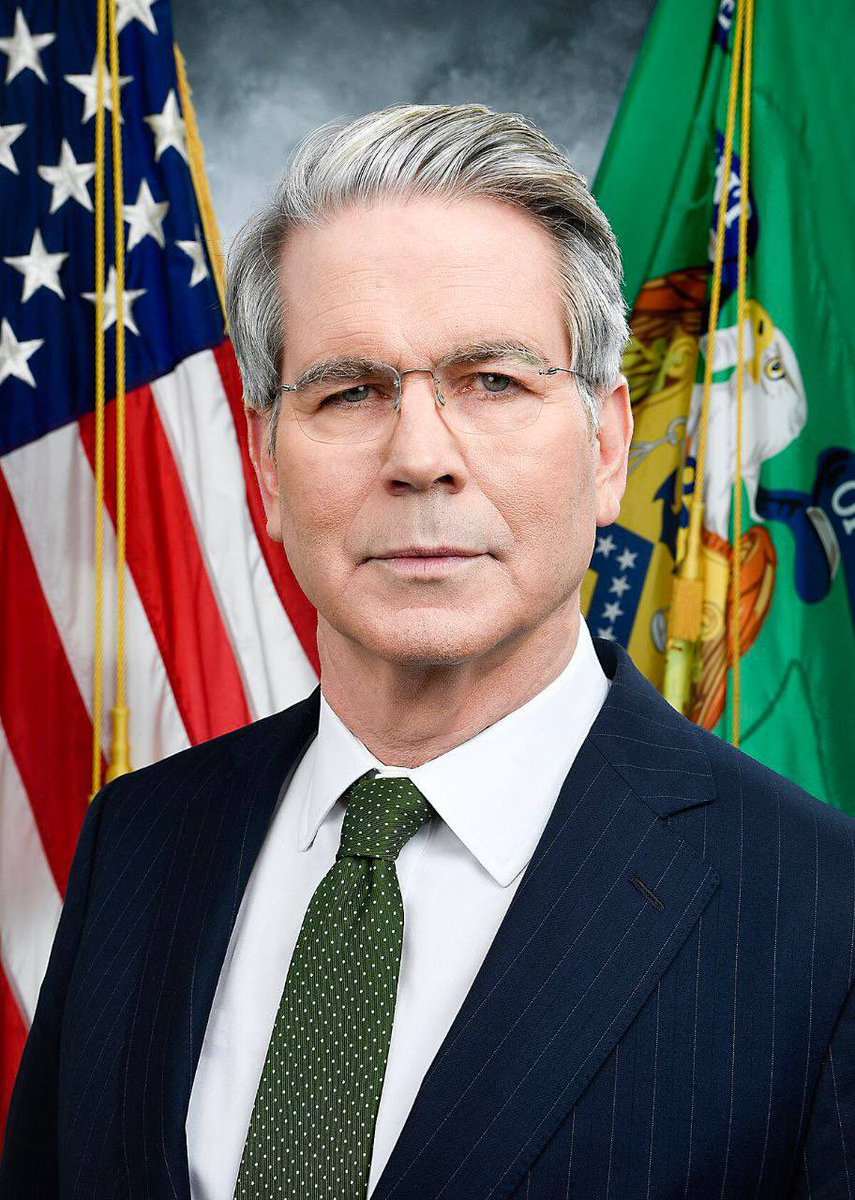

BREAKING: Scott Bessent’s Shocking Bid for Fed Chair Sparks Outrage!

Scott Bessent: Potential Candidate for Next Federal Reserve Chair

In a significant development within financial circles, Scott Bessent has emerged as a potential candidate for the next Chair of the Federal Reserve. This news was first reported by Bloomberg and shared on social media by Ash Crypto, generating considerable buzz among market analysts and investors alike. As discussions surrounding monetary policy and the economic outlook intensify, Bessent’s candidacy could have substantial implications for the future direction of U.S. economic policy.

Who is Scott Bessent?

Scott Bessent is a prominent figure in the finance industry, known for his extensive experience in investment management and macroeconomic analysis. He previously served as the Chief Investment officer for George Soros’ investment firm, Soros Fund Management, where he managed billions in assets. His background in global markets and deep understanding of economic dynamics position him as a knowledgeable candidate to lead the Federal Reserve, especially as the U.S. grapples with inflationary pressures and interest rate adjustments.

