Groundbreaking $XRP ETF Debuts: Game Changer or Gamble for Investors?

Canada Shocks Wall Street: First XRP Spot ETF Ignites Crypto Controversy!

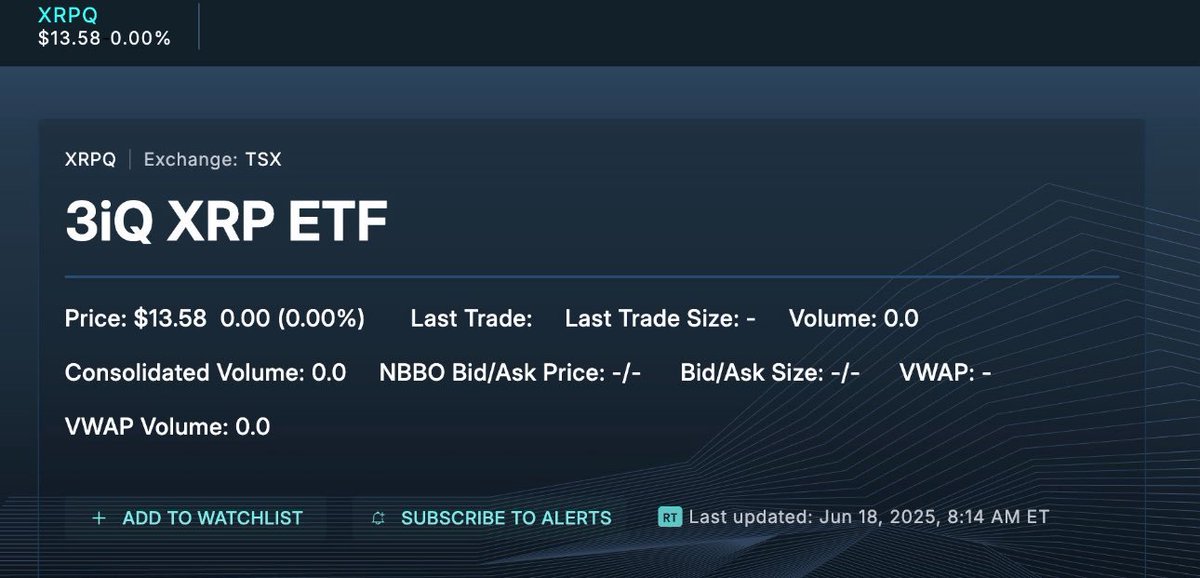

The recent launch of the first XRP Spot ETF on the Toronto Stock Exchange (TSE) marks a pivotal moment in the cryptocurrency landscape, garnering significant attention from both investors and the financial community. This groundbreaking development illustrates the growing acceptance of cryptocurrencies in mainstream finance, setting the stage for a new investment paradigm.

What is an XRP Spot ETF?

An XRP Spot ETF (Exchange-Traded Fund) is a financial product that enables investors to gain exposure to the cryptocurrency XRP without needing to buy and store the digital asset directly. Instead, the ETF tracks the price of XRP and trades on stock exchanges like traditional stocks, offering a regulated and straightforward way for investors to engage with XRP. This innovation presents both potential rewards and inherent risks.

Why is the Launch Significant?

The launch of the XRP Spot ETF carries substantial significance for multiple reasons:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Mainstream Acceptance: This event signifies a growing acceptance of cryptocurrencies in traditional financial markets. The approval of such ETFs could pave the way for more institutional adoption, legitimizing digital assets in the eyes of conservative investors.

- Accessibility: By providing a regulated product, the XRP Spot ETF simplifies the investment process for everyday investors, democratizing access to cryptocurrencies and attracting a wider audience reluctant to invest directly due to complexities and security concerns.

- Market Growth: The introduction of this ETF has the potential to stimulate further growth in the cryptocurrency market. As interest in XRP rises, it may lead to upward price movements and increased trading volumes, benefiting the overall ecosystem.

