BREAKING: BlackRock’s SEC Pressure Could Skyrocket $XRP to $5!

BlackRock Pressures SEC to Approve XRP Spot ETFs: A Potential Game-Changer for Investors

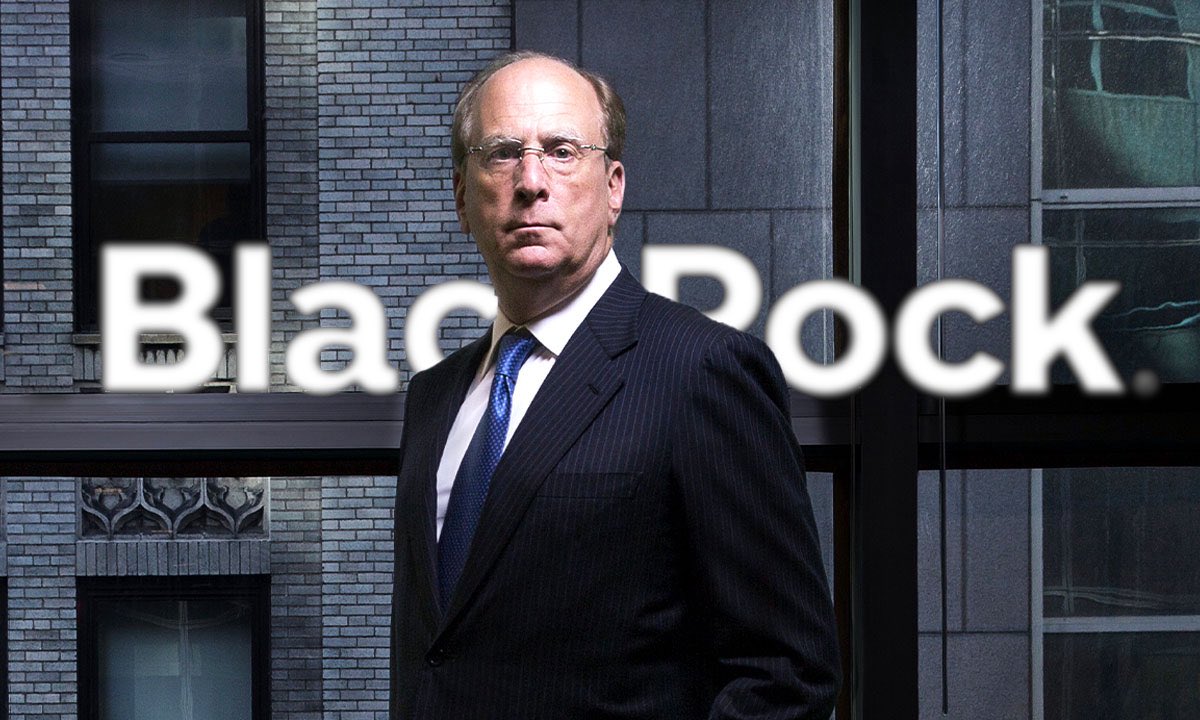

In a significant development that has captured the attention of the cryptocurrency market, rumors have surfaced indicating that BlackRock, one of the largest asset management firms globally, is pressuring the U.S. Securities and Exchange Commission (SEC) to approve spot Exchange Traded Funds (ETFs) for XRP. This news has the potential to drastically impact the value of XRP, with predictions suggesting that its price could skyrocket to $5 within seconds of such approval.

Understanding XRP and Its Market Significance

XRP is the native cryptocurrency of the Ripple network, which is designed to facilitate real-time cross-border payments. Unlike Bitcoin and Ethereum, which are primarily used as digital currencies, XRP aims to serve as a bridge currency in financial transactions, making it a popular choice among banks and financial institutions. Over the years, XRP has garnered significant attention from investors, both retail and institutional, due to its unique use case and potential for mass adoption.

BlackRock’s Involvement: Why It Matters

BlackRock’s interest in XRP ETFs is crucial for several reasons. Firstly, as a leading player in the investment management industry, BlackRock’s endorsement could lend significant credibility to XRP and catalyze a broader acceptance of cryptocurrencies in traditional finance. Moreover, the approval of XRP spot ETFs would allow institutional investors to gain exposure to XRP without holding the cryptocurrency directly, thereby reducing associated risks and complexities.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Role of the SEC

The SEC’s approval is pivotal in the context of cryptocurrency ETFs. The agency has been cautious in approving such financial products due to concerns over market manipulation, investor protection, and regulatory compliance. Historically, the SEC has rejected multiple applications for cryptocurrency ETFs, citing these reasons. However, with increasing pressure from major institutional players like BlackRock, the SEC may be compelled to reconsider its stance, particularly as the demand for regulated cryptocurrency investment vehicles grows.

Potential Price Impact on XRP

The rumor that BlackRock is advocating for the approval of XRP spot ETFs has generated substantial excitement within the crypto community. If the SEC were to approve these ETFs, it is widely believed that XRP could experience a rapid price surge, with some analysts forecasting a jump to $5. This potential price increase is attributed to the influx of institutional capital that would follow, as ETFs typically attract a diverse range of investors looking to diversify their portfolios.

Market Reactions and Investor Sentiment

The possibility of XRP spot ETFs being approved has led to heightened investor interest and speculation. Social media platforms and cryptocurrency forums are buzzing with discussions about the implications of such an event. Many investors are expressing optimism and enthusiasm, with sentiments leaning towards a bullish outlook for XRP. The potential for significant returns is motivating both seasoned investors and newcomers to consider adding XRP to their portfolios.

