Trump’s Shocking Trade Deal with China Sparks Controversy and Market Surge!

BREAKING: Trump Announces Trade Deal with China Complete – Market Surge Expected!

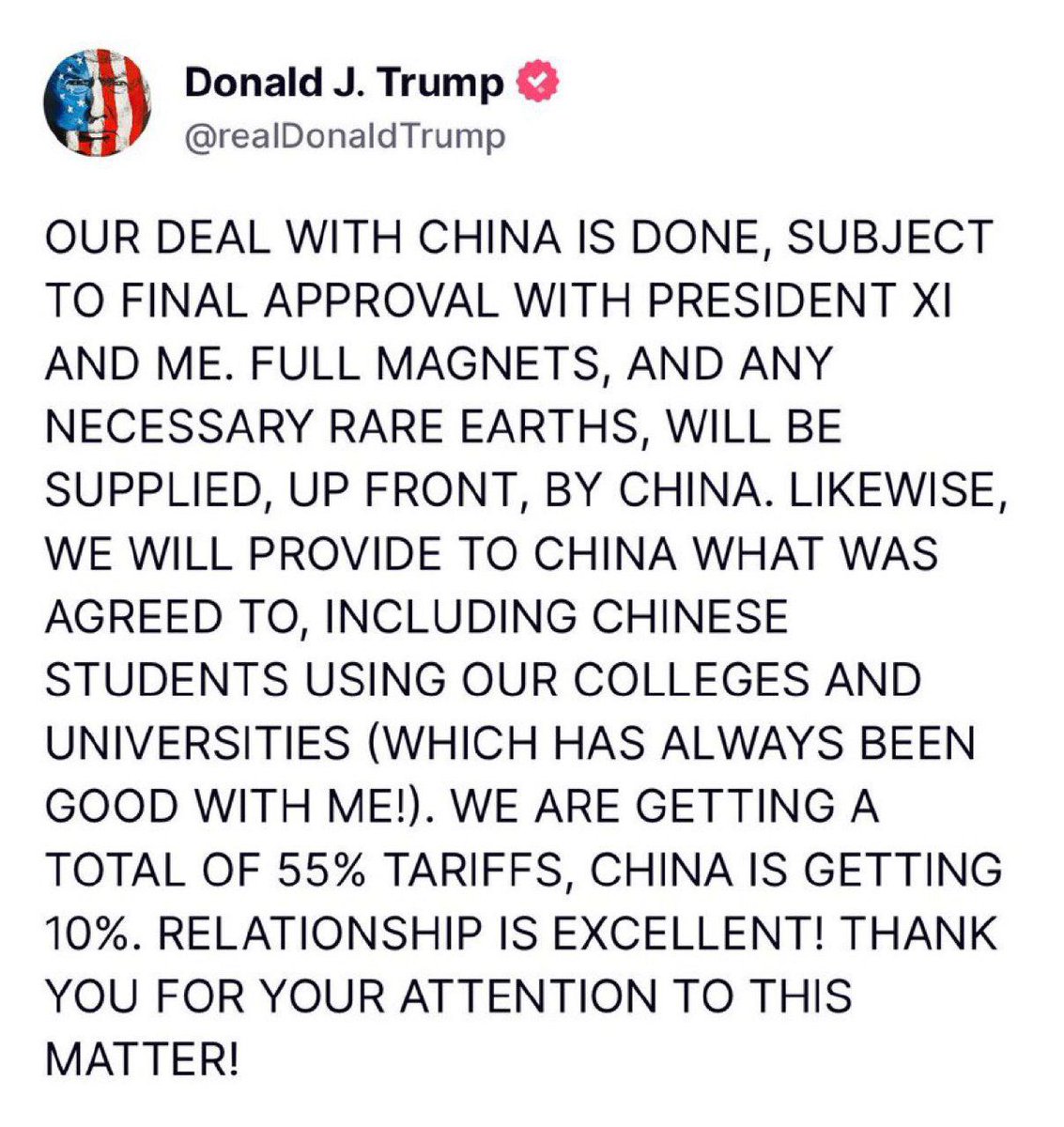

In a momentous announcement on June 11, 2025, President trump disclosed that the long-anticipated trade deal with China has been finalized. This news has ignited optimism in the financial markets, with expectations of a bullish impact that could stimulate market growth. Investors and market participants are reacting positively to this significant development, which marks a pivotal point in U.S.-China trade relations.

