BREAKING: pDAI Soars 30% as Bandaid Crisis Hits Pharmacies!

pDAI Cryptocurrency Surge: An Overview of the Recent Market Movement

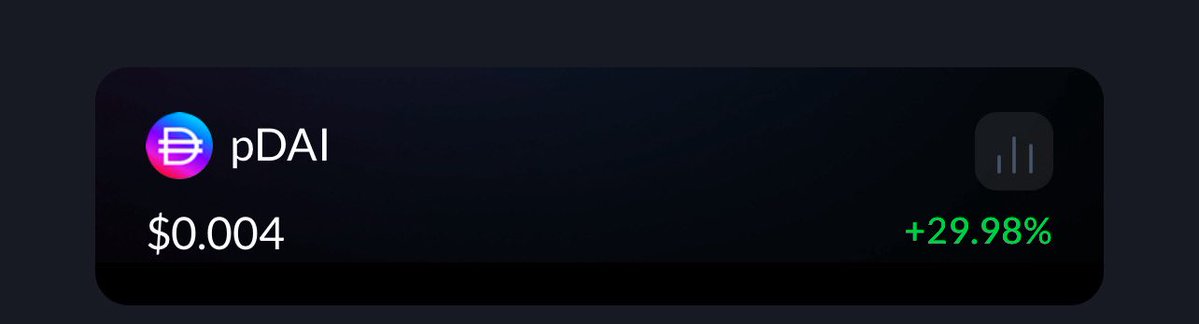

In the ever-evolving landscape of cryptocurrency, few events capture the attention of investors quite like a sudden price surge. Recently, the cryptocurrency pDAI has seen an impressive increase of over 30%, igniting interest among both seasoned investors and newcomers alike. This surge has been attributed to significant market developments, including reports that pharmacies are running dangerously low on essential supplies like bandaids. This unexpected correlation has sparked debates and discussions across various platforms, particularly Twitter. As we delve deeper into the implications of this surge, we’ll also explore the broader ecosystem of PulseChain, where pDAI resides.

Understanding the pDAI Surge

The surge in pDAI’s value can be traced back to a tweet from a notable influencer in the crypto community, yourfriendSOMMI. The tweet highlighted not only the 30% increase in pDAI’s value but also tied this rise to the alarming shortage of bandaids in pharmacies. While this connection may seem tenuous at first glance, it underscores a unique aspect of the cryptocurrency market: the influence of social media and community sentiment on price fluctuations.

Factors Influencing the Rise of pDAI

- Social Media Influence: The crypto market is highly susceptible to sentiment analysis. Positive tweets, endorsements, or even memes can lead to significant price shifts. In this case, the tweet from yourfriendSOMMI served as a catalyst for pDAI’s rally, demonstrating the power of social media in influencing investor behavior.

- Market Speculation: The mention of a "hidden gem ecosystem" in relation to PulseChain piqued investor curiosity. Speculation is a driving force in the crypto market, and when investors perceive a project as undervalued or poised for growth, they are likely to invest, pushing the price upward.

- Broader Market Trends: The cryptocurrency market is influenced by various external factors, including macroeconomic trends, regulatory news, and technological advancements. Positive developments in the PulseChain ecosystem can also contribute to pDAI’s price increase, as investors look for promising projects within the blockchain space.

PulseChain: A Hidden Gem Ecosystem

PulseChain, which is linked to pDAI, has been gaining traction as a promising blockchain ecosystem. Founded by Richard Heart, PulseChain aims to provide a more efficient, faster, and cheaper alternative to Ethereum. The platform’s focus on improving scalability and transaction speed has attracted attention from developers and investors alike.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Key Features of PulseChain

- Low Transaction Fees: One of the standout features of PulseChain is its low transaction fees, which make it appealing for users and developers looking to build decentralized applications (dApps) without incurring high costs.

- Faster Transaction Speeds: Compared to Ethereum, PulseChain boasts significantly faster transaction times, which can enhance user experience and facilitate more efficient operations for dApps.

- Community-Centric Approach: The PulseChain ecosystem is built around community engagement and developer support, making it an attractive option for those looking to contribute to the growth of the blockchain space.

The Future of pDAI and PulseChain

As pDAI continues to gain momentum, investors are keenly watching its trajectory. The recent price increase to $0.004 (0.4 cents) has marked a significant milestone for the cryptocurrency. However, as with any investment in the crypto space, it’s essential to exercise caution and conduct thorough research before diving in.

Potential Risks

- Market Volatility: The cryptocurrency market is notoriously volatile, and while pDAI has experienced a surge, it is not immune to rapid declines. Investors must be prepared for potential fluctuations in value.

- Regulatory Scrutiny: As cryptocurrencies gain popularity, they also attract regulatory attention. Changes in regulations can impact the viability and acceptance of projects like pDAI and PulseChain.

- Technological Challenges: The success of any blockchain project hinges on its technology. While PulseChain has promising features, it must continue to innovate and resolve potential technical issues to maintain investor confidence.

Conclusion

The recent surge in pDAI’s value is a fascinating development within the cryptocurrency landscape, highlighting the interplay between social media, community sentiment, and market dynamics. As pDAI rises in popularity, it draws attention to the broader PulseChain ecosystem, which is being recognized as a hidden gem in the crypto world.

Investors looking to capitalize on this momentum should stay informed about ongoing developments within PulseChain and the overall cryptocurrency market. While the initial excitement surrounding pDAI is palpable, it is crucial to approach investments with a balanced perspective, considering both the potential rewards and inherent risks.

