Whale’s $134K BTC Investment Turns into Shocking $31M Windfall!

Whale Sells 300 BTC for $31 Million: A Remarkable Crypto Journey

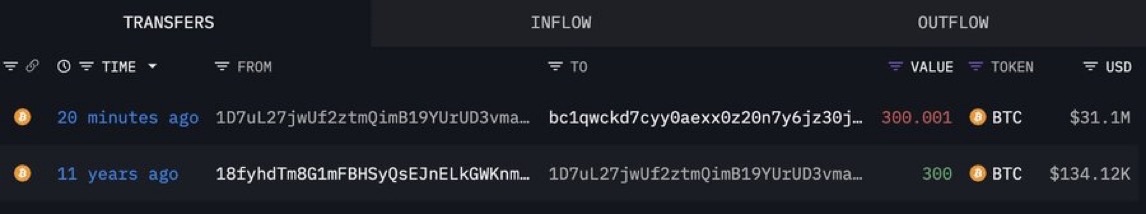

In a stunning turn of events that has captivated the cryptocurrency community, a whale—an individual or entity holding a large amount of cryptocurrency—has recently cashed out an impressive 300 Bitcoin (BTC) for a staggering $31 million. This momentous sale, highlighted in a tweet by Crypto Beast, details how this savvy investor secured their holdings for merely $134,000 over a decade ago.

The Initial Investment

In 2014, this whale purchased 300 BTC for just $134,000. At that time, Bitcoin was still emerging as a legitimate asset class, gaining traction among early adopters and tech enthusiasts. The decision to invest such a significant sum into Bitcoin was not without its risks. However, it was a forward-thinking choice that would yield incredible returns over the years.

The Crypto Market Evolution

Since that initial investment, the cryptocurrency market has undergone a dramatic transformation. The price of Bitcoin has experienced extreme volatility, characterized by substantial surges and significant declines. Over the past decade, Bitcoin has transitioned from being a niche digital asset, primarily used for peer-to-peer transactions, to becoming a mainstream financial instrument recognized by institutional investors and governments alike.

The Cash-Out Moment

Fast forward to today, the whale’s 300 BTC, which were acquired for $134,000, were sold for an astonishing $31 million. This sale represents a return on investment (ROI) that is difficult to fathom, showcasing the potential for wealth generation in the cryptocurrency market. The decision to sell at this moment could have been influenced by various factors, including market conditions, personal financial goals, or a strategic move to realize profits after years of holding.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Impact on Bitcoin’s Price

The sale of such a large amount of Bitcoin can have ripple effects on the cryptocurrency market. High-profile transactions often attract attention and can lead to fluctuations in Bitcoin’s price. The market is particularly sensitive to large sell-offs, as they can create a sense of urgency among investors, potentially leading to panic selling or increased buying pressure.

Lessons Learned from the Whale’s Journey

The story of this whale offers several key takeaways for investors—both new and seasoned—in the cryptocurrency space:

- Long-Term Vision: The whale’s ability to hold onto their investment for over a decade highlights the importance of having a long-term vision in the volatile world of cryptocurrencies. Many investors may be tempted to sell during market dips, but patience can often yield substantial rewards.

- Understanding Market Dynamics: The cryptocurrency market is influenced by various factors, including technological advancements, regulatory changes, and macroeconomic trends. Investors should stay informed about these dynamics to make educated decisions.

- Risk Management: Investing in cryptocurrencies comes with inherent risks. This whale’s journey underscores the necessity of risk management strategies, including diversification and setting profit-taking thresholds.

- The Power of Timing: The decision to cash out at the right moment can significantly affect an investor’s returns. Monitoring market indicators and trends can help investors make informed decisions about when to enter or exit positions.

The Future of Cryptocurrency Investment

As Bitcoin approaches new price milestones, the allure of cryptocurrency investment continues to grow. With institutional adoption increasing and financial products linked to Bitcoin becoming more prevalent, the landscape is evolving rapidly. More investors are recognizing the potential for substantial returns, as demonstrated by the whale’s remarkable journey.

Conclusion

The story of the whale who turned a $134,000 investment into $31 million serves as a powerful reminder of the potential rewards that cryptocurrency can offer. As the market continues to mature, investors can learn from this journey and apply these lessons to their investment strategies. Whether you’re an experienced trader or just starting in the world of cryptocurrency, understanding the intricacies of this asset class can lead to successful investment outcomes.

In summary, the cryptocurrency market presents unique opportunities and challenges. As evidenced by this whale’s success, a combination of long-term vision, market understanding, and effective risk management can pave the way for financial success in this dynamic landscape. With each passing day, the world of cryptocurrency continues to unfold, offering new stories, lessons, and opportunities for those willing to engage with it.

BREAKING

This whale grabbed 300 BTC for $134K 11 years ago. Today, they cashed out for $31 million. pic.twitter.com/VFRcdLdD0K

— Crypto Beast (@cryptobeastreal) June 20, 2025

BREAKING

In the world of cryptocurrency, stories about savvy investors and their dramatic gains surface regularly. One such captivating tale recently made waves in the crypto community. A whale—an investor who holds large amounts of cryptocurrency—made headlines by cashing out a staggering $31 million after buying 300 BTC for just $134,000 eleven years ago. This news has not only ignited discussions about the potential of Bitcoin but also raised questions about market timing, investment strategies, and the future of digital currencies.

