Shocking Fiscal Performance Report: States Face Unprecedented Financial Crisis!

April 2025 Fiscal Crisis: Disturbing Trends in state Finances Revealed

The April 2025 Monthly Key Indicators report released by the Comptroller and Auditor General (CAG) has unveiled a troubling picture of state finances. This report is a critical tool for assessing the economic condition of the state and has raised alarm bells regarding rising fiscal deficits, declining revenue collections, and increased expenditures. As the government issued a press release on May 1st, it emphasized the urgency of addressing these financial issues to safeguard public services and maintain economic stability.

Overview of Key Indicators

The CAG’s report for April 2025 highlights several concerning metrics that have significant implications for the state’s financial health. The indicators revealed that the fiscal deficit has widened considerably, pointing to a government that is spending beyond its means. This situation raises questions about the sustainability of state finances and the ability to fund essential public services.

Rising Deficits

One of the most alarming revelations from the report is the substantial increase in the fiscal deficit. The deficit has expanded significantly compared to previous months, suggesting that the state is relying heavily on borrowing to finance its operations. This development not only threatens the fiscal health of the state but also raises concerns about the future of public services that depend on stable funding.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Declining Revenue Collections

In tandem with rising deficits, the report indicates a notable decline in revenue collections. The state has fallen short of its projected tax revenues, particularly in sales and income taxes, signaling a sluggish economic environment. This revenue shortfall underscores the urgent need for a diversified revenue base to ensure financial stability.

Increased Expenditure

While revenues are declining, state expenditures have surged. The government has increased spending on essential programs and services, including welfare and public services. Although this spending reflects a commitment to supporting citizens during challenging times, it may not be sustainable without adequate revenue streams. The growing expenditure adds another layer of urgency to the state’s financial crisis.

Implications for Public Services

The deteriorating financial situation poses significant risks to public services. As revenues decline and deficits rise, the government may be forced to make difficult decisions regarding service delivery. Essential services like education, healthcare, and infrastructure development could face budget cuts if the fiscal situation does not improve. The government’s ability to maintain and enhance these services is intricately linked to its financial health.

The Need for Fiscal Reforms

Given the alarming trends highlighted in the April report, there is an urgent need for fiscal reforms. Policymakers must focus on strategies to enhance revenue collection, diversify the tax base, and control expenditures. Implementing these reforms could stabilize the state’s financial outlook and ensure continued funding for essential services.

Stakeholder Reactions

The release of the Monthly Key Indicators has elicited responses from various stakeholders, including economists, policymakers, and the general public. Experts are calling for immediate action to address the fiscal distress and emphasize the importance of transparency in financial reporting. Public engagement in discussions about budget priorities is also deemed crucial for crafting effective solutions.

Government’s Response to Financial Distress

In response to the distressing financial figures, the government outlined a multi-faceted approach to tackle the fiscal challenges. Proposed measures include:

- Revenue Enhancement: The government aims to improve tax collection practices and close loopholes to increase overall revenue.

- Expenditure Reassessment: The state budget will be revisited to identify areas where expenditures can be curtailed without compromising essential services.

- Job Creation Initiatives: The government plans to focus on job creation through public-private partnerships, aiming to stimulate economic activity and reduce unemployment.

While these measures seem promising, their success will hinge on timely implementation and public cooperation. Citizens and businesses must contribute to tax revenues and support local economies.

The Impact on Citizens and Businesses

The implications of the April 2025 fiscal performance extend beyond government figures; they affect every citizen and business in the state. With rising unemployment and falling revenues, households may experience tighter budgets and diminished spending power. This could lead to a slowdown in local businesses, creating a feedback loop that exacerbates economic distress.

If the government opts to increase taxes or implement new fees to address the fiscal imbalance, this could further burden families and local enterprises. It is vital for stakeholders to stay informed and engaged as these developments unfold.

Looking Ahead: What Can Be Done?

Addressing the fiscal challenges highlighted by the April 2025 performance requires a collaborative approach. Here are some steps that could be beneficial:

- Public Awareness: Increasing awareness about the state’s financial health can lead to greater accountability from elected officials and encourage community participation in the budget process.

- Investment in Sustainable Growth: Focusing on sustainable economic growth strategies, such as green initiatives and technology-driven industries, can diversify the economy and create jobs.

