Breaking: CA’s Gavin Newsom Sparks Outrage with Gas Tax Hike!

Gavin Newsom’s New Gas Tax Hikes in California: What You Need to Know

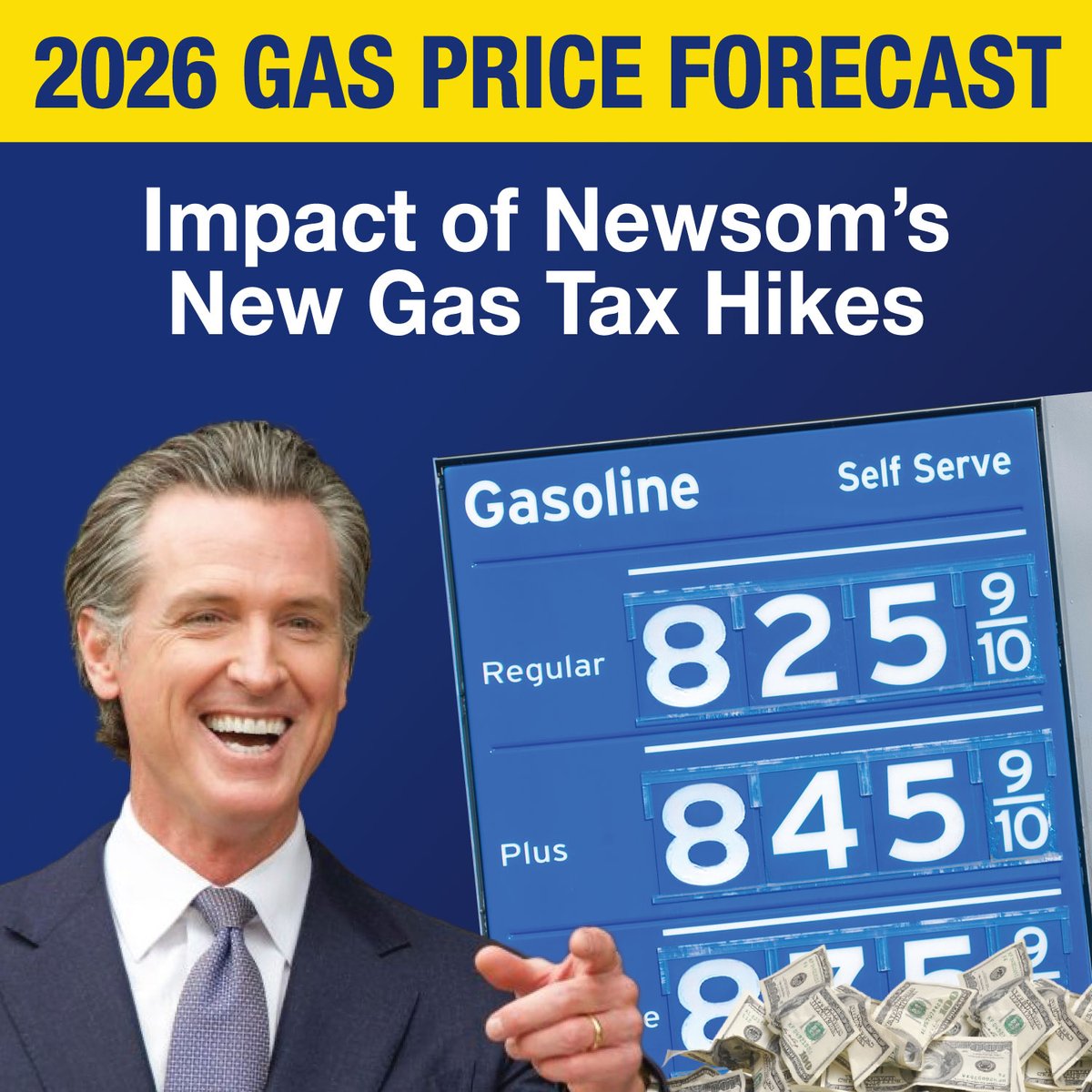

Starting July 1st, California has implemented new gas tax hikes and costly regulations under Governor Gavin Newsom’s administration. These changes are poised to significantly impact the state’s gas prices, potentially pushing them to an alarming $8-10 per gallon by 2026. This summary aims to provide an overview of these new regulations, their implications for California residents, and the broader conversation around fuel taxes and regulations.

