Bank of New York Mellon Exposed for Ties to Iran’s Terrorism!

The Controversy Surrounding BNY Mellon’s Sponsorship of MTN Group

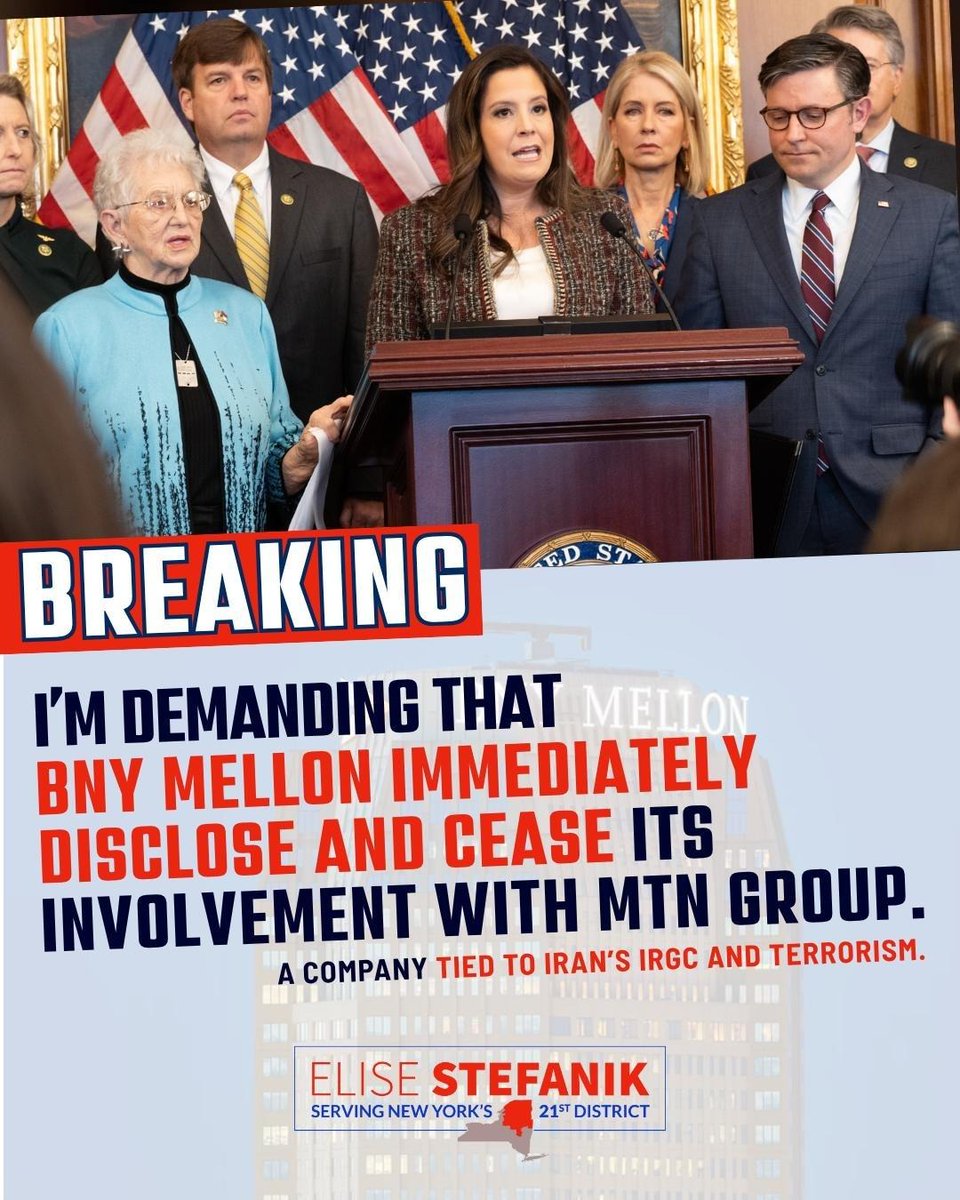

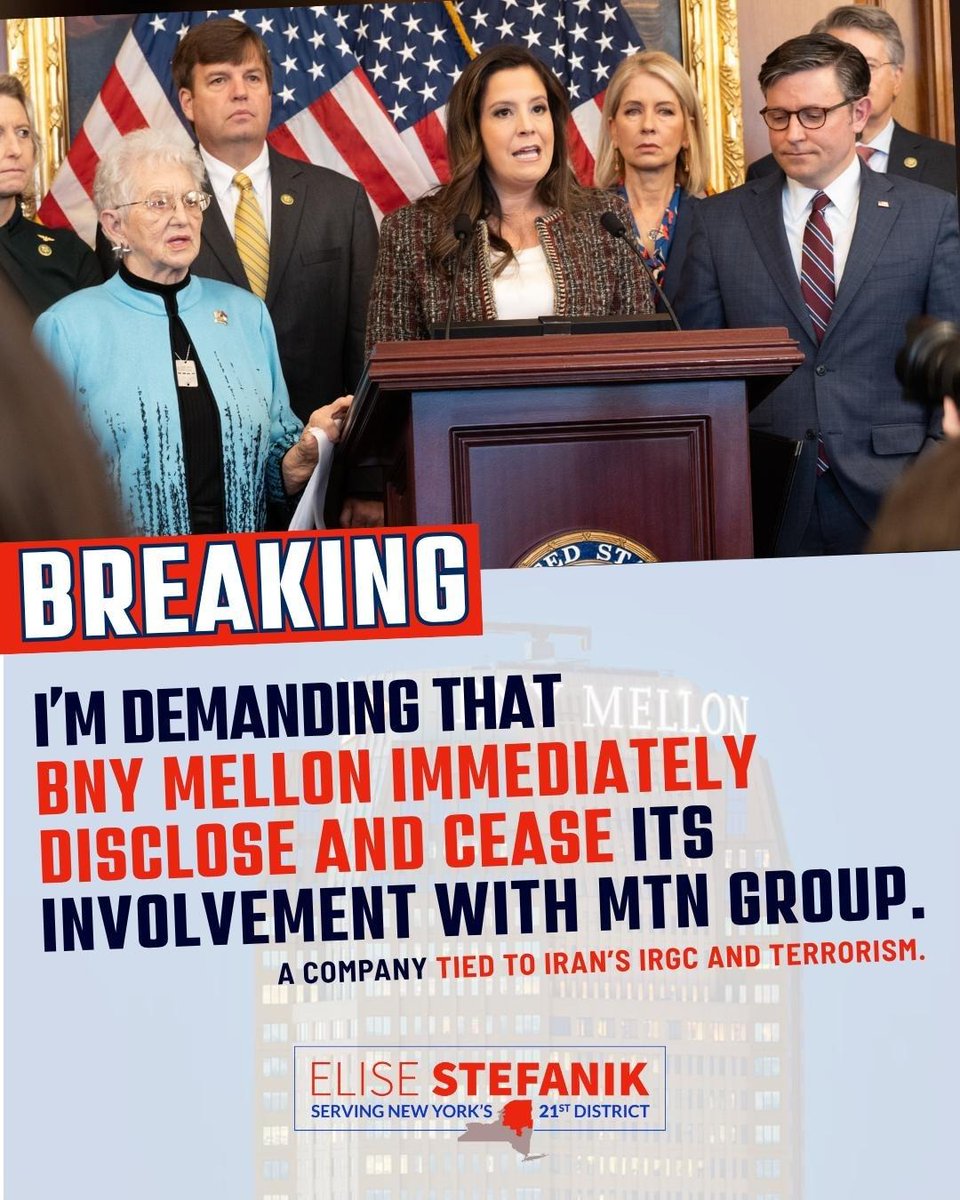

In a recent tweet by Representative Elise Stefanik, significant concerns were raised regarding the Bank of New York Mellon’s (BNY Mellon) sponsorship of MTN Group. This controversy highlights the complex interplay between financial institutions and global corporate partnerships, particularly when those partnerships involve companies with controversial ties. As the political landscape continues to evolve, the implications of such affiliations cannot be understated.

