Metaplanet’s Shocking ¥16.88B Bitcoin Buy: Is Japan’s Crypto Future at Stake?

Metaplanet’s Shocking ¥16.88 Billion Bitcoin Buy: Is This the Future?

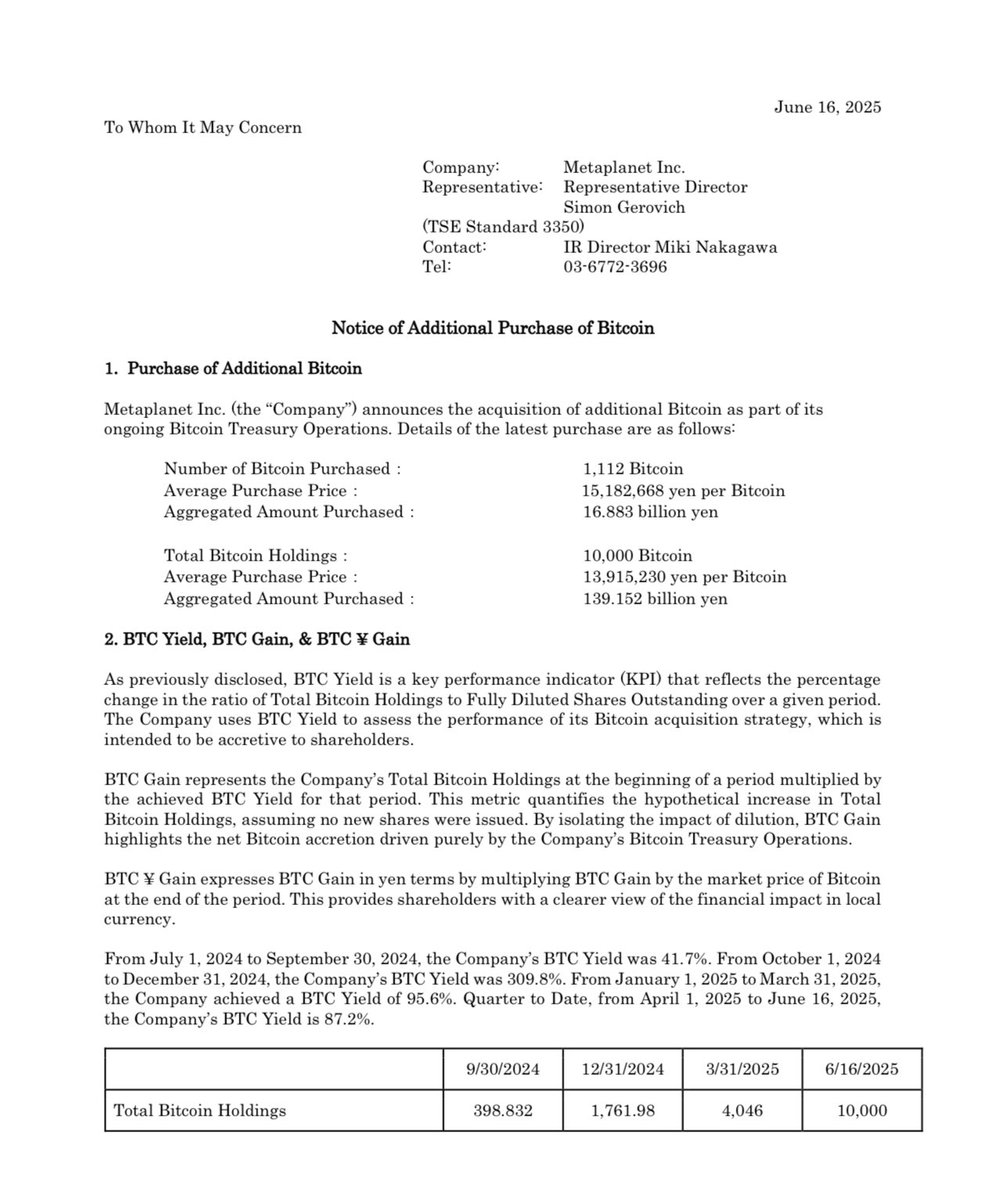

On June 16, 2025, a groundbreaking event in the cryptocurrency sector captured headlines: Metaplanet, a leading technology firm, announced its acquisition of ¥16.88 billion (approximately $156 million) worth of Bitcoin. This bold investment not only signifies a pivotal moment for Metaplanet but also highlights the increasing acceptance of Bitcoin within mainstream finance, particularly in Japan’s dynamic economy.