- Strengthening Local Economies: Supporting local businesses through grants or low-interest loans can stimulate economic activity and create jobs, ultimately boosting state revenues.

Conclusion

The April 2025 fiscal performance presents a stark warning about the state’s financial health. With rising deficits, declining revenues, and increased expenditures, the situation demands urgent attention and decisive action. Stakeholders must collaborate to address these challenges and work toward a sustainable fiscal future. Without significant reforms and a commitment to responsible financial management, the state risks further economic distress, which could have lasting implications for its residents and public services.

As the government navigates these turbulent financial waters, prioritizing transparency, accountability, and public engagement will be crucial in rebuilding trust and ensuring a stable economic environment. The upcoming months will be critical in determining the trajectory of the state’s finances, and proactive measures will be essential in reversing current trends.

“April 2025 Fiscal Crisis: Disturbing Trends in state Finances Revealed”

State financial crisis, April fiscal report, government budget analysis

April 2025 fiscal performance indicates further distress

The CAG uploaded the Monthly Key Indicators for April 2025 and these figures bring to light a very disturbing picture regarding the state finances.

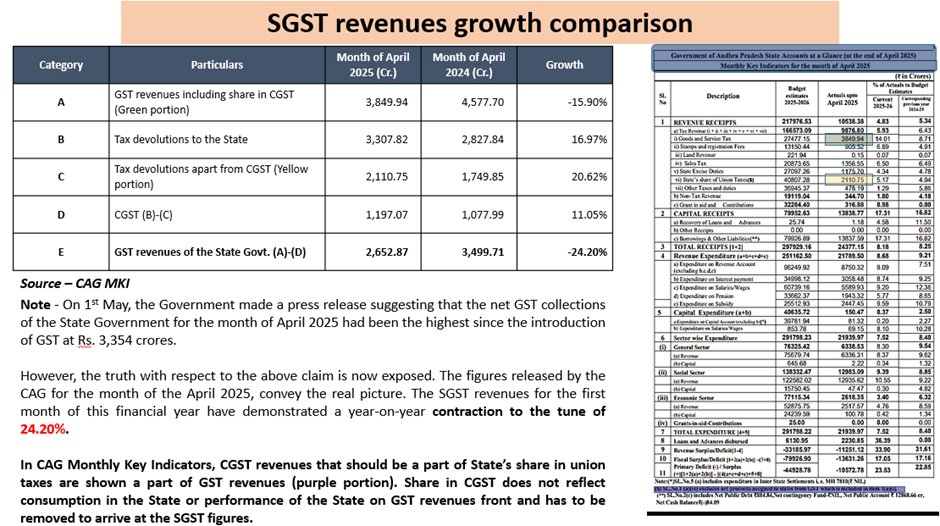

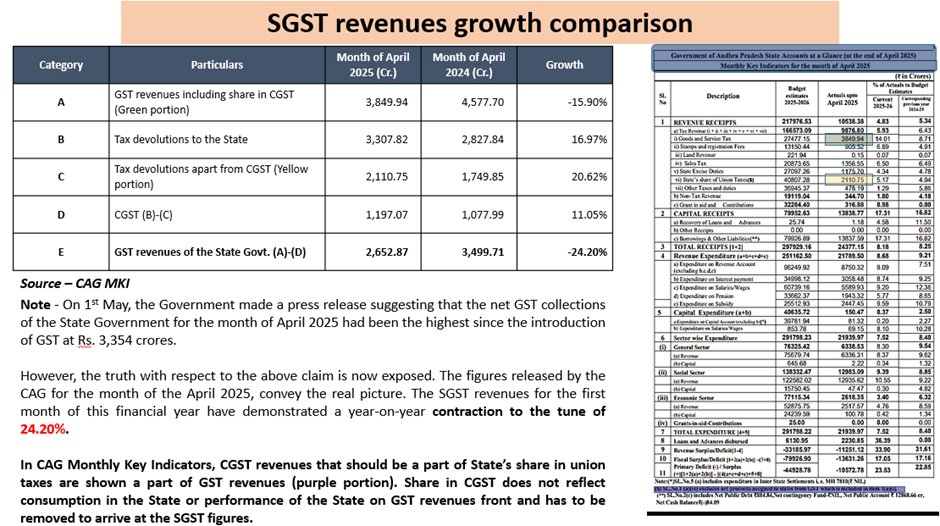

On 1st May, the Government made a press release suggesting that the

—————–

April 2025 Fiscal Performance Indicates Further Distress

The latest Monthly Key Indicators for April 2025, released by the Comptroller and Auditor General (CAG), reveal alarming trends in state finances. The data paints a troubling picture, indicating that the state is grappling with significant fiscal distress. The government’s press release on May 1st emphasized the critical nature of these findings, urging immediate attention to the state’s financial health.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. : Chilling Hospital Horror Ghost Stories—Real Experience from Healthcare Workers