Implications for Investors

Investors contemplating the XRP Spot ETF should carefully evaluate both the potential benefits and risks involved:

- Volatility: Like all cryptocurrencies, XRP is subject to significant price fluctuations. Investing in an ETF does not eliminate this risk, and investors should be prepared for the possibility of rapid price changes.

- Regulatory Environment: The regulatory landscape for cryptocurrencies is still evolving. While the approval of the XRP Spot ETF is a positive development, future regulatory changes could impact its performance and accessibility.

- Diversification: For those looking to diversify their portfolios, an XRP Spot ETF can be an interesting addition, allowing exposure to the cryptocurrency market without directly managing digital assets.

The Future of Cryptocurrency ETFs

The successful launch of the XRP Spot ETF may signal a shift in how cryptocurrencies are integrated into traditional finance. As regulators become more comfortable with digital assets, we may witness the emergence of more cryptocurrency ETFs, encompassing a variety of cryptocurrencies beyond XRP. This could lead to further innovations in financial products available to investors, enhancing the overall market.

Conclusion

The introduction of the first XRP Spot ETF on the Toronto Stock Exchange represents a watershed moment for both XRP and the broader cryptocurrency market. As interest in digital assets continues to expand, this ETF offers a fresh avenue for investors to engage with cryptocurrencies in a regulated environment. While there are risks associated with cryptocurrency investments, the potential for growth and accessibility presented by the XRP Spot ETF is substantial. Investors should remain vigilant and informed about developments in cryptocurrency ETFs and consider their implications for personal investment strategies.

Understanding the Ripple Network

To appreciate the significance of the XRP Spot ETF, it’s essential to understand the Ripple network and the role of XRP within it. Ripple is a technology company focused on enabling real-time cross-border payment solutions for banks and financial institutions. XRP serves as a bridge currency in the Ripple network, facilitating swift and cost-effective transactions between different fiat currencies. The unique consensus algorithm employed by Ripple enables faster transaction times compared to traditional financial systems, making it a compelling choice for cross-border transactions.

Market Reactions and Future Implications

The launch of the XRP Spot ETF has already generated considerable excitement in the market. Investors are closely monitoring how this development will impact the price of XRP and the broader cryptocurrency landscape.

Immediate Market Response

In the immediate aftermath of the announcement, analysts noted a spike in trading volumes for XRP. The excitement surrounding the ETF has led to increased interest from both retail and institutional investors.

Long-Term Effects on the Cryptocurrency Ecosystem

In the long run, the successful launch of the XRP Spot ETF could pave the way for other cryptocurrencies to follow suit. As more assets gain ETF approval, we may see a significant shift in how cryptocurrencies are integrated into traditional finance, leading to greater adoption, innovation, and investment opportunities.

Risks and Considerations

While the XRP Spot ETF presents numerous opportunities, potential investors should remain aware of certain risks:

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is continually evolving. Changes in regulations could impact the ETF’s operations or the value of XRP. Staying informed about regulatory developments is crucial for investors.

Market Volatility

Cryptocurrencies are known for their price volatility. While the ETF may provide some stability, the underlying asset, XRP, could still experience significant price swings. Investors should be prepared for this inherent risk.

Management Fees

Like any ETF, the XRP Spot ETF may charge management fees. These fees can affect overall returns, so it’s vital to understand the cost structure before investing.

Conclusion: A New Era for XRP and Cryptocurrencies

The launch of the first XRP Spot ETF on the Toronto Stock Exchange is a landmark development that opens new doors for both individual and institutional investors. By enhancing accessibility, legitimacy, and potential price stability for XRP, this ETF signifies a broader acceptance of cryptocurrencies within traditional financial markets. As the crypto landscape continues to evolve, the implications of this launch will resonate far beyond immediate market reactions. The XRP Spot ETF represents not only a new investment opportunity but also a step toward integrating digital assets into the global financial ecosystem.