The Importance of Bitcoin in Today’s Economy

Bitcoin, introduced in 2009 as the first cryptocurrency, has dramatically altered perceptions of money and investment. As a decentralized digital asset, it appeals to investors seeking alternatives to traditional banking systems. Over the years, Bitcoin has gained traction, emerging as a key player in financial markets and influencing global investment strategies.

Metaplanet’s Strategic Investment

Metaplanet’s substantial investment in Bitcoin reflects a strategic decision to diversify its asset portfolio. This move is part of a broader trend among corporations that recognize the value of digital currencies. By integrating Bitcoin into their operations—be it through direct investment, payment solutions, or blockchain technology—companies are positioning themselves to benefit from the burgeoning cryptocurrency market.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Impact on the Cryptocurrency Market

The ramifications of Metaplanet’s purchase are expected to be significant. Large-scale investments typically instill confidence in the cryptocurrency market, potentially driving up Bitcoin prices. As institutional players like Metaplanet enter the market, demand for Bitcoin may increase, leading to enhanced liquidity and stability. This investment also highlights the growing acceptance of cryptocurrencies in Japan, where supportive government regulations foster an environment conducive to blockchain innovation.

Bitcoin’s Role in Diversifying Investments

Investors are increasingly looking to diversify their portfolios, and Bitcoin serves as an attractive option. Its performance often diverges from traditional assets such as stocks and bonds, providing a hedge against market volatility. By investing in Bitcoin, companies like Metaplanet can mitigate risks associated with economic fluctuations while capitalizing on potential high returns.

The Future of Bitcoin in Japan

Japan has long been a leader in cryptocurrency adoption, making it a critical player in the global digital currency landscape. The country boasts a robust infrastructure for cryptocurrency exchanges and a growing number of businesses that accept Bitcoin as a payment method. Metaplanet’s investment strengthens Japan’s position in the cryptocurrency space and sets the stage for continued innovation and growth.

As more companies and individuals embrace Bitcoin, we can anticipate that Japan’s responsiveness to cryptocurrency trends will influence global markets, encouraging other regions to consider similar investments.

Conclusion

Metaplanet’s acquisition of ¥16.88 billion in Bitcoin marks a significant milestone in the cryptocurrency world. It reflects the increasing integration of digital currencies into established businesses and highlights the broader trend of institutional adoption, particularly in Japan. As we advance, the consequences of such investments will shape the future of Bitcoin and the cryptocurrency market at large.

In summary, Metaplanet’s strategic investment in Bitcoin underscores the cryptocurrency’s growing legitimacy as a valuable asset. With Japan leading the charge in cryptocurrency adoption, the future appears promising for Bitcoin and its role in the global economy.

—

The Significance of Metaplanet’s Purchase

Metaplanet’s decision to invest ¥16.88 billion in Bitcoin is monumental for several reasons. Firstly, it underlines the increasing integration of cryptocurrency into mainstream business practices. With companies like Metaplanet embracing Bitcoin, we are witnessing a paradigm shift where digital currencies are regarded as legitimate investment vehicles rather than mere speculative assets.

Moreover, this purchase illustrates the confidence major players have in Bitcoin’s long-term viability. Despite the fluctuations and controversies surrounding cryptocurrencies, Metaplanet’s investment signals an expectation of substantial growth in the Bitcoin market, a sentiment echoed by many analysts.

Why Bitcoin?