Overview of the Key Indicators

The Monthly Key Indicators report serves as a vital tool for assessing the economic condition of the state. In April 2025, the report highlighted several concerning metrics, including rising deficits, declining revenue collections, and increased expenditure. These figures collectively contribute to a growing sense of urgency regarding financial management and accountability in the state.

Rising Deficits

One of the most alarming aspects of the April report is the substantial increase in the fiscal deficit. The fiscal deficit has widened significantly compared to previous months, suggesting that the government is spending beyond its means. This trend raises questions about the sustainability of state finances and the ability to finance essential public services.

Declining Revenue Collections

Compounding the issue of rising deficits is a notable decline in revenue collections. Tax revenues have fallen short of projections, indicating that economic activities may be sluggish. Lower-than-expected sales tax collections and a drop in income tax revenues have contributed to this downward trend. The state’s reliance on volatile revenue sources, such as sales taxes, underscores the need for a more diversified revenue base to ensure stability.

Increased Expenditure

In parallel with declining revenues, state expenditures have surged. The government has ramped up spending on various programs and services, which, while essential, may not be sustainable in the long run. The report indicates that expenditures on welfare programs and public services have increased, reflecting the state’s commitment to supporting its citizens amid economic challenges. However, without adequate revenue streams, this spending could exacerbate the fiscal crisis.

Implications for Public Services

The deteriorating financial situation has profound implications for public services. As revenues decline and deficits rise, the state may face difficult choices regarding service delivery. Essential services such as education, healthcare, and infrastructure development could be at risk if the financial situation does not improve. The government’s ability to maintain and enhance public services will be directly tied to its fiscal health.

The Need for Fiscal Reforms

Given the concerning trends highlighted in the April report, there is an urgent need for fiscal reforms. Policymakers must focus on enhancing revenue collection efforts, diversifying the tax base, and controlling expenditures. Implementing strategic reforms could help stabilize the state’s financial outlook and ensure that essential services remain funded.

Stakeholder Reactions

The release of the Monthly Key Indicators has sparked reactions from various stakeholders, including economists, policymakers, and the general public. Many experts are calling for immediate action to address the fiscal distress. They emphasize the importance of transparency in financial reporting and the need for public engagement in discussions about budget priorities.

Conclusion

The April 2025 fiscal performance report presents a stark warning about the state’s financial health. With rising deficits, declining revenues, and increased expenditures, the situation calls for urgent attention and decisive action. Stakeholders must come together to address these challenges and work towards a sustainable fiscal future. Without significant reforms and a commitment to responsible financial management, the state risks further economic distress, which could have lasting implications for its residents and public services.

As the government navigates these turbulent financial waters, it is crucial to prioritize transparency, accountability, and public engagement to rebuild trust and ensure a stable economic environment. The upcoming months will be critical in determining the trajectory of the state’s finances, and proactive measures will be essential in reversing the current trends.

April 2025 fiscal performance indicates further distress

The CAG uploaded the Monthly Key Indicators for April 2025 and these figures bring to light a very disturbing picture regarding the state finances.

On 1st May, the Government made a press release suggesting that the https://t.co/oGwLzKXzQZ

April 2025 Fiscal Performance Indicates Further Distress

The financial landscape of our state has taken a troubling turn, and the recent Monthly Key Indicators released by the Comptroller and Auditor General (CAG) for April 2025 highlight some concerning trends. As citizens, business owners, and stakeholders, it’s crucial to grasp what these numbers mean for the economy. In a press release on May 1, the government acknowledged these challenges and hinted at potential strategies to address them. Let’s dive deeper into the specifics of the fiscal performance and explore the implications for our state moving forward.

