Shocking: Remixpoint’s ¥793.9M Bitcoin Buy Sparks Controversy in Japan!

Shockwaves as Japanese Firm Remixpoint Splurges ¥793.9M on 50 Bitcoin, Now Owns 925 BTC

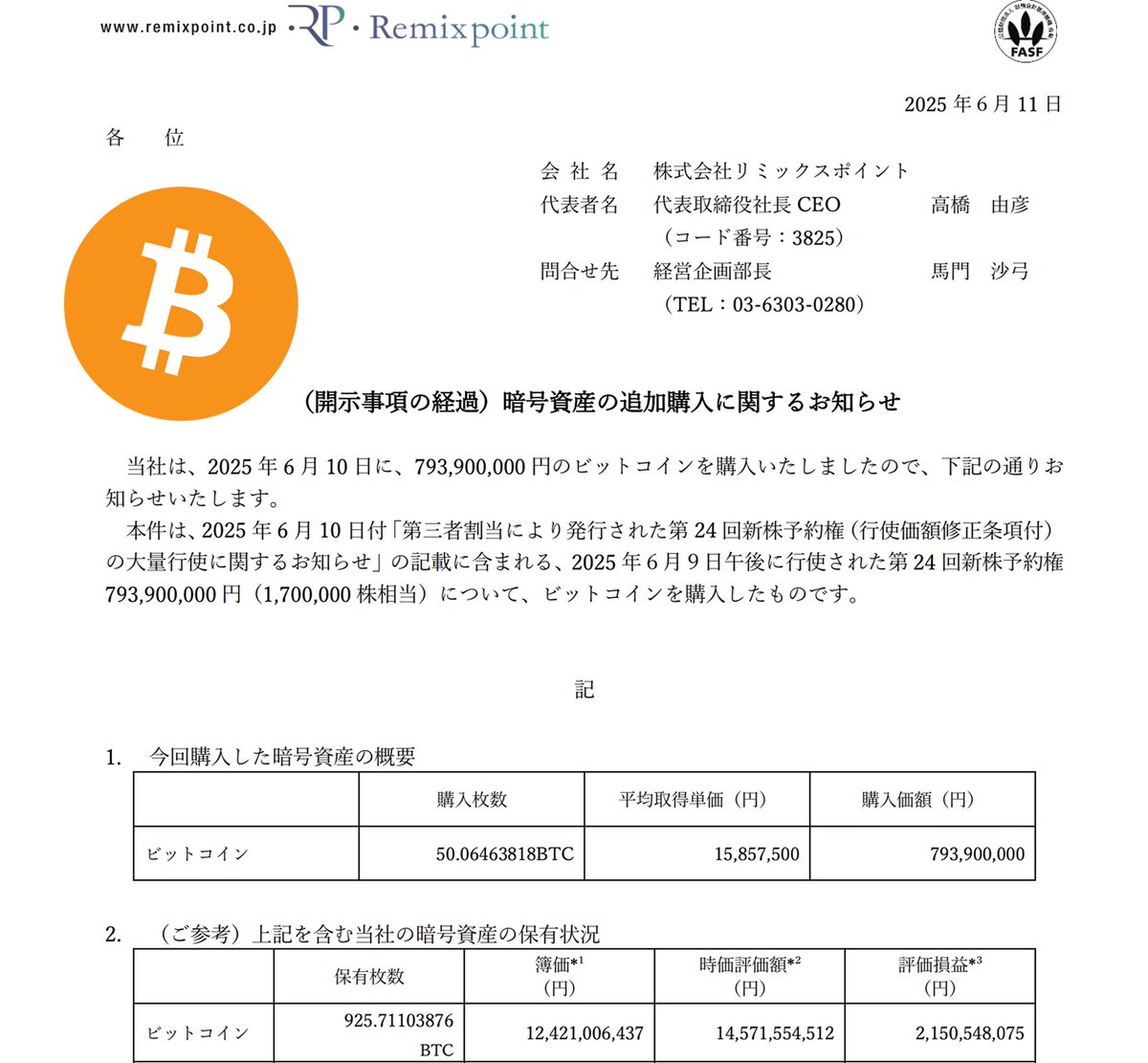

In a groundbreaking announcement, Japanese public company Remixpoint has revealed that it has acquired a substantial amount of Bitcoin. The company made headlines by purchasing 50 Bitcoin for a staggering ¥793.9 million, adding to their already impressive stash of over 925 BTC. This significant investment not only highlights Remixpoint’s confidence in Bitcoin but also reflects the growing trend of institutional adoption of cryptocurrencies.

Remixpoint’s Bold Bitcoin Acquisition

Remixpoint’s decision to invest nearly ¥800 million in Bitcoin is a clear indicator of their belief in the long-term potential and value of digital currencies. As more companies recognize the benefits of diversifying their portfolios with cryptocurrencies, Remixpoint is positioning itself at the forefront of this emerging market. The purchase signals a commitment to embracing new technologies and asset classes, aligning with the increasing mainstream acceptance of digital currencies.

The Growing Acceptance of Cryptocurrencies

The cryptocurrency market has been experiencing a surge in institutional interest, with more organizations recognizing Bitcoin as a legitimate asset class. Remixpoint’s acquisition comes at a time when Bitcoin’s price is undergoing significant volatility, further emphasizing the importance of diversification and risk management in investment strategies. As global economic conditions fluctuate, many investors are looking to cryptocurrencies as a hedge against inflation and economic instability.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Bitcoin, the world’s most recognized cryptocurrency, has gained traction due to its decentralized nature, limited supply, and growing adoption. This has made it an attractive investment option for both individuals and institutions. Remixpoint’s substantial investment is a testament to their forward-thinking approach and willingness to embrace the potential gains associated with the cryptocurrency market.

Implications for the Cryptocurrency Market