The Significance of the Trade Deal

The completion of the trade agreement between the United States and China has been a focal point of negotiations for several months. Both nations have engaged in extensive discussions to address longstanding trade imbalances and other pertinent issues. The finalization of this agreement is perceived as a crucial step toward enhancing trade relations between these two economic giants.

Market analysts are heralding the news of the trade deal’s completion as a major turning point. Traders are expressing enthusiasm, viewing this development as a boon for market performance. The bullish sentiment surrounding the trade deal is expected to resonate across various sectors, with numerous companies poised to benefit from the anticipated increase in trade opportunities.

Investor Confidence and Market Implications

The announcement of the trade agreement has already created waves in the financial markets, with many investors feeling an invigorated sense of confidence. The prospect of reduced tariffs and enhanced market access is likely to drive stock prices upward, particularly for businesses that have substantial operations in China. This optimistic outlook could result in increased profits for American companies and foster a more robust economy overall.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

As details of the trade deal continue to emerge, it is anticipated that the bullish sentiment will persist in the coming days and weeks. However, investors should remain cognizant of the complexities inherent in trade agreements and the potential for implementation challenges that may arise.

Global Economic Impact

The ramifications of the U.S.-China trade deal extend beyond the two nations, making it a significant development for the global economy. As the world’s second-largest economy, China plays a vital role in international trade dynamics. Consequently, changes in trade relationships between the U.S. and China can trigger ripple effects that influence markets worldwide.

One of the promising outcomes of this trade agreement is the potential for increased stability in the global economy. The uncertainty that has characterized the U.S.-China trade war has generated concerns among investors and businesses alike. With a new trade deal in place, there is hope that this uncertainty will diminish, leading to more confident investment and spending decisions across the globe.

Looking Ahead: Challenges and Opportunities

While the completion of the trade deal is a positive step, it is essential to remember that trade agreements represent just one aspect of a healthy economic landscape. Both the United States and China continue to face various challenges, including geopolitical tensions, economic growth hurdles, and the need for technological innovation.

As we look toward the future, it will be critical to monitor the implementation of this trade deal and its broader implications for the global economy. Although there may be obstacles along the way, the finalization of this agreement represents progress toward a more stable and prosperous economic environment for all parties involved.

BREAKING:

PRESIDENT trump SAID THE

TRADE DEAL WITH CHINA IS DONE.BULLISH FOR THE MARKETS pic.twitter.com/n0Boc7qUYr

— Ash Crypto (@Ashcryptoreal) June 11, 2025

In a tweet from Ash Crypto, the confirmation of the trade deal by President trump has reverberated through the markets, generating a wave of bullish sentiment among investors. Now, let’s explore what this trade deal entails and its implications for both nations and the global economy.

What the Trade Deal Entails

The trade deal between the United States and China has been a significant development that has evolved over several months. President trump has consistently advocated for the renegotiation of trade agreements with China, highlighting unfair practices and tariffs that have adversely affected American businesses. This new deal aims to address these issues by creating a more equitable trading environment for both countries.

One of the key features of the trade deal is the reduction of tariffs on specific goods, which is expected to benefit businesses on both sides. This reduction will facilitate more efficient and cost-effective trade between the U.S. and China. Furthermore, the agreement includes provisions for the protection of intellectual property and increased market access for American companies in China.

Conclusion

In summary, the completion of the trade deal between the United States and China marks a significant milestone with anticipated positive impacts on the markets. The bullish sentiment surrounding this announcement reflects growing investor confidence and optimism for future market performance. As more details about the trade deal emerge, market participants will be keenly observing the implications and opportunities that arise from this crucial agreement.

The trade deal not only signifies a step toward resolving trade tensions but also fosters stronger economic ties between the U.S. and China. With the potential for increased market growth and stability on the horizon, this agreement is poised to leave a lasting impact on both nations and the global economy.

