Trump Claims Inflation is Dead: Is Michigan Living in a Lie?

Understanding Inflation: A Real-World Perspective

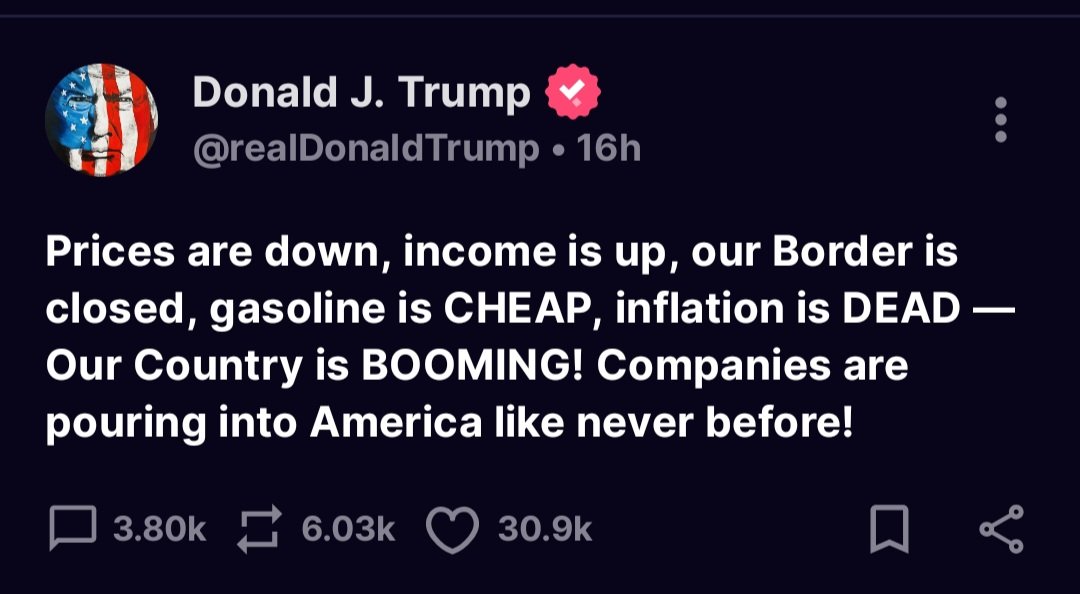

In recent discussions surrounding the economy, the topic of inflation has surfaced frequently, especially in the context of social media debates and political rhetoric. A recent tweet from Jesse Lynn highlights a profound question regarding the perception of inflation’s status across different regions, particularly in Michigan. The tweet expresses skepticism about claims that "inflation is dead," suggesting that many people are not experiencing this supposed reality in their everyday lives.

The Context of Inflation in the United States

Inflation, defined as the rate at which the general level of prices for goods and services rises, eroding purchasing power, has been a pressing issue for many Americans. The Federal Reserve aims to maintain a stable inflation rate, typically around 2% per year, to ensure economic stability and growth. However, recent years have witnessed fluctuations in inflation rates due to various factors, including supply chain disruptions, increased consumer demand post-pandemic, and geopolitical tensions.

The Discrepancy Between Political Narratives and Personal Experience

Jesse Lynn’s tweet encapsulates a growing frustration among individuals who feel disconnected from the political narrative surrounding inflation. While some political figures and media outlets assert that inflation is under control or even declining, many people, particularly in regions like Michigan, report experiencing rising costs in their daily lives. The tweet raises an essential question: Is inflation truly "dead," or is this merely a perception shaped by political agendas?

Regional Variations in Inflation

One of the critical aspects of understanding inflation is recognizing that its impact can vary significantly across different regions. For example, urban areas may experience different inflation rates compared to rural locations due to factors such as housing costs, availability of goods, and local economic conditions. In Michigan, residents have noted price increases in essential items like food, gas, and housing, leading to a sense of economic strain that contradicts the narrative of a declining inflation rate.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Emotional Toll of Economic Uncertainty

Inflation is not just a statistical measure; it has real consequences on people’s lives. The emotional toll of rising prices can lead to anxiety and frustration as individuals struggle to make ends meet. Jesse Lynn’s tweet reflects this sentiment, as she voices her concern that the economic situation in her area does not align with what is being reported. This disconnect can foster distrust in political leaders and economic institutions, leading to further polarization on economic issues.

Understanding Inflation Through Personal Stories

To truly grasp the impact of inflation, it’s essential to listen to personal stories from individuals across various demographics. For many, inflation affects their ability to save for the future, invest in education, or afford basic necessities. The stories shared by people like Jesse Lynn serve as a reminder that economic indicators, while important, do not always capture the full picture of people’s lived experiences.

The Role of Social Media in Economic Discourse

Social media platforms have become a vital space for individuals to share their experiences and opinions on economic issues. The immediacy of these platforms allows for real-time discussions, enabling people to voice their concerns and seek validation from others facing similar challenges. However, social media can also amplify misinformation and create echo chambers, making it essential for users to critically evaluate the information they encounter.

Conclusion: Bridging the Gap Between Perception and Reality

As the debate over inflation continues, it is crucial to bridge the gap between political narratives and the realities faced by everyday Americans. Engaging with personal experiences, like those shared by Jesse Lynn, can provide valuable insights into the ongoing economic challenges many individuals face. Policymakers and economic leaders must consider these voices to create effective strategies that address inflation and its impact on communities.

