Bitcoin Revolution? Lawmakers Seek Tax-Free Everyday Crypto Purchases!

Senators Push for Bitcoin Exemption: Will Everyday Purchases Spark Tax Chaos?

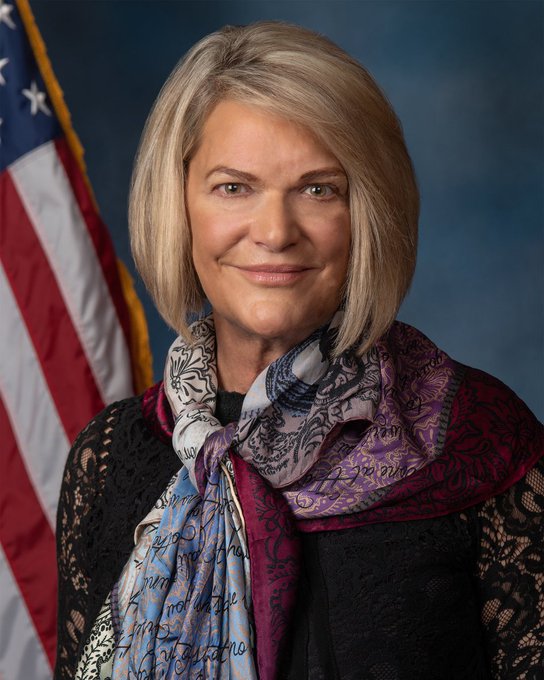

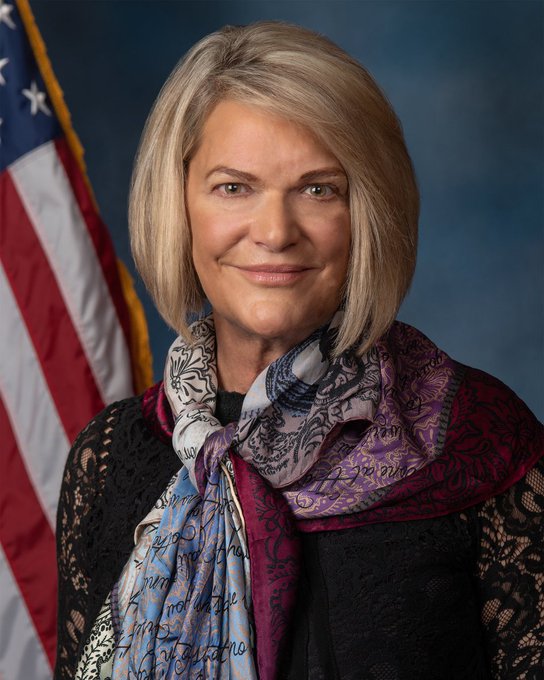

In a significant move for cryptocurrency enthusiasts, Senator Cynthia Lummis and former Congressman Mike Rogers are advocating for a legislative change that could reshape how Americans utilize Bitcoin for everyday transactions. Their proposal aims to create an exemption allowing individuals to make small purchases with Bitcoin without incurring complex tax reporting requirements. This initiative has the potential to simplify cryptocurrency use in daily life, potentially fostering wider adoption.

The Call for Legislative Change

Currently, Bitcoin users face substantial tax implications whenever they use their cryptocurrency for everyday purchases. Each transaction can trigger capital gains taxes, thus complicating small transactions and acting as a barrier to mainstream adoption of Bitcoin and other cryptocurrencies. Lummis and Rogers argue that passing an exemption for small transactions will alleviate this burden, enabling consumers to spend Bitcoin similarly to traditional fiat currencies without the fear of incurring tax liabilities.