Bitcoin, often dubbed digital gold, has cemented its status as the leading cryptocurrency since its inception. Its decentralized nature, limited supply, and potential for high returns make it attractive to investors. But what makes Bitcoin particularly appealing to companies like Metaplanet?

The growing adoption of Bitcoin as a transaction medium, alongside its potential as a hedge against inflation, contributes to its allure. As traditional currencies face uncertainty, Bitcoin offers a sense of security and stability that appeals to investors seeking alternatives.

Understanding the Market Dynamics

To grasp the implications of Metaplanet’s purchase, it’s essential to understand the current market dynamics. The cryptocurrency landscape has experienced unprecedented growth, fueled by increased institutional adoption and retail interest. As more companies and individuals recognize the potential benefits of Bitcoin, demand continues to surge.

Additionally, regulatory clarity is gradually emerging in various regions, providing a more stable environment for cryptocurrency investments. This shift encourages more businesses to enter the crypto space and reassures investors about the protection of their assets under evolving regulations.

The Future of Bitcoin and Corporate Investment

Metaplanet’s substantial investment heralds a new direction for corporate investment in Bitcoin. We can expect more companies to follow suit, viewing Bitcoin as a strategic asset rather than merely a speculative gamble. This trend could initiate a ripple effect, prompting other businesses to reconsider their asset allocation strategies.

As companies diversify their portfolios to include cryptocurrencies, we may witness an overall increase in Bitcoin’s price stability. With more institutional players entering the market, the volatility often associated with cryptocurrencies may diminish over time.

The Broader Implications for the Financial Landscape

The broader implications of Metaplanet’s investment extend beyond the cryptocurrency realm. As corporations increasingly integrate Bitcoin into their financial strategies, a shift in traditional finance may occur.

Banks and financial institutions may be compelled to adapt their services to accommodate the growing demand for cryptocurrency-related products. This could lead to the development of more robust infrastructures, including Bitcoin-specific banking services and investment funds.

The Role of Regulation in Shaping the Future

As the cryptocurrency market evolves, the role of regulation becomes increasingly crucial. Governments and regulatory bodies worldwide are grappling with how to approach cryptocurrencies, striving to balance fostering innovation and ensuring investor protection.

Metaplanet’s acquisition of Bitcoin may act as a catalyst for more regulatory clarity in the crypto space. As more companies enter the market, regulators may feel pressured to establish frameworks that protect consumers while promoting growth and innovation.

Risks and Challenges Ahead

Despite the optimistic outlook surrounding Metaplanet’s investment, it is vital to consider the risks and challenges that lie ahead. The cryptocurrency market is known for its volatility, and significant investments can lead to substantial losses. Companies must navigate these risks while remaining agile in their investment strategies.

Additionally, potential regulatory changes can create uncertainty. While clearer regulations may ultimately benefit the market, sudden shifts can impact Bitcoin’s price and accessibility, posing challenges for corporate investors.

The Community Response

The announcement of Metaplanet’s investment has generated considerable buzz within the cryptocurrency community. Enthusiasts view this as a validation of Bitcoin’s legitimacy, while skeptics remain cautious, citing the inherent risks associated with such a significant investment.

Social media platforms, especially Twitter, have become hotspots for discussions about this development, showcasing the passionate nature of cryptocurrency advocates eager to see Bitcoin recognized as a mainstream financial asset.

Conclusion

Metaplanet’s purchase of ¥16.88 billion in Bitcoin represents a pivotal moment in the ongoing narrative of cryptocurrency adoption. This investment symbolizes a broader acceptance of cryptocurrencies in the corporate world, paving the way for a future where Bitcoin plays a central role in global finance.

As we continue to explore its impact on the financial landscape, one thing is clear: the world of cryptocurrency is here to stay, and the future of Bitcoin is bright.

Metaplanet’s Shocking ¥16.88 Billion Bitcoin Buy: Is This the Future?

