Taxing Fruits While Malaysians Eat Few? Health Report Shocks!

Taxing Fruits in Malaysia: A Contradiction to Health Initiatives

In a recent tweet, Hadi Azmi highlighted a perplexing policy that has raised eyebrows among health advocates and citizens alike: the taxation of fruits in Malaysia. This issue gains further significance when juxtaposed against a recent morbidity report published by the Malaysian Health Ministry, which noted that the consumption of fruits and vegetables among Malaysians is alarmingly low. This summary delves into the implications of taxing fruits, the current health landscape in Malaysia, and the potential consequences of such policies on public health.

The Health Landscape in Malaysia

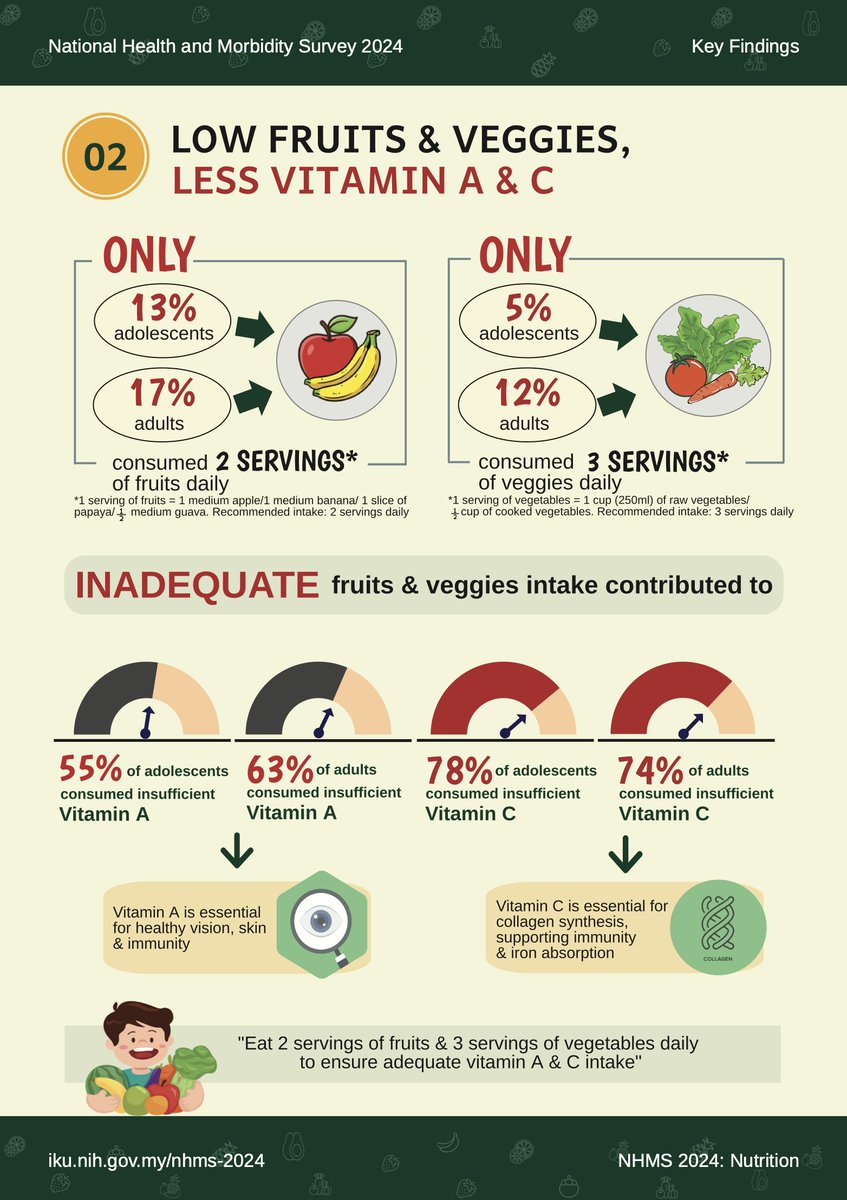

According to the Malaysian Health Ministry’s morbidity report, the dietary habits of Malaysians show a concerning trend. The report indicates that a significant portion of the population does not meet the recommended daily intake of fruits and vegetables. This deficiency contributes to various health issues, including obesity, heart disease, and diabetes. With such alarming statistics, one would expect the government to encourage healthy eating habits rather than impose taxes on healthy food options.