The Role of the Federal Reserve Chair

The Chair of the Federal Reserve plays a crucial role in shaping U.S. monetary policy. This position involves making key decisions on interest rates, controlling inflation, and overseeing the nation’s banking system. The Chair’s actions can significantly influence economic growth, employment, and financial stability in the country. As the U.S. faces various economic challenges, including rising inflation and potential recession, the selection of the next Fed Chair is more critical than ever.

Why Scott Bessent?

Bessent’s candidacy is notable for several reasons. First, his experience at Soros Fund Management has equipped him with a robust understanding of global markets and economic trends. His tenure there included navigating complex financial landscapes, which is essential for the Federal Reserve’s role in maintaining economic stability.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Second, Bessent has a reputation for applying a data-driven approach to investment decisions. This analytical mindset could translate well into the Fed’s policy-making process, allowing for more informed decisions based on economic indicators and market behavior.

Furthermore, Bessent is known for his views on the interplay between fiscal policy and monetary policy. His perspective on how these factors impact the economy could lead to innovative approaches in managing the U.S. economy during turbulent times.

Market Reactions to the News

The announcement regarding Scott Bessent being considered for the Fed Chair position has elicited a range of responses from market analysts and investors. Many view his potential appointment as a sign that the Federal Reserve may adopt a more proactive stance in addressing economic challenges. Investors are keenly observing how this could affect interest rates and monetary policy, particularly in light of ongoing inflation concerns.

Moreover, the financial markets tend to respond swiftly to news regarding the Federal Reserve, as the central bank’s decisions have direct implications for investment strategies and economic outlooks. As discussions around Bessent’s candidacy continue, market participants will likely remain vigilant, adjusting their positions based on emerging information.

The Importance of Leadership in Times of Economic Uncertainty

In times of economic uncertainty, strong leadership at the Federal Reserve becomes paramount. The next Chair will need to navigate complex issues such as inflation, employment rates, and global economic pressures. Bessent’s background in macroeconomic strategy may provide a steady hand in guiding the Fed through these challenges.

Leadership at the Fed also requires effective communication skills to convey policy decisions to the public and financial markets. A clear and transparent approach can help build trust and confidence in the Fed’s actions, which is crucial for maintaining economic stability.

The Future of the Federal Reserve

As potential candidates for the Federal Reserve Chair are discussed, the future of U.S. monetary policy remains a hot topic among economists and policymakers. The Fed’s decisions will have lasting impacts not only within the United States but also globally, given the interconnected nature of today’s economies.

Bessent’s candidacy represents a shift towards a possibly more analytical and pragmatic approach to monetary policy. If selected, he may prioritize data-driven decision-making and a nuanced understanding of global economic dynamics.

Conclusion

Scott Bessent’s consideration as a potential candidate for the next Federal Reserve Chair marks a significant moment in the ongoing discussion about U.S. monetary policy. His extensive background in finance and macroeconomic analysis positions him as a strong contender for a role that is critical in shaping the future of the U.S. economy. As the financial markets react to this news, all eyes will be on the Federal Reserve’s decision-makers, who hold the key to navigating through the complexities of the current economic landscape.

Investors, analysts, and policymakers alike are eager to see how Bessent’s potential leadership could influence monetary policy and the broader economic environment. The coming months will be pivotal as discussions unfold about the future of the Federal Reserve and its approach to addressing the pressing challenges facing the U.S. economy.

BREAKING:

SCOTT BESSENT IS BEING CONSIDERED AS POTENTIAL NEXT FED CHAIR CANDIDATE.

SOURCE: BBG pic.twitter.com/B1qIgkVj6j

— Ash Crypto (@Ashcryptoreal) June 10, 2025

BREAKING: Scott Bessent is Being Considered as Potential Next Fed Chair Candidate

In the ever-evolving landscape of U.S. economics, the buzz around Scott Bessent becoming the next Federal Reserve Chair is making waves. As reported by [Bloomberg](https://www.bloomberg.com), this news has sparked a flurry of discussions among economists, analysts, and investors alike. With the Federal Reserve playing such a crucial role in shaping monetary policy and influencing the economy, the appointment of a new chair can have significant implications for financial markets and everyday Americans.

Who is Scott Bessent?

Scott Bessent is not a stranger to the world of finance. He has built a robust career that includes impressive stints in both the public and private sectors. Bessent served as the Chief Investment officer for Soros Fund Management and has a strong background in economic strategy and portfolio management. His experience in these high-stakes roles has equipped him with the insights necessary to navigate the complexities of the U.S. economy.