Understanding the Connection to Iran

MTN Group, a prominent telecommunications company, has garnered attention due to its substantial 49% stake in Iran Cell. This connection has raised alarms because Iran Cell is reported to have links to the Islamic Revolutionary Guard Corps (IRGC), a branch of Iran’s armed forces known for its involvement in various acts of terrorism, including those targeting Americans. The IRGC has been designated by the U.S. government as a terrorist organization, which adds layers of complexity to BNY Mellon’s financial involvement with MTN Group.

The Financial Implications

BNY Mellon, as a major financial institution, plays a crucial role in managing assets and facilitating transactions worldwide. The bank’s sponsorship of a company with ties to an organization designated as a terrorist entity raises ethical questions about corporate responsibility and financial accountability. Stakeholders, investors, and the general public are increasingly wary of how their financial institutions align themselves with companies that may undermine national security.

Calls for Transparency

Rep. Elise Stefanik’s demands for BNY Mellon to "come clean" about its sponsorship of MTN Group reflect a broader call for transparency in corporate governance. In an era where information is readily available, organizations are expected to disclose their affiliations and the potential risks associated with them. This is particularly pertinent when those affiliations could implicate them in activities that contravene U.S. laws or public sentiment.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Impact on Public Perception

The implications of this controversy extend beyond financial transactions. Public perception of BNY Mellon could be significantly affected by its involvement with MTN Group. Consumers and investors are increasingly prioritizing ethical considerations in their financial decisions. A bank perceived as being associated with terrorism or human rights violations could face backlash, leading to a decline in customer trust and potential financial repercussions.

Legislative Action and Accountability

In response to these concerns, it is likely that there will be increased scrutiny from lawmakers and regulatory bodies regarding the financial relationships between U.S. banks and foreign companies with questionable ties. This could lead to new legislation aimed at ensuring greater accountability from financial institutions. Lawmakers like Rep. Stefanik may push for stricter regulations that require banks to conduct thorough due diligence before entering into sponsorships or partnerships with foreign entities.

The Global Financial Landscape

The situation with BNY Mellon and MTN Group underscores the challenges faced by financial institutions operating in a globalized economy. As banks expand their reach into emerging markets, they must navigate a complex web of regulations, cultural differences, and ethical considerations. The balance between pursuing profitable partnerships and maintaining a strong ethical stance becomes increasingly challenging, especially in regions where political stability is tenuous.

Conclusion: A Call for Ethical Banking Practices

As the controversy surrounding BNY Mellon’s sponsorship of MTN Group unfolds, it serves as a critical reminder of the need for ethical banking practices and corporate responsibility. Financial institutions must be vigilant in their partnerships, ensuring that they do not inadvertently support organizations involved in terrorism or other unethical activities. The call for transparency and accountability is not just a political issue; it is a fundamental aspect of maintaining trust in the financial system.

In a world where consumers are more informed and engaged than ever, banks that prioritize ethical considerations in their operations will likely fare better in the long run. As this situation develops, the eyes of stakeholders will remain focused on BNY Mellon, awaiting clarity on its affiliations and the steps it will take to address these pressing concerns.

The Bank of New York Mellon must come clean over its sponsorship of MTN Group—a company tied to Iran’s IRGC and terrorism against Americans. MTN’s owns 49% stake in Iran Cell which has direct links to attacks that killed Americans.

As a result, I demand Bank of New York Mellon… pic.twitter.com/HugCj91dLJ

— Rep. Elise Stefanik (@RepStefanik) June 11, 2025

The Bank of New York Mellon must come clean over its sponsorship of MTN Group—a company tied to Iran’s IRGC and terrorism against Americans.