Metaplanet Bitcoin investment, cryptocurrency market trends, Japan blockchain adoption

On June 16, 2025, Bitcoin Magazine reported a significant financial development in the cryptocurrency sector: Metaplanet, a prominent technology firm, made headlines by purchasing ¥16.88 billion worth of Bitcoin. This bold move highlights the growing acceptance and integration of Bitcoin into mainstream finance, particularly within Japan’s robust economy.

### The Importance of Bitcoin in Today’s Economy

Bitcoin, the first and most well-known cryptocurrency, has transformed the way people view and use money. Initially launched in 2009, Bitcoin has steadily gained traction as a digital asset and a store of value. Its decentralized nature appeals to many investors looking for alternatives to traditional banking systems. With the rise of cryptocurrencies, Bitcoin has emerged as a leading player, influencing market trends and investment strategies worldwide.

### Metaplanet’s Strategic Investment

Metaplanet’s investment of ¥16.88 billion (approximately $156 million) in Bitcoin signals a strategic decision to diversify their asset portfolio and leverage the growth potential of cryptocurrencies. This acquisition reflects a broader trend among corporations recognizing the value of digital currencies. Companies are increasingly integrating Bitcoin into their operations, whether through direct investment, payment solutions, or blockchain technology.

### The Impact on the Cryptocurrency Market

This substantial purchase by Metaplanet is expected to have positive ramifications for the cryptocurrency market. Large-scale investments often lead to increased confidence among investors, potentially driving up the price of Bitcoin. As more institutional players enter the market, the demand for Bitcoin may surge, leading to enhanced liquidity and stability.

Moreover, Metaplanet’s decision underscores the growing acceptance of cryptocurrencies in Japan. The Japanese government has been supportive of cryptocurrency regulations, fostering a conducive environment for blockchain innovation and investment. This regulatory clarity encourages businesses to explore Bitcoin as a viable asset, further solidifying its presence in the market.

### Bitcoin’s Role in Diversifying Investments

Investors are increasingly looking to diversify their portfolios, and Bitcoin presents an attractive option. Its performance often differs from traditional assets like stocks and bonds, providing a hedge against market volatility. By investing in Bitcoin, companies like Metaplanet can mitigate risks associated with economic fluctuations and capitalize on the potential for high returns.

### The Future of Bitcoin in Japan

Japan has long been at the forefront of cryptocurrency adoption, making it a key player in the global digital currency landscape. The country has a robust infrastructure for cryptocurrency exchanges and a growing number of businesses accepting Bitcoin as a payment method. Metaplanet’s investment further cements Japan’s position as a leader in the cryptocurrency space.

As more companies and individuals embrace Bitcoin, we can expect to see continued innovation and growth within the sector. The Japanese market’s responsiveness to cryptocurrency trends may influence other regions, encouraging global companies to consider similar investments.

### Conclusion

Metaplanet’s purchase of ¥16.88 billion in Bitcoin represents a significant milestone in the cryptocurrency world, showcasing the increasing integration of digital currencies into established businesses. This investment not only enhances Metaplanet’s asset diversification strategy but also reflects the broader trend of institutional adoption of Bitcoin, particularly in Japan.

As we move forward, the implications of such investments will shape the future of Bitcoin and the cryptocurrency market at large. Companies, investors, and regulators alike will need to stay attuned to the evolving landscape as Bitcoin continues to gain traction and redefine the financial ecosystem.

In summary, Metaplanet’s strategic investment in Bitcoin is a testament to the cryptocurrency’s growing legitimacy and potential as a valuable asset. With Japan leading the charge in cryptocurrency adoption, the future looks promising for Bitcoin and its role in the global economy.

JUST IN: Metaplanet purchases ¥16.88 billion #Bitcoin pic.twitter.com/EAWOf0tg9F

— Bitcoin Magazine (@BitcoinMagazine) June 16, 2025

JUST IN: Metaplanet purchases ¥16.88 billion Bitcoin

In the ever-evolving world of cryptocurrency, significant events unfold almost daily, capturing the attention of investors, analysts, and enthusiasts worldwide. One such pivotal moment occurred when Metaplanet, a rising powerhouse in the tech industry, announced its acquisition of ¥16.88 billion worth of Bitcoin. This bold move not only highlights the growing acceptance of digital currencies but also raises questions about the future landscape of both cryptocurrency and global finance.