In summary, the story of pDAI’s remarkable rise serves as a reminder of the unpredictable nature of the cryptocurrency market, where news, social media, and community engagement can significantly influence price movements. As we continue to monitor the evolution of pDAI and PulseChain, one thing remains clear: the world of cryptocurrency is as thrilling as it is complex, offering opportunities and challenges for investors at every turn.

BREAKING: pDAI is up +30% again today, rallying off the news that Pharmacy’s are running dangerously low on bandaids.

PulseChain is a hidden gem ecosystem.

We are now at the Richard Heart fud level of $0.004 (0.4 cents). pic.twitter.com/wuhTdDW59N

— yourfriendSOMMI (@yourfriendSOMMI) June 28, 2025

Breaking news in the crypto world! pDAI has surged a whopping 30% today, and the excitement is palpable. What’s driving this rally? Well, it turns out that pharmacies are facing a significant shortage of bandaids. Yes, you heard that right! It’s not just about the crypto charts; it’s about real-world implications that are making waves in the digital currency space. When you think about it, who would have thought that a supply shortage of bandaids could be a catalyst for a crypto boom?

BREAKING: pDAI is up +30% again today, rallying off the news that Pharmacy’s are running dangerously low on bandaids.

This sudden price increase has caught the attention of investors and enthusiasts alike. The market is buzzing, and pDAI’s performance is being closely monitored. It’s fascinating how external factors, like supply chains and healthcare products, can influence the crypto market. If you’ve been following the news, you know that the demand for first-aid supplies has skyrocketed, leading to this unexpected price action in pDAI.

PulseChain is a hidden gem ecosystem.

Now, let’s shift gears to talk about PulseChain. Many consider it a hidden gem in the expansive crypto ecosystem. Launched by Richard Heart, PulseChain is designed to provide faster and more efficient transactions than Ethereum. With lower fees and a focus on sustainability, PulseChain aims to attract a wide range of users, from developers to casual investors.

The ecosystem is still relatively unknown to the average investor, which gives it that “hidden gem” status. As the crypto market evolves, PulseChain could potentially become a significant player, especially as more people start looking for alternatives to Ethereum. If you’re not already familiar with PulseChain, now might be the perfect time to do some digging.

We are now at the Richard Heart fud level of $0.004 (0.4 cents).

What does it mean to be at the Richard Heart FUD level? For those new to the crypto scene, FUD stands for Fear, Uncertainty, and Doubt. It’s a term used to describe negative information spread to manipulate market sentiment. At just $0.004, or 0.4 cents, pDAI is sitting at a price point that many believe is undervalued, especially considering the recent surge. This could be a unique entry point for new investors or those looking to diversify their portfolios.

Investing in cryptocurrencies like pDAI and PulseChain can be risky but also rewarding. The volatility presents opportunities for significant gains, but it’s essential to do your homework before jumping in. Understanding the underlying technology, market trends, and the broader economic factors at play can give you a leg up.

What Makes PulseChain Stand Out?

So, what exactly sets PulseChain apart from other cryptocurrencies? For starters, the focus on speed and efficiency cannot be overstated. Transactions on PulseChain are processed much faster than those on Ethereum, making it an attractive option for developers building decentralized applications (dApps). Moreover, the lower transaction fees can be a game-changer for users who want to avoid the high gas fees often associated with Ethereum transactions.

Another aspect worth mentioning is PulseChain’s commitment to sustainability. In a world increasingly concerned about environmental impact, PulseChain seeks to provide a greener alternative to traditional blockchain technologies. This focus on eco-friendliness could be a significant draw for investors who are socially conscious and looking for projects that align with their values.

The Role of Community in Crypto Success

The success of any cryptocurrency often hinges on its community. PulseChain has garnered a loyal following, thanks in part to Richard Heart’s engaging personality and commitment to transparency. Community members are often the best advocates for a project, spreading the word and bringing in new investors. As more people learn about PulseChain and its potential, we can expect to see continued interest and investment.

Furthermore, social media plays a crucial role in shaping public perception and sentiment in the crypto market. Platforms like Twitter are filled with discussions, updates, and opinions that can sway investors’ decisions. Engaging with the community, whether through forums, social media, or local meetups, can provide valuable insight and foster a sense of belonging within the crypto space.

Understanding Market Trends and Volatility

When investing in cryptocurrencies, understanding market trends is essential. The crypto market is notoriously volatile, and prices can swing dramatically in a short amount of time. This volatility can be daunting for new investors, but it also presents opportunities for those willing to take calculated risks.

Keeping an eye on news, trends, and external factors affecting the market is crucial. As we’ve seen with the recent bandaid supply issue, real-world events can have a significant impact on crypto prices. Staying informed and adaptable will help you navigate the ups and downs of the market.

Investing in pDAI: What You Need to Know

If you’re considering investing in pDAI, there are a few things to keep in mind. First, make sure you’re aware of the risks involved in cryptocurrency investing. While the potential for high returns is alluring, the market can be unpredictable. Always do your research, read whitepapers, and consider seeking advice from financial experts.

Additionally, diversifying your investment portfolio can help mitigate risks. Instead of putting all your eggs in one basket, consider spreading your investments across different cryptocurrencies, including pDAI and PulseChain. This strategy can help you weather the storm during market downturns.

Final Thoughts

The recent surge in pDAI, fueled by factors like the bandaid shortage, highlights the interconnectedness of the real world and the crypto market. As more people become aware of PulseChain and its potential, it may very well solidify its status as a hidden gem in the ecosystem. Whether you’re a seasoned investor or just starting, keeping a close eye on trends and engaging with the community can be invaluable in navigating this exciting landscape.

Stay tuned for more updates, and remember to invest wisely!