Bank of New York Mellon’s Ties to Iran’s IRGC Spark Outrage!

The Bank of New York Mellon and MTN Group: A Controversial Connection

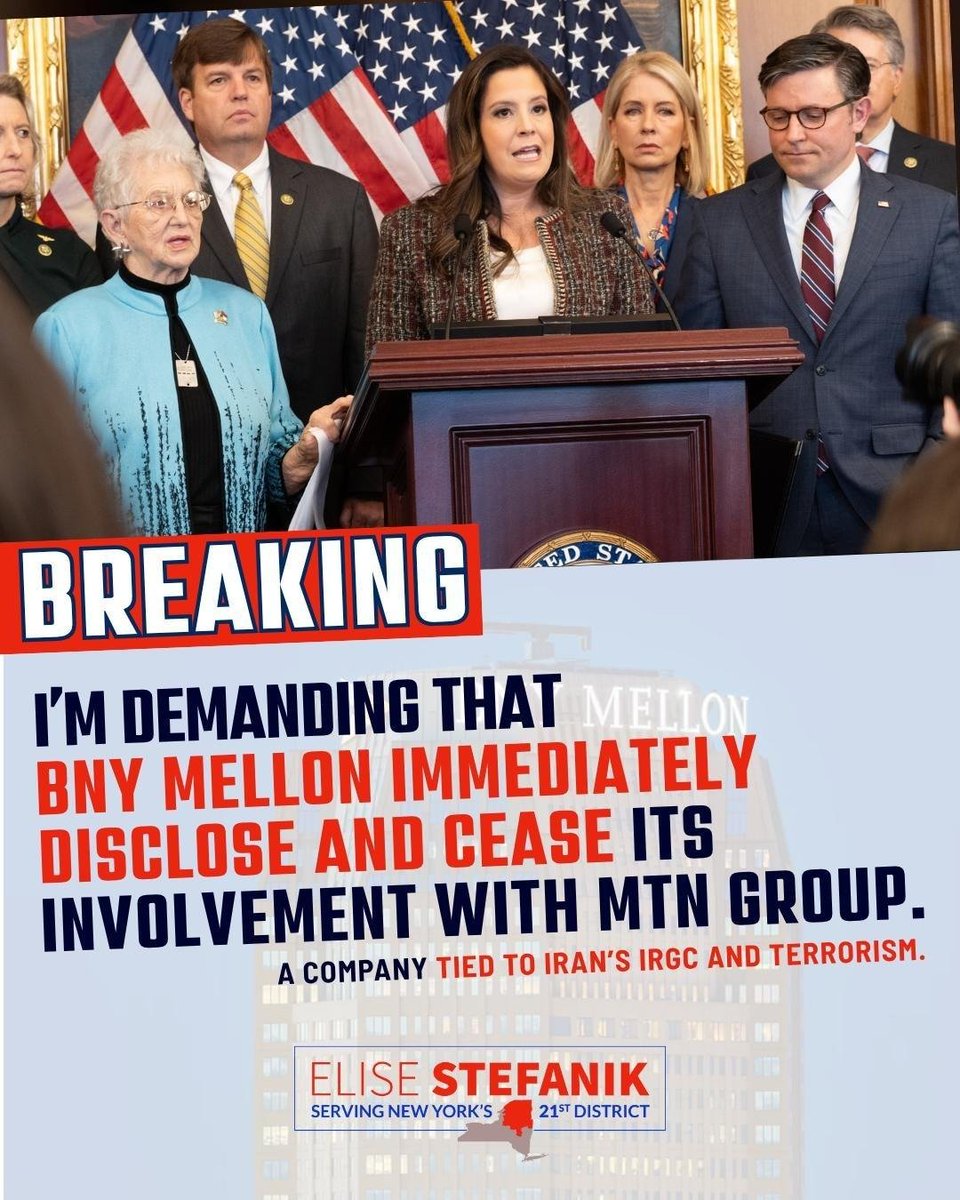

On June 11, 2025, Rep. Elise Stefanik raised significant concerns regarding the Bank of New York Mellon’s (BNY Mellon) sponsorship of MTN Group, a telecommunications company with a controversial background linked to Iran’s Islamic Revolutionary Guard Corps (IRGC) and terrorism against Americans. This revelation has sparked a debate over financial institutions’ responsibility in dealing with companies that have connections to entities involved in global terrorism.