The Importance of Simplifying Cryptocurrency Use

The push for this exemption is not just about easing the burden on Bitcoin users; it’s also about encouraging broader acceptance of cryptocurrency. With Bitcoin gaining traction as a legitimate payment method, removing tax barriers for small transactions could motivate more businesses to accept it, enhancing consumer confidence in using cryptocurrency for day-to-day purchases. Moreover, the absence of a clear regulatory framework for cryptocurrency has created confusion among consumers and businesses alike. By establishing clear guidelines for tax exemptions on small Bitcoin transactions, lawmakers can provide the clarity necessary for individuals and businesses to engage confidently in cryptocurrency transactions.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Benefits of Using Bitcoin for Everyday Purchases

There are numerous advantages to using Bitcoin for everyday purchases. Primarily, Bitcoin transactions can often be faster and cheaper than traditional banking methods, particularly for international payments. This efficiency can save consumers time and money, making Bitcoin an attractive alternative for everyday spending. Additionally, using Bitcoin can enhance user privacy compared to conventional payment methods, as transactions do not require personal information to be shared. Furthermore, in a landscape marked by inflation and economic uncertainty, many consumers are seeking alternative ways to protect their wealth. Bitcoin has been promoted as a hedge against inflation, and allowing its use for everyday purchases could empower consumers in managing their financial futures.

The Future of Bitcoin and Cryptocurrency Legislation

As discussions surrounding cryptocurrency legislation evolve, the proposal by Lummis and Rogers could mark a significant step towards acceptance of Bitcoin as a mainstream payment method. The potential exemption for small transactions may lay the groundwork for further legislative efforts aimed at establishing a more favorable environment for cryptocurrencies. Lawmakers must acknowledge the dynamic nature of the cryptocurrency market and the needs of its users. By fostering an environment that encourages innovation and eases the regulatory burden on consumers, policymakers can facilitate the growth of the cryptocurrency ecosystem.

Conclusion

The initiative led by senator Cynthia Lummis and former Congressman Mike Rogers to allow Americans to use Bitcoin for small everyday purchases without cumbersome tax reporting represents a promising development in cryptocurrency legislation. By simplifying Bitcoin utilization, this exemption could enhance consumer confidence, promote cryptocurrency acceptance among businesses, and ultimately contribute to broader adoption of digital currencies.

As the world increasingly embraces technological advancements in finance, the need for clear and supportive regulations will become paramount. By recognizing the potential of cryptocurrencies and taking steps to create a favorable regulatory environment, lawmakers can help shape the future of finance, enabling consumers to leverage the benefits of Bitcoin in their daily lives.

In summary, the proposed exemption for small Bitcoin transactions could represent a turning point in how Americans engage with cryptocurrency, ushering in a new era of financial freedom and innovation. As this conversation gains momentum, monitoring the legislative efforts and their implications for the future of digital currencies in everyday commerce will be essential.

Key Takeaways

- Legislative Advocacy: Senator Lummis and Mike Rogers are pushing for an exemption to allow Bitcoin use for small purchases without tax reporting.

- Tax Implications: Current regulations treat each Bitcoin transaction as a taxable event, complicating everyday spending.

- Consumer Confidence: Simplifying Bitcoin use could encourage more businesses to accept cryptocurrency and enhance consumer confidence.

- Economic Benefits: The exemption could stimulate economic activity and position the U.S. as a leader in cryptocurrency adoption.

- Public Sentiment: Growing public interest in Bitcoin usage for everyday transactions may influence legislative outcomes.

This proposal reflects a growing recognition of Bitcoin’s potential role in daily financial transactions. As public opinion shifts and influential voices advocate for favorable policies, the future of Bitcoin as an integrated part of everyday commerce looks promising. Whether you are a seasoned crypto enthusiast or a newcomer exploring the world of digital currencies, the potential for a more inclusive financial system is within reach.

Senators Push for Bitcoin Exemption: Will Everyday Purchases Spark Tax Chaos?

