BREAKING: Grab’s $1.5B Deal Raises Eyebrows—Is It a Cash Grab?

Grab Holdings Secures $1.5 Billion in Convertible Note Offering

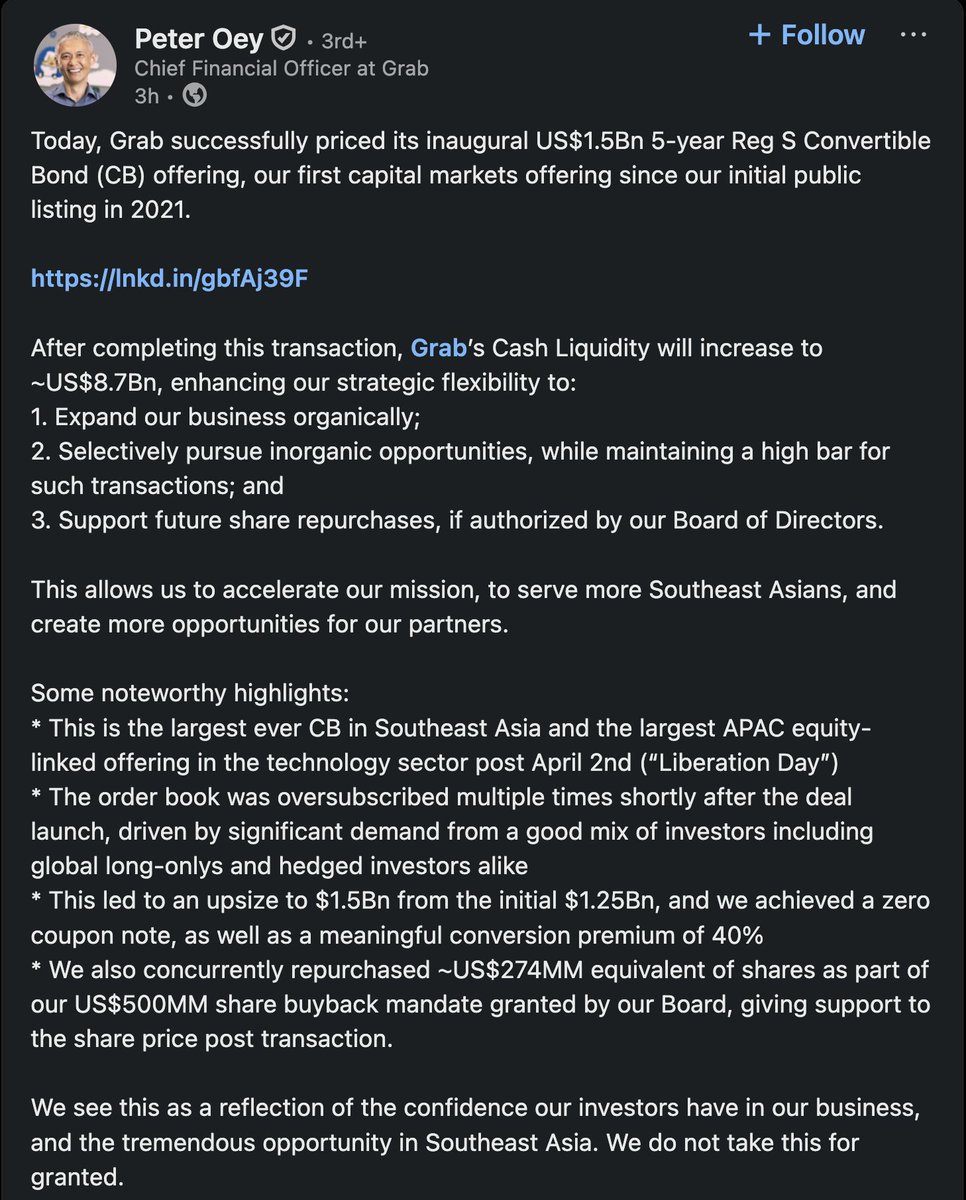

In a groundbreaking announcement, Grab Holdings, a leading technology company in Southeast Asia, has successfully completed a $1.5 billion convertible note offering. This significant financial move was confirmed by Peter Oey, Grab’s Chief Financial officer, who highlighted key details about the funding round and its implications for the company’s future.

Financial Position Strengthened

Following the completion of the convertible note offering, Grab Holdings now boasts a robust cash reserve of $8.7 billion. This financial strength is crucial for the company as it navigates the competitive landscape of the Southeast Asian market, which includes various sectors such as transportation, food delivery, and digital payments.

High Demand for the Offering

The convertible note offering was met with overwhelming interest from investors, with Oey noting that the round was oversubscribed by "multiple times." This indicates a strong confidence among investors in Grab’s business model and future growth prospects. The high demand reflects the market’s acknowledgment of Grab’s strategic position in the rapidly evolving technology ecosystem in Southeast Asia.

Strategic Use of Funds

The capital raised through this offering will be strategically utilized to fuel Grab’s growth initiatives. While specific details about the allocation of funds were not disclosed in the initial announcement, the company is expected to invest in technology enhancements, expansion of services, and possibly acquisitions that align with its long-term growth strategy. The focus will likely be on strengthening its core offerings in ride-hailing, food delivery, and financial services, which are critical components of Grab’s business model.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Importance of Convertible Notes

Convertible notes are a popular financing instrument for tech companies, providing flexibility for both the issuer and investors. They allow companies like Grab to raise capital without immediately diluting equity, as these notes can later convert into shares at a predetermined price. This mechanism is particularly appealing in the current market, where tech companies often face volatility and changing valuations.