The Impact of New Gas Taxes

California has long been known for its high gas prices, and these new tax hikes are set to exacerbate the situation. The gas tax in California is already among the highest in the nation, and the additional increases will place an even heavier burden on consumers. With gas prices projected to reach between $8 and $10 per gallon by 2026, many Californians are concerned about the financial strain this will impose on their daily lives.

Reasons Behind the Tax Hikes

Governor Gavin Newsom’s administration argues that the new gas taxes are essential for several reasons:

- Infrastructure Improvements: A significant portion of the revenue generated from these taxes will be allocated to maintain and improve California’s aging infrastructure. This includes road repairs, public transportation enhancements, and other critical projects aimed at promoting sustainable transportation options.

- Environmental Initiatives: The state is committed to reducing carbon emissions and transitioning to renewable energy sources. The new regulations are designed to encourage the use of electric vehicles and other sustainable alternatives, aligning with California’s ambitious climate goals.

- Funding Public Services: The increased revenue from gas taxes is also expected to support essential public services, which have been underfunded in recent years. This includes investments in education, healthcare, and social services that benefit the broader community.

Public Response to the Tax Hikes

The announcement of the new gas tax hikes has sparked significant public outcry. Many Californians are voicing their concerns about the rising cost of living and how these taxes will disproportionately affect low- and middle-income families. Critics argue that the state should seek alternative funding sources rather than relying on gas taxes that burden consumers further.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Alternatives to Gasoline

As part of Governor Newsom’s strategy to combat rising gas prices and reduce dependency on fossil fuels, the state is promoting the adoption of electric vehicles (EVs) and other alternative fuel sources. California is investing in EV charging infrastructure and offering incentives for residents to make the switch to sustainable vehicles. However, the transition to electric vehicles is not without its challenges, as the upfront costs can be prohibitive for many consumers.

The Broader Context of Fuel Taxes

California’s new gas tax hikes are part of a larger national conversation about fuel taxes and their role in modern society. As concerns about climate change and environmental sustainability grow, states across the country are grappling with how to fund infrastructure while also promoting cleaner energy alternatives.

It’s essential to examine how these tax increases compare to those in other states. While California has some of the highest gas prices due to its taxes and regulations, other states also face their own challenges in balancing taxation with the need for infrastructure funding and environmental initiatives.

Conclusion

The implementation of Gavin Newsom’s new gas tax hikes in California marks a significant shift in the state’s approach to fuel taxation and environmental policy. While the administration argues that these changes are necessary for infrastructure improvements and environmental sustainability, the potential impact on gas prices and the financial burden on consumers cannot be overlooked.

As California residents brace themselves for the possibility of gas prices soaring to $8-10 per gallon by 2026, it is crucial for them to stay informed and engaged in discussions about the future of fuel taxes and sustainable transportation. The conversation surrounding these issues will likely continue to evolve as more Californians weigh the costs and benefits of these new regulations.

Key Takeaways

- Gavin Newsom’s new gas tax hikes and regulations took effect on July 1st.

- Gas prices in California could reach $8-10 per gallon by 2026.

- The tax revenue is intended for infrastructure improvements and environmental initiatives.

- Public response has been largely critical, with concerns over the financial impact on families.

- The state is promoting electric vehicles and alternative fuels to combat rising gas prices.

- The situation in California reflects a broader national conversation about fuel taxes and sustainability.

Understanding these developments is essential for California residents as they navigate the changing landscape of fuel costs and environmental policy. Engaging with local representatives and participating in community discussions can help shape the future of transportation and taxation in the state.