### The Significance of Metaplanet’s Purchase

Metaplanet’s decision to invest a staggering ¥16.88 billion in Bitcoin is monumental for several reasons. Firstly, it underscores the increasing integration of cryptocurrency into mainstream business practices. With corporations like Metaplanet stepping up to embrace Bitcoin, we’re witnessing a paradigm shift where digital currencies are no longer seen as speculative assets but as legitimate investment vehicles.

Moreover, this purchase illustrates the confidence that major players have in Bitcoin’s long-term viability. Despite the fluctuations and controversies surrounding cryptocurrencies, Metaplanet’s investment signals that they anticipate substantial growth in the Bitcoin market—an outlook shared by many analysts.

### Why Bitcoin?

Bitcoin, often referred to as digital gold, has solidified its position as the leading cryptocurrency since its inception in 2009. Its decentralized nature, scarcity, and potential for high returns make it an attractive option for investors. But what makes Bitcoin particularly appealing to companies like Metaplanet?

The growing adoption of Bitcoin as a means of transaction, coupled with its potential as a hedge against inflation, contributes to its allure. As traditional currencies face uncertainty, Bitcoin offers a sense of security and stability that appeals to investors looking for alternatives.

### Understanding the Market Dynamics

To fully appreciate the implications of Metaplanet’s purchase, it’s crucial to understand the current market dynamics. The cryptocurrency landscape has witnessed unprecedented growth, driven by increased institutional adoption and retail interest. As more companies and individuals recognize the potential benefits of Bitcoin, the demand continues to rise.

Additionally, regulatory clarity is gradually emerging in various regions, providing a more stable environment for cryptocurrency investments. This shift not only encourages more businesses to enter the crypto space but also reassures investors that their assets are protected under evolving regulations.

### The Future of Bitcoin and Corporate Investment

Metaplanet’s substantial investment is a harbinger of the future direction of corporate investment in Bitcoin. We can expect more companies to follow suit, seeing Bitcoin as a strategic asset rather than just a speculative gamble. This trend could lead to a ripple effect, prompting other businesses to reconsider their asset allocation strategies.

Furthermore, as businesses diversify their portfolios to include cryptocurrencies, we may witness an overall increase in Bitcoin’s price stability. With more institutional players entering the market, the volatility that cryptocurrencies are often associated with may diminish over time.

### The Broader Implications for the Financial Landscape

The implications of Metaplanet’s investment extend beyond the immediate realm of cryptocurrency. As corporations increasingly integrate Bitcoin into their financial strategies, we can anticipate a shift in how traditional finance operates.

Banks and financial institutions may be compelled to adapt their services to accommodate the growing demand for cryptocurrency-related products. This could lead to the development of more robust infrastructures, including Bitcoin-specific banking services, investment funds, and payment solutions.

### The Role of Regulation in Shaping the Future

As the cryptocurrency market continues to evolve, the role of regulation becomes increasingly significant. Governments and regulatory bodies worldwide are grappling with how to approach cryptocurrencies, striving to strike a balance between fostering innovation and ensuring investor protection.

Metaplanet’s acquisition of Bitcoin may serve as a catalyst for more regulatory clarity in the crypto space. As more companies enter the market, regulators may feel pressured to establish frameworks that protect consumers while promoting growth and innovation.

### Risks and Challenges Ahead

Despite the optimistic outlook surrounding Metaplanet’s investment, it’s essential to consider the risks and challenges that lie ahead. The cryptocurrency market is notoriously volatile, and significant investments can result in substantial losses. Companies like Metaplanet must navigate these risks while remaining agile in their investment strategies.

Additionally, the potential for regulatory changes can create uncertainty. While clearer regulations may ultimately benefit the market, any sudden shifts can impact Bitcoin’s price and accessibility, posing challenges for corporate investors.