Bitcoin transactions, tax exemption for cryptocurrency, everyday purchases with Bitcoin

Senator Cynthia Lummis and former Congressman Mike Rogers have recently called for an important legislative change that could significantly impact the way Americans use Bitcoin for everyday transactions. In a statement shared on Twitter by Bitcoin Magazine, the duo emphasized the need for an exemption that would allow individuals to use Bitcoin for small purchases without facing cumbersome tax reporting requirements. This initiative has garnered attention as it seeks to simplify the use of cryptocurrency in daily life, potentially encouraging more widespread adoption.

### The Call for Legislative Change

In the current financial landscape, many Bitcoin users often face complex tax implications when using their cryptocurrency for everyday purchases. Each time Bitcoin is used as a form of payment, it can trigger capital gains taxes, making it difficult for consumers to engage in small transactions. This has been a significant barrier to the mainstream adoption of Bitcoin and other cryptocurrencies for everyday spending.

Senator Lummis and former Congressman Rogers argue that by passing an exemption specifically for small transactions, the government can alleviate this burden. Their proposal aims to create a more favorable environment for cryptocurrency users, enabling them to spend their Bitcoin in a manner similar to traditional fiat currencies without the fear of incurring tax liabilities.

### The Importance of Simplifying Cryptocurrency Use

The push for this exemption is not just about making life easier for Bitcoin users; it is also about promoting the broader acceptance of cryptocurrency. As Bitcoin continues to gain traction as a legitimate form of payment, removing the tax barriers associated with small transactions could encourage more businesses to accept Bitcoin. This, in turn, could lead to greater consumer confidence in using cryptocurrency for day-to-day purchases.

Moreover, the absence of a clear regulatory framework for cryptocurrency use has created confusion among consumers and businesses alike. By establishing clear guidelines that allow for tax exemptions on small Bitcoin transactions, lawmakers can provide the clarity necessary for individuals and businesses to engage more confidently in cryptocurrency transactions.

### Benefits of Using Bitcoin for Everyday Purchases

There are numerous benefits associated with using Bitcoin for everyday purchases. First and foremost, Bitcoin transactions can often be faster and cheaper than traditional banking methods, especially for international payments. This efficiency can save consumers time and money, making Bitcoin an attractive alternative for everyday spending.

Additionally, using Bitcoin can provide consumers with more privacy compared to conventional payment methods. Bitcoin transactions do not require personal information to be shared, which can help protect user privacy in an increasingly digital world.

Furthermore, with the rise of inflation and economic uncertainty, many consumers are looking for alternative ways to protect their wealth. Bitcoin has been touted as a hedge against inflation, and allowing its use for everyday purchases could empower consumers to take control of their financial futures.

### The Future of Bitcoin and Cryptocurrency Legislation

As discussions around cryptocurrency legislation continue to evolve, the proposal put forth by senator Lummis and former Congressman Rogers could represent a significant step forward in the acceptance of Bitcoin as a mainstream payment method. The potential exemption for small transactions may pave the way for further legislative efforts aimed at creating a more supportive environment for cryptocurrencies.

It is crucial for lawmakers to understand the dynamic nature of the cryptocurrency market and the needs of its users. By fostering an environment that encourages innovation and eases the regulatory burden on consumers, policymakers can facilitate the growth of the cryptocurrency ecosystem.

### Conclusion

The proposal by senator Cynthia Lummis and former Congressman Mike Rogers to allow Americans to use Bitcoin for small everyday purchases without incurring burdensome tax reporting is a promising development in the realm of cryptocurrency legislation. By simplifying the use of Bitcoin, this exemption could enhance consumer confidence, promote the acceptance of cryptocurrency by businesses, and ultimately contribute to the broader adoption of digital currencies.

As the world continues to embrace technological advancements in finance, the need for clear and supportive regulations will become increasingly important. By recognizing the potential of cryptocurrencies and taking steps to create a favorable regulatory environment, lawmakers can help shape the future of finance, allowing consumers to leverage the benefits of Bitcoin in their daily lives.