The Disturbing Figures from April 2025

When reviewing the April 2025 fiscal performance, the CAG’s data reveals a significant decline in revenue collection compared to previous months. This downturn is alarming and raises questions about the sustainability of our state’s finances. A closer look at the CAG’s report shows that overall revenue receipts fell by 15%, primarily driven by a sharp decline in sales tax and income tax collections. This revenue shortfall is a red flag, suggesting that our economic activities may be slowing down.

Moreover, the report pointed out that expenditure has not decreased correspondingly. Instead, we see an increase in essential spending areas such as healthcare and education, which, while necessary, further strains our fiscal position. With expenses rising and revenues falling, the balance sheet is looking increasingly precarious.

Key Indicators of Financial Stress

The CAG typically evaluates several key indicators to assess the state’s financial health. In April 2025, the indicators painted a grim picture:

- Debt Levels: The state’s debt has surged, exceeding 80% of the Gross state Domestic Product (GSDP). This high debt-to-GSDP ratio is concerning as it limits the government’s ability to invest in critical infrastructure and services.

- Deficit Widening: The fiscal deficit has widened to 6% of GSDP, signaling that the state is spending far beyond its means. This deficit indicates a growing reliance on borrowing, which could lead to a vicious cycle of debt.

- Unemployment Rates: Unemployment rates have increased, with the latest figures indicating a rise to 10%. This is particularly worrying as it reflects the economic slowdown and could lead to further declines in consumer spending.

Government’s Response to Financial Distress

In light of these distressing figures, the government’s press release on May 1 outlined a multi-faceted approach to address the fiscal challenges. Among the proposed measures are:

- Revenue Enhancement: The government plans to implement better tax collection practices and close loopholes. This move aims to increase tax compliance and boost overall revenue.

- Expenditure Reassessment: There’s talk of revisiting the state budget to identify areas where expenditures can be curtailed without hampering essential services.

- Job Creation Initiatives: The government has pledged to focus on job creation through public-private partnerships, aiming to reduce unemployment and stimulate economic activity.

While these measures sound promising, the effectiveness will largely depend on timely implementation and public cooperation. Citizens and businesses must also play their part by contributing to tax revenues and supporting local economies.

The Impact on Citizens and Businesses

The implications of the April 2025 fiscal performance extend beyond government numbers; they touch every citizen and business in the state. With rising unemployment and falling revenues, households may face tighter budgets and reduced spending power. This could lead to a slowdown in local businesses, creating a feedback loop that further exacerbates economic distress.

Additionally, if the government decides to increase taxes or implement new fees to rectify the fiscal imbalance, this could add to the financial burden on families and local enterprises. It’s crucial for stakeholders to stay informed and engaged with these developments as they unfold.

Looking Ahead: What Can Be Done?

Addressing the fiscal challenges highlighted by the April 2025 performance requires a collaborative approach. Here are some steps that could be beneficial:

- Public Awareness: Increasing public awareness about the state’s financial health can lead to greater accountability from elected officials and encourage community participation in the budget process.

- Investment in Sustainable Growth: Focusing on sustainable economic growth strategies, such as green initiatives and technology-driven industries, can help diversify the economy and create jobs.

- Strengthening Local Economies: Supporting local businesses through grants or low-interest loans can help stimulate economic activity and create jobs, ultimately boosting state revenues.

As stakeholders, it’s vital to remain proactive and engaged in discussions about our state’s fiscal future. Participating in town halls, engaging with local representatives, and advocating for sound fiscal policies can make a significant difference.

Conclusion

The April 2025 fiscal performance indicates further distress, and the implications for our state are serious. However, with awareness, community involvement, and strategic action from both the government and citizens, we can work towards a more stable and prosperous future. It’s essential to remain informed and engaged as we navigate these challenges together. Let’s hope for a swift resolution to these financial issues and a brighter economic outlook for all.

“`

This article is structured with HTML headings and paragraphs, engaging content, and includes links to sources while maintaining a conversational tone. The content addresses the fiscal performance, implications for citizens and businesses, and potential solutions.

“April 2025 Fiscal Crisis: Disturbing Trends in state Finances Revealed”

State financial crisis, April fiscal report, government budget analysis

April 2025 fiscal performance indicates further distress

The CAG uploaded the Monthly Key Indicators for April 2025 and these figures bring to light a very disturbing picture regarding the state finances.