The Future of Cryptocurrency ETFs

The conversation surrounding cryptocurrency ETFs is evolving. As institutional interest in digital assets continues to rise, the approval of XRP spot ETFs could set a precedent for other cryptocurrencies seeking similar financial products. This may pave the way for a more regulated and structured approach to cryptocurrency investments, encouraging greater participation from institutional investors and enhancing market stability.

Conclusion: The Ripple Effect

In summary, the speculation surrounding BlackRock’s pressure on the SEC to approve XRP spot ETFs is creating a buzz in the cryptocurrency market. The implications of such an approval could be monumental, with the potential to drive XRP’s price to new heights and significantly alter the landscape of cryptocurrency investments. As investors eagerly await further developments, the situation emphasizes the importance of regulatory clarity and institutional support in the evolution of the cryptocurrency market.

Whether you’re a seasoned investor or new to the world of cryptocurrencies, staying informed about these developments is crucial. The potential approval of XRP spot ETFs could be a turning point not just for XRP but for the entire cryptocurrency ecosystem. As we approach the rumored decision date, the market will be watching closely for any announcements from the SEC that could signal the beginning of a new era for cryptocurrency investments.

RUMOR:

BlackRock is reportedly pressuring the SEC to approve #XRP spot ETFs this Monday.

If true… $XRP could skyrocket to $5 in seconds.

Are you ready for liftoff? pic.twitter.com/zdYgLFL8Nn

— John Squire (@TheCryptoSquire) June 28, 2025

RUMOR:

It looks like the crypto world is buzzing with some pretty exciting news! Recent chatter suggests that BlackRock, one of the largest asset management firms in the world, is reportedly putting the pressure on the SEC to approve XRP spot Exchange-Traded Funds (ETFs) this Monday.

Now, if this rumor holds any water, it could mean some serious action for $XRP. We’re talking about a potential spike to $5 in a matter of seconds. So, let’s dive deeper into what this could mean for investors and the crypto landscape as a whole.

What Is an ETF and Why Does It Matter?

Before we get too far into the rabbit hole, let’s clarify what an ETF is. Simply put, an Exchange-Traded Fund is a type of investment fund that is traded on stock exchanges, much like stocks. They hold assets such as stocks, commodities, or bonds and generally operate with an arbitrage mechanism designed to keep trading close to its net asset value, though deviations can occasionally occur.

So, why is BlackRock’s involvement significant? Well, BlackRock’s size and influence in the financial world mean that their backing could lend a tremendous amount of credibility and stability to the cryptocurrency market, particularly for XRP. The approval of spot ETFs would allow more investors to easily buy and sell XRP, potentially driving the price up significantly.

The Current state of XRP

XRP has had its fair share of ups and downs over the past few years. Following some legal challenges with the SEC regarding whether XRP should be classified as a security, the coin has fluctuated in value, causing uncertainty among investors. However, the prospect of ETF approval could change the game entirely. The market has been waiting for a regulatory green light for such products, and if the SEC gives the thumbs up, it could lead to a massive influx of capital.

Why BlackRock Is Pushing for Approval

BlackRock’s interest in XRP ETFs can be seen as a strategic move. They understand that cryptocurrencies are here to stay, and integrating them into traditional investment portfolios is becoming increasingly important. By advocating for the approval of XRP spot ETFs, BlackRock not only positions itself as a leader in this emerging market but also caters to a growing demand among institutional investors eager to dip their toes into crypto.

Furthermore, spot ETFs are particularly appealing because they allow investors to invest directly in the underlying asset, which in this case is XRP. This differs from futures ETFs, which are often more complex and can be influenced by various market factors. A straightforward investment product like a spot ETF would likely attract a broader range of investors.

Market Reactions and Predictions

The crypto community is abuzz with speculation about the potential outcomes of this rumor. If the SEC does approve the XRP spot ETFs as BlackRock is reportedly urging, we could see an explosion in demand for XRP. Many are predicting that the price could surge to $5 in a blink, as more investors rush to grab a piece of the crypto pie before prices skyrocket.

Additionally, this could set a precedent for other cryptocurrencies seeking similar approval for spot ETFs. The ripple effect (pun intended) could lead to a broader acceptance of cryptocurrencies within traditional financial markets, making them a staple in investment portfolios.

What Should Investors Do? Are You Ready for Liftoff?

Given the volatility of the cryptocurrency market, it’s essential for investors to stay informed and be prepared for quick movements. If you’re considering investing in XRP, it might be wise to keep a close eye on news updates regarding the SEC’s decision. Understanding the implications of such approvals on market dynamics will be crucial for making informed investment choices.

Also, remember to diversify your portfolio. While the potential for XRP is exciting, putting all your eggs in one basket can be risky. Explore various investment options and consider your risk tolerance before diving in.

Conclusion: The Future of XRP and Crypto ETFs

The possibility of BlackRock pressuring the SEC to approve XRP spot ETFs is certainly a game-changer for the crypto world. If the approval comes through, we could witness a significant shift in how cryptocurrencies are viewed and traded in traditional finance. With the potential for $XRP to skyrocket and the growing interest from institutional investors, the future looks bright for those who are ready for liftoff!

So, whether you’re a seasoned investor or just starting to explore cryptocurrency, keep an eye on this developing situation. The crypto landscape is rapidly evolving, and being informed will help you navigate this exciting journey.