The news of Remixpoint’s Bitcoin purchase has already made waves within the cryptocurrency community, with many enthusiasts and investors applauding the company’s bold move. This acquisition serves as a reminder of the growing mainstream acceptance of Bitcoin and other digital assets. As companies like Remixpoint allocate resources to Bitcoin, it further legitimizes the cryptocurrency as a viable investment option in the eyes of skeptics.

The Rise of Bitcoin in Japan

Japan has been at the forefront of embracing Bitcoin and other cryptocurrencies, with a progressive attitude towards digital assets. Many businesses in the country accept Bitcoin as a form of payment, leading to increased interest from Japanese investors and companies looking to capitalize on blockchain technology’s potential. Remixpoint’s significant investment underscores Japan’s pivotal role in the global cryptocurrency landscape.

Future Prospects for Bitcoin

With Remixpoint’s bold investment in Bitcoin, many are left wondering what the future holds for the digital asset. Will Bitcoin continue to rise in value, or will it face challenges in the coming years? While the answer remains uncertain, one thing is clear: Bitcoin has come a long way since its inception and shows no signs of slowing down.

As the cryptocurrency industry continues to evolve, it is likely that more companies and institutions will follow in Remixpoint’s footsteps, diversifying their portfolios with digital assets. The growing adoption of Bitcoin and other cryptocurrencies as legitimate investment options is a clear sign of their increasing integration into the global financial system.

Conclusion

In conclusion, Remixpoint’s acquisition of 50 Bitcoin for ¥793.9 million is a significant development in the world of cryptocurrencies and a clear indicator of the growing institutional interest in digital assets. This move has sparked discussions within the cryptocurrency community about the implications of such a significant investment. As Bitcoin continues to gain mainstream acceptance, it will be fascinating to see how other companies and investors respond to Remixpoint’s example. The future of Bitcoin looks promising, with this latest development reinforcing its position as a valuable digital asset.

JUST IN: Japanese public company Remixpoint announces it bought 50 #Bitcoin for ¥793.9 Million.