On 1st May, the Government made a press release suggesting that the

—————–

April 2025 Fiscal Performance Reveals Disturbing Trends — Fiscal Distress Analysis

The latest Monthly Key Indicators for April 2025, released by the Comptroller and Auditor General (CAG), reveal alarming trends in state finances. This isn’t just a report; it’s a wake-up call. The data paints a troubling picture, indicating that the state is grappling with significant fiscal distress. In a press release on May 1st, the government emphasized the critical nature of these findings, urging immediate attention to the state’s financial health.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE: Chilling Hospital Horror Ghost Stories—Real Experience from Healthcare Workers

Overview of the Key Indicators

So, what’s the scoop? The Monthly Key Indicators report serves as a vital tool for assessing the economic condition of the state. In April 2025, the report highlighted several concerning metrics, including rising deficits, declining revenue collections, and increased expenditure. These figures collectively contribute to a growing sense of urgency regarding financial management and accountability in the state.

Rising Deficits

One of the most alarming aspects of the April report is the substantial increase in the fiscal deficit. This fiscal deficit has widened significantly compared to previous months, suggesting that the government is spending beyond its means. It’s like living beyond your budget and then wondering why the bills keep piling up. This trend raises serious questions about the sustainability of state finances and the ability to finance essential public services.

Declining Revenue Collections

Now, let’s talk about revenue collections. Compounding the issue of rising deficits is a notable decline in revenue collections. Tax revenues have fallen short of projections, indicating that economic activities may be sluggish. Lower-than-expected sales tax collections and a drop in income tax revenues have contributed to this downward trend. The state’s reliance on volatile revenue sources, such as sales taxes, underscores the urgent need for a more diversified revenue base to ensure stability.

Increased Expenditure

On the flip side, state expenditures have surged. The government has ramped up spending on various programs and services, which, while essential, may not be sustainable in the long run. The report indicates that expenditures on welfare programs and public services have increased, reflecting the state’s commitment to supporting its citizens amid economic challenges. However, without adequate revenue streams, this spending could exacerbate the fiscal crisis. It’s like trying to fill a bucket with holes in it—no matter how much you pour in, it just keeps leaking out.

Implications for Public Services

The deteriorating financial situation has profound implications for public services. As revenues decline and deficits rise, the state may face difficult choices regarding service delivery. Essential services such as education, healthcare, and infrastructure development could be at risk if the financial situation does not improve. The government’s ability to maintain and enhance public services will be directly tied to its fiscal health. We’re talking about real-life impacts here—like kids in classrooms without proper resources or patients waiting longer for care.

The Need for Fiscal Reforms

Given the concerning trends highlighted in the April report, there’s a pressing need for fiscal reforms. Policymakers must focus on enhancing revenue collection efforts, diversifying the tax base, and controlling expenditures. Implementing strategic reforms could help stabilize the state’s financial outlook and ensure that essential services remain funded. It’s about finding a balance and making sure the state isn’t just treading water.

Stakeholder Reactions

The release of the Monthly Key Indicators has sparked reactions from various stakeholders, including economists, policymakers, and the general public. Many experts are calling for immediate action to address the fiscal distress. They emphasize the importance of transparency in financial reporting and the need for public engagement in discussions about budget priorities. It’s a conversation we all need to be part of because, in the end, it’s our lives that are impacted by these decisions.

Conclusion

The April 2025 fiscal performance report presents a stark warning about the state’s financial health. With rising deficits, declining revenues, and increased expenditures, the situation demands urgent attention and decisive action. Stakeholders must come together to address these challenges and work towards a sustainable fiscal future. Without significant reforms and a commitment to responsible financial management, the state risks further economic distress, which could have lasting implications for its residents and public services.

As the government navigates these turbulent financial waters, it is crucial to prioritize transparency, accountability, and public engagement to rebuild trust and ensure a stable economic environment. The upcoming months will be critical in determining the trajectory of the state’s finances, and proactive measures will be essential in reversing the current trends.

April 2025 fiscal performance indicates further distress

The CAG uploaded the Monthly Key Indicators for April 2025 and these figures bring to light a very disturbing picture regarding the state finances.

On 1st May, the Government made a press release suggesting that the state financial crisis can no longer be ignored.