### The Community Response

The announcement of Metaplanet’s investment has generated considerable buzz within the cryptocurrency community. Enthusiasts view this as a validation of Bitcoin’s legitimacy, while skeptics remain cautious, noting the inherent risks of such a significant investment.

Social media platforms, particularly Twitter, have become a hotbed for discussions around this development. Communities are buzzing with excitement and debate, showcasing the passionate nature of cryptocurrency advocates and their desire to see Bitcoin recognized as a mainstream financial asset.

### Conclusion

Metaplanet’s purchase of ¥16.88 billion in Bitcoin marks a pivotal moment in the ongoing narrative of cryptocurrency adoption. As we witness the intersection of technology and finance, the implications of this investment extend beyond just numbers on a balance sheet. It symbolizes a broader acceptance of cryptocurrencies in the corporate world, setting the stage for a future where Bitcoin plays a central role in global finance.

With the potential for more corporations to follow Metaplanet’s lead, we may be on the brink of a new era in investment strategies, one that embraces the innovative possibilities presented by digital currencies. The future of Bitcoin is bright, and as we continue to explore its impact on the financial landscape, one thing is clear: the world of cryptocurrency is here to stay.

JUST IN: Metaplanet purchases ¥16.88 billion #Bitcoin

Metaplanet’s Shocking ¥16.88 Billion Bitcoin Buy: Is This the Future?

Metaplanet Bitcoin investment, cryptocurrency market trends, Japan blockchain adoption

On June 16, 2025, Bitcoin Magazine reported a significant financial development in the cryptocurrency sector: Metaplanet, a prominent technology firm, made headlines by purchasing ¥16.88 billion worth of Bitcoin. This bold move highlights the growing acceptance and integration of Bitcoin into mainstream finance, particularly within Japan’s robust economy.

The Importance of Bitcoin in Today’s Economy

Bitcoin has truly changed the game when it comes to how we think about and use money. Launched back in 2009, it has steadily gained recognition as a digital asset and a reliable store of value. The beauty of Bitcoin lies in its decentralized nature, which appeals to a growing number of investors eager for alternatives to traditional banking systems. As cryptocurrencies gain traction, Bitcoin continues to be at the forefront, influencing market trends and investment strategies worldwide. If you want to dive deeper into Bitcoin’s foundational role in the economy, check out this Investopedia article on Bitcoin.

Metaplanet’s Strategic Investment

Now, let’s talk about Metaplanet’s jaw-dropping investment of ¥16.88 billion (roughly $156 million) in Bitcoin. This isn’t just a random purchase; it reflects a strategic choice to diversify their asset portfolio and tap into the growth potential of cryptocurrencies. This trend isn’t isolated to Metaplanet; many corporations are recognizing the immense value in digital currencies. They’re increasingly integrating Bitcoin into their operations, whether through direct investments, payment solutions, or the exciting realm of blockchain technology. You can explore more about corporate investments in cryptocurrencies in this Forbes article.

The Impact on the Cryptocurrency Market

What does this substantial purchase mean for the cryptocurrency market? Well, it’s likely to have positive ramifications. Large-scale investments tend to boost confidence among investors, which could drive up Bitcoin’s price. As we see more institutional players jumping into the fray, the demand for Bitcoin is expected to surge, enhancing liquidity and stability across the market. Plus, Metaplanet’s decision shines a spotlight on the growing acceptance of cryptocurrencies in Japan, where the government has been quite supportive of regulations that encourage blockchain innovation and investment. This clarity fosters an environment where businesses feel more confident exploring Bitcoin as a viable asset. To read more about Japan’s supportive regulatory environment, check out this CoinDesk article.

Bitcoin’s Role in Diversifying Investments

Investors are on the lookout for ways to diversify their portfolios, and Bitcoin offers a compelling option. Its performance often contrasts with traditional assets like stocks and bonds, making it a potential hedge against market volatility. By investing in Bitcoin, companies like Metaplanet can manage risks tied to economic fluctuations and take advantage of the potential for high returns. If you’re curious about how Bitcoin fits into investment strategies, Forbes has a great guide on it.