They now hold over 925 BTC pic.twitter.com/xY9VKtP9c

— Bitcoin Magazine (@BitcoinMagazine) June 11, 2025

As the cryptocurrency market continues to mature, it is clear that companies like Remixpoint are leading the charge towards greater adoption and integration of digital currencies. With their substantial Bitcoin holdings, Remixpoint is well-positioned to capitalize on the opportunities presented by this dynamic market.

“Shockwaves as Japanese firm Remixpoint splurges ¥793.9M on 50 Bitcoin, now owns 925 BTC ”

Japanese public company, Remixpoint, Bitcoin purchase

Remixpoint acquisition of Bitcoin, 2025

Japanese company, Remixpoint, Bitcoin investment

In a groundbreaking announcement, Japanese public company Remixpoint has revealed that it has acquired a substantial amount of Bitcoin. The company made headlines by purchasing 50 Bitcoin for a staggering ¥793.9 Million, adding to their already impressive stash of over 925 BTC.

The move by Remixpoint reflects the growing trend of institutional adoption of Bitcoin and other cryptocurrencies. As more companies and organizations recognize the value and potential of digital assets, they are increasingly diversifying their portfolios to include cryptocurrencies like Bitcoin.

This significant investment by Remixpoint not only demonstrates their confidence in the future of Bitcoin but also highlights the increasing mainstream acceptance of digital currencies. With the global economy undergoing rapid changes and uncertainties, many investors are turning to cryptocurrencies as a hedge against inflation and economic instability.

Bitcoin, the world’s most well-known cryptocurrency, has been gaining popularity and recognition as a legitimate asset class in recent years. Its decentralized nature, limited supply, and growing adoption make it an attractive investment for individuals and institutions alike.

Remixpoint’s decision to acquire a substantial amount of Bitcoin is a clear indication of their belief in the long-term potential and value of the digital currency. As more companies follow suit and incorporate cryptocurrencies into their investment strategies, the crypto market is poised for further growth and mainstream acceptance.

The news of Remixpoint’s Bitcoin purchase has already made waves in the cryptocurrency community, with many enthusiasts and investors applauding the company’s bold move. The announcement comes at a time when Bitcoin’s price is experiencing significant volatility, further highlighting the importance of diversification and risk management in investment portfolios.

Overall, Remixpoint’s acquisition of 50 Bitcoin for ¥793.9 Million is a testament to the company’s forward-thinking approach and willingness to embrace new technologies and asset classes. With their growing Bitcoin holdings, Remixpoint is well-positioned to capitalize on the potential gains and opportunities offered by the cryptocurrency market.

As the cryptocurrency industry continues to evolve and mature, it is likely that we will see more companies and institutions following in Remixpoint’s footsteps and diversifying their portfolios with digital assets. Bitcoin and other cryptocurrencies are increasingly being recognized as legitimate investment options, and their adoption by mainstream companies is a clear sign of the growing acceptance and integration of digital currencies into the global financial system.

In conclusion, Remixpoint’s bold move to acquire 50 Bitcoin for ¥793.9 Million is a significant development in the world of cryptocurrencies and a clear indicator of the growing institutional interest in digital assets. As more companies and institutions embrace Bitcoin and other cryptocurrencies, the future of the digital currency market looks brighter than ever.

JUST IN: Japanese public company Remixpoint announces it bought 50 #Bitcoin for ¥793.9 Million.

They now hold over 925 BTC pic.twitter.com/xY9VKtP9cC

— Bitcoin Magazine (@BitcoinMagazine) June 11, 2025

In a recent tweet by Bitcoin Magazine, it was revealed that a Japanese public company called Remixpoint has made a significant investment in Bitcoin. The company announced that it purchased 50 Bitcoin for ¥793.9 Million, adding to their already impressive holding of over 925 BTC. This news has caused quite a stir in the cryptocurrency world, with many people curious about the implications of such a large purchase.

