BREAKING: Genius Group to Sue Over Naked Short Selling Scandal!

Breaking news: Genius Group Files Naked Short Selling Lawsuit

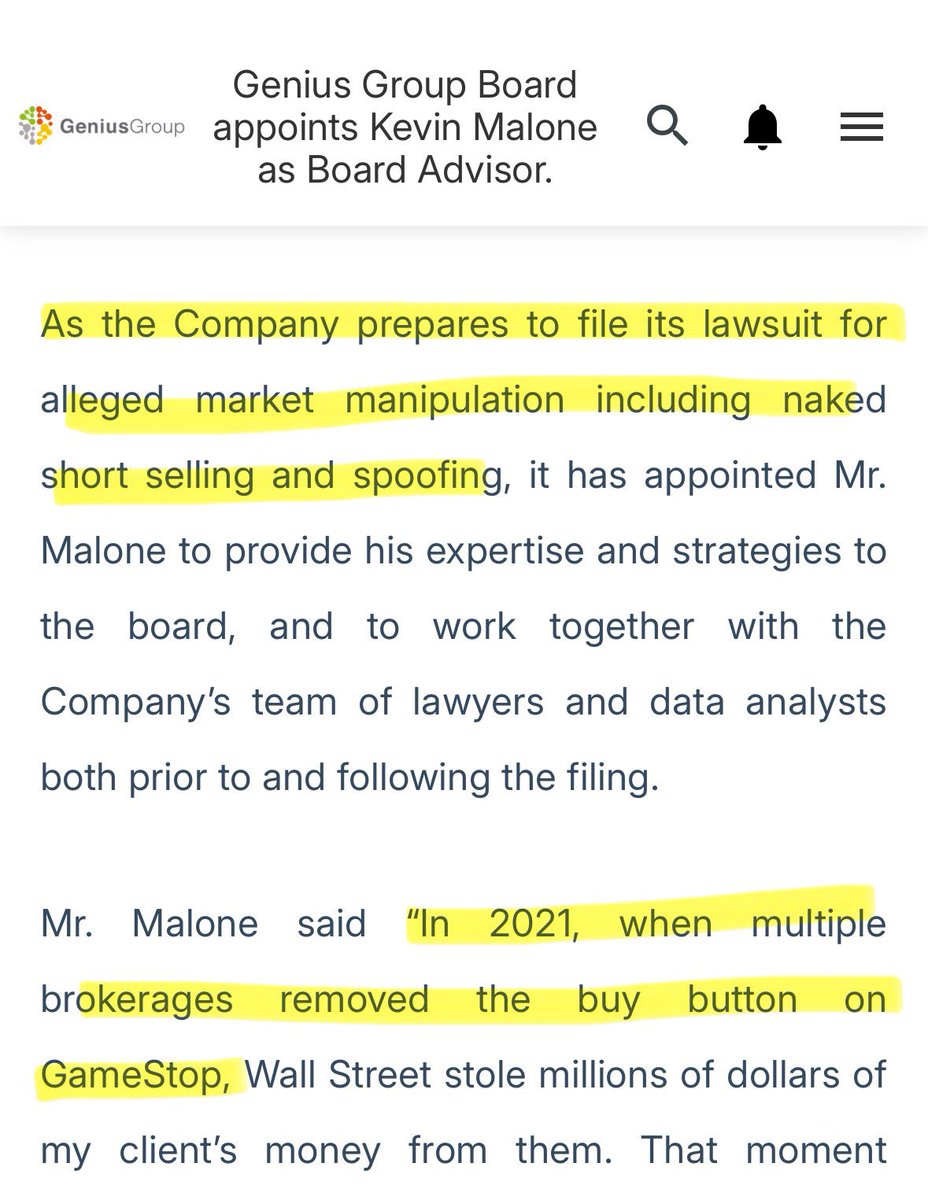

In a significant development within the financial markets, Genius Group has announced its intention to file a lawsuit related to naked short selling, a controversial trading practice that has garnered attention in recent years. This move comes as the company appoints Kevin Malone as a Board Advisor, signaling its commitment to addressing trading irregularities that may be adversely affecting its stock performance.

What is Naked Short Selling?

Naked short selling occurs when an investor sells shares of a stock that they have not yet borrowed, failing to deliver the shares to the buyer by the settlement date. This practice can lead to an artificial increase in the supply of shares, which may result in a decline in the stock’s price. Naked short selling has been criticized for its potential to manipulate stock prices and undermine market integrity.