Investors interested in participating in this exciting new chapter should conduct thorough research and consider their risk tolerance before diving in. With the right approach, the XRP Spot ETF could be a valuable addition to an investment portfolio.

Canada Shocks Wall Street: First $XRP Spot ETF Ignites Crypto Controversy!

XRP Spot ETF launch, Toronto Stock Exchange cryptocurrency, Canadian ETF investment opportunities

The recent launch of the first XRP Spot ETF on the Toronto Stock Exchange marks a significant milestone in the cryptocurrency landscape. This groundbreaking development has drawn considerable attention from both investors and the financial community, highlighting the growing acceptance of cryptocurrencies in mainstream finance.

What is an XRP Spot ETF?

An XRP Spot ETF (Exchange-Traded Fund) is a financial product that allows investors to gain exposure to the cryptocurrency XRP without needing to buy and store the digital asset directly. Instead, the ETF tracks the price of XRP and is traded on stock exchanges like traditional stocks. This provides a regulated and straightforward way for investors to engage with XRP, offering both potential rewards and risks.

Why is the Launch Significant?

The launch of the XRP Spot ETF is noteworthy for several reasons:

- Mainstream Acceptance: This event signifies a growing acceptance of cryptocurrencies in traditional financial markets. The approval of such ETFs can pave the way for more institutional adoption, legitimizing digital assets in the eyes of conservative investors.

- Accessibility: By providing a regulated product, the XRP Spot ETF makes it easier for everyday investors to gain exposure to XRP. This can democratize access to cryptocurrencies, attracting a broader audience who may have been hesitant to invest directly in digital assets due to complexities and security concerns.

- Market Growth: The introduction of this ETF may stimulate further growth in the cryptocurrency market. As interest in XRP increases, it could lead to upward price movement and increased trading volumes, benefiting the overall ecosystem.

Implications for Investors

Investors considering the XRP Spot ETF should weigh both the potential benefits and risks involved.

- Volatility: Like all cryptocurrencies, XRP is subject to significant price fluctuations. Investing in an ETF does not eliminate this risk, and investors should be prepared for the possibility of rapid price changes.

- Regulatory Environment: The regulatory landscape for cryptocurrencies is still evolving. While the approval of the XRP Spot ETF is a positive sign, any future regulatory changes could impact its performance and accessibility.

- Diversification: For investors looking to diversify their portfolios, an XRP Spot ETF can be an interesting addition. It allows for exposure to the cryptocurrency market without the need to directly manage digital assets.

The Future of Cryptocurrency ETFs

The successful launch of the XRP Spot ETF may signal a shift in how cryptocurrencies are integrated into traditional finance. As regulators become more comfortable with digital assets, we may see more cryptocurrency ETFs emerge, covering a variety of cryptocurrencies beyond XRP. This could lead to further innovations in the financial products available to investors, enhancing the overall market.

Conclusion

The launch of the first XRP Spot ETF on the Toronto Stock Exchange represents a pivotal moment for both XRP and the broader cryptocurrency market. As interest in digital assets continues to grow, this ETF provides a new avenue for investors to engage with cryptocurrencies in a regulated environment. While there are risks associated with investing in cryptocurrencies, the potential for growth and accessibility offered by the XRP Spot ETF is significant. As the market evolves, investors should keep a close eye on developments in cryptocurrency ETFs and consider how they fit into their investment strategies.

BREAKING: The first $XRP Spot ETF launches on the Toronto Stock Exchange. pic.twitter.com/MoDr67S7bS

— Cointelegraph (@Cointelegraph) June 18, 2025

In an exciting development for cryptocurrency enthusiasts and investors, the first $XRP spot ETF has officially launched on the Toronto Stock Exchange (TSE). This significant milestone marks a new chapter in the world of digital assets, particularly for $XRP, the native cryptocurrency of the Ripple network. As the cryptocurrency market continues to evolve, the introduction of a spot ETF is a pivotal moment, signaling greater acceptance and integration of cryptocurrencies into traditional financial markets.