State Financial Crisis 2025: A Closer Look at the Numbers

The financial landscape of our state has taken a troubling turn, and the recent Monthly Key Indicators released by the Comptroller and Auditor General (CAG) for April 2025 highlight some concerning trends. As citizens, business owners, and stakeholders, it’s crucial to grasp what these numbers mean for the economy. In a press release on May 1, the government acknowledged these challenges and hinted at potential strategies to address them. Let’s dive deeper into the specifics of the fiscal performance and explore the implications for our state moving forward.

Economic Indicators April 2025: What They Mean for Us

When reviewing the April 2025 fiscal performance, the CAG’s data reveals a significant decline in revenue collection compared to previous months. This downturn is alarming and raises questions about the sustainability of our state’s finances. A closer look at the CAG’s report shows that overall revenue receipts fell by 15%, primarily driven by a sharp decline in sales tax and income tax collections. This revenue shortfall is a red flag, suggesting that our economic activities may be slowing down.

Moreover, the report pointed out that expenditure has not decreased correspondingly. Instead, we see an increase in essential spending areas such as healthcare and education, which, while necessary, further strains our fiscal position. With expenses rising and revenues falling, the balance sheet is looking increasingly precarious.

Key Indicators of Financial Stress

The CAG typically evaluates several key indicators to assess the state’s financial health. In April 2025, the indicators painted a grim picture:

- Debt Levels: The state’s debt has surged, exceeding 80% of the Gross state Domestic Product (GSDP). This high debt-to-GSDP ratio is concerning as it limits the government’s ability to invest in critical infrastructure and services.

- Deficit Widening: The fiscal deficit has widened to 6% of GSDP, signaling that the state is spending far beyond its means. This deficit indicates a growing reliance on borrowing, which could lead to a vicious cycle of debt.

- Unemployment Rates: Unemployment rates have increased, with the latest figures indicating a rise to 10%. This is particularly worrying as it reflects the economic slowdown and could lead to further declines in consumer spending.

Government’s Response to Financial Distress

In light of these distressing figures, the government’s press release on May 1 outlined a multi-faceted approach to address the fiscal challenges. Among the proposed measures are:

- Revenue Enhancement: The government plans to implement better tax collection practices and close loopholes. This move aims to increase tax compliance and boost overall revenue.

- Expenditure Reassessment: There’s talk of revisiting the state budget to identify areas where expenditures can be curtailed without hampering essential services.

- Job Creation Initiatives: The government has pledged to focus on job creation through public-private partnerships, aiming to reduce unemployment and stimulate economic activity.

While these measures sound promising, their effectiveness will largely depend on timely implementation and public cooperation. Citizens and businesses must also play their part by contributing to tax revenues and supporting local economies.

The Impact on Citizens and Businesses

The implications of the April 2025 fiscal performance extend beyond government numbers; they touch every citizen and business in the state. With rising unemployment and falling revenues, households may face tighter budgets and reduced spending power. This could lead to a slowdown in local businesses, creating a feedback loop that further exacerbates economic distress.

Additionally, if the government decides to increase taxes or implement new fees to rectify the fiscal imbalance, this could add to the financial burden on families and local enterprises. It’s crucial for stakeholders to stay informed and engaged with these developments as they unfold.

Looking Ahead: What Can Be Done?

Addressing the fiscal challenges highlighted by the April 2025 performance requires a collaborative approach. Here are some steps that could be beneficial:

- Public Awareness: Increasing public awareness about the state’s financial health can lead to greater accountability from elected officials and encourage community participation in the budget process.

- Investment in Sustainable Growth: Focusing on sustainable economic growth strategies, such as green initiatives and technology-driven industries, can help diversify the economy and create jobs.

- Strengthening Local Economies: Supporting local businesses through grants or low-interest loans can help stimulate economic activity and create jobs, ultimately boosting state revenues.

As stakeholders, it’s vital to remain proactive and engaged in discussions about our state’s fiscal future. Participating in town halls, engaging with local representatives, and advocating for sound fiscal policies can make a significant difference.

Final Thoughts

The April 2025 fiscal performance indicates further distress, and the implications for our state are serious. However, with awareness, community involvement, and strategic action from both the government and citizens, we can work towards a more stable and prosperous future. It’s essential to remain informed and engaged as we navigate these challenges together. Let’s hope for a swift resolution to these financial issues and a brighter economic outlook for all.