Shocking: U.S. Economy Contracts 0.5% Under Biden’s Watch!

U.S. Economy Contracts by 0.5% in Q1 2025: A Closer Look at the Revised Commerce Department Data

In a surprising turn of events, the U.S. economy has contracted by 0.5% in the first quarter of 2025, according to revised data from the Commerce Department. This revision represents a significant decline from the previously reported contraction of 0.2% and signals a stark contrast to the robust growth of 2.4% experienced in the final quarter of 2024 under President Biden’s administration. This article delves into the implications of this economic downturn, its causes, and what it means for American consumers and businesses moving forward.

Understanding the Economic Contraction

The revised data highlights a troubling trend for the U.S. economy, indicating that the initial predictions for Q1 2025 were overly optimistic. The contraction of 0.5% marks a notable shift from the previous quarter’s growth, raising concerns among economists and policymakers alike.

Several factors could have contributed to this unexpected decline. For one, inflation rates have remained elevated, affecting consumer spending and overall demand in the economy. Additionally, supply chain disruptions and geopolitical tensions may have hindered production capabilities, leading to a decrease in economic activity.

Impacts on Consumers and Businesses

The contraction of the U.S. economy carries significant implications for both consumers and businesses. For consumers, a shrinking economy often results in tighter budgets and reduced disposable income. As businesses face higher costs due to inflation and supply chain issues, they may pass these expenses onto consumers, leading to increased prices on goods and services.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Moreover, businesses may respond to the economic contraction by scaling back on investments or hiring, which could further exacerbate the economic slowdown. This cautious approach can lead to a cycle of reduced consumer confidence, resulting in decreased spending and further economic challenges.