What is an ETF?

Before delving deeper into the implications of the $XRP spot ETF, let’s clarify what an ETF (Exchange-Traded Fund) is. An ETF is an investment fund that is traded on stock exchanges, much like stocks. It holds assets such as stocks, commodities, or bonds, and generally operates with an arbitrage mechanism that allows investors to buy and sell shares of the ETF throughout the trading day.

In the case of a spot ETF, the fund directly holds the underlying asset—in this case, $XRP—rather than derivatives or futures contracts. This means that when you invest in a spot ETF, you are essentially buying a share in the actual cryptocurrency, making it a straightforward way for traditional investors to gain exposure to digital currencies without needing to manage wallets or worry about custody and security.

The Significance of the $XRP Spot ETF Launch

The launch of the $XRP spot ETF on the Toronto Stock Exchange is more than just a new investment vehicle; it represents a broader acceptance of cryptocurrencies within established financial systems. Here are a few reasons why this development is particularly noteworthy:

Enhanced Legitimacy for Cryptocurrencies

The approval and launch of a spot ETF for $XRP by a regulated exchange like the TSE lend an air of legitimacy to cryptocurrencies as a whole. Many institutional investors have been hesitant to dive into the crypto space due to regulatory uncertainties and concerns around security. However, with the advent of an ETF, these barriers are gradually being dismantled.

Increased Accessibility for Investors

Investing in cryptocurrencies has often been seen as daunting due to the complexities associated with private keys, wallets, and exchanges. An ETF simplifies this process, allowing more traditional investors to partake in the burgeoning digital asset market. By purchasing shares of the $XRP spot ETF, investors can easily gain exposure to $XRP without needing to navigate the intricacies of cryptocurrency exchanges.

Potential for Price Stability

The introduction of an ETF can lead to increased liquidity in the market. With more investors entering the space, the buying and selling pressure may help stabilize the price of $XRP over time. This is particularly important for a cryptocurrency that has experienced significant volatility in the past. Increased liquidity can also lead to more accurate price discovery, benefiting both investors and the overall market.

Opportunities for Institutional Investment

The $XRP spot ETF opens the door for institutional investors to allocate funds towards $XRP. Many institutions have mandates that restrict them from investing in assets that are not traded on regulated exchanges. With the launch of this ETF, institutional players now have a compliant vehicle through which they can invest in $XRP, potentially leading to substantial inflows of capital.

How Does the $XRP Spot ETF Work?

The $XRP spot ETF operates similarly to other ETFs. Here’s a brief overview of how it works:

- Asset Management: The ETF issuer purchases and holds $XRP on behalf of the investors. The amount of $XRP held by the ETF directly corresponds to the number of shares outstanding.

- Trading on an Exchange: Shares of the ETF can be traded on the Toronto Stock Exchange just like any other stock. This means investors can buy and sell shares throughout the trading day at market prices.

- Price Tracking: The price of the ETF shares is designed to closely track the price of $XRP. This tracking is facilitated through the management of the underlying assets, ensuring that the ETF reflects the performance of $XRP as closely as possible.

- Dividends and Distribution: Depending on the ETF’s structure, investors may receive dividends or distributions based on the performance of the underlying asset. However, it’s essential to check the specific terms of the $XRP spot ETF for any such details.

Understanding the Ripple Network

To appreciate the significance of the $XRP spot ETF, it’s also crucial to understand the Ripple network and the role of $XRP within it. Ripple is a technology company that focuses on enabling real-time cross-border payment solutions for banks and financial institutions.

The Role of $XRP

$XRP serves as a bridge currency in the Ripple network, allowing for swift and cost-effective transactions between different fiat currencies. The unique consensus algorithm used by Ripple enables faster transaction times compared to traditional financial systems, making it a compelling option for cross-border transactions.

Market Reactions and Future Implications

The launch of the $XRP spot ETF has already generated considerable buzz in the market. Investors are closely monitoring how this development will impact the price of $XRP and the broader cryptocurrency landscape.