ALERT: Starting today (July 1st), Gavin Newsom’s new gas tax hikes and costly regulations go into effect in CA — that will push gas prices to $8-10 per gallon in 2026! https://t.co/49vy7jCXpv

ALERT: Starting today (July 1st), Gavin Newsom’s new gas tax hikes and costly regulations go into effect in CA — that will push gas prices to $8-10 per gallon in 2026!

Hey there, California residents! If you haven’t been keeping up with the latest news, there’s some big stuff happening with gas prices in our state. Starting today, July 1st, Gavin Newsom’s new gas tax hikes and regulations are officially in effect. Yes, you heard that right! This is going to have a major impact on your wallet, and we’re talking about gas prices that could soar to $8-10 per gallon by 2026. Let’s dive into what this means for you and your daily life.

What Are the New Gas Tax Hikes?

So, what exactly are these gas tax hikes? The new regulations imposed by Gavin Newsom’s administration include increases in the state gas tax, which is already one of the highest in the nation. According to [CalMatters](https://calmatters.org), the gas tax is designed to fund road repairs and public transit improvements. But with these new hikes, many are questioning whether the funds will truly be used for infrastructure or if it’s just another way for the state to squeeze more money out of residents.

Why Are Prices Expected to Skyrocket?

The California Energy Commission has projected that these tax hikes, when combined with other existing taxes and fees, could push gas prices to an astounding $8-10 per gallon by 2026. You might be wondering why this is happening. Well, it all boils down to a combination of factors, including rising crude oil prices and environmental regulations that are intended to combat climate change. While these regulations are well-intentioned, they can make gas more expensive for the average consumer.

The Impact on Daily Life

Imagine filling up your gas tank and seeing prices like that! The reality is that these hikes are going to hit everyone hard. Commuters who rely on their cars to get to work will feel the pinch, and families who use their vehicles for everyday activities will have to adjust their budgets. As we all know, gas prices are already pretty high, and this just adds fuel to the fire. Many families may have to rethink their travel plans or even consider using public transportation more often.

What Can Residents Do?

With these changes coming into play, it’s important to stay informed and proactive. One of the best things you can do is to speak out. Contact your local representatives and let them know how you feel about these tax hikes. You can also stay updated on the ongoing discussions around gas prices and regulations by following local news outlets. Engaging in community discussions can help amplify your voice.

The Environmental Angle

Now, let’s talk a little bit about the environmental aspect of these regulations. The state is pushing hard for cleaner energy and reducing carbon emissions. While it’s crucial to work towards a greener future, the immediate effects of these gas tax hikes could deter people from making environmentally friendly choices. When gas prices are sky-high, people may be less inclined to buy electric vehicles or invest in public transportation options. It’s a tricky balance, and the state needs to find a way to finance environmental initiatives without burdening residents.

Looking at Alternatives

As gas prices continue to climb, it might be time to consider some alternatives. Are there carpooling options available in your area? Could you use public transportation instead of driving? An electric bike could also be a great investment. Plus, it’s a fun way to get around! Whatever you choose, thinking outside the box can help you save money in the long run.

Conclusion: What Lies Ahead

As we move forward, it’s essential to keep an eye on how these gas tax hikes will shape California’s economy and our daily lives. The situation is evolving, and it’s crucial to stay informed. Remember, your voice matters, and being proactive can lead to change. Whether you’re a commuter, a parent, or just someone who drives occasionally, these new regulations will impact us all. So, buckle up, and let’s navigate these changes together!

Stay Informed!

Make sure to keep checking in with reliable news sources and community forums. The conversation around gas prices and regulations is likely to evolve, and staying informed will help you make the best choices for yourself and your family. And remember, you’re not alone in this; together, we can advocate for fairer policies that won’t break the bank.

“`

This HTML article is structured with headings and paragraphs as requested, providing a conversational tone while discussing the impact of Gavin Newsom’s gas tax hikes in California.