China’s Shocking Gold Hoard: 10x More Than Officially Admitted!

China’s Secret Gold Purchases: An Analysis of Recent Trends

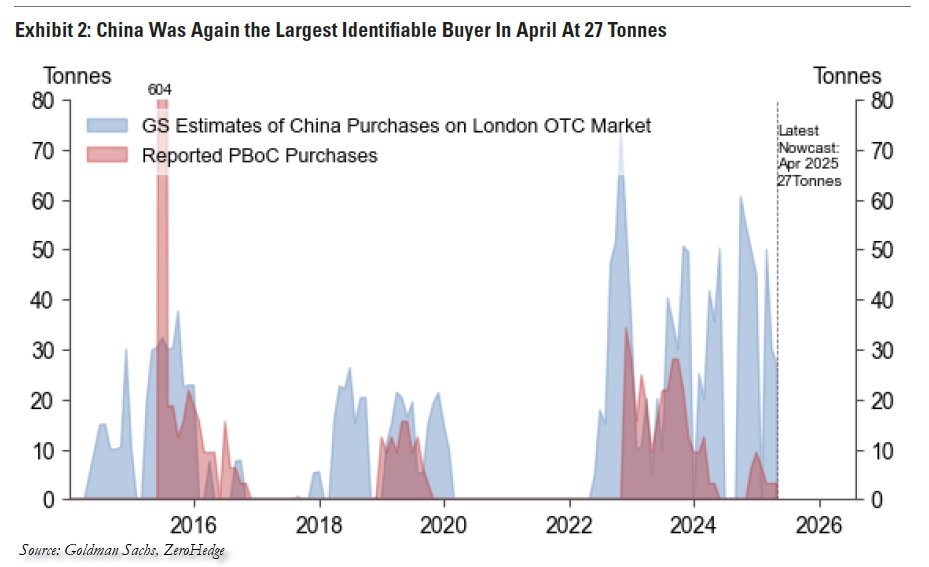

In recent years, China has emerged as a pivotal player in the global gold market, with reports indicating that the nation is secretly acquiring significantly more gold than it publicly acknowledges. According to a tweet by Zero Hedge, China is purchasing approximately 27 tonnes of gold, a staggering tenfold increase compared to the official report of just 3 tonnes. This discrepancy raises important questions about China’s economic strategy, its motivations for accumulating gold, and the potential implications for the global economy.

The Significance of Gold in China’s Economic Strategy

Gold has historically been viewed as a safe-haven asset and a hedge against inflation and currency devaluation. For China, the accumulation of gold is not merely a financial strategy but also a means to bolster its national reserves and enhance its geopolitical influence. By secretly purchasing large quantities of gold, China aims to strengthen its financial position in anticipation of potential economic instability, both domestically and globally.

In a world where currencies can be subject to volatility, gold serves as a reliable store of value. China’s push to increase its gold reserves is a calculated move to diversify its assets, reduce reliance on the U.S. dollar, and prepare for a future where gold-backed currencies could gain prominence. This strategy aligns with China’s long-term objective of establishing itself as a dominant global economic power.

Understanding the Discrepancy in Reporting

The stark contrast between China’s reported gold purchases and actual acquisitions highlights a significant gap in transparency. The official reports suggest a mere 3 tonnes of gold bought, while indications point towards a much larger figure of 27 tonnes. This discrepancy can be attributed to several factors:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Strategic Secrecy: By keeping its gold purchases under wraps, China may be attempting to prevent market speculation and manipulation. Large-scale purchases can drive up prices, and maintaining secrecy allows China to acquire gold at more favorable rates.

- Regulatory Control: China has stringent regulations surrounding gold trading and ownership. The government may prefer to keep its gold accumulation discreet to avoid attracting attention or triggering policy changes that could affect its buying strategy.

- Long-term Vision: China’s approach to gold accumulation is part of a broader long-term vision for its economy. By gradually increasing its gold reserves, China can position itself as a more formidable player in global finance without alarming other nations or destabilizing the market.

Implications for the Global Economy

China’s secretive gold purchases have far-reaching implications for the global economy. As one of the world’s largest economies, China’s actions in the gold market can influence prices, investor sentiment, and national policies. Some of the key implications include:

1. Price Volatility

As China quietly accumulates gold, it could create upward pressure on gold prices, especially if other countries or investors become aware of the scale of its purchases. This price volatility can impact not only investors in gold but also industries that rely on the metal, such as jewelry and electronics.

2. Shifts in Currency Dynamics

China’s gold accumulation strategy may signal a shift away from the U.S. dollar as the world’s primary reserve currency. If China continues to build its gold reserves, it could potentially lead to increased interest in gold-backed currencies and a reevaluation of the dollar’s dominance in international trade.

3. Geopolitical Tensions

China’s aggressive accumulation of gold may raise concerns among other nations, particularly the United States and its allies. As China strengthens its financial position, it could embolden its geopolitical ambitions, leading to heightened tensions in regions like the South China Sea and beyond.

4. Alternative Investment Opportunities

For investors, China’s actions may indicate a shift in the investment landscape. As gold becomes a more attractive asset due to its perceived stability, investors may look to diversify their portfolios to include gold and related assets. This trend could also spark increased interest in other alternative investments.