Immediate Market Response

In the immediate aftermath of the announcement, many analysts noted a spike in trading volumes for $XRP. The excitement surrounding the ETF has led to increased interest from retail and institutional investors alike.

Long-Term Effects on the Cryptocurrency Ecosystem

In the long run, the successful launch of the $XRP spot ETF could pave the way for other cryptocurrencies to follow suit. As more assets gain ETF approval, we may see a significant shift in how cryptocurrencies are integrated into traditional finance. This could lead to greater adoption, innovation, and investment opportunities within the space.

Risks and Considerations

While the $XRP spot ETF presents many opportunities, potential investors should also be aware of certain risks:

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is continually evolving. Changes in regulations could impact the ETF’s operations or the value of $XRP. It’s essential for investors to stay informed about regulatory developments that may affect their investments.

Market Volatility

Cryptocurrencies are known for their price volatility. While the ETF may provide some stability, the underlying asset—$XRP—could still experience significant price swings. Investors should be prepared for this inherent risk.

Management Fees

Like any ETF, the $XRP spot ETF may charge management fees. These fees can impact overall returns, so it’s important to understand the cost structure before investing.

Conclusion: A New Era for $XRP and Cryptocurrencies

The launch of the first $XRP spot ETF on the Toronto Stock Exchange is a landmark development that opens new doors for both individual and institutional investors. By enhancing accessibility, legitimacy, and potential price stability for $XRP, this ETF signifies a broader acceptance of cryptocurrencies within traditional financial markets.

As the crypto landscape continues to evolve, the implications of this launch will likely resonate far beyond the immediate market reactions. The $XRP spot ETF not only represents a new investment opportunity but also a step toward the integration of digital assets into the global financial ecosystem.

Investors interested in participating in this exciting new chapter should conduct thorough research and consider their risk tolerance before diving in. With the right approach, the $XRP spot ETF could be a valuable addition to an investment portfolio.

BREAKING: The first $XRP Spot ETF launches on the Toronto Stock Exchange.

Canada Shocks Wall Street: First $XRP Spot ETF Ignites Crypto Controversy!

XRP Spot ETF launch, Toronto Stock Exchange cryptocurrency, Canadian ETF investment opportunities

The recent launch of the first XRP Spot ETF on the Toronto Stock Exchange marks a significant milestone in the cryptocurrency landscape. This groundbreaking development has drawn considerable attention from both investors and the financial community, highlighting the growing acceptance of cryptocurrencies in mainstream finance.

What is an XRP Spot ETF?

An XRP Spot ETF (Exchange-Traded Fund) is a financial product that allows investors to gain exposure to the cryptocurrency XRP without needing to buy and store the digital asset directly. Instead, the ETF tracks the price of XRP and is traded on stock exchanges like traditional stocks. This provides a regulated and straightforward way for investors to engage with XRP, offering both potential rewards and risks.

Why is the Launch Significant?

The launch of the XRP Spot ETF is noteworthy for several reasons:

- Mainstream Acceptance: This event signifies a growing acceptance of cryptocurrencies in traditional financial markets. The approval of such ETFs can pave the way for more institutional adoption, legitimizing digital assets in the eyes of conservative investors.

- Accessibility: By providing a regulated product, the XRP Spot ETF makes it easier for everyday investors to gain exposure to XRP. This can democratize access to cryptocurrencies, attracting a broader audience who may have been hesitant to invest directly in digital assets due to complexities and security concerns.

- Market Growth: The introduction of this ETF may stimulate further growth in the cryptocurrency market. As interest in XRP increases, it could lead to upward price movement and increased trading volumes, benefiting the overall ecosystem.

Implications for Investors

Investors considering the XRP Spot ETF should weigh both the potential benefits and risks involved.

- Volatility: Like all cryptocurrencies, XRP is subject to significant price fluctuations. Investing in an ETF does not eliminate this risk, and investors should be prepared for the possibility of rapid price changes.