The Role of Kevin Malone

Kevin Malone, known for his extensive experience in the finance and investment sectors, has been appointed as a Board Advisor to Genius Group. Malone is a prominent figure in the investment community and has previously highlighted critical issues surrounding stock trading practices. His appointment is seen as a strategic move to bolster the company’s defense against what it perceives as unlawful trading activities.

In a recent statement, Malone drew parallels between the current situation and the GameStop trading frenzy that occurred in early 2021. He remarked, “When multiple brokerages removed the buy button on GameStop, Wall Street stole millions of dollars.” This statement underscores Malone’s commitment to advocating for fair trading practices and protecting shareholder interests.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Context of the Lawsuit

The upcoming lawsuit by Genius Group comes amidst increasing scrutiny of trading practices in the stock market, particularly regarding the treatment of retail investors. The GameStop saga revealed how market dynamics can be affected by broker actions and the influence of institutional investors. Genius Group’s decision to pursue legal action indicates a proactive stance against what it perceives as harmful market practices that could impact its operations and shareholders.

The Impact on Investors

For investors, this lawsuit could have significant implications. If Genius Group successfully addresses the issues related to naked short selling, it may lead to increased transparency and fairness in the stock market, ultimately benefiting shareholders. The appointment of Kevin Malone adds credibility to the company’s efforts, as he brings a wealth of knowledge and experience in navigating complex market situations.

Moreover, the growing awareness around naked short selling and its potential consequences may encourage other companies to take similar actions. This ripple effect could result in a more vigilant approach to trading practices across the market, benefiting retail investors who have often felt at a disadvantage compared to institutional players.

The Broader Market Implications

The Genius Group lawsuit is part of a larger narrative regarding the evolving landscape of stock trading and investor rights. The rise of retail trading platforms and the democratization of investment access have empowered individual investors. However, with this empowerment comes the responsibility to protect against potential abuses in the market.

The lawsuit may also spark discussions among regulators and policymakers about the need for stricter regulations surrounding short selling practices. Given the complexities and potential for abuse in this area, regulatory bodies may find themselves pressured to reevaluate existing rules and implement measures that safeguard market integrity.

Conclusion: A Call for Fairness in Trading

As Genius Group prepares to file its lawsuit against naked short selling, the financial community is watching closely. The appointment of Kevin Malone as a Board Advisor highlights the company’s strategic approach to confronting perceived injustices in the market. By drawing attention to the issues surrounding naked short selling, Genius Group aims to advocate for fair trading practices that protect the interests of all investors.

The unfolding situation serves as a reminder of the importance of transparency and accountability in financial markets. As retail investors continue to engage in the stock market, they must be vigilant about the potential risks posed by unethical trading practices. The outcome of Genius Group’s legal action could pave the way for a more equitable trading environment, benefiting both individual and institutional investors alike.

In summary, the combination of Genius Group’s lawsuit, Kevin Malone’s involvement, and the broader implications for market fairness underscores a pivotal moment in the evolution of investor rights and trading practices. As the situation develops, it will be crucial for investors to stay informed and engaged, advocating for a marketplace that values integrity and fairness above all.

BREAKING COMPANY PREPARES TO FILE NAKED SHORT SELLING LAWSUIT

Genius Group Appoints Kevin Malone as a Board Advisor ahead of the filing

Malone Highlights GameStop: “When multiple brokerages removed the buy button on GameStop, Wall Street stole millions of dollars” $GNS $GME pic.twitter.com/hjYvq3c4x2

— X Market News (@xMarketNews) June 30, 2025

BREAKING COMPANY PREPARES TO FILE NAKED SHORT SELLING LAWSUIT

In a dramatic turn of events, a company has announced its intention to file a lawsuit over naked short selling, which has been a hot topic in financial circles for a while now. Naked short selling is a practice where investors sell shares they do not own or have not borrowed, a tactic that can create significant market volatility and is often seen as unethical. This development is particularly noteworthy as it highlights the ongoing concerns around market manipulation and the integrity of trading practices.

The announcement has stirred excitement among investors and traders alike, especially those who have been closely following the saga of companies like GameStop and others caught in the crosshairs of aggressive short-selling strategies. Many are eager to see how this lawsuit unfolds and what it may mean for the future of trading regulations.

Genius Group Appoints Kevin Malone as a Board Advisor ahead of the filing

In a strategic move, Genius Group has appointed Kevin Malone as a Board Advisor just ahead of their upcoming filing. Malone is no stranger to the financial world and brings a wealth of experience to the table. His appointment is seen as a proactive step to navigate the complex landscape of market regulations and investor relations.