Understanding the Controversy

Background on MTN Group

MTN Group, a major telecommunications provider in Africa and the Middle East, owns a 49% stake in Iran Cell, the telecommunications operator within Iran. This connection has raised alarms due to Iran’s long-standing reputation for supporting terrorism and being involved in activities that have led to the loss of American lives. The IRGC is known for its role in orchestrating terrorist activities and has been designated as a terrorist organization by several countries, including the United States.

The Call for Accountability

Rep. Stefanik’s call for the Bank of New York Mellon to "come clean" is rooted in the need for transparency and accountability from financial institutions. As one of the largest banks in the U.S., BNY Mellon plays a critical role in global finance, and its partnerships can significantly impact international relations and security. The concern is that by sponsoring a company like MTN Group, BNY Mellon may inadvertently be supporting activities that undermine American safety and interests.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Implications of the Connection

The implications of BNY Mellon’s sponsorship of MTN Group extend beyond financial concerns. They raise ethical questions about the responsibilities of banks and financial institutions in evaluating their partnerships. Financial institutions are expected to perform due diligence and adhere to regulations regarding associations with companies that may be tied to terrorism or other illegal activities.

The Broader Context of Financial Institutions and Terrorism

The Role of Due Diligence

Due diligence is a critical process for banks and financial institutions. It involves thoroughly investigating potential partners and clients to ensure they do not have links to illegal activities or organizations. In today’s interconnected world, the stakes are higher than ever, as financial transactions can inadvertently support terrorism or other harmful activities.

Regulatory Frameworks

In the United States, several laws and regulations aim to prevent financial institutions from engaging with companies linked to terrorism. The USA PATRIOT Act and the Bank Secrecy Act impose strict requirements on banks to monitor transactions and report suspicious activities. Failure to comply with these regulations can result in severe penalties, including fines and reputational damage.

The Importance of Corporate Responsibility

Corporate responsibility is becoming increasingly important in today’s business environment. Consumers and investors are more aware of the ethical implications of their choices, and they expect companies to be transparent about their operations. Financial institutions, in particular, are under scrutiny to ensure that they do not support activities that could harm society.

What’s Next for BNY Mellon?

Calls for Action

In light of Rep. Stefanik’s statements, there is a growing call for BNY Mellon to reassess its relationship with MTN Group. Stakeholders, including investors, customers, and the public, are demanding clarity on the bank’s stance regarding its sponsorship and the potential implications of its partnership with a company tied to terrorism.

Potential Impact on BNY Mellon’s Reputation

The controversy surrounding BNY Mellon’s involvement with MTN Group could have significant repercussions for the bank’s reputation. In an era where corporate responsibility is paramount, any association with terrorism-related entities can lead to a loss of trust among clients and the public. This could ultimately impact the bank’s bottom line and future business opportunities.

A Shift in Financial Practices?

The situation may prompt BNY Mellon and other financial institutions to reevaluate their practices regarding due diligence and risk assessment. As awareness of the consequences of financial partnerships grows, banks may implement stricter guidelines to ensure they do not inadvertently support organizations linked to terrorism.

Conclusion

The connection between the Bank of New York Mellon and MTN Group raises important questions about the responsibilities of financial institutions in today’s global landscape. With Rep. Elise Stefanik’s call for accountability, the spotlight is on BNY Mellon to clarify its role and ensure it upholds the highest standards of corporate responsibility. As the debate unfolds, it serves as a critical reminder of the interconnectedness of finance, ethics, and international security in an increasingly complex world.

This situation emphasizes the need for financial institutions to engage in thorough due diligence, adhere to regulatory frameworks, and maintain transparency in their operations. By doing so, they can better protect their reputations and contribute to a safer and more secure global environment.

The Bank of New York Mellon must come clean over its sponsorship of MTN Group—a company tied to Iran’s IRGC and terrorism against Americans. MTN owns 49% stake in Iran Cell which has direct links to attacks that killed Americans.

As a result, I demand Bank of New York Mellon… pic.twitter.com/Yi0aO8Od1R

— Rep. Elise Stefanik (@RepStefanik) June 11, 2025

The Bank of New York Mellon must come clean over its sponsorship of MTN Group—a company tied to Iran’s IRGC and terrorism against Americans.

In recent times, the financial world has witnessed increasing scrutiny over corporate affiliations, especially when they involve sensitive geopolitical matters. A notable example is the call for transparency directed at The Bank of New York Mellon regarding its sponsorship of MTN Group. This telecommunications giant is not just any company; it has a significant stake in activities that have serious implications for international security and American lives.

MTN owns 49% stake in Iran Cell which has direct links to attacks that killed Americans.

