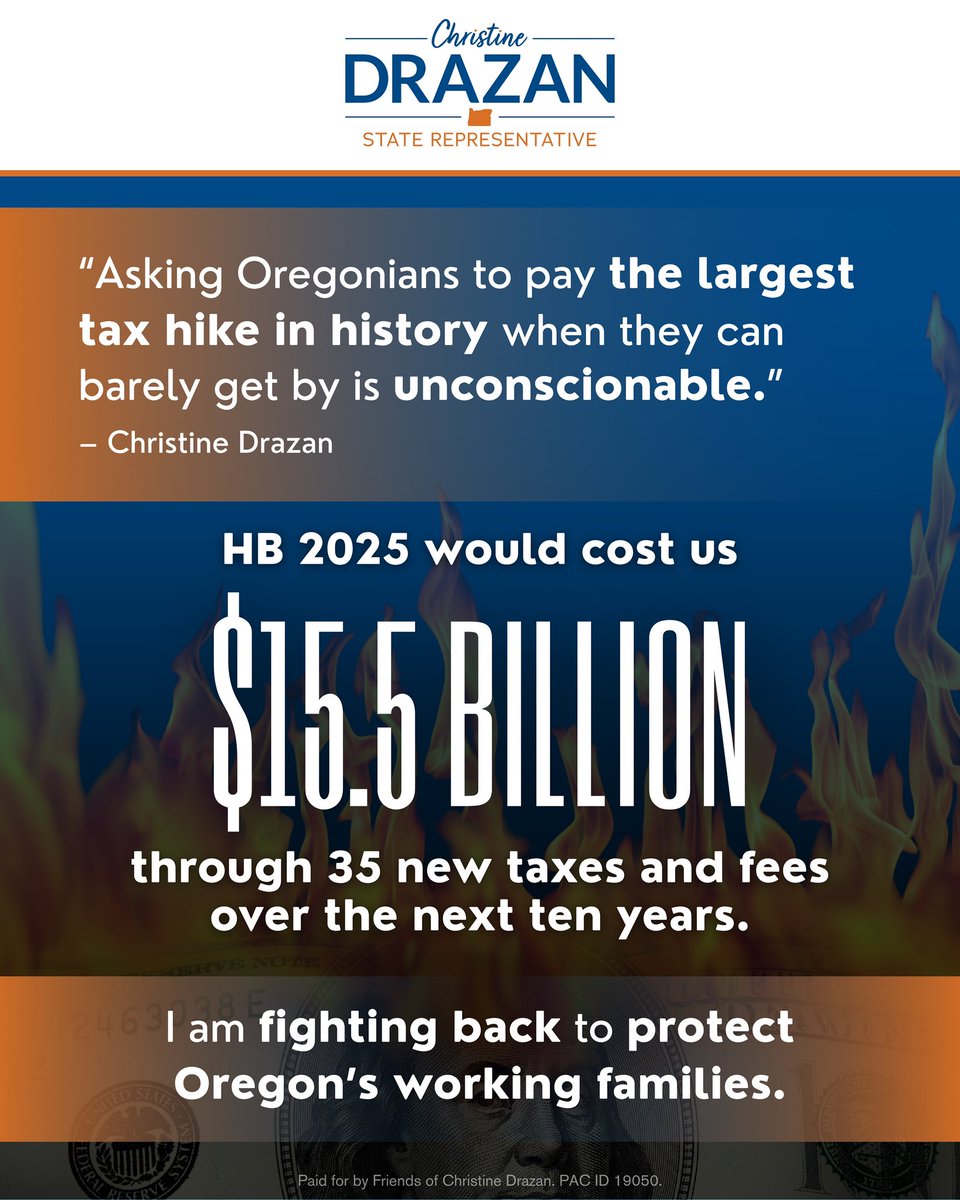

Democrats’ Plan: $15.5B Tax Hike on Struggling Oregonians!

Democrats Propose $15.5 Billion in New Taxes for Oregonians

In a recent proposal, Democrats have put forth a plan that could extract an additional $15.5 billion from Oregon residents over the next decade through 35 new taxes and fees. This initiative has sparked considerable debate and concern among citizens, many of whom are already struggling to make ends meet. In this summary, we will delve into the implications of this proposed taxation strategy and its potential impact on families across Oregon.

The Burden of Additional Taxes

Oregonians are already facing rising costs across various sectors, including essential needs such as gas and groceries. The implementation of new taxes and fees could exacerbate these financial pressures, placing an even heavier burden on families who are already stretched thin. With inflation continuing to affect household budgets, the introduction of additional financial obligations is seen by many as irresponsible governance.

Prioritizing Responsible Governance

Opponents of the proposal argue that the responsibility of governing should prioritize the well-being of the constituents. Instead of implementing new taxes that could hinder economic recovery and growth, they suggest that lawmakers focus on more efficient spending and accountability within existing budgets. The call for responsible governance emphasizes the need for leaders to be mindful of the financial challenges faced by everyday Oregonians.

Impact on Daily Life

The introduction of 35 new taxes and fees could have far-reaching implications for daily life in Oregon. Families are already coping with increased prices for basic necessities. The prospect of additional taxes raises concerns about affordability and accessibility. For instance, higher taxes on gas could lead to increased transportation costs, affecting not only individuals but also businesses that rely on transportation for their operations.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Economic Recovery and Growth

As Oregon continues to recover from the economic impacts of recent events, many citizens believe that fostering growth should take precedence over increasing tax burdens. Economic recovery relies on empowering individuals and businesses to thrive, rather than imposing additional financial strain. Critics of the proposed tax plan argue that it could stifle innovation and hinder small businesses, which are crucial for the state‘s economic vitality.