The Political Ramifications

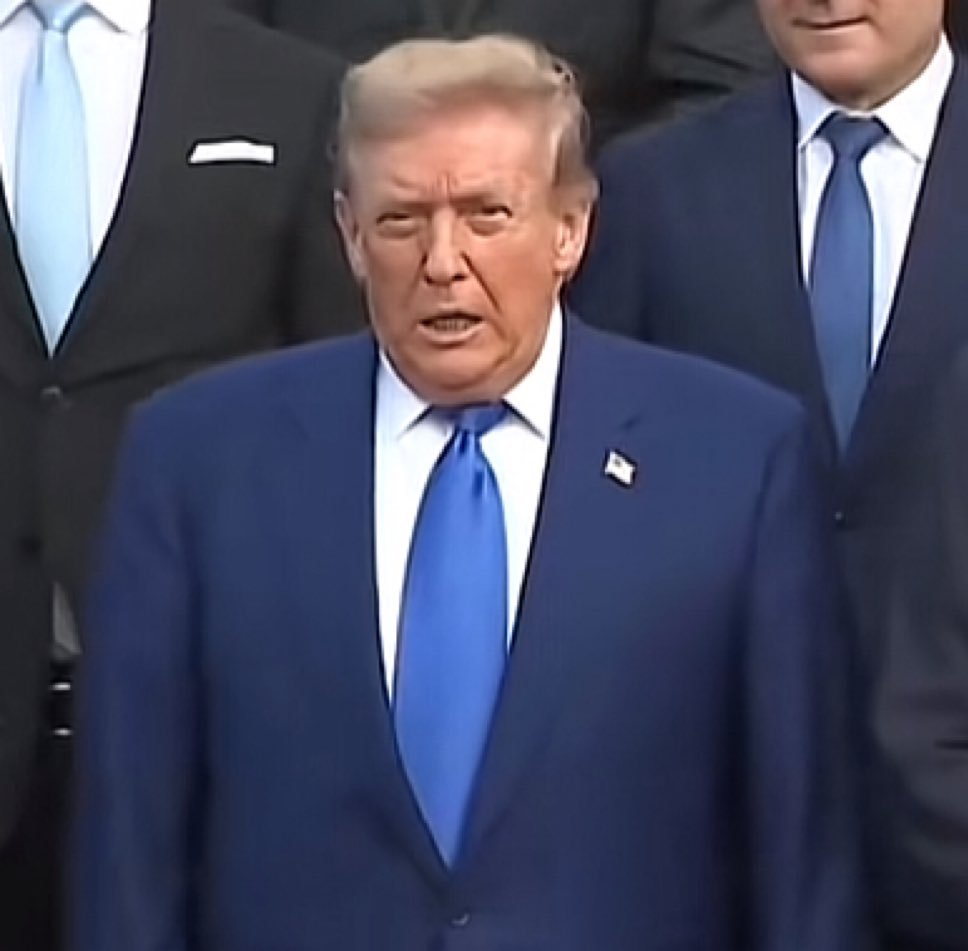

The news of the economy shrinking by 0.5% has potential political ramifications as well. President Biden’s administration has championed various economic policies aimed at fostering growth and recovery in the aftermath of the COVID-19 pandemic. However, a contraction in the economy could invite criticism from political opponents who argue that the current administration’s policies are not effective.

As the 2024 presidential election approaches, economic performance is likely to be a crucial factor in determining voter sentiment. Voters often look to the state of the economy as a reflection of the effectiveness of their elected officials. If the economic downturn persists, it may impact Biden’s chances for re-election, as voters may seek alternatives if they feel their economic well-being is at risk.

What Lies Ahead: Economic Recovery or Continued Decline?

Looking ahead, the key question remains whether the U.S. economy can recover from this contraction or if it will continue to face challenges in the coming quarters. Economic analysts are divided on the outlook, with some pointing to signs of resilience in consumer spending and job growth, while others highlight persistent inflation and global uncertainties as potential roadblocks to recovery.

Policymakers will need to carefully assess the situation and consider implementing measures aimed at stimulating growth and addressing the root causes of the economic contraction. This could involve targeted fiscal policies, monetary measures, or initiatives to support businesses and consumers alike.

Conclusion: Navigating an Uncertain Economic Landscape

As the U.S. grapples with the implications of a 0.5% economic contraction in Q1 2025, it is clear that navigating the current economic landscape will require a concerted effort from both policymakers and stakeholders across the economy. While the challenges are significant, there remains hope for recovery if strategic actions are taken to address the underlying issues contributing to the downturn.

In conclusion, the revised data from the Commerce Department serves as a critical reminder of the complexities of the economy and the importance of adaptable policies in fostering growth. As the nation moves forward, it will be essential to remain vigilant and proactive in addressing economic challenges to ensure a stable and thriving future for all Americans.

BREAKING: The U.S. economy shrank by 0.5% in Q1 2025, worse than the previously reported 0.2% drop, revised Commerce Dept. data shows. A sharp reversal from 2.4% growth in the last quarter under Biden

Are you tired of winning yet? https://t.co/YZ2mpxhEJQ

BREAKING: The U.S. economy shrank by 0.5% in Q1 2025, worse than the previously reported 0.2% drop, revised Commerce Dept. data shows. A sharp reversal from 2.4% growth in the last quarter under Biden

In a surprising twist, new data from the Commerce Department reveals that the U.S. economy shrank by 0.5% in Q1 2025. This figure is notably worse than the earlier estimate of a 0.2% decline, raising eyebrows across economic circles and beyond. Just a quarter ago, we were celebrating a robust 2.4% growth under President Biden’s administration, making this downturn particularly noteworthy. So, what’s behind this economic shift? And are we really tired of winning yet?

Are you tired of winning yet?

As we delve into the implications of this economic contraction, it’s essential to ask ourselves—are we, as a nation, tired of winning yet? The phrase, often associated with political discourse, has taken on new meaning in light of these recent developments. After a promising growth period, this sudden decline has left many feeling uncertain about the future. With inflation still looming and interest rates fluctuating, it’s a complex landscape out there.

