical questions and implications:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

1. Market Reactions

The immediate market reaction to such a transaction can be quite volatile. Investors and traders often closely monitor governmental activities related to cryptocurrency, as they can influence market sentiment. The fact that the government is actively participating in the crypto market by liquidating seized assets could potentially instill confidence in the legitimacy and stability of cryptocurrencies as an asset class.

2. Regulatory Environment

This transaction highlights the evolving regulatory environment surrounding cryptocurrencies. As governments become more involved in the crypto space—both in terms of seizure and liquidation of assets—it signals a trend towards greater regulatory oversight. This could lead to more structured frameworks for how cryptocurrencies are handled, potentially affecting everything from trading practices to taxation.

3. Future Seizures and Auctions

The U.S. government has a history of seizing cryptocurrencies tied to criminal investigations. Following the seizure, there is often a process in place to auction off these assets. This recent transaction may suggest a more systematic approach to managing seized cryptocurrencies, possibly paving the way for future auctions or sales in regulated environments.

The Role of Coinbase in Government Transactions

Coinbase has positioned itself as a leading platform for cryptocurrency transactions, especially among institutional investors. The choice to deposit government-seized ETH into Coinbase Prime indicates the platform’s reputation for security and compliance with regulatory standards. This relationship between the government and Coinbase could potentially foster further collaborations in the future, especially as the government navigates the complexities of digital asset management.

The Broader Context of Cryptocurrency Seizures

Cryptocurrency seizures are not a new phenomenon. Governments worldwide have been seizing digital assets as part of efforts to combat illegal activities. The U.S. government has been particularly proactive in this area, with various law enforcement agencies actively monitoring and confiscating cryptocurrencies linked to criminal enterprises. These actions are part of a broader strategy to deter illegal activities and enforce the law in the digital sphere.

The Future of Government Involvement in Cryptocurrencies

As cryptocurrencies become more mainstream, the role of government in this space is likely to expand. The transfer of $200,000 worth of ETH to Coinbase is indicative of a larger trend where governments may begin to view digital currencies as legitimate financial instruments. This could lead to increased regulatory frameworks that govern how cryptocurrencies are traded, purchased, and sold, ultimately shaping the future of the industry.

Conclusion

The recent transfer of $200,000 in Ethereum by the U.S. government to Coinbase raises important questions about the future of cryptocurrencies and their regulation. As governments continue to seize digital assets in the fight against crime, the interplay between regulatory bodies and cryptocurrency exchanges will become increasingly significant. Observers in the crypto space should remain vigilant, as these developments will likely influence market dynamics and investor behavior in the coming years.

In summary, the U.S. government’s transaction of ETH to Coinbase marks a pivotal moment in the ongoing evolution of cryptocurrency regulation and usage. This event serves as a reminder of the complexities and challenges inherent in the intersection of traditional finance and the burgeoning world of digital currencies. As the landscape continues to evolve, stakeholders must stay informed and prepared for the implications of such government actions on the broader cryptocurrency market.

ARKHAM ALERT: THE US GOVERNMENT JUST DEPOSITED $200K ETH TO COINBASE

A US Government wallet just moved $200K to a Coinbase Prime Deposit, after a $10 test transaction.

This ETH was originally seized from Chase Senecal in October 2022. pic.twitter.com/CFdfN73zyD

— Arkham (@arkham) July 7, 2025

ARKHAM ALERT: THE US GOVERNMENT JUST DEPOSITED $200K ETH TO COINBASE

In a surprising twist in the world of cryptocurrency, the US government has made headlines by depositing a whopping $200,000 worth of Ethereum (ETH) to a Coinbase Prime account. This move has sparked discussions and curiosity within the crypto community, especially considering it follows a $10 test transaction. If you’re wondering what this means for the crypto landscape and the implications of such government actions, you’ve come to the right place.

A US Government Wallet Just Moved $200K to a Coinbase Prime Deposit

The recent transfer of $200K in ETH from a US government wallet to Coinbase Prime is not just a routine transaction; it’s a significant development that adds a layer of intrigue to the already dynamic world of cryptocurrencies. For those who might not be in the loop, Coinbase Prime is a platform designed for institutions, offering advanced trading tools and services tailored to the needs of large-scale investors. So, why is the government moving funds to a platform like Coinbase? This could indicate a broader acceptance or strategic use of cryptocurrencies by government entities.