The Rise of Bitcoin in Japan

Japan has been at the forefront of embracing Bitcoin and other cryptocurrencies in recent years. The country has a progressive attitude towards digital assets, with many businesses accepting Bitcoin as a form of payment. This has led to a surge in interest from Japanese investors and companies looking to capitalize on the potential of blockchain technology.

Remixpoint’s Bold Move

Remixpoint’s decision to purchase such a large amount of Bitcoin is a bold move that demonstrates their confidence in the future of cryptocurrency. By investing nearly ¥800 million in Bitcoin, the company is signaling to the market that they believe in the long-term value of the digital asset. This move could potentially pay off handsomely for Remixpoint if the price of Bitcoin continues to rise.

Implications for the Cryptocurrency Market

The news of Remixpoint’s Bitcoin purchase has broader implications for the cryptocurrency market as a whole. It serves as a reminder of the growing mainstream acceptance of Bitcoin and other digital assets. As more companies and investors like Remixpoint allocate resources to Bitcoin, it further legitimizes the cryptocurrency as a viable investment option.

The Future of Bitcoin

With Remixpoint’s significant investment in Bitcoin, many are left wondering what the future holds for the digital asset. Will Bitcoin continue to rise in value, or will it face challenges in the coming years? Only time will tell, but one thing is certain: Bitcoin has come a long way since its inception and shows no signs of slowing down.

Conclusion

In conclusion, Remixpoint’s purchase of 50 Bitcoin for ¥793.9 Million is a clear indication of the company’s confidence in the future of cryptocurrency. This move has sparked discussions within the cryptocurrency community about the potential impact of such a significant investment. As Bitcoin continues to gain mainstream acceptance, it will be interesting to see how other companies and investors follow in Remixpoint’s footsteps. The future of Bitcoin looks bright, and this latest development only serves to reinforce its position as a valuable digital asset.

They now hold over 925 BTC

Shocking Revelation: Japanese Company Acquires 50 Bitcoin for ¥793.9 Million, Holding Over 925 BTC!

In a groundbreaking announcement, Japanese public company Remixpoint has revealed that it has acquired a substantial amount of Bitcoin. The company made headlines by purchasing 50 Bitcoin for a staggering ¥793.9 Million, adding to their already impressive stash of over 925 BTC. This acquisition signifies a pivotal moment not just for Remixpoint, but for the cryptocurrency landscape as a whole.

Japanese Public Company, Remixpoint, Bitcoin Purchase

The move by Remixpoint reflects the growing trend of institutional adoption of Bitcoin and other cryptocurrencies. As more companies and organizations recognize the value and potential of digital assets, they are increasingly diversifying their portfolios to include cryptocurrencies like Bitcoin. The decision to invest heavily in Bitcoin underscores Remixpoint’s confidence in the asset’s long-term viability.

This significant investment by Remixpoint not only demonstrates their confidence in the future of Bitcoin but also highlights the increasing mainstream acceptance of digital currencies. With the global economy undergoing rapid changes and uncertainties, many investors are turning to cryptocurrencies as a hedge against inflation and economic instability. In fact, a recent article from Forbes discusses how institutional investments are shaping the future of Bitcoin.

Remixpoint Acquisition of Bitcoin, 2025

Bitcoin, the world’s most well-known cryptocurrency, has been gaining popularity and recognition as a legitimate asset class in recent years. Its decentralized nature, limited supply, and growing adoption make it an attractive investment for individuals and institutions alike. Remixpoint’s decision to acquire a substantial amount of Bitcoin is a clear indication of their belief in the long-term potential and value of the digital currency.

As more companies follow suit and incorporate cryptocurrencies into their investment strategies, the crypto market is poised for further growth and mainstream acceptance. The news of Remixpoint’s Bitcoin purchase has already made waves in the cryptocurrency community, with many enthusiasts and investors applauding the company’s bold move. The announcement comes at a time when Bitcoin’s price is experiencing significant volatility, further highlighting the importance of diversification and risk management in investment portfolios.