- Regulatory Environment: The regulatory landscape for cryptocurrencies is still evolving. While the approval of the XRP Spot ETF is a positive sign, any future regulatory changes could impact its performance and accessibility.

- Diversification: For investors looking to diversify their portfolios, an XRP Spot ETF can be an interesting addition. It allows for exposure to the cryptocurrency market without the need to directly manage digital assets.

The Future of Cryptocurrency ETFs

The successful launch of the XRP Spot ETF may signal a shift in how cryptocurrencies are integrated into traditional finance. As regulators become more comfortable with digital assets, we may see more cryptocurrency ETFs emerge, covering a variety of cryptocurrencies beyond XRP. This could lead to further innovations in the financial products available to investors, enhancing the overall market.

Conclusion

The launch of the first XRP Spot ETF on the Toronto Stock Exchange represents a pivotal moment for both XRP and the broader cryptocurrency market. As interest in digital assets continues to grow, this ETF provides a new avenue for investors to engage with cryptocurrencies in a regulated environment. While there are risks associated with investing in cryptocurrencies, the potential for growth and accessibility offered by the XRP Spot ETF is significant. As the market evolves, investors should keep a close eye on developments in cryptocurrency ETFs and consider how they fit into their investment strategies.

BREAKING: The first $XRP Spot ETF launches on the Toronto Stock Exchange. pic.twitter.com/MoDr67S7bS

— Cointelegraph (@Cointelegraph) June 18, 2025

In an exciting development for cryptocurrency enthusiasts and investors, the first $XRP spot ETF has officially launched on the Toronto Stock Exchange (TSE). This significant milestone marks a new chapter in the world of digital assets, particularly for $XRP, the native cryptocurrency of the Ripple network. As the cryptocurrency market continues to evolve, the introduction of a spot ETF is a pivotal moment, signaling greater acceptance and integration of cryptocurrencies into traditional financial markets.

What is an ETF?

Before delving deeper into the implications of the $XRP spot ETF, let’s clarify what an ETF (Exchange-Traded Fund) is. An ETF is an investment fund that is traded on stock exchanges, much like stocks. It holds assets such as stocks, commodities, or bonds and generally operates with an arbitrage mechanism that allows investors to buy and sell shares of the ETF throughout the trading day.

In the case of a spot ETF, the fund directly holds the underlying asset—in this case, $XRP—rather than derivatives or futures contracts. This means that when you invest in a spot ETF, you are essentially buying a share in the actual cryptocurrency, making it a straightforward way for traditional investors to gain exposure to digital currencies without needing to manage wallets or worry about custody and security.

The Significance of the $XRP Spot ETF Launch

The launch of the $XRP spot ETF on the Toronto Stock Exchange is more than just a new investment vehicle; it represents a broader acceptance of cryptocurrencies within established financial systems. Here are a few reasons why this development is particularly noteworthy:

Enhanced Legitimacy for Cryptocurrencies

The approval and launch of a spot ETF for $XRP by a regulated exchange like the TSE lend an air of legitimacy to cryptocurrencies as a whole. Many institutional investors have been hesitant to dive into the crypto space due to regulatory uncertainties and concerns around security. However, with the advent of an ETF, these barriers are gradually being dismantled.

Increased Accessibility for Investors

Investing in cryptocurrencies has often been seen as daunting due to the complexities associated with private keys, wallets, and exchanges. An ETF simplifies this process, allowing more traditional investors to partake in the burgeoning digital asset market. By purchasing shares of the $XRP spot ETF, investors can easily gain exposure to $XRP without needing to navigate the intricacies of cryptocurrency exchanges.

Potential for Price Stability

The introduction of an ETF can lead to increased liquidity in the market. With more investors entering the space, the buying and selling pressure may help stabilize the price of $XRP over time. This is particularly important for a cryptocurrency that has experienced significant volatility in the past. Increased liquidity can also lead to more accurate price discovery, benefiting both investors and the overall market.

