BREAKING: $200M USDC Minted! Markets Set for Explosive Surge!

Understanding the Impact of USDC Minting on Cryptocurrency Markets

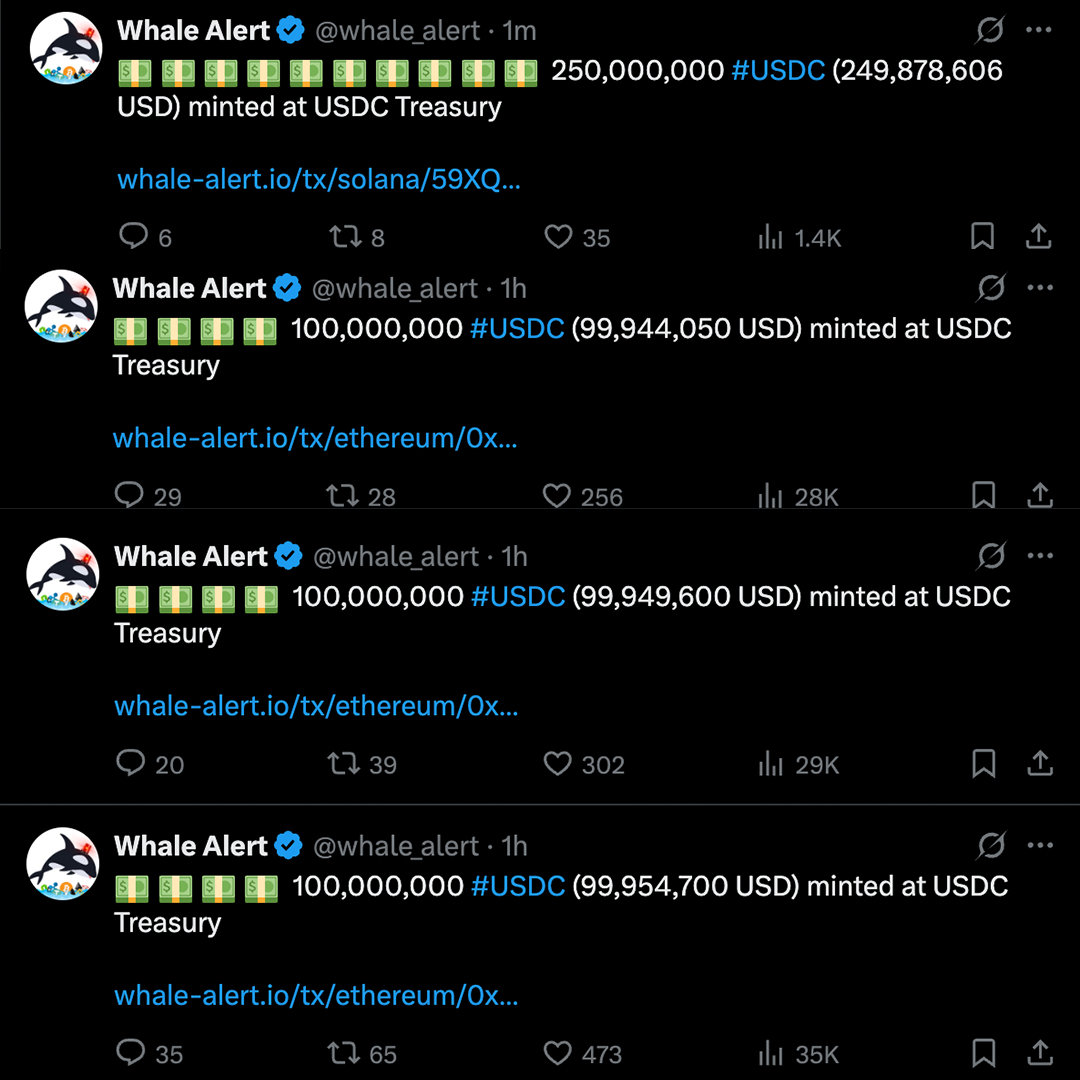

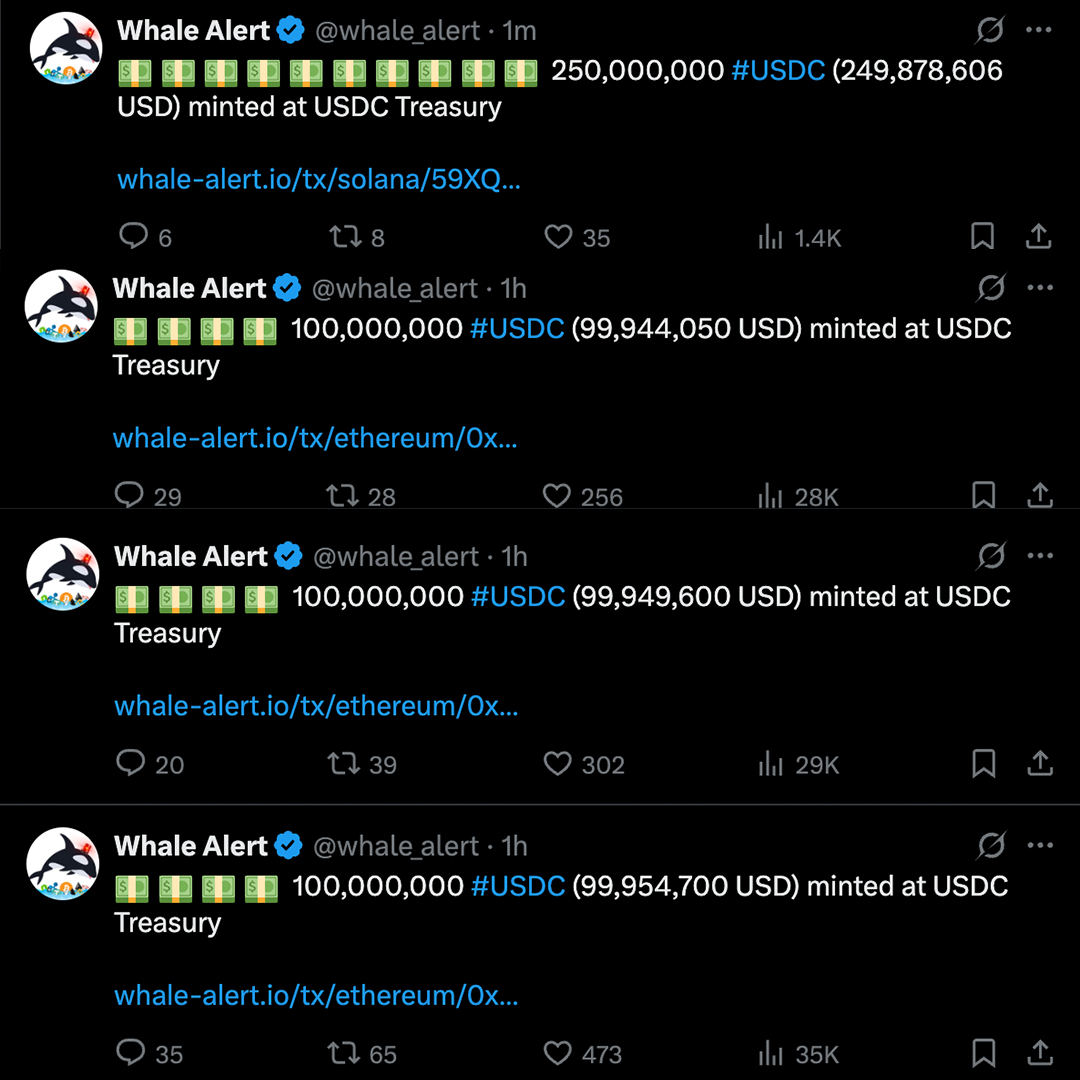

In the dynamic world of cryptocurrency, real-time updates can have a significant impact on market trends and investor sentiment. A recent tweet from prominent crypto influencer Ash Crypto revealed that another $200 million in USD Coin (USDC) was minted at the USDC Treasury, bringing the total to a staggering $550 million minted on that day alone. This announcement has sent ripples through the crypto community, sparking discussions about the potential implications for market dynamics.

What Does USDC Minting Mean?

USDC is a type of stablecoin, which means its value is pegged to the US dollar. The minting process involves creating new coins that are backed by corresponding reserves of fiat currency. This process is crucial for maintaining liquidity in the cryptocurrency market, allowing investors to trade in and out of positions without significant volatility.