The Future of Bitcoin in Japan

Japan has consistently been a leader in cryptocurrency adoption, making it a key player in the global digital currency landscape. With a robust infrastructure for cryptocurrency exchanges and a growing number of businesses accepting Bitcoin for payments, Metaplanet’s investment only cements Japan’s position at the forefront of the cryptocurrency space. As more companies and individuals embrace Bitcoin, we can expect ongoing innovation and growth within the sector. Japan’s responsiveness to cryptocurrency trends might even inspire other regions to follow suit, encouraging global companies to make similar investments. You can learn more about Japan’s crypto landscape in this Cryptopolitan article.

What’s Next for Bitcoin?

Metaplanet’s purchase of ¥16.88 billion in Bitcoin is a significant milestone in the cryptocurrency world and reflects a broader trend of institutional adoption of Bitcoin, especially in Japan. As we move forward, the implications of such investments will undoubtedly shape the future of Bitcoin and the cryptocurrency market as a whole. Companies, investors, and regulators alike will need to stay attuned to this evolving landscape as Bitcoin continues to gain traction and redefine the financial ecosystem.

The Broader Implications for the Financial Landscape

The effects of Metaplanet’s investment extend beyond just the cryptocurrency realm. As more corporations integrate Bitcoin into their financial strategies, we may witness a fundamental shift in how traditional finance operates. Banks and financial institutions could be urged to adapt their services to accommodate the growing demand for cryptocurrency-related products. This could lead to the development of more robust infrastructures, including Bitcoin-specific banking services, investment funds, and payment solutions.

The Role of Regulation in Shaping the Future

As the cryptocurrency market evolves, regulatory frameworks will become increasingly significant. Governments and regulatory bodies worldwide are grappling with how to approach cryptocurrencies, aiming for a balance between fostering innovation and ensuring investor protection. Metaplanet’s acquisition of Bitcoin could serve as a catalyst for increased regulatory clarity in the crypto space. As more companies enter the market, regulators may feel pressured to establish frameworks that protect consumers while promoting growth and innovation. For insights into global regulatory trends, consider reading this Brookings Institution report.

Risks and Challenges Ahead

While the outlook surrounding Metaplanet’s investment seems optimistic, it’s essential to consider the risks and challenges that lie ahead. The cryptocurrency market is notoriously volatile, and large investments can lead to significant losses. Companies like Metaplanet must navigate these risks while remaining agile in their investment strategies. Furthermore, potential regulatory changes can create uncertainty. Although clearer regulations may ultimately benefit the market, sudden shifts can impact Bitcoin’s price and accessibility, posing challenges for corporate investors.

The Community Response

The announcement of Metaplanet’s investment has generated a lot of buzz within the cryptocurrency community. Enthusiasts view this as a validation of Bitcoin’s legitimacy, while skeptics remain cautious, highlighting the inherent risks of such a hefty investment. Social media platforms, particularly Twitter, have become vibrant hubs for discussions around this development. Communities are buzzing with excitement and debate, showcasing the passionate nature of cryptocurrency advocates eager to see Bitcoin recognized as a mainstream financial asset.

In Summary

Metaplanet’s purchase of ¥16.88 billion in Bitcoin marks a pivotal moment in the ongoing narrative of cryptocurrency adoption. As technology and finance intersect, the implications of this investment stretch far beyond mere numbers on a balance sheet. It symbolizes a broader acceptance of cryptocurrencies in the corporate world, paving the way for a future where Bitcoin plays a central role in global finance. With the potential for more corporations to follow Metaplanet’s lead, we may be on the brink of a new era in investment strategies, one that embraces the exciting possibilities offered by digital currencies. The future of Bitcoin is indeed bright, and as we continue to explore its impact on the financial landscape, one thing is clear: the world of cryptocurrency is here to stay.

JUST IN: Metaplanet purchases ¥16.88 billion #Bitcoin