In recent times, there’s been a surge of concern surrounding the financial activities of major institutions. One such institution, the Bank of New York Mellon (BNY Mellon), has come under scrutiny due to its sponsorship of MTN Group. This isn’t just corporate chatter; it’s a serious issue that ties into broader questions about ethics, accountability, and national security. MTN Group holds a 49% stake in Iran Cell, which has been linked to the Iranian Revolutionary Guard Corps (IRGC) and has connections to violence that has directly impacted Americans.

MTN’s ownership of Iran Cell and its implications

When we talk about MTN Group owning a significant stake in Iran Cell, it’s crucial to understand what that really means. Iran Cell is not just another telecom company; it’s a key player in Iran’s telecommunications sector. This relationship raises eyebrows, especially when you consider the IRGC’s notorious reputation for involvement in terrorist activities. The Reuters report highlights how the IRGC has been linked to various attacks that have claimed American lives. So, when BNY Mellon associates itself with MTN Group, it’s not merely a business decision; it has far-reaching implications.

Why should BNY Mellon come clean?

There’s a pressing need for transparency. Rep. Elise Stefanik has called for BNY Mellon to “come clean” regarding its sponsorship of MTN Group. This isn’t just political posturing; it’s about holding a financial giant accountable for its associations. When a major bank is linked to entities that have ties to organizations known for terrorism, it raises serious ethical questions. How can BNY Mellon justify its sponsorship of a company that is indirectly linked to violence against Americans? The public deserves answers.

The risks of corporate sponsorships

Corporate sponsorships should ideally promote positive values and contribute to societal well-being. However, BNY Mellon’s association with MTN Group reveals a stark contrast to this ideal. The bank’s decision to support a company tied to the IRGC brings up issues of morality and responsibility in the corporate world. It’s essential to ask: what message does this send to the American people? Are financial institutions willing to overlook ethical considerations for profit? This kind of corporate behavior can erode public trust, and trust is paramount in the banking sector.

The implications for investors

Investors are increasingly considering the ethical implications of their investments. With the growing awareness about corporate responsibility, BNY Mellon could face backlash from shareholders who may not want their money tied to a company with such questionable affiliations. Ethical investing is on the rise, and individuals are looking to support organizations that align with their values. If BNY Mellon does not address these concerns, it risks alienating a significant portion of its investor base.

Understanding the IRGC’s role

The IRGC is a powerful entity in Iran, known for its military and political influence. Its involvement in terrorism is well-documented, with numerous reports linking it to attacks against American interests. The C-SPAN clip illustrates the gravity of the IRGC’s operations and the potential risks they pose. By supporting companies like MTN Group, BNY Mellon may inadvertently be enabling these activities, raising further questions about its role in the global landscape.

The call for accountability

As concerns mount, the demand for accountability from BNY Mellon grows louder. Rep. Elise Stefanik’s statements highlight a broader sentiment that corporate giants must be held accountable for their actions. The relationship between BNY Mellon and MTN Group is not just a financial arrangement; it’s a matter of national security and ethical responsibility. The bank needs to clarify its position and the extent of its involvement with MTN Group.

What can be done?

So, what can BNY Mellon do to address these concerns? First and foremost, transparency is key. The bank should openly disclose its sponsorship details with MTN Group and provide context about its business decisions. Engaging with stakeholders, including investors and the public, can also help rebuild trust. Additionally, BNY Mellon could explore partnerships with companies that promote peace and stability rather than those with links to violence.

The future of corporate responsibility

The case of BNY Mellon and MTN Group serves as a crucial reminder about the importance of corporate responsibility. As consumers become more aware of the implications of corporate actions, financial institutions must adapt and prioritize ethical considerations in their business dealings. This trend is not just a passing phase; it’s a shift towards a more accountable corporate landscape.

Final thoughts on BNY Mellon and MTN Group

The situation involving BNY Mellon and MTN Group is complex, but it’s clear that the stakes are high. The intertwining of finance and ethics in this case underscores the need for transparency and accountability in the corporate world. As the narrative unfolds, it will be interesting to see how BNY Mellon responds to the growing calls for clarity and change. It’s a pivotal moment for not just the bank, but for the entire financial industry.

“`