BREAKING: Trump Announces Trade Deal with China Complete – Market Surge Expected!

Trump trade deal, China agreement, Market boost

President trump announced that the trade deal with China has been finalized, signaling positive news for the markets. This development is expected to have a bullish impact, with potential for market growth. The announcement was made by President trump on June 11, 2025, and was met with optimism by investors and market participants.

The completion of the trade deal between the United States and China has been a key focus for both countries in recent months. Negotiations have been ongoing, with both sides working to address trade imbalances and other issues. The finalization of the deal is seen as a significant step towards improving trade relations between the two economic powerhouses.

The news of the trade deal being done has been met with enthusiasm by traders, who see it as a positive development for the markets. The announcement has the potential to boost investor confidence and drive market performance. The bullish sentiment surrounding the trade deal is expected to have a ripple effect across various sectors, with companies likely to benefit from increased trade opportunities.

Overall, the completion of the trade deal with China is a positive development for the markets. It represents a step towards resolving trade tensions and fostering stronger economic ties between the United States and China. The announcement by President trump has been well-received by investors, who are hopeful that the deal will lead to increased market growth and stability.

In conclusion, the trade deal between the United States and China being finalized is a significant milestone that is expected to have a positive impact on the markets. The bullish sentiment surrounding the announcement indicates investor confidence and optimism for future market performance. As the details of the deal are further clarified, market participants will be closely monitoring the implications and opportunities that arise from this important agreement.

BREAKING:

PRESIDENT trump SAID THE

TRADE DEAL WITH CHINA IS DONE.BULLISH FOR THE MARKETS pic.twitter.com/n0Boc7qUYr

— Ash Crypto (@Ashcryptoreal) June 11, 2025

In a recent tweet by Ash Crypto, it was announced that President trump has confirmed the completion of a trade deal with China. This news has sent shockwaves through the markets, with many investors feeling bullish about the future. Let’s dive deeper into what this trade deal means for both countries and the global economy.

What the Trade Deal Entails

The trade deal between the United States and China is a significant development that has been months in the making. President trump has been vocal about his desire to renegotiate trade agreements with China, citing unfair practices and tariffs that have hurt American businesses. This new deal is aimed at addressing some of these issues and creating a more level playing field for both countries.

One of the key aspects of the trade deal is the reduction of tariffs on certain goods. This is expected to benefit both American and Chinese businesses, as it will make it easier and more cost-effective to trade between the two countries. Additionally, the deal includes provisions for intellectual property protection and increased market access for American companies in China.

Implications for the Markets

The announcement of the trade deal has had an immediate impact on the markets, with many investors feeling optimistic about the future. The prospect of reduced tariffs and increased market access has led to a surge in stock prices, particularly for companies that do a significant amount of business with China.

This bullish sentiment is likely to continue in the coming days and weeks as more details about the trade deal are revealed. Investors are hopeful that the deal will lead to increased profits for American businesses and a stronger economy overall. However, it is important to keep in mind that trade agreements can be complex and take time to fully implement, so there may be some bumps along the way.

Global Economic Impact

The trade deal between the United States and China is not just significant for the two countries involved, but also for the global economy as a whole. China is the world’s second-largest economy and a major trading partner for many countries around the world. Any changes in trade agreements between the US and China are likely to have ripple effects that are felt far and wide.

One of the potential benefits of the trade deal is increased stability in the global economy. The uncertainty surrounding the trade war between the US and China has been a source of concern for many investors and businesses. With a new trade deal in place, there is hope that some of this uncertainty will be alleviated, leading to more confident investment and spending decisions.

Looking Ahead

While the completion of the trade deal is a positive development, it is important to remember that trade agreements are just one piece of the puzzle when it comes to a healthy economy. There are still many challenges that both the US and China face, including geopolitical tensions, economic growth, and technological innovation.

As we look ahead to the future, it will be important to monitor how the trade deal between the US and China is implemented and its impact on the global economy. While there may be some bumps along the way, the completion of this deal is a step in the right direction towards a more stable and prosperous economic environment for all.