When large amounts of USDC are minted, it often indicates a growing demand for liquidity in the market. This demand can be driven by increased trading activity or as a response to market conditions that require more stable assets to hedge against volatility.

The Day’s Minting Breakdown

On June 3, 2025, the announcement of $550 million being minted in a single day is unprecedented and noteworthy. The initial $200 million minting was part of a broader trend that investors must pay attention to. Such a substantial influx of USDC could serve multiple purposes:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Market Liquidity: More USDC in circulation means that traders have greater access to stable assets, enabling them to execute trades quickly and efficiently. This influx can help stabilize prices during times of market volatility.

- Increased Trading Activity: The minting of USDC often corresponds with heightened trading activity, particularly in decentralized finance (DeFi) protocols and exchanges. Traders may perceive this minting as a signal to enter the market, potentially leading to price surges in various cryptocurrencies.

- Investor Sentiment: The announcement itself can influence investor sentiment. Phrases like "Pump the markets" suggest that the crypto community is optimistic about the immediate future, which can lead to increased buying pressure.

Market Reactions to the Minting

Historically, significant minting events of USDC have been followed by increased trading volumes and price movements across various cryptocurrencies. The market’s reaction to this announcement will depend on several factors:

- Market Conditions: If the overall sentiment in the crypto market is bullish, the minting of USDC could act as a catalyst for further price increases. Conversely, if the market is experiencing bearish trends, even a large amount of minted USDC may not have the desired effect.

- news Cycle: The broader news cycle can also play a role. If there are positive developments in the cryptocurrency space, such as regulatory clarity or institutional adoption, the minting of USDC could amplify bullish sentiments.

- Technical Analysis: Traders often rely on technical indicators to guide their decisions. A significant minting event could shift technical patterns, prompting traders to adjust their strategies accordingly.

Potential Implications for Investors

For investors, the minting of $550 million in USDC presents both opportunities and risks. Here are some considerations:

- Short-Term Opportunities: Traders looking to capitalize on short-term price movements may find opportunities in the wake of such announcements. The excitement generated by large minting events can lead to quick gains.

- Long-Term Strategy: For long-term investors, understanding the implications of increased USDC supply is essential. While it can indicate a healthier market, excessive minting without corresponding demand could lead to devaluation.

- Diversification: As always, diversification remains a key strategy. Investors should consider holding a mix of stablecoins like USDC alongside other cryptocurrencies to balance their portfolios.

The Future of USDC and Stablecoins

The minting of USDC reflects broader trends in the stablecoin market. As digital currencies continue to gain acceptance and adoption, stablecoins are likely to play an increasingly important role in facilitating transactions and providing liquidity.

- Regulatory Developments: The future of stablecoins like USDC may be influenced by regulatory developments. Governments around the world are beginning to formulate policies regarding digital currencies, which could impact how stablecoins are used and traded.

- Technological Innovations: Innovations in blockchain technology may lead to the development of new stablecoins or improvements in existing ones. This could enhance the functionality and appeal of USDC as a stable asset.

- Integration into DeFi: As decentralized finance continues to grow, stablecoins will be integral to the ecosystem. USDC’s role in lending, borrowing, and yield farming will likely expand, further solidifying its position in the market.

Conclusion

The recent minting of another $200 million in USDC, totaling $550 million minted on June 3, 2025, has sparked excitement and speculation in the cryptocurrency markets. This event highlights the importance of stablecoins in providing liquidity and stability in an otherwise volatile environment.

For investors and traders, understanding the implications of such minting events is crucial for making informed decisions. As the landscape of cryptocurrency continues to evolve, staying updated on developments like this will be essential for navigating the complex world of digital assets.

In summary, the impact of USDC minting is multifaceted, influencing market dynamics, investor sentiment, and the future of stablecoins. By keeping a close eye on these developments, stakeholders can position themselves to capitalize on opportunities in the ever-changing crypto landscape.

BREAKING:

ANOTHER $200M USDC JUST MINTED AT USDC TREASURY – $550 MILLION MINTED TODAY!

