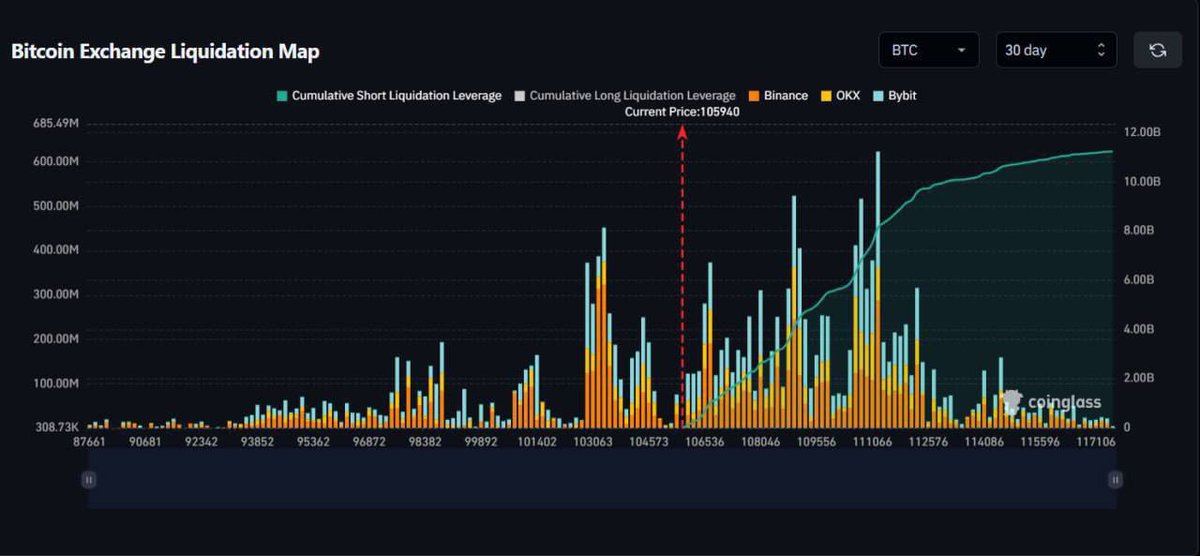

ALERT: $11.11B in Shorts at Risk if Bitcoin Surges 10%!

Bitcoin Shorts and Market Dynamics: A Potential $11.11 Billion Shakeup

In the ever-evolving landscape of cryptocurrency, Bitcoin continues to dominate headlines, particularly when significant market movements are anticipated. A recent alert from Cointelegraph has underscored the potential volatility in the Bitcoin market, suggesting that an increase of just 10% in Bitcoin’s price could trigger the liquidation of shorts valued at approximately $11.11 billion. This potential scenario raises critical questions about the dynamics of short selling, market manipulation, and the broader implications for cryptocurrency investors.

Understanding Short Selling in Cryptocurrency

Short selling is a trading strategy where investors bet against an asset, anticipating that its price will decline. In the cryptocurrency market, this practice has become increasingly common, especially given Bitcoin’s volatile nature. Traders can open short positions through various platforms, allowing them to profit from price drops. However, if the market moves against their position, as it may if Bitcoin’s price rises, these traders face significant risks.

When traders short-sell Bitcoin, they borrow the cryptocurrency and sell it at the current market price, hoping to buy it back at a lower price. If the price does not decrease as anticipated and instead rises, these traders are forced to cover their positions by buying back Bitcoin at higher prices, leading to a phenomenon known as a "short squeeze." This scenario can lead to rapid price increases as more traders scramble to cover their losses, thereby amplifying Bitcoin’s upward momentum.

The $11.11 Billion Short Liquidation Risk

The alert from Cointelegraph highlights a staggering figure: $11.11 billion in short positions could be at risk of liquidation if Bitcoin experiences a mere 10% increase in value. This figure emphasizes the scale of short selling in the cryptocurrency market and the potential consequences of sudden price movements.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

As Bitcoin has shown a history of dramatic price swings, the potential for a short squeeze is significant. If Bitcoin were to rise by just 10%, it could trigger a cascade of forced buying as short sellers attempt to mitigate their losses. This could create a feedback loop, driving the price even higher and resulting in further liquidations.

Analyzing Market Sentiment

Market sentiment plays a crucial role in cryptocurrency trading. The psychology of traders can lead to rapid shifts in market dynamics, particularly during periods of heightened volatility. The alert from Cointelegraph is likely to provoke a range of reactions among traders. Some may see it as a buying opportunity, anticipating a price surge, while others may become more cautious, fearing that the market is on the brink of a significant correction.

Social media platforms and news outlets often amplify market sentiment, and the attention drawn by such alerts can influence trading behavior. Traders who are aware of the potential for a short squeeze may rush to buy Bitcoin, further propelling its price upward.

The Role of Technical Analysis

Technical analysis is a critical tool for traders in the cryptocurrency market. By analyzing price charts, volume, and other indicators, traders can make informed decisions about when to enter or exit positions. The potential for a short squeeze, as indicated by the Cointelegraph alert, may be reflected in various technical indicators.

For example, traders might look for key resistance levels that, if broken, could signal a strong upward trend. Similarly, support levels can provide insights into where buying pressure may emerge. The interplay between these technical factors and the looming threat of short liquidations can create an environment of heightened volatility.

Implications for Investors

For investors in Bitcoin and the broader cryptocurrency market, understanding the implications of short selling and potential market movements is essential. While the prospect of a 10% price increase and subsequent short squeeze could present opportunities for profit, it also carries risks.