Japanese Company, Remixpoint, Bitcoin Investment

Overall, Remixpoint’s acquisition of 50 Bitcoin for ¥793.9 Million is a testament to the company’s forward-thinking approach and willingness to embrace new technologies and asset classes. With their growing Bitcoin holdings, Remixpoint is well-positioned to capitalize on the potential gains and opportunities offered by the cryptocurrency market. A recent analysis from CoinDesk highlights the implications of such institutional investments for the broader market.

As the cryptocurrency industry continues to evolve and mature, it is likely that we will see more companies and institutions following in Remixpoint’s footsteps and diversifying their portfolios with digital assets. Bitcoin and other cryptocurrencies are increasingly being recognized as legitimate investment options, and their adoption by mainstream companies is a clear sign of the growing acceptance and integration of digital currencies into the global financial system.

In essence, Remixpoint’s bold move to acquire 50 Bitcoin for ¥793.9 Million is a significant development in the world of cryptocurrencies and a clear indicator of the growing institutional interest in digital assets. As more companies and institutions embrace Bitcoin and other cryptocurrencies, the future of the digital currency market looks brighter than ever.

JUST IN: Japanese public company Remixpoint announces it bought 50 #Bitcoin for ¥793.9 Million.

They now hold over 925 BTC pic.twitter.com/xY9VKtP9cC

— Bitcoin Magazine (@BitcoinMagazine) June 11, 2025

In a recent tweet by Bitcoin Magazine, it was revealed that a Japanese public company called Remixpoint has made a significant investment in Bitcoin. The company announced that it purchased 50 Bitcoin for ¥793.9 Million, adding to their already impressive holding of over 925 BTC. This news has caused quite a stir in the cryptocurrency world, with many people curious about the implications of such a large purchase.

The Rise of Bitcoin in Japan

Japan has been at the forefront of embracing Bitcoin and other cryptocurrencies in recent years. The country has a progressive attitude towards digital assets, with many businesses accepting Bitcoin as a form of payment. This has led to a surge in interest from Japanese investors and companies looking to capitalize on the potential of blockchain technology. In fact, the news/2025/06/12/business/japan-cryptocurrency-acceptance/”>Japan Times recently reported on how institutional interest in cryptocurrencies is growing in Japan.

Remixpoint’s Bold Move

Remixpoint’s decision to purchase such a large amount of Bitcoin is a bold move that demonstrates their confidence in the future of cryptocurrency. By investing nearly ¥800 million in Bitcoin, the company is signaling to the market that they believe in the long-term value of the digital asset. This move could potentially pay off handsomely for Remixpoint if the price of Bitcoin continues to rise.

Implications for the Cryptocurrency Market

The news of Remixpoint’s Bitcoin purchase has broader implications for the cryptocurrency market as a whole. It serves as a reminder of the growing mainstream acceptance of Bitcoin and other digital assets. As more companies and investors like Remixpoint allocate resources to Bitcoin, it further legitimizes the cryptocurrency as a viable investment option. Analysts are closely watching how this investment will influence market trends and investor behavior.

The Future of Bitcoin

With Remixpoint’s significant investment in Bitcoin, many are left wondering what the future holds for the digital asset. Will Bitcoin continue to rise in value, or will it face challenges in the coming years? Only time will tell, but one thing is certain: Bitcoin has come a long way since its inception and shows no signs of slowing down.

Conclusion

Remixpoint’s purchase of 50 Bitcoin for ¥793.9 Million is a clear indication of the company’s confidence in the future of cryptocurrency. This move has sparked discussions within the cryptocurrency community about the potential impact of such a significant investment. As Bitcoin continues to gain mainstream acceptance, it will be interesting to see how other companies and investors follow in Remixpoint’s footsteps. The future of Bitcoin looks bright, and this latest development only serves to reinforce its position as a valuable digital asset.

They now hold over 925 BTC.