Market Confidence in Grab

Grab’s successful fundraising efforts come at a time when investors are increasingly cautious due to broader economic uncertainties. The strong demand for Grab’s convertible notes indicates a robust market confidence in the company’s ability to navigate challenges while capitalizing on growth opportunities. This confidence is bolstered by Grab’s established presence in the region and its innovative approach to technology and services.

Future Growth Prospects

With the additional capital, Grab is well-positioned to enhance its competitive edge within the Southeast Asian market. The company has a diverse range of services, including GrabFood, GrabExpress, and GrabPay, which cater to a wide array of consumer needs. Expanding these services and improving user experience will likely be a priority as Grab seeks to retain and attract customers amid increasing competition.

Conclusion

In summary, Grab Holdings’ recent $1.5 billion convertible note offering not only strengthens its financial position but also showcases the confidence investors have in the company’s growth trajectory. With $8.7 billion in cash and a strong demand for its notes, Grab is poised to leverage this capital for strategic initiatives that will further solidify its leadership in Southeast Asia’s technology landscape. As the company looks to the future, the successful execution of its growth strategies will be crucial in maintaining its competitive advantage and delivering value to shareholders.

BREAKING: Grab’s CFO, Peter Oey, confirms that the company has completed a $1.5B convertible note offering and shares details:

– Grab now has $8.7B in cash

– Round was over subscribed by “multiple times,” shortly after they announced the deal

– Will use the money for… pic.twitter.com/4RrYdKdQ3c— amit (@amitisinvesting) June 12, 2025

Grab’s $1.5B Convertible Note Offering: What You Need to Know

Grab, the Southeast Asian tech giant, recently made headlines with a major financial move. The company announced that it has completed a whopping $1.5 billion convertible note offering. This decision has attracted significant attention, especially given the implications it has for Grab’s future growth and market position. Let’s dive into the details and explore what this means for investors and consumers alike.

Understanding Convertible Notes

Now, before we get into the nitty-gritty of Grab’s recent offering, it’s essential to understand what a convertible note is. In simple terms, a convertible note is a form of short-term debt that converts into equity, typically during a future financing round. This means that investors who buy these notes can potentially convert their debt into shares of the company at a later date, often at a discounted rate.

Grab’s CFO, Peter Oey, confirmed that the note offering was oversubscribed by “multiple times.” This indicates that there was a high level of interest from investors, suggesting confidence in Grab’s business model and growth prospects. The excitement surrounding this offering speaks volumes about how investors view the future of Grab in the tech and transportation landscape.

Grab’s Cash Reserves: A Game-Changer

As a result of this fundraising effort, Grab now holds an impressive $8.7 billion in cash. This significant liquidity puts Grab in a strong position to pursue various strategic initiatives. Whether it’s expanding into new markets, investing in technology, or enhancing existing services, the options are plentiful. With this cash on hand, Grab can accelerate its growth strategy and further solidify its market dominance.

Imagine having that kind of financial cushion! It’s like having a safety net that allows a company to take calculated risks and explore new opportunities without the constant worry of cash flow issues. For Grab, this is particularly important as it continues to navigate the competitive landscape of ride-hailing, food delivery, and digital payments.

Investor Confidence and Market Implications

The fact that Grab’s convertible note offering was oversubscribed multiple times is a strong indicator of investor confidence. It suggests that investors believe in Grab’s potential for growth and profitability. This level of backing can significantly impact the company’s stock performance and market perception.

For potential investors, this could be a signal to consider getting in on the action. With an established brand and a proven business model, Grab is already a household name in Southeast Asia. The additional capital from this offering could lead to innovations and improvements that enhance customer experiences and attract even more users.

How Will Grab Utilize This Capital?

Grab’s management has hinted at several areas where this funding will be allocated, although specific details are still forthcoming. It’s likely that a portion of the funds will be directed toward technological enhancements, possibly through investments in AI and machine learning to improve the efficiency of their platforms.

Moreover, Grab has been diversifying its services beyond ride-hailing into food delivery and financial services. This means that part of the funds could also be funneled into expanding these verticals. Given the growth of the food delivery market, especially post-pandemic, there’s a huge opportunity for Grab to solidify its position in this sector.

What This Means for Grab’s Future

So, what does this all mean for Grab’s future? With $8.7 billion in cash and strong investor backing, Grab is well-positioned to capitalize on growth opportunities. The company can now focus on scaling its operations and enhancing user experiences. Whether this translates into faster service, better app features, or expanded service areas, customers can expect an elevated level of service.

Furthermore, Grab’s ability to innovate and adapt is critical in an industry that’s constantly evolving. As competition intensifies with other ride-hailing and delivery services vying for market share, having a robust financial foundation will be key to maintaining its leadership position.

The Broader Market Context

Let’s not forget the broader market context in which Grab operates. The tech landscape in Southeast Asia is booming, with increasing smartphone penetration and a growing middle class. This environment creates fertile ground for companies like Grab to thrive.

Moreover, as the world continues to shift toward digital solutions, Grab’s emphasis on technology and innovation will likely resonate well with consumers. The company’s ability to adapt to changing consumer preferences and market dynamics will be crucial as it navigates this growth phase.

Conclusion: What Lies Ahead for Grab

In summary, Grab’s recent $1.5 billion convertible note offering is a significant milestone for the company. With $8.7 billion in cash and strong investor confidence, Grab is poised for continued growth and expansion. The upcoming months and years will reveal how effectively Grab can leverage this capital to enhance its service offerings and maintain its competitive edge.

As an investor or consumer, keeping an eye on how Grab deploys its new resources will be essential. The potential for innovation, expansion, and market leadership is vast, and those who follow Grab closely may find themselves at the forefront of an exciting journey in Southeast Asia’s tech scene.

For more insights on Grab’s financial strategies and market movements, you can check out the original announcement on [Twitter](https://twitter.com/amitisinvesting/status/1933178726163882054).