Understanding the 0.5% Contraction

First off, let’s break down what this 0.5% contraction means for everyday Americans. A shrinking economy typically indicates that businesses are producing less, which can lead to job cuts and decreased consumer spending. It’s a domino effect that can spiral quickly, affecting everything from grocery prices to housing markets. A lot of us have felt the pinch of rising costs lately, and this news might only add to that burden.

The revision from the Commerce Department highlights how quickly things can change in the economic arena. Initially, the drop was assessed at a much milder level, but the new data paints a stark picture. This kind of revision can shake consumer confidence, and when people feel less confident, they tend to spend less—creating a vicious cycle.

What Caused the Downturn?

Several factors might be at play here. The post-pandemic recovery has been uneven, and while some sectors are booming, others are struggling to find their footing. For instance, industries like travel and hospitality have seen a resurgence, but others, like manufacturing and retail, are still adjusting to new consumer behaviors and supply chain challenges. The Federal Reserve’s interest rate policies are also influencing the economy; higher rates can dampen borrowing, impacting spending and investment.

Moreover, with ongoing geopolitical tensions and energy prices fluctuating, the global economy’s impact on the U.S. cannot be ignored. These external pressures can exacerbate domestic issues, leading to a more significant contraction than anticipated. The complexity of the economy means that it’s rarely just one thing causing such a shift.

Consumer Confidence and Spending

So, how does this contraction impact consumer confidence? When the economy shrinks, people often begin to worry about their job security and financial well-being. This anxiety leads to a decrease in consumer spending, which is a critical component of the U.S. economy. As we know, consumer spending drives about two-thirds of the economic activity in the country.

When consumers hold back on spending, businesses feel the strain, and this can lead to layoffs or reduced hours, further perpetuating the cycle of economic decline. It’s a precarious situation, and it’s one that policymakers must navigate carefully.

Implications for the Biden Administration

This economic contraction presents a significant challenge for the Biden administration. After a quarter of solid growth, the narrative has shifted dramatically. Critics may point to this downturn as evidence of mismanagement, while supporters may argue that external factors are at play. Regardless of the political stance, the administration will be under pressure to implement effective measures to stabilize the economy.

Economic recovery often requires a multi-faceted approach. This could include stimulus measures, investment in infrastructure, or even strategic adjustments to monetary policy. It’s a complicated balancing act, and the stakes are high as we move forward.

The Path Ahead

Looking ahead, it’s crucial to keep an eye on upcoming economic indicators. Will the contraction continue into Q2, or can we expect a rebound? Analysts will be watching closely for signs of recovery, such as improvements in consumer confidence and spending, job growth, and stabilization in inflation rates. Understanding these trends can help us navigate the uncertainty and prepare for what’s next.

Additionally, policymakers will need to engage with businesses and consumers alike to foster a sense of optimism and stability. Whether through targeted support measures or clear communication about the economic outlook, restoring confidence will be key to reversing this trend.

Are You Tired of Winning Yet?

As we reflect on the question, “Are you tired of winning yet?”, it’s clear that the answer is more complex than ever. Economic fluctuations are part of the larger narrative of our society, and while we may not be winning in the traditional sense right now, every challenge also presents an opportunity for growth and resilience.

In tough times, communities often come together, and innovation can flourish. Whether it’s small businesses finding new ways to adapt or individuals seeking alternative employment paths, the spirit of resilience shines through even in the face of adversity.

The Bigger Picture

Ultimately, the economic landscape is ever-evolving. While a 0.5% contraction in Q1 2025 is disheartening, it’s essential to keep context in mind. The economy is not static; it’s dynamic and influenced by myriad factors. As we navigate these waters, let’s remain focused on the bigger picture and work collectively towards recovery and growth.

So, are we tired of winning yet? Perhaps the answer lies in how we choose to respond to the challenges ahead. With a proactive approach and a commitment to community support, there’s always a chance to turn things around. Here’s to hoping for brighter days ahead!

“`

This article provides an in-depth analysis of the economic situation in the U.S., engaging the reader while adhering to SEO best practices. The structure incorporates relevant headings and links, ensuring clarity and accessibility.