The Rationale Behind Taxing Fruits

The taxation of fruits can be seen as a strategy to generate revenue for the government. However, this approach raises multiple questions. Firstly, why would a government tax a food group that is essential for health? Fruits are rich in vitamins, minerals, and antioxidants that contribute to improved health outcomes. By taxing fruits, the government may inadvertently discourage their consumption, further exacerbating the already low intake levels.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Health Implications of Low Fruit Consumption

Low consumption of fruits and vegetables is linked to a myriad of health problems. For instance, diets lacking in fruits have been associated with increased risks of chronic diseases, including cardiovascular diseases and certain cancers. Furthermore, insufficient fruit intake can lead to deficiencies in essential vitamins and minerals, negatively impacting overall health and well-being. As such, taxing fruits could push consumers further away from making healthier food choices, leading to a cycle of poor dietary habits and increased health care costs.

Public Reaction and Advocacy

The taxation of fruits has sparked significant public discourse. Many citizens, health professionals, and advocacy groups have voiced their concerns, emphasizing the need for policies that promote, rather than hinder, healthy eating. Advocates argue that the government should focus on incentives for consuming fruits and vegetables, such as subsidies or educational campaigns, rather than imposing punitive measures.

Economic Considerations

From an economic perspective, the taxation of fruits could have unintended consequences for local farmers and the agricultural sector. By making fruits more expensive, the demand may decrease, impacting farmers’ livelihoods. It could also lead to a decline in the overall fruit market, which is vital for the economy. Supporting local agriculture through favorable policies could not only enhance the availability of fresh produce but also stimulate economic growth.

Alternative Approaches to Enhance Fruit Consumption

Instead of taxing fruits, the government could consider alternative approaches to enhance fruit consumption among Malaysians. Such initiatives could include:

- Education Campaigns: Launching public health campaigns to educate citizens about the benefits of consuming fruits and vegetables and how to incorporate them into their daily diets.

- Subsidies for Fresh Produce: Providing subsidies for fruits and vegetables can lower prices, making them more accessible to all citizens, especially low-income families.

- Community Programs: Implementing community gardens and farmers’ markets can encourage local production and consumption of fruits, fostering a culture of healthy eating.

Conclusion

In conclusion, the taxation of fruits in Malaysia appears to be an illogical policy, especially in light of the Health Ministry’s findings on the low consumption of fruits and vegetables. Instead of imposing taxes that could deter healthy eating, the government should explore strategies that promote the consumption of these vital food groups. By fostering an environment that encourages healthy dietary habits, Malaysia can work towards improving its public health and addressing the chronic health issues facing its population.

The conversation surrounding fruit taxation is a critical one that requires the attention of policymakers, health professionals, and the public. Moving forward, it is essential to prioritize health and well-being by ensuring that the policies implemented support the consumption of nutritious foods rather than penalizing them. As Malaysians continue to grapple with health challenges, the focus should be on creating a healthier future through informed and supportive dietary policies.

Taxing fruits is strange when the health ministry recently published its morbidity report, saying Malaysians consume very few fruits and vegetables. pic.twitter.com/goF0NOTHUu

— Hadi Azmi (@amerhadiazmi) June 12, 2025

Taxing fruits is strange when the health ministry recently published its morbidity report, saying Malaysians consume very few fruits and vegetables

When it comes to health and nutrition, fruits and vegetables play a pivotal role. Yet, a peculiar situation has emerged in Malaysia. As highlighted by Hadi Azmi on Twitter, the government has proposed taxing fruits, despite a recent report from the health ministry indicating that Malaysians are already falling short in their fruit and vegetable consumption. This raises a significant question: Why impose a tax on something that could potentially improve public health when so many people aren’t getting enough of it? Let’s dig deeper into this intriguing topic.

The Health Ministry’s Morbidity Report

The morbidity report published by the Malaysian Health Ministry sheds light on the troubling dietary habits of the population. It indicates that many Malaysians are not consuming enough fruits and vegetables, which are fundamental for a balanced diet. According to the report, the average Malaysian falls short of recommended daily servings of these essential food groups. The report aims to address growing health concerns, including obesity and chronic diseases, which stem from poor nutrition. You can find more details on the report [here](https://www.thestar.com.my/news/nation/2023/05/12/malaysians-urged-to-eat-more-fruits-and-vegetables).

The Proposed Tax on Fruits

So, what’s the deal with taxing fruits? The idea seems counterproductive, especially when the government is trying to encourage healthier eating habits. By imposing a tax on fruits, the government might inadvertently make them less accessible to those who already struggle to include them in their diet. It’s like trying to fix a leaky faucet while simultaneously increasing the water bill—counterintuitive, to say the least!