The Need for Alternative Solutions

In light of the proposed tax increases, there is a growing call for alternative solutions that do not involve burdening Oregonians with new fees. Advocates for a more balanced approach suggest that legislators explore options such as budget reallocations, increased efficiency in government spending, and targeted investments in key areas that can drive economic growth without imposing a financial burden on residents.

Community Response

Community members are voicing their concerns regarding the proposed taxes, with many emphasizing the need for a more empathetic approach to governance. Local organizations and advocacy groups are mobilizing to raise awareness about the potential consequences of these tax increases. The community response underscores the importance of listening to constituents and considering their financial realities when making policy decisions.

Conclusion: A Call for Thoughtful Governance

As discussions around the proposed $15.5 billion in new taxes and fees continue, it is essential for lawmakers to consider the implications of their decisions on the lives of everyday Oregonians. Responsible governance should prioritize the well-being of families and the overall economic health of the state. By exploring alternative solutions and engaging with the community, legislators can work towards a more equitable and sustainable approach that supports Oregonians rather than further taxing them.

In summary, the proposed tax increases by Democrats could have significant consequences for families in Oregon who are already facing financial challenges. The focus should be on responsible governance that prioritizes the needs of constituents and seeks alternative pathways for economic growth and sustainability.

Democrats want to take $15.5 billion more from Oregonians through 35 new taxes and fees over the next ten years. This is not responsible governing, but a direct attack on the people who are already stretched to the breaking point. Families are paying more for gas, groceries, and https://t.co/lPPX5goCNZ

Democrats want to take $15.5 billion more from Oregonians through 35 new taxes and fees over the next ten years.

It seems like every time we turn around, there’s another financial burden placed on the hardworking families of Oregon. The latest proposal from the Democrats suggests they want to take $15.5 billion more from Oregonians over the next ten years through a staggering 35 new taxes and fees. This isn’t just a minor inconvenience; it’s a significant strain on families that are already stretched to the breaking point. It raises the question: is this really responsible governing?

This is not responsible governing, but a direct attack on the people who are already stretched to the breaking point.

The notion of responsible governance is all about balancing the needs of the community with the realities of everyday life. However, when you look at the proposed increase in taxes, it feels more like an attack on the very people who keep this state running. Families are struggling to make ends meet—paying more for essentials like gas and groceries. To pile on new taxes and fees in such a climate seems not only irresponsible but downright cruel.

Families are paying more for gas, groceries, and

Have you noticed how much more you’re spending on gas and groceries lately? It’s frustrating. Families across Oregon are feeling the pinch as prices soar. According to the USDA, food prices are expected to rise even more in the coming years, making it harder for families to keep their budgets in check. Adding new taxes on top of these rising costs is like throwing gasoline on an already raging fire.

Why now? The timing of these tax proposals is troubling.

With the economy still recovering from the effects of the pandemic, one would think that this would be a time for relief, not additional burdens. Yet, here we are, faced with a proposal that could send many families deeper into financial distress. The timing of these tax hikes raises eyebrows. Is this really the right moment to be asking for more from the people who are already struggling?

How will these new taxes impact everyday Oregonians?

The implications of these new taxes are far-reaching. Families will have to make tough choices. Will they cut back on groceries to pay for that new tax? Or perhaps skip filling up the gas tank to save a few bucks? It’s a slippery slope, and the consequences could be dire. Many families are already living paycheck to paycheck, and these new taxes will only exacerbate an already dire situation.

What are the proposed taxes and fees?

While the specifics of these 35 new taxes and fees have yet to be fully disclosed, we can anticipate some common themes based on past proposals. Expect increases in property taxes, sales taxes, and perhaps even new fees for services that were previously free or low-cost. Each of these proposals chips away at the financial stability of Oregon families. The Oregon Department of Administrative Services has a wealth of information on previous tax efforts, and it’s often enlightening to see where those funds have gone.

Public response: What are Oregonians saying?

The sentiment among Oregonians is palpable. Many feel that enough is enough. Social media platforms and community forums are buzzing with concern over this latest tax proposal. People are coming together to voice their frustrations, sharing stories of how these taxes will directly affect their lives. The overwhelming consensus? Oregonians want their government to focus on solutions that alleviate financial burdens, not create new ones.

Alternative solutions: What can be done?

Instead of continuously raising taxes, what if the focus shifted toward budget cuts and reallocating existing funds? There are areas within state spending that could likely be trimmed without sacrificing essential services. Encouraging fiscal responsibility within government spending could potentially yield a more balanced approach. This way, the burden doesn’t fall on the shoulders of the citizens who are already struggling.

Looking ahead: The future of taxation in Oregon

As we look toward the future, it’s essential to pay attention to how these proposed taxes unfold. Will the public outcry lead to a reconsideration of these proposals? Or will the government push forward, ignoring the voices of the people? It’s crucial for Oregonians to stay informed and engaged. Knowing what’s at stake can empower citizens to advocate for their needs and hold their representatives accountable.

The role of community engagement in governance

Community engagement is vital. When citizens come together to discuss issues like taxation and fiscal responsibility, they can create a powerful force for change. Local meetings, town halls, and online forums can provide platforms for Oregonians to express their views and influence state policy. It’s not just about complaining—it’s about coming together to find solutions that work for everyone.

Summing it up: The call for responsible governance

The call for responsible governance has never been more urgent. With the proposed increase of $15.5 billion through 35 new taxes and fees, it is essential for Oregonians to stay informed and engaged. Families are already under tremendous financial pressure, and adding more taxes is not the answer. The focus should be on creating a sustainable fiscal environment that supports its citizens rather than burdens them further.

In the end, the future of Oregon depends on the choices made today. Let’s advocate for a government that prioritizes the well-being of its people, ensuring that financial stability is within reach for every family. The path forward must be one of collaboration and understanding, not one of financial strain and hardship.