Malone’s background is particularly relevant in this context. He has been vocal about the challenges faced by companies that find themselves at the mercy of aggressive short-selling tactics. His insights and experience may prove invaluable as Genius Group prepares to take its stand against what it perceives as unfair market practices.

The timing of Malone’s appointment is crucial. With the lawsuit on the horizon, his role could be pivotal in shaping the company’s strategy and communication with shareholders, analysts, and the broader market. As the situation unfolds, many will be watching closely to see how his expertise influences the company’s approach.

Malone Highlights GameStop: “When multiple brokerages removed the buy button on GameStop, Wall Street stole millions of dollars”

One of the most striking comments made by Malone revolves around the infamous GameStop saga. He stated, “When multiple brokerages removed the buy button on GameStop, Wall Street stole millions of dollars.” This statement encapsulates the feelings of many retail investors who felt betrayed during the GameStop short squeeze, where the stock skyrocketed due to a massive influx of retail buying amid a backdrop of heavy short positions.

The GameStop incident has become a case study in market manipulation and the power dynamics between retail investors and institutional players. Malone’s remarks shine a light on the ethical implications of trading practices and the need for more transparency and fairness in the market.

Investors are increasingly advocating for their rights and pushing back against what they perceive as systemic injustices. As the Genius Group lawsuit progresses, it may resonate with many who share similar sentiments about the need to hold powerful financial institutions accountable.

The Implications of Naked Short Selling Lawsuits

The filing of a naked short selling lawsuit can have far-reaching implications. For one, it may set a precedent that could influence how future cases are handled. If successful, this could empower other companies to take similar actions against unethical trading practices, potentially leading to a shift in how short selling is regulated.

The market might also experience increased volatility during the lawsuit process as investors react to news and updates. Traders will be keeping a close eye on developments, analyzing the potential impact on stock prices and trading volumes.

Moreover, the lawsuit could attract media attention, bringing more public scrutiny to the practices of short selling and the mechanisms that allow it to occur. This heightened awareness could spark broader discussions about market reforms and the need for regulatory changes to protect retail investors.

Investor Sentiment and Community Reactions

Investor sentiment is a crucial factor in the stock market, and the announcement of the lawsuit has already begun to stir reactions across social media platforms. Many retail investors are rallying behind Genius Group, expressing their support for the fight against naked short selling. The community’s response is reminiscent of the unified front seen during the GameStop frenzy, where retail investors banded together against perceived injustices.

Social media has become a powerful tool for investors to share information and rally support, and platforms like Twitter are buzzing with discussions around $GNS and its implications for the broader market. The hashtag #NakedShortSelling is gaining traction, with many advocating for more stringent regulations and transparency in trading practices.

As the situation continues to evolve, the community’s sentiment will play a significant role in shaping the narrative around the lawsuit and its potential outcomes. Investor engagement and activism are likely to remain strong, especially as the case garners more attention.

The Future of Trading Regulations

The Genius Group lawsuit could serve as a catalyst for discussions about the future of trading regulations. As more companies take a stand against naked short selling, there may be increased pressure on regulatory bodies to implement changes that protect investors from unethical practices.

Market regulators like the SEC are already facing scrutiny over their handling of trading regulations. If the Genius Group lawsuit gains traction, it could prompt a reevaluation of current rules and lead to reforms aimed at enhancing market transparency and fairness.

In this evolving landscape, the role of technology and data analytics in trading will also come into focus. As investors become more informed and empowered, the demand for tools that provide greater visibility into trading activities will likely increase. This shift could lead to innovations in trading platforms and analytics, further leveling the playing field for retail investors.

Conclusion: A Call to Action

The impending lawsuit by Genius Group against naked short selling practices represents a significant moment in the world of finance. With Kevin Malone at the helm as an advisor, the company appears poised to make a bold statement against perceived market injustices. The echoes of the GameStop saga remind us that the battle between retail investors and institutional players is far from over.

As investors and traders closely monitor this situation, it’s essential for everyone involved to stay informed and engaged. The outcome of this lawsuit could influence not only the parties involved but also the broader landscape of market regulations. For those passionate about fair trading practices, this is a call to action—stay vocal, stay informed, and support efforts that strive for transparency and equity in the financial markets.

For more details, check out the original tweet from [X Market News](https://twitter.com/xMarketNews/status/1939664451998769572).