This whale grabbed 300 BTC for $134K 11 years ago.

Let’s break this down. Eleven years ago, Bitcoin was a fledgling currency, often regarded as a novelty rather than a serious investment. At that time, 300 BTC could be snagged for a mere $134,000—a sum that sounds astonishingly low by today’s standards. Fast forward to 2025, and Bitcoin’s price skyrocketed, leading to a jaw-dropping cash-out of $31 million. This transformation is a testament to the volatility and potential profitability of investing in cryptocurrencies.

Today, they cashed out for $31 million.

The whale’s decision to sell at this point is particularly interesting. It underscores the importance of market timing in investment. While many investors continue to hold onto their Bitcoin, hoping for even higher prices, this whale clearly identified the right moment to cash in. This strategic move raises the question: how do investors decide when to sell? For some, it’s about hitting a specific target price, while for others, it could be a fear of market downturns. The decision-making process can often be a mix of intuition, research, and a bit of luck.

The Impact of Whale Activity on the Market

In the cryptocurrency ecosystem, whales have a significant impact on market dynamics. When a whale decides to sell a large amount of Bitcoin, it can lead to price fluctuations. This is because the market reacts to such large transactions, often leading to panic selling among smaller investors. As news of this whale’s cash-out spreads, it might inspire other investors to rethink their own strategies. Are they holding on for too long? Should they consider cashing out a portion of their investments?

Understanding Bitcoin’s Journey

Bitcoin’s journey from a niche digital currency to a mainstream asset class is nothing short of remarkable. Initially embraced by tech enthusiasts and libertarians, Bitcoin has now entered the portfolios of institutional investors and hedge funds. This evolution has sparked increased interest in cryptocurrencies, leading to the rise of various altcoins and blockchain technologies.

In the early days, many investors faced skepticism and uncertainty. However, as Bitcoin began to gain traction, its price surged. The story of the whale who bought 300 BTC for $134,000 exemplifies the kind of transformational growth that has attracted countless investors. The current price of Bitcoin, fluctuating around tens of thousands of dollars, showcases the impressive potential for returns in this space.

Investment Strategies and Risk Management

With great potential comes great risk. Investing in cryptocurrencies is not for the faint of heart. The market is notoriously volatile, with prices that can swing dramatically within hours. This leads to essential discussions around investment strategies. For those looking to replicate the success of the whale, it’s crucial to have a strategy in place.

Some common strategies include dollar-cost averaging, where investors buy a fixed dollar amount of Bitcoin at regular intervals, regardless of its price. This approach can help mitigate the effects of volatility. Others might choose to hold onto their investments long-term, betting on Bitcoin’s continued appreciation over the years. Regardless of the strategy, maintaining a robust risk management plan is vital.

The Future of Cryptocurrency Investments

As the cryptocurrency market continues to mature, what does the future hold for investors? The story of the whale serves as an inspiring example, but it also invites scrutiny of what lies ahead for Bitcoin and other cryptocurrencies. Regulatory changes, technological advancements, and market demand will all play crucial roles in shaping the future landscape.

Moreover, the increasing acceptance of Bitcoin as a legitimate asset class could pave the way for new investment opportunities. The rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) further expands the potential for innovative investment strategies within the crypto realm.

Community and Collaboration in Crypto

The cryptocurrency community is vibrant and collaborative. Many investors turn to online forums, social media platforms, and dedicated crypto communities to share insights and strategies. Platforms like Twitter, where news and updates spread rapidly, play a significant role in shaping public perception and investor behavior. The tweet that announced this whale’s cash-out sparked conversations about market trends and investment philosophies, underscoring the importance of staying connected in this fast-paced environment.

Lessons Learned from the Whale’s Journey

The whale’s journey from a $134,000 investment to a $31 million cash-out offers several key lessons for investors:

- Long-Term Vision: Patience can yield significant rewards. Holding onto assets during market fluctuations can be a winning strategy.

- Market Timing: Recognizing when to sell is crucial. Investors must be informed and aware of market trends to make timely decisions.

- Risk Management: Having a solid plan in place helps mitigate potential losses and guides investors through market volatility.

- Stay Informed: Engaging with the crypto community and staying updated on news can provide valuable insights and opportunities.

The Role of Education in Cryptocurrency

As the popularity of cryptocurrencies grows, education becomes paramount. New investors must equip themselves with knowledge about the market, investment strategies, and the technology behind cryptocurrencies. Numerous resources, including online courses, webinars, and articles, are available to help individuals navigate this complex landscape.

Moreover, understanding the underlying technology, like blockchain, can enhance an investor’s grasp of cryptocurrency’s potential. This knowledge empowers investors to make informed decisions and contribute to discussions within the community.

Final Thoughts on the Whale’s Cash-Out

The incredible story of the whale who cashed out 300 BTC for $31 million serves as a powerful reminder of the opportunities within the cryptocurrency market. However, it also highlights the importance of strategy, timing, and education. As more individuals enter this space, they must learn from the experiences of early adopters and navigate the complexities of the market with caution and insight.

As the future of cryptocurrency unfolds, stories like this will continue to inspire and educate investors about the potential rewards and risks associated with this dynamic asset class. Whether you’re a seasoned investor or just starting, there’s always something new to learn and explore in the ever-evolving world of cryptocurrency.