Bessent’s expertise in macroeconomic trends and his forward-thinking approach make him a compelling candidate for the position of Fed Chair. But what does this potential appointment mean for the Federal Reserve and the broader economy?

The Role of the Federal Reserve Chair

The Federal Reserve Chair is a pivotal figure in the U.S. financial system. This role involves setting key interest rates, making decisions about monetary policy, and managing inflation. The chairperson’s decisions can lead to ripple effects that impact everything from mortgage rates to job growth.

With the economy facing uncertainties—such as fluctuating inflation rates, labor market shifts, and changes in consumer spending—the selection of a new chair could steer the Fed’s policies in a new direction. If Bessent steps into this role, his approach to these challenges will be closely scrutinized.

Potential Economic Implications

Bringing Scott Bessent into the Fed could signal a shift in how monetary policy is approached. His background suggests that he may favor a more dynamic and responsive strategy, which could be beneficial in addressing rapid economic changes. Should Bessent prioritize aggressive measures to combat inflation, we could see a rise in interest rates, which would subsequently affect borrowing costs for consumers and businesses.

Conversely, if his focus leans more toward stimulating economic growth, we might see more accommodative policies that could support job creation and increased spending. The implications of these decisions are profound, and they could shape the economic landscape for years to come.

Market Reactions to Bessent’s Potential Candidacy

As news of Scott Bessent being considered as the next Fed Chair spreads, market reactions are proving to be quite telling. Investors are keenly watching how this potential candidacy could influence stock prices, bond yields, and overall market sentiment. Typically, a change in Fed leadership can lead to volatility as market participants adjust their expectations based on the new chair’s likely policies.

Analysts have already begun speculating about how Bessent’s appointment might impact various sectors. For instance, sectors sensitive to interest rates, such as real estate and utilities, could react sharply if Bessent adopts a hawkish stance. Conversely, growth-oriented sectors may benefit if he leans toward a more dovish approach.

Comparing Bessent with Other Candidates

The conversation around potential Fed Chair candidates is not limited to Scott Bessent. Other names have floated around, including current Fed officials and economists with varying ideologies. Each candidate brings their own perspective and proposed strategies, making the selection process even more critical.

When comparing Bessent to others, it’s essential to consider their backgrounds and how those experiences shape their economic philosophies. For example, while some candidates may focus more on regulatory measures, Bessent could bring a more investment-focused viewpoint. This distinction could have significant ramifications for how the Fed approaches its dual mandate of maximizing employment and stabilizing prices.

Public Perception and Political Considerations

Public perception plays a vital role in the selection process for the Fed Chair. As the Federal Reserve operates independently from the government, public trust in its leadership is crucial. Scott Bessent’s reputation in the financial community could either bolster or hinder this trust, depending on how his past decisions are viewed.

Furthermore, political considerations cannot be overlooked. The appointment of the Fed Chair often reflects the current administration’s economic priorities. If Bessent is viewed as aligning with the administration’s goals, he may face a smoother confirmation process. However, if there are concerns about his policies from either side of the political aisle, it could complicate his path to the position.

The Future of the Federal Reserve Under Bessent

Looking ahead, the future of the Federal Reserve under Scott Bessent, should he be appointed, could be characterized by a blend of traditional monetary policy and innovative strategies to address modern economic challenges. With global markets becoming increasingly interconnected, the Fed’s role in international economics will also be vital.

Bessent’s experience in global markets could provide valuable insights into how U.S. monetary policy interacts with international economic trends. This perspective could be particularly relevant as the world navigates issues such as supply chain disruptions and geopolitical tensions.

Conclusion: What’s Next?

As discussions continue about Scott Bessent being considered as the next Fed Chair candidate, the ramifications for the economy and financial markets are profound. The economic landscape is ever-changing, and the selection of a new chair will undoubtedly leave a lasting impact on monetary policy and the broader economy.

With key decisions on the horizon, it’s essential for stakeholders—from individual investors to large institutions—to stay informed about developments regarding the Federal Reserve’s leadership. As we await further announcements, keeping an eye on Scott Bessent’s potential candidacy could provide critical insights into the future of U.S. monetary policy.

For those interested in following this story as it unfolds, you can keep up with the latest news on platforms like [Bloomberg](https://www.bloomberg.com) and other financial news outlets.