PRESIDENT trump SAID THE

TRADE DEAL WITH CHINA IS DONE.

BULLISH FOR THE MARKETS

BREAKING: Trump Announces Trade Deal with China Complete – Market Surge Expected!

In a significant turn of events, President trump has announced that the long-anticipated trade deal with China is officially complete. This news is sending ripples through the financial markets, with expectations of a bullish impact that could lead to substantial market growth. The announcement was made on June 11, 2025, and has already sparked optimism among investors and market participants alike.

Trump Trade Deal, China Agreement, Market Boost

The completion of this trump trade deal marks a pivotal moment for both the United States and China, two of the world’s largest economies. Over the past few months, negotiations have been intense as both countries worked to address critical issues, including trade imbalances and tariffs that have previously strained relations. With this agreement now finalized, many view it as a significant step toward improving trade relations between these economic powerhouses.

Investor Enthusiasm and Market Confidence

Upon hearing the news of the finalized China agreement, traders and investors displayed immediate enthusiasm. The announcement is expected to boost investor confidence and drive market performance significantly. Many sectors are likely to experience a ripple effect, benefiting from increased trade opportunities. This positive sentiment is crucial, especially after a period of uncertainty surrounding trade relations.

Understanding the Trade Deal’s Details

So, what exactly does this trade deal entail? The agreement focuses on reducing tariffs on various goods exchanged between the U.S. and China. This reduction is anticipated to benefit businesses on both sides by making trade not only easier but also more cost-effective. Furthermore, the deal includes critical provisions for protecting intellectual property rights and enhancing market access for American companies in China. These elements are designed to create a more balanced playing field, addressing long-standing complaints about unfair practices.

Immediate Market Reactions and Future Implications

With the announcement creating a buzz in the stock market, many investors are reacting positively. Companies that have relied heavily on trade with China are seeing their stock prices surge, reflecting the heightened optimism. This market boost is not just a flash in the pan; many analysts believe that the bullish sentiment surrounding this deal will continue as more details emerge. Investors are hopeful that the agreement will lead to increased profits for American businesses and contribute to a more robust overall economy.

The Global Economic Ripple Effect

This trade deal is not merely a bilateral agreement; its implications extend globally. China, being the second-largest economy in the world, plays a vital role in international trade dynamics. Any changes to trade agreements between the U.S. and China can trigger ripple effects felt across various economies worldwide. Increased stability in trade relations is expected to alleviate uncertainties that have previously hampered investor confidence, fostering a more conducive environment for investment and growth.

Addressing Challenges Ahead

While the completion of the trade deal is undoubtedly a positive development, it’s essential to keep in mind that it is only one piece of a much larger economic puzzle. Both the U.S. and China still face numerous challenges, including geopolitical tensions, economic growth fluctuations, and the ongoing need for technological innovation. As we move forward, monitoring the implementation of this trade deal and its broader economic impact will be crucial.

The Road Ahead: What to Watch For

As we look ahead, the focus will be on how this trade agreement unfolds and its long-term effects on both economies. While there may be challenges ahead, such as potential delays in implementation or disagreements over specific provisions, the overall sentiment remains optimistic. Stakeholders will be keen to see how the deal shapes trade policies moving forward and what new opportunities arise from this agreement.

Conclusion: A Step Towards Economic Stability

The announcement of the trump trade deal with China being finalized is a significant milestone that signals a positive shift in U.S.-China relations. The bullish sentiment surrounding this agreement indicates a renewed investor confidence, paving the way for potential market growth and stability. As details continue to unfold, market participants will be closely monitoring the implications and opportunities that arise from this critical agreement.

BREAKING:

PRESIDENT trump SAID THE

TRADE DEAL WITH CHINA IS DONE.BULLISH FOR THE MARKETS pic.twitter.com/n0Boc7qUYr

— Ash Crypto (@Ashcryptoreal) June 11, 2025

With this exciting news, traders and investors alike are poised for what could be a significant market boost. The trump trade deal with China is more than just an agreement; it’s a potential turning point for the global economy.