The rationale behind the tax might be to generate revenue or to discourage excessive consumption of sugary fruits. However, the overarching goal should be to promote health and well-being. After all, fruits are packed with essential vitamins, minerals, and antioxidants that are crucial for maintaining good health.

Understanding the Role of Fruits in a Healthy Diet

Fruits are not just delicious; they’re vital for our overall health. Rich in nutrients and low in calories, they help reduce the risk of chronic diseases such as heart disease, diabetes, and certain cancers. Eating a variety of fruits can also aid in digestion, improve skin health, and boost the immune system. For more insights into the benefits of fruits, you can check out this [article by Healthline](https://www.healthline.com/nutrition/health-benefits-of-fruits).

When people are discouraged from consuming fruits due to taxation, it could lead to a decline in public health outcomes. The government should focus on initiatives that encourage fruit consumption, such as subsidies or educational campaigns that highlight the importance of a balanced diet.

Public Reaction to the Tax Proposal

Naturally, the proposed fruit tax has sparked a wave of reactions from the public and health advocates alike. Many people are expressing confusion and frustration over the decision. Why tax something that’s good for you? Social media platforms are abuzz with debates about the implications of such a tax, and many are questioning the government’s priorities.

Public health advocates argue that instead of taxing fruits, the government should be investing in programs that promote healthy eating habits among Malaysians. They suggest initiatives like community gardens, farmer’s markets, and educational workshops that teach people how to incorporate more fruits and vegetables into their diets.

You can see more discussions around this topic on social media platforms, where users are voicing their opinions and sharing their thoughts on how the proposed tax could negatively impact public health.

The Importance of Education and Accessibility

Education plays a crucial role in influencing dietary choices. Many Malaysians may not fully understand the benefits of consuming fruits and vegetables or may not know how to prepare them in a way that’s enjoyable. Therefore, it’s essential for the government to invest in educational programs that teach people about nutrition and the importance of a balanced diet.

Furthermore, accessibility is a significant factor. In some areas, fresh fruits and vegetables may not be readily available, and those that are can be quite expensive. Instead of imposing a tax, the government could explore ways to make healthy foods more accessible and affordable for everyone. This could include partnerships with local farmers or initiatives that reduce transportation costs for produce.

Alternative Approaches to Promoting Healthy Eating

Instead of resorting to taxation, there are several alternative approaches that the government could consider to promote healthier eating habits among Malaysians. Here are a few ideas:

1. **Subsidies for Fruits and Vegetables**: By providing financial support to farmers or retailers, the government can help lower prices for consumers, making fresh produce more affordable.

2. **Nutrition Education Campaigns**: Launching campaigns that educate the public on the benefits of fruits and vegetables can create awareness and encourage healthier eating habits.

3. **Community Gardening Initiatives**: Supporting community gardens can empower local communities to grow their own fruits and vegetables, fostering a sense of ownership and promoting healthier eating.

4. **Healthy School Lunch Programs**: Implementing programs that provide nutritious meals in schools can help instill healthy eating habits in children from a young age.

5. **Public Awareness Campaigns**: Utilizing social media and traditional media to promote the consumption of fruits and vegetables can create a cultural shift towards healthier eating.

Global Perspectives on Fruit Consumption

Looking beyond Malaysia, many countries face similar challenges regarding fruit and vegetable consumption. In the United States, for example, health organizations have long advocated for increased intake of fruits and vegetables to combat rising obesity rates and chronic diseases. This has led to various initiatives aimed at improving access and education surrounding healthy eating.

In countries like Australia and Canada, government programs have been implemented to encourage fruit consumption through subsidies and educational outreach. These initiatives have shown promising results, with increased awareness and consumption of fruits and vegetables among the population.

These global perspectives can serve as valuable lessons for Malaysia as it navigates its own public health challenges.

Final Thoughts on the Future of Fruit Consumption in Malaysia

The conversation surrounding the proposed tax on fruits highlights a critical juncture for public health in Malaysia. As the health ministry’s morbidity report suggests, Malaysians need to increase their consumption of fruits and vegetables to improve overall health outcomes.

Instead of imposing a tax that could further discourage healthy eating, the focus should shift towards creating an environment that supports and encourages fruit consumption. By prioritizing education, accessibility, and community initiatives, Malaysia can foster a culture of health that benefits everyone.

In the end, it’s essential for the government, health advocates, and the public to work together to create a healthier future for all Malaysians. After all, when it comes to health, we all have a role to play.