In summary, the proposed exemption for small Bitcoin transactions could mark a turning point for how Americans engage with cryptocurrency, fostering a new era of financial freedom and innovation. As this conversation gains traction, it will be essential to monitor how these legislative efforts unfold and their implications for the future of digital currencies in everyday commerce.

JUST IN: Senator Cynthia Lummis & former Congressman Mike Rogers said we must pass an “exemption to allow Americans to use Bitcoin for small everyday purchases without triggering burdensome tax reporting.” pic.twitter.com/p0XIZXb1oR

— Bitcoin Magazine (@BitcoinMagazine) June 23, 2025

JUST IN: Senator Cynthia Lummis & Former Congressman Mike Rogers Say We Must Pass an Exemption

In a significant development for cryptocurrency enthusiasts, Senator Cynthia Lummis and former Congressman Mike Rogers have made a compelling case for an exemption that would allow Americans to use Bitcoin for small everyday purchases without the cumbersome tax reporting currently required. This proposal could revolutionize how we perceive and use digital currencies in our daily lives.

The push for such an exemption is rooted in the belief that Bitcoin, and cryptocurrencies in general, should be accessible to everyone, particularly for routine transactions. The current tax regulations can be a barrier for many, discouraging the use of Bitcoin for small purchases, which is counterproductive to the broader adoption of digital currencies.

The Current Landscape of Bitcoin and Taxation

As it stands, every time a person uses Bitcoin to buy a cup of coffee or a book, it’s treated as a taxable event by the IRS. This means that the individual must calculate any gains or losses on the Bitcoin used, report them, and potentially pay taxes on those gains. Consequently, many people find it easier to stick with traditional fiat currencies like the US dollar.

This taxation model poses challenges, especially for those who view Bitcoin as a viable currency rather than an investment. The idea of needing to report every small transaction can deter everyday users from engaging with Bitcoin, creating a barrier that stifles its growth and utility.

Why an Exemption Matters

Senator Lummis and Mike Rogers argue that an exemption would empower Americans to use Bitcoin in their daily lives without the fear of tax repercussions for minor purchases. This change could lead to a more widespread acceptance of Bitcoin, fostering a culture where cryptocurrencies are viewed as a legitimate form of currency rather than mere speculative assets.

Additionally, an exemption could stimulate economic activity. Imagine walking into your favorite café, ordering a drink, and paying with Bitcoin without worrying about a potential tax liability. Such convenience can encourage more people to use Bitcoin, thus enhancing its value and utility.

The Potential Economic Impact

The economic implications of allowing Bitcoin to be used freely for small transactions are profound. Increased adoption could lead to higher demand for Bitcoin, potentially driving up its price. Additionally, as more people begin to use Bitcoin for everyday purchases, businesses may also start to accept it more widely, creating a more robust ecosystem for digital currencies.

Moreover, the move could position the United States as a leader in cryptocurrency adoption. While other countries are exploring regulatory frameworks for digital currencies, the U.S. could set a precedent by allowing small transactions without triggering tax obligations. This could attract innovators and investors looking to capitalize on a more favorable regulatory environment.

Addressing Concerns About Tax Evasion

One of the main arguments against such an exemption is the concern that it could open the door to tax evasion. Critics argue that making small transactions tax-free could encourage illicit activities. However, Lummis and Rogers contend that appropriate safeguards can be implemented to minimize this risk.

For instance, transactions over a certain threshold could still trigger tax reporting requirements, allowing for the use of Bitcoin in small transactions while maintaining oversight for larger ones. This balanced approach could satisfy both proponents of cryptocurrency and those concerned about potential misuse.

The Role of Public Sentiment

Public sentiment plays a crucial role in the acceptance of Bitcoin as a mainstream currency. As more individuals and businesses express their desire to use Bitcoin for everyday purchases, lawmakers are likely to take notice. The push from influential figures like Lummis and Rogers could galvanize public support and create momentum for legislative change.