In summary, the discourse surrounding inflation is complex and multifaceted, influenced by regional differences, personal experiences, and political narratives. As we navigate this economic landscape, it is essential to foster open dialogues that encompass diverse perspectives and prioritize the needs of individuals struggling with the realities of inflation in their daily lives.

I have an honest question for everyone. I keep seeing all over social media and Trumps posts saying inflation is dead… Do any of you actually see that in real life or is Michigan just f*cked because inflation is not dead where I’m at. The real world. pic.twitter.com/YQavQSK0bc

— Jesse Lynn (@jesseRoss597206) June 7, 2025

I have an honest question for everyone. I keep seeing all over social media and trump‘s posts saying inflation is dead…

It’s a valid question, right? With the economy being such a hot topic lately, I can’t help but wonder how many folks out there are genuinely feeling the impact of inflation. It’s easy to scroll through social media and see all these posts claiming that inflation is a thing of the past. But then you step outside, and reality hits you like a ton of bricks. The cost of living seems to be climbing higher every day, and for many people, especially in places like Michigan, it feels far from dead.

Do any of you actually see that in real life or is Michigan just f*cked?

First off, let’s talk about Michigan. The state has its own unique economic landscape, and the people living there are experiencing inflation in ways that many others might not fully understand. Prices for essentials like groceries, gas, and housing are on the rise, and it’s hard to ignore the strain it puts on everyday life. So when someone like Jesse Lynn asks this question, it resonates with a lot of people. Michigan isn’t alone in feeling the pinch; many states are grappling with similar issues. Are you feeling it too?

The Real World: What Inflation Feels Like

For those who are skeptical of the claims that inflation is “dead,” it’s essential to look around and see what’s happening in your own community. Are you noticing prices going up at your local grocery store? Have your utility bills skyrocketed? Many people are finding it increasingly challenging to make ends meet. According to the Bureau of Labor Statistics, inflation rates have fluctuated, but the cost of living continues to rise, affecting everything from food to housing.

Social Media vs. Reality

Social media can sometimes create a bubble where perceptions don’t match reality. Influencers or public figures might post about how inflation is under control, but those statements can feel disconnected from the lives of everyday people. It’s easy to share statistics or opinions, but living through the consequences of rising prices is a different story. A simple trip to the supermarket can reveal just how much more you’re spending compared to a few months or even a year ago.

The Impact of Inflation on Daily Life

When we talk about inflation, we’re not just discussing numbers on a chart. We’re talking about real-life implications. For families, rising prices can mean cutting back on essentials. Maybe you’re skipping that family dinner out or reconsidering your grocery list to include more affordable options. It’s about prioritizing what you can afford. This is the reality that many people face, and it’s a struggle that shouldn’t be dismissed.

Where Are We Going? Understanding Economic Trends

Understanding the broader economic trends is crucial in this discussion. Inflation doesn’t exist in a vacuum; it’s influenced by a variety of factors, including supply chain disruptions, interest rates, and government policies. The Federal Reserve plays a significant role in managing inflation through monetary policy. When inflation starts to rise, they might increase interest rates to cool down spending. But how does that actually impact you and me? Higher interest rates can mean more expensive loans and credit, making it harder to finance a car or a home.

What Can We Do About It?

Feeling overwhelmed by inflation? You’re not alone. Many people are searching for ways to adapt to this new economic reality. One strategy is to create a budget that reflects your current financial situation. Prioritizing necessities and finding ways to save on non-essential items can help you stretch your dollars further. Additionally, consider shopping at local farmers’ markets or discount stores to find better deals on groceries.

Engaging in the Conversation

It’s crucial to engage in conversations about inflation and its impact on our lives. Sharing your experiences with friends and family can provide some much-needed support. It helps to know that others are feeling the same pressures, and together, you can brainstorm solutions or just vent about the frustrations of rising costs. Social media can be a powerful tool for connection, so don’t hesitate to share your own story like Jesse Lynn did. Your voice matters, and it can help others feel less alone.

Keeping an Eye on the Future

What does the future hold regarding inflation? It’s difficult to say, especially with so many variables at play. However, staying informed about economic trends and government policies can give us a better understanding of what to expect. Following reliable news sources and economic reports can help you stay ahead of the curve. If you know what’s coming, you can better prepare for it.

The Emotional Toll of Inflation

Let’s not overlook the emotional toll that inflation can take on individuals and families. Financial stress can lead to anxiety, frustration, and even depression. It’s essential to acknowledge these feelings and seek support if needed. Whether it’s talking to a friend, seeking professional help, or participating in community discussions, addressing the emotional side of financial pressure is just as important as managing the numbers.

Finding Community Solutions

Communities can come together to create solutions that address the impact of inflation. Local initiatives aimed at supporting families facing economic hardships can make a significant difference. Food banks, community gardens, and financial literacy programs can provide resources and assistance. Getting involved in local organizations can help you contribute to the collective effort to combat the effects of inflation and support those who are struggling.

What’s Next for Inflation?

Looking ahead, it’s essential to remain vigilant about inflation and its impact on our lives. The economy is constantly changing, and staying informed is crucial. While some may claim that inflation is dead, the reality for many is quite different. By continuing to have honest conversations about our experiences, we can better understand the challenges we face and work together towards solutions.

In Summary

So, the next time you see a post claiming inflation is dead, remember to take it with a grain of salt. Real life often tells a different story. People like Jesse Lynn are sharing their realities, and it’s important to listen. Whether you’re in Michigan or anywhere else, your experiences matter, and together we can navigate these turbulent economic waters. Remember, you’re not alone in this, and there’s strength in community and conversation.