Conclusion

China’s secret gold purchases, as highlighted by Zero Hedge, reflect a strategic approach to enhance its economic stability and global standing. The significant gap between reported and actual gold acquisitions underscores the complexities of the global financial landscape and the importance of transparency. As China continues to accumulate gold, the implications for the global economy, currency dynamics, and geopolitical relations will be profound.

Investors and policymakers alike should monitor these developments closely, as they could shape the future of the global economy in unforeseen ways. Understanding China’s motivations and actions in the gold market is crucial for navigating the evolving landscape of international finance and investment.

In conclusion, China’s strategy of accumulating gold in secret not only impacts its own economic future but also poses challenges and opportunities for the rest of the world. As the global market continues to evolve, the implications of these actions will be felt far beyond China’s borders, making it essential for stakeholders to stay informed and prepared for the changes ahead.

China continues to secretly buy 10x more gold (27 tonnes) than it reports (3 tonnes) pic.twitter.com/uKMMQGvGXX

— zerohedge (@zerohedge) June 13, 2025

China Continues to Secretly Buy 10x More Gold (27 Tonnes) Than It Reports (3 Tonnes)

China’s gold purchasing habits have become a hot topic in financial discussions lately, especially following the revelations that the nation is secretly acquiring significantly more gold than it officially reports. Recent reports suggest that while China claims to buy only 3 tonnes of gold, it’s actually acquiring around 27 tonnes, making it a staggering 10 times more than what’s disclosed. This discrepancy raises questions about the motivations behind these secretive purchases and their potential impact on global gold markets.

The Importance of Gold in China’s Economic Strategy

Gold has always held a special place in the hearts of investors and nations alike. For China, the precious metal isn’t just a shiny asset; it’s a crucial part of its economic strategy. As the world’s largest gold producer and consumer, China’s gold purchasing strategy reflects its desire to secure its financial standing in the global arena. By increasing its gold reserves, China aims to hedge against inflation, economic instability, and currency fluctuations.

The Chinese government appears to be positioning itself to bolster its financial security and enhance its international influence. In a world where economic power is often tied to gold reserves, China’s significant accumulation could serve as a strategic move to challenge the dominance of the US dollar.

Understanding the Secrecy Behind China’s Gold Purchases

Why is China opting for secrecy in its gold acquisition? There are multiple layers to this strategy. First, by underreporting its gold purchases, China can avoid triggering market reactions. If the world were to know that China is rapidly increasing its gold reserves, it could lead to heightened demand and higher prices, complicating China’s buying strategy.

Furthermore, in the competitive landscape of global finance, keeping such information under wraps allows China to gain an edge. The less the world knows about its gold reserves, the better positioned it is to maneuver in the global market. This secrecy can also be viewed as a way to maintain control over its financial narrative and avoid unnecessary speculation.

The Role of Gold in Global Markets

Gold has always been a safe haven for investors, especially during times of uncertainty. With geopolitical tensions, economic disruptions, and inflation fears, many turn to gold as a reliable store of value. China’s significant gold purchases could influence global markets in various ways. If China continues to ramp up its gold reserves quietly, it could lead to increased volatility in gold prices and a shift in investment strategies globally.

Moreover, China’s actions might encourage other nations to reassess their own gold reserves. Countries may feel the need to bolster their gold holdings in response to China’s aggressive accumulation. This could potentially lead to a gold rush of sorts, where countries scramble to acquire more gold, affecting supply and demand dynamics.

Implications for Investors

For investors, the implications of China’s secretive gold purchases are profound. Understanding these trends can provide valuable insights into future market movements. If China continues to buy gold at such a rate, it may signal a long-term bullish trend for gold prices. Investors might want to consider diversifying their portfolios by including gold or gold-related assets.

Additionally, keeping an eye on China’s gold buying patterns could serve as an early indicator for potential shifts in the global economy. As the world’s second-largest economy, China’s economic moves often have ripple effects across financial markets.

The Future of Gold in China

As China continues to expand its gold reserves, the future of gold in the nation looks promising. The government’s focus on increasing gold holdings aligns with its long-term economic goals. With the global economy’s uncertainties, gold’s role as a safe haven is only expected to grow.

China’s strategy might also lead to enhanced partnerships with countries rich in gold resources, further securing its position in the gold market. These partnerships could result in new trade agreements and investment opportunities that benefit both China and its partners.

Staying Informed About China’s Gold Moves

For those interested in tracking China’s gold purchasing activities, staying informed is crucial. Financial news outlets and market analysts often provide updates on gold market trends and China’s gold policies. Subscribing to reliable financial news sources or following expert analyses can keep investors in the loop regarding any significant changes in China’s gold acquisition strategy.

Conclusion: The Bigger Picture

China’s secretive gold purchases illustrate a larger narrative about economic power dynamics. As the nation continues to buy 10 times more gold than it reports, the implications for global markets and investors are significant. Understanding these trends can provide valuable insights into both China’s economic strategy and the future of gold as a critical asset class.

Whether you’re an investor, a market analyst, or just a curious observer, it’s essential to keep a close eye on China’s gold moves. The ongoing developments in this arena could shape financial markets for years to come, making it a topic worth following closely.

By staying informed and understanding the motivations behind these purchases, you can make more educated decisions regarding your investments and financial strategies in an ever-changing global economy.