Moreover, as younger generations, who are more comfortable with technology and digital currencies, become a larger part of the consumer market, the demand for Bitcoin-friendly policies will only grow. This demographic shift could be pivotal in shaping the future of cryptocurrency regulation.

What’s Next for the Proposal?

As this proposal gains traction, it will be essential to monitor its progress through Congress. Lawmakers will likely hold hearings to discuss the implications of such an exemption, weighing the benefits against potential risks. Engaging with stakeholders, including cryptocurrency advocates, tax policy experts, and law enforcement, will be crucial in crafting a balanced approach.

Additionally, the voices of everyday Americans will be vital in shaping the narrative. As the public becomes more informed about the potential benefits and challenges of using Bitcoin for small purchases, their input could influence legislative outcomes significantly.

The Future of Bitcoin and Everyday Transactions

The potential for Bitcoin to become a staple in everyday transactions hinges on the successful passage of this exemption. If enacted, it could mark a pivotal moment in the evolution of digital currencies, moving them from speculative investments to practical tools for daily life.

As we look to the future, the prospect of using Bitcoin without the burden of tax reporting for small transactions is an exciting one. It opens up possibilities for financial inclusion, innovation, and a more dynamic economy. The ongoing dialogue around this proposal reflects the growing recognition of cryptocurrency’s potential role in our financial lives.

How Can Individuals Prepare for the Change?

For those eager to embrace Bitcoin in their daily transactions, staying informed is crucial. Following developments around this exemption and understanding the evolving landscape of cryptocurrency can empower individuals to make informed choices. Engaging with local cryptocurrency communities, attending events, and participating in discussions can provide valuable insights.

Additionally, individuals should consider exploring Bitcoin wallets and payment solutions that facilitate everyday transactions. As businesses begin to adopt Bitcoin payments, being prepared to use digital currencies effectively will be essential.

Conclusion

The call from senator Cynthia Lummis and former Congressman Mike Rogers for an exemption allowing Americans to use Bitcoin for small everyday purchases without the burden of tax reporting is a step toward a more inclusive financial future. By removing barriers to entry, this proposal could lead to wider adoption of Bitcoin, fostering innovation and economic growth.

As we navigate this exciting landscape, the conversation around cryptocurrency continues to evolve. With influential voices advocating for meaningful change, the future looks bright for Bitcoin and its role in our daily lives. Whether you’re a seasoned crypto enthusiast or just starting to explore this world, the potential for a more integrated financial system is within reach.

JUST IN: Senator Cynthia Lummis & former Congressman Mike Rogers said we must pass an “exemption to allow Americans to use Bitcoin for small everyday purchases without triggering burdensome tax reporting.”

Senators Push for Bitcoin Exemption: Will Everyday Purchases Spark Tax Chaos?

Bitcoin transactions, tax exemption for cryptocurrency, everyday purchases with Bitcoin

Senator Cynthia Lummis and former Congressman Mike Rogers have recently called for an important legislative change that could significantly impact the way Americans use Bitcoin for everyday transactions. In a statement shared on Twitter by Bitcoin Magazine, the duo emphasized the need for an exemption that would allow individuals to use Bitcoin for small purchases without facing cumbersome tax reporting requirements. This initiative has garnered attention as it seeks to simplify the use of cryptocurrency in daily life, potentially encouraging more widespread adoption.

The Call for Legislative Change

In the current financial landscape, many Bitcoin users often face complex tax implications when using their cryptocurrency for everyday purchases. Each time Bitcoin is used as a form of payment, it can trigger capital gains taxes, making it difficult for consumers to engage in small transactions. This has been a significant barrier to the mainstream adoption of Bitcoin and other cryptocurrencies for everyday spending.

Senator Lummis and former Congressman Rogers argue that by passing an exemption specifically for small transactions, the government can alleviate this burden. Their proposal aims to create a more favorable environment for cryptocurrency users, enabling them to spend their Bitcoin in a manner similar to traditional fiat currencies without the fear of incurring tax liabilities. This could mean that buying that morning coffee or a quick snack won’t come with a hefty tax headache!