Opportunities for Institutional Investment

The $XRP spot ETF opens the door for institutional investors to allocate funds towards $XRP. Many institutions have mandates that restrict them from investing in assets that are not traded on regulated exchanges. With the launch of this ETF, institutional players now have a compliant vehicle through which they can invest in $XRP, potentially leading to substantial inflows of capital.

How Does the $XRP Spot ETF Work?

The $XRP spot ETF operates similarly to other ETFs. Here’s a brief overview of how it works:

- Asset Management: The ETF issuer purchases and holds $XRP on behalf of the investors. The amount of $XRP held by the ETF directly corresponds to the number of shares outstanding.

- Trading on an Exchange: Shares of the ETF can be traded on the Toronto Stock Exchange just like any other stock. This means investors can buy and sell shares throughout the trading day at market prices.

- Price Tracking: The price of the ETF shares is designed to closely track the price of $XRP. This tracking is facilitated through the management of the underlying assets, ensuring that the ETF reflects the performance of $XRP as closely as possible.

- Dividends and Distribution: Depending on the ETF’s structure, investors may receive dividends or distributions based on the performance of the underlying asset. However, it’s essential to check the specific terms of the $XRP spot ETF for any such details.

Understanding the Ripple Network

To appreciate the significance of the $XRP spot ETF, it’s also crucial to understand the Ripple network and the role of $XRP within it. Ripple is a technology company that focuses on enabling real-time cross-border payment solutions for banks and financial institutions.

The Role of $XRP

$XRP serves as a bridge currency in the Ripple network, allowing for swift and cost-effective transactions between different fiat currencies. The unique consensus algorithm used by Ripple enables faster transaction times compared to traditional financial systems, making it a compelling option for cross-border transactions.

Market Reactions and Future Implications

The launch of the $XRP spot ETF has already generated considerable buzz in the market. Investors are closely monitoring how this development will impact the price of $XRP and the broader cryptocurrency landscape.

Immediate Market Response

In the immediate aftermath of the announcement, many analysts noted a spike in trading volumes for $XRP. The excitement surrounding the ETF has led to increased interest from retail and institutional investors alike.

Long-Term Effects on the Cryptocurrency Ecosystem

In the long run, the successful launch of the $XRP spot ETF could pave the way for other cryptocurrencies to follow suit. As more assets gain ETF approval, we may see a significant shift in how cryptocurrencies are integrated into traditional finance. This could lead to greater adoption, innovation, and investment opportunities within the space.

Risks and Considerations

While the $XRP spot ETF presents many opportunities, potential investors should also be aware of certain risks:

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is continually evolving. Changes in regulations could impact the ETF’s operations or the value of $XRP. It’s essential for investors to stay informed about regulatory developments that may affect their investments.

Market Volatility

Cryptocurrencies are known for their price volatility. While the ETF may provide some stability, the underlying asset—$XRP—could still experience significant price swings. Investors should be prepared for this inherent risk.

Management Fees

Like any ETF, the $XRP spot ETF may charge management fees. These fees can impact overall returns, so it’s important to understand the cost structure before investing.

Conclusion: A New Era for $XRP and Cryptocurrencies

The launch of the first $XRP spot ETF on the Toronto Stock Exchange is a landmark development that opens new doors for both individual and institutional investors. By enhancing accessibility, legitimacy, and potential price stability for $XRP, this ETF signifies a broader acceptance of cryptocurrencies within traditional financial markets.

As the crypto landscape continues to evolve, the implications of this launch will likely resonate far beyond the immediate market reactions. The $XRP spot ETF not only represents a new investment opportunity but also a step toward the integration of digital assets into the global financial ecosystem.

Investors interested in participating in this exciting new chapter should conduct thorough research and consider their risk tolerance before diving in. With the right approach, the $XRP spot ETF could be a valuable addition to an investment portfolio.

BREAKING: The first $XRP Spot ETF launches on the Toronto Stock Exchange.