Understanding the implications of MTN Group’s operations requires diving into its ownership structure. With a 49% stake in Iran Cell, MTN Group is not just a passive investor. It is a major player in a market that is often criticized for its ties to the Islamic Revolutionary Guard Corps (IRGC). The IRGC has a notorious reputation for its involvement in activities that threaten global security, including direct links to terrorism that has tragically resulted in the loss of American lives.

The connections between MTN, Iran Cell, and the IRGC raise serious questions about the ethical responsibilities of corporations operating in volatile regions. It’s not just about profits anymore; it’s about the moral implications of doing business where human rights and global security are at stake.

As a result, I demand Bank of New York Mellon…

This is where public figures, like Rep. Elise Stefanik, step into the spotlight, demanding accountability from major financial institutions. The demand for The Bank of New York Mellon to “come clean” reflects a growing sentiment that corporate transparency is not just a nice-to-have but a necessity, especially when it comes to investments that could potentially fund terrorism.

The call to action is clear. If corporations like The Bank of New York Mellon are willing to engage with companies that have ties to organizations like the IRGC, they owe it to the public to disclose the nature of these relationships. Transparency can serve as a powerful tool in combating the complex web of financial dealings that can inadvertently support terrorism.

The Implications of Corporate Sponsorship

Corporate sponsorship in sensitive areas can have far-reaching effects. It raises questions not only about financial ethics but also about the broader impacts on society and national security. When companies align themselves with entities that have dubious backgrounds, they risk not only their reputations but also the safety and well-being of citizens.

Furthermore, financial institutions often play a crucial role in shaping the landscape of international relations. By sponsoring organizations tied to controversial governments or militant groups, they can inadvertently contribute to the perpetuation of conflict and instability. This is why the demand for accountability is so critical.

The Role of Investors and Stakeholders

Investors and stakeholders are increasingly aware of the impact of their investments. They want to know that their money isn’t inadvertently supporting terrorism or human rights abuses. This growing awareness is pushing companies to adopt more stringent ethical standards and practices.

For The Bank of New York Mellon, this means not just addressing the concerns raised by politicians like Rep. Stefanik but also ensuring that they have robust policies in place to vet their sponsorships and investments. This includes a thorough understanding of the companies they associate with, particularly in regions known for instability and human rights violations.

Public Awareness and Advocacy

The role of public advocacy in this situation cannot be understated. Organizations and individuals who raise awareness about the implications of corporate sponsorship can help hold companies accountable. Social media platforms, like Twitter, have become powerful tools for advocacy, allowing voices like Rep. Stefanik’s to reach a broad audience quickly.

As the public becomes more informed about the connections between financial institutions and controversial companies, the pressure on these institutions to act responsibly will only increase. This is a positive development in the pursuit of corporate accountability.

What’s Next for The Bank of New York Mellon?

The Bank of New York Mellon is now faced with a critical juncture. The demand for transparency regarding its sponsorship of MTN Group and connections to the IRGC is forcing the institution to reevaluate its business practices. This could lead to a comprehensive review of their partnerships and sponsorships, ensuring they align with ethical standards that prioritize human rights and global security.

Moreover, as more stakeholders express their concerns, the bank may find it necessary to adopt more rigorous due diligence processes. This could include assessing the reputations and backgrounds of the companies they plan to invest in or support, especially those operating in high-risk regions.

The Importance of Ethical Investment

In an increasingly interconnected world, ethical investment is becoming a priority for many individuals and organizations. The Bank of New York Mellon, along with other financial institutions, must recognize that their investment choices can dramatically impact global affairs. By choosing to disengage from companies with ties to terrorism or oppressive regimes, they can contribute to a more stable and secure world.

Ultimately, the push for transparency isn’t just about one bank or one sponsorship; it’s about setting a precedent for financial institutions everywhere. By demanding accountability, stakeholders are not only advocating for ethical business practices but also extending their influence to create a safer and more just society.

Conclusion: The Path Forward

The Bank of New York Mellon is at a crucial crossroads, with demands for clarity and accountability ringing loud and clear. As they navigate the complexities of their sponsorships and investments, the spotlight will remain on them. Will they choose to embrace transparency and ethical responsibility, or will they continue to operate in the shadows of corporate sponsorships that could potentially support terrorism?

As citizens, investors, and advocates, it’s our responsibility to keep the pressure on and demand that corporations like The Bank of New York Mellon prioritize ethical practices over profit margins. The stakes are high, and the consequences of inaction could be dire.