The Importance of Simplifying Cryptocurrency Use

Now, this push for an exemption isn’t just about making life easier for Bitcoin users; it’s also about promoting the broader acceptance of cryptocurrency. Imagine walking into a store and being able to pay with Bitcoin without worrying about tax implications. As Bitcoin continues to gain traction as a legitimate form of payment, removing the tax barriers associated with small transactions could encourage more businesses to accept Bitcoin. This, in turn, could lead to greater consumer confidence in using cryptocurrency for day-to-day purchases, making it a household name.

Moreover, the absence of a clear regulatory framework for cryptocurrency use has created confusion among consumers and businesses alike. By establishing clear guidelines that allow for tax exemptions on small Bitcoin transactions, lawmakers can provide the clarity necessary for individuals and businesses to engage more confidently in cryptocurrency transactions. It’s about time we made Bitcoin user-friendly, right?

Benefits of Using Bitcoin for Everyday Purchases

What’s in it for you? There are numerous benefits associated with using Bitcoin for everyday purchases. First and foremost, Bitcoin transactions can often be faster and cheaper than traditional banking methods, especially for international payments. This efficiency can save consumers time and money, making Bitcoin an attractive alternative for everyday spending. Plus, who doesn’t love a good deal?

Additionally, using Bitcoin can provide consumers with more privacy compared to conventional payment methods. Bitcoin transactions don’t require personal information to be shared, which can help protect user privacy in our increasingly digital world. With rising concerns over data breaches and identity theft, this feature could be a game-changer.

Let’s not forget about inflation. With the rise of inflation and economic uncertainty, many consumers are looking for alternative ways to protect their wealth. Bitcoin has been touted as a hedge against inflation, and allowing its use for everyday purchases could empower consumers to take control of their financial futures. So, using Bitcoin could not only be a smart decision for your wallet but also for your peace of mind.

The Future of Bitcoin and Cryptocurrency Legislation

As discussions around cryptocurrency legislation continue to evolve, the proposal put forth by senator Lummis and former Congressman Rogers could represent a significant step forward in the acceptance of Bitcoin as a mainstream payment method. The potential exemption for small transactions may pave the way for further legislative efforts aimed at creating a more supportive environment for cryptocurrencies. It’s a win-win situation!

It is crucial for lawmakers to understand the dynamic nature of the cryptocurrency market and the needs of its users. By fostering an environment that encourages innovation and eases the regulatory burden on consumers, policymakers can facilitate the growth of the cryptocurrency ecosystem. After all, we’re in the digital age, and it’s high time our laws caught up!

Why an Exemption Matters

Senator Lummis and Mike Rogers argue that an exemption would empower Americans to use Bitcoin in their daily lives without the fear of tax repercussions for minor purchases. This change could lead to a more widespread acceptance of Bitcoin, fostering a culture where cryptocurrencies are viewed as a legitimate form of currency rather than mere speculative assets. It’s about time Bitcoin was treated like the currency it was meant to be!

Additionally, an exemption could stimulate economic activity. Imagine walking into your favorite café, ordering a drink, and paying with Bitcoin without worrying about a potential tax liability. Such convenience can encourage more people to use Bitcoin, thus enhancing its value and utility. Just think about how many people might jump on the Bitcoin bandwagon if it became that easy!

The Potential Economic Impact

The economic implications of allowing Bitcoin to be used freely for small transactions are profound. Increased adoption could lead to higher demand for Bitcoin, potentially driving up its price. Additionally, as more people begin to use Bitcoin for everyday purchases, businesses may also start to accept it more widely, creating a more robust ecosystem for digital currencies. It’s a cycle that could keep giving!