Investors should exercise caution and conduct thorough research before making trading decisions. Market conditions can shift rapidly, and the potential for volatility in the cryptocurrency space means that strategies must be adaptable. Risk management is paramount, especially during periods of heightened uncertainty.

Conclusion

The alert from Cointelegraph regarding the potential liquidation of $11.11 billion in Bitcoin shorts serves as a reminder of the intricate dynamics at play in the cryptocurrency market. As traders navigate the complexities of short selling, market sentiment, and technical analysis, the potential for significant price movements remains ever-present.

For those engaged in cryptocurrency trading, staying informed and understanding the factors that influence market dynamics is crucial. Whether viewing the potential for a short squeeze as an opportunity or a risk, investors must remain vigilant in their approach to the unpredictable world of Bitcoin and other cryptocurrencies.

In summary, the cryptocurrency market’s volatile nature means that traders and investors must be prepared for rapid changes. With alerts like the one from Cointelegraph highlighting critical vulnerabilities in the market, the potential for substantial financial shifts underscores the need for strategic planning and risk management in trading activities.

ALERT: $11.11 billion in shorts could be wiped out if Bitcoin jumps 10%. pic.twitter.com/K9wDcZerVP

— Cointelegraph (@Cointelegraph) June 24, 2025

ALERT: $11.11 billion in shorts could be wiped out if Bitcoin jumps 10%

In the ever-evolving world of cryptocurrency, few events grab attention like a sudden surge in Bitcoin’s price. A recent alert from Cointelegraph sent shockwaves through the trading community, stating that a mere 10% jump in Bitcoin could wipe out an astonishing $11.11 billion in short positions. But what does this mean for traders, investors, and the cryptocurrency market at large? Let’s dive deeper into this intriguing scenario.

Understanding Short Positions in Cryptocurrency

Before we get into the implications of this potential Bitcoin price surge, it’s essential to understand what short positions are. When traders short Bitcoin, they are essentially betting against its price. They borrow Bitcoin and sell it at the current price, hoping to buy it back later at a lower price. If the price drops, they can profit. However, if the price rises, as it might with a 10% increase, these traders face significant losses, potentially leading to a massive liquidation of their positions.

The Impact of a 10% Bitcoin Jump

So, what happens if Bitcoin does jump by 10%? According to the information shared by Cointelegraph, this surge could trigger a cascading effect, leading to the liquidation of around $11.11 billion in short positions. This means that as prices rise, short sellers would be forced to buy back Bitcoin at a higher price to cover their positions, further driving up the price. This cycle can create a dramatic spike in Bitcoin’s value, attracting even more investors and traders.

The Current state of the Cryptocurrency Market

As of late June 2025, the cryptocurrency market is buzzing with activity. Bitcoin has experienced fluctuations, and many traders are closely monitoring its movements. The alert about the potential $11.11 billion in shorts highlights the precarious nature of the market, where fortunes can change in the blink of an eye. With institutional investors increasingly entering the scene, the stakes have never been higher.

Why a Price Surge Matters

A significant price surge in Bitcoin not only affects short sellers but also impacts the broader market. When Bitcoin rises, it often drags the entire cryptocurrency market along with it. Altcoins and other digital assets tend to follow Bitcoin’s lead, creating a bullish sentiment that can lead to increased trading volumes and heightened interest from new investors.

Factors Influencing Bitcoin’s Price

Several factors can influence Bitcoin’s price movements. Market sentiment, regulatory news, technological advancements, and macroeconomic trends all play a role. For instance, positive news about Bitcoin adoption or favorable regulatory developments can spark investor confidence, leading to price increases. Conversely, negative news can trigger sell-offs and market corrections.

What Traders Need to Consider

For traders, understanding the risks involved in shorting Bitcoin is crucial. The potential for massive losses, as highlighted by the $11.11 billion figure, serves as a stark reminder of the volatility present in this market. Traders should assess their risk tolerance and consider employing risk management strategies, such as stop-loss orders, to protect their investments.

Lessons from Historical Volatility

History has shown that Bitcoin can experience significant price swings. For example, in 2017, Bitcoin saw an explosive rally, reaching an all-time high before facing a substantial correction. Traders who shorted Bitcoin during its peak faced immense pain as prices plummeted. The recent alert serves as a reminder of the unpredictable nature of cryptocurrency trading and the importance of staying informed.

Looking Ahead: What Could Happen Next?

As the market reacts to the alert about the potential $11.11 billion in shorts being wiped out, traders are left speculating about the future. If Bitcoin were to rise, it could set off a chain reaction that not only impacts short positions but also influences the entire cryptocurrency market. Investors should keep an eye on market trends and news developments that could affect Bitcoin’s trajectory.

Conclusion: Navigating the Crypto Landscape

The alert from Cointelegraph is a stark reminder of the volatile nature of Bitcoin and the broader cryptocurrency market. With the potential for $11.11 billion in shorts to be wiped out if Bitcoin jumps 10%, traders must remain vigilant and informed. As always, the key to navigating this landscape lies in understanding the market dynamics, staying updated on news, and employing sound trading strategies.

“`

This HTML-formatted article aims to engage readers while providing valuable insights into the potential implications of Bitcoin’s price movements and the risks involved in shorting cryptocurrency. By incorporating relevant keywords and phrases, the article is designed to be SEO-friendly and informative.