After a $10 Test Transaction

It’s worth noting that this substantial deposit came after a modest $10 test transaction. This small amount may seem trivial in the grand scheme of things, but it signifies due diligence on the part of the government. By performing a test transaction, they can ensure that everything functions smoothly before moving larger sums. It’s a strategic approach that reflects careful planning and consideration, especially in the volatile world of crypto.

This ETH Was Originally Seized from Chase Senecal in October 2022

Now, let’s delve into the origins of this Ethereum. The ETH that the government has just deposited was originally seized from an individual named Chase Senecal back in October 2022. The seizure of cryptocurrency is not uncommon, particularly when it involves cases related to fraud, money laundering, or other illicit activities. In this case, the funds were likely tied to legal proceedings, and now they are making their way into a legitimate financial ecosystem.

What Does This Mean for the Future of Cryptocurrency?

The infusion of government-held cryptocurrency into mainstream platforms like Coinbase could signal a shift in how institutional players view digital assets. As the government engages more with cryptocurrencies, it may pave the way for greater legitimacy and acceptance of these assets in the financial market. This could potentially lead to increased investment from institutional players who are waiting for more clarity and security in this space.

The Growing Role of Government in the Crypto Space

It’s fascinating to observe how governments worldwide are beginning to engage with cryptocurrencies. From regulatory frameworks to direct involvement in trading, the landscape is evolving rapidly. The US government’s recent actions highlight this trend, suggesting that they are not just passive observers but active participants in the cryptocurrency market.

Implications for Investors and the Market

For investors, this development raises several questions. Should they view government involvement as a positive sign of stability in the crypto market or as a potential precursor to increased regulation? The answer likely lies somewhere in between. While government participation can lead to increased legitimacy, it may also bring about stricter regulations that could impact how cryptocurrencies are traded and used.

Monitoring the Situation

As this story unfolds, it’s essential for investors and crypto enthusiasts to keep a close eye on any developments related to government actions in the cryptocurrency space. The market is highly reactive, and news like this can significantly influence investor sentiment and trading behavior. Tools and platforms that provide real-time updates, like [Arkham](https://twitter.com/arkham/status/1942266881181720862?ref_src=twsrc%5Etfw), are invaluable for staying informed.

The Broader Context of Cryptocurrency Regulation

In the broader context, the US government’s actions come at a time when many countries are grappling with how to regulate cryptocurrencies. The lack of a clear regulatory framework has created uncertainty, leading to volatility in prices and trading volumes. However, as governments start to engage more with cryptocurrencies, it may lead to the establishment of more robust regulations that could stabilize the market in the long run.

What Should Investors Do?

For those invested in cryptocurrencies, it’s crucial to stay informed and adapt to these changes. Arming yourself with knowledge about potential regulatory developments and market movements can help you make better investment decisions. Whether it’s keeping an eye on government actions, understanding the technical aspects of cryptocurrencies, or following market trends, being proactive is key.

The Importance of Security in Cryptocurrency Transactions

With the government’s involvement, the emphasis on security in cryptocurrency transactions has never been more critical. The transfer of funds, especially large sums, necessitates robust security measures to prevent fraud and hacking. This situation serves as a reminder of the importance of using secure wallets and reputable platforms like Coinbase, which have established themselves as leaders in the space.

Community Reactions and Speculations

The crypto community is buzzing with discussions about the implications of the US government’s actions. Speculations abound regarding potential future regulations and how they might impact the market. Some view this as a positive step towards mainstream acceptance, while others remain cautious, wary of the potential for overreach in terms of regulation.

Looking Ahead: The Future of Cryptocurrency

As we look to the future, the relationship between the government and cryptocurrencies will undoubtedly evolve. The recent deposit of $200,000 in ETH to Coinbase by the US government marks a pivotal moment that could have lasting implications for the industry. Whether this will lead to greater adoption, improved regulations, or a volatile market remains to be seen.

Staying Informed and Engaged

In this rapidly changing environment, it’s crucial for everyone involved in the crypto space to stay informed and engaged. Whether you’re a casual investor, a crypto enthusiast, or an industry professional, understanding the implications of government actions is essential for navigating this exciting yet unpredictable landscape. So, keep your eyes peeled for updates, and don’t hesitate to dive deeper into the world of cryptocurrencies!

“`

This comprehensive article is designed to be engaging and informative while following your instructions for formatting and content.