Moreover, the move could position the United States as a leader in cryptocurrency adoption. While other countries are exploring regulatory frameworks for digital currencies, the U.S. could set a precedent by allowing small transactions without triggering tax obligations. This could attract innovators and investors looking to capitalize on a more favorable regulatory environment. Let’s not be left behind in the crypto race!

Addressing Concerns About Tax Evasion

One of the main arguments against such an exemption is the concern that it could open the door to tax evasion. Critics argue that making small transactions tax-free could encourage illicit activities. However, Lummis and Rogers contend that appropriate safeguards can be implemented to minimize this risk. For instance, transactions over a certain threshold could still trigger tax reporting requirements, allowing for the use of Bitcoin in small transactions while maintaining oversight for larger ones. This balanced approach could satisfy both proponents of cryptocurrency and those concerned about potential misuse.

The Role of Public Sentiment

Public sentiment plays a crucial role in the acceptance of Bitcoin as a mainstream currency. As more individuals and businesses express their desire to use Bitcoin for everyday purchases, lawmakers are likely to take notice. The push from influential figures like Lummis and Rogers could galvanize public support and create momentum for legislative change.

Moreover, as younger generations, who are more comfortable with technology and digital currencies, become a larger part of the consumer market, the demand for Bitcoin-friendly policies will only grow. This demographic shift could be pivotal in shaping the future of cryptocurrency regulation.

What’s Next for the Proposal?

As this proposal gains traction, it will be essential to monitor its progress through Congress. Lawmakers will likely hold hearings to discuss the implications of such an exemption, weighing the benefits against potential risks. Engaging with stakeholders, including cryptocurrency advocates, tax policy experts, and law enforcement, will be crucial in crafting a balanced approach. It’s a team effort!

Additionally, the voices of everyday Americans will be vital in shaping the narrative. As the public becomes more informed about the potential benefits and challenges of using Bitcoin for small purchases, their input could influence legislative outcomes significantly. Your voice matters!

The Future of Bitcoin and Everyday Transactions

The potential for Bitcoin to become a staple in everyday transactions hinges on the successful passage of this exemption. If enacted, it could mark a pivotal moment in the evolution of digital currencies, moving them from speculative investments to practical tools for daily life. Imagine a future where you can buy your groceries or pay for a meal with Bitcoin, and it’s as easy as pie!

As we look to the future, the prospect of using Bitcoin without the burden of tax reporting for small transactions is an exciting one. It opens up possibilities for financial inclusion, innovation, and a more dynamic economy. The ongoing dialogue around this proposal reflects the growing recognition of cryptocurrency’s potential role in our financial lives.

How Can Individuals Prepare for the Change?

For those eager to embrace Bitcoin in their daily transactions, staying informed is crucial. Following developments around this exemption and understanding the evolving landscape of cryptocurrency can empower individuals to make informed choices. Engaging with local cryptocurrency communities, attending events, and participating in discussions can provide valuable insights. The more you know, the more empowered you’ll be!

Additionally, individuals should consider exploring Bitcoin wallets and payment solutions that facilitate everyday transactions. As businesses begin to adopt Bitcoin payments, being prepared to use digital currencies effectively will be essential. It’s all about being ahead of the curve!

Embracing a New Era of Financial Freedom

The call from senator Cynthia Lummis and former Congressman Mike Rogers for an exemption allowing Americans to use Bitcoin for small everyday purchases without the burden of tax reporting is a step toward a more inclusive financial future. By removing barriers to entry, this proposal could lead to wider adoption of Bitcoin, fostering innovation and economic growth.

As we navigate this exciting landscape, the conversation around cryptocurrency continues to evolve. With influential voices advocating for meaningful change, the future looks bright for Bitcoin and its role in our daily lives. Whether you’re a seasoned crypto enthusiast or just starting to explore this world, the potential for a more integrated financial system is within reach.

JUST IN: Senator Cynthia Lummis & former Congressman Mike Rogers said we must pass an “exemption to allow Americans to use Bitcoin for small everyday purchases without triggering burdensome tax reporting.”