PUMP THE MARKETS pic.twitter.com/Rj85XSdPka

— Ash Crypto (@Ashcryptoreal) June 3, 2025

BREAKING:

Hey there, crypto enthusiasts! If you’ve been keeping an eye on the crypto market lately, you probably saw the buzz surrounding the recent minting of USDC. This isn’t just any old news—another $200M USDC just minted at USDC Treasury, contributing to a staggering total of $550 million minted today! Exciting, right? Let’s delve into what this means for the market and why you should care.

ANOTHER $200M USDC JUST MINTED AT USDC TREASURY

So, what does this mean when we say another $200 million USDC just minted at USDC Treasury? Essentially, USDC, a popular stablecoin pegged to the US dollar, is being minted or created in massive quantities. This minting process usually indicates a growing demand for stablecoins in the crypto ecosystem. When more USDC is minted, it often reflects increased trading activity or the need for liquidity in the market.

The recent minting at the USDC Treasury, as reported by Ash Crypto, shows a significant move by the Treasury to inject liquidity into the market. But why is this important? Well, for traders and investors, it signals that there’s a lot of money flowing into the crypto space, which can often lead to price increases for various cryptocurrencies.

$550 MILLION MINTED TODAY!

The fact that $550 million minted today is a massive indicator of market sentiment. When large amounts of USDC are minted, it generally leads to a surge in trading volume across exchanges. This can lead to price spikes, especially for cryptocurrencies that traders are looking to buy with their newly minted USDC.

Moreover, this minting can also act as a catalyst for other market movements. If traders see that there’s a significant increase in USDC, they might start buying up tokens, leading to a domino effect of price increases across the board. It’s like a chain reaction where the excitement of new money entering the market leads to more buying and, consequently, higher prices.

PUMP THE MARKETS

Now, let’s talk about the phrase PUMP THE MARKETS . It’s an exciting call to action that many in the crypto community often use when they anticipate a price surge. The injection of $550 million in USDC could be the spark that ignites a frenzied buying spree. Investors are always looking for reasons to jump into the market, and a substantial minting event like this is a clear signal that there’s potential for growth.

In the world of cryptocurrencies, sentiment can change in an instant. News like this can create a bullish trend where traders feel more confident about investing their money, leading to increased demand and higher prices. If you’re in the market, it’s essential to stay updated with these developments, as they can significantly impact your investment strategies.

Understanding USDC and Its Impact on the Market

USDC is a stablecoin that’s gaining traction in the crypto world due to its reliability and backing by real assets. Each USDC is backed by a US dollar, ensuring that its value remains stable. This stability makes USDC a popular choice for traders looking to minimize risk while still participating in the volatile crypto market.

The recent minting of USDC reflects a broader trend where more investors are turning to stablecoins as a safe haven during market fluctuations. As traders exchange volatile cryptocurrencies for USDC, it creates a more stable environment for trading and investing.

Market Reactions and Predictions

Following the news of the minting, market reactions can vary. Some traders might rush to buy leading cryptocurrencies like Bitcoin and Ethereum, anticipating a price increase. Others might be more cautious, waiting to see how the market stabilizes before making any moves.

Analysts are closely watching these developments, and many are predicting that this fresh influx of USDC could lead to a bullish trend. If the momentum continues, we might see significant price increases across various cryptocurrencies in the coming days and weeks. But as always, it’s crucial to do your research and understand the risks involved in crypto trading.

The Role of News in Cryptocurrency Trading

In the world of cryptocurrency, news plays a pivotal role in influencing market trends. Events like this minting can significantly sway investor sentiment, leading to rapid price changes. That’s why staying informed about the latest news, like the recent minting of USDC, is crucial for anyone involved in trading or investing in cryptocurrencies.

Social media platforms, particularly Twitter, have become essential tools for real-time updates in the crypto space. Traders often rely on trusted sources and influencers to provide insights into market movements. So, if you’re not already following key figures in the industry, now might be a good time to start!

The Future of Stablecoins

As we look ahead, it’s clear that stablecoins like USDC will continue to play a significant role in the cryptocurrency ecosystem. Their ability to provide stability amidst the volatility of other cryptocurrencies makes them a popular choice for both traders and investors.

The recent minting of $550 million could be just the beginning. As more people and institutions recognize the value of stablecoins, we can expect to see even more significant minting events in the future. This could lead to a more stable and robust crypto market overall.

Conclusion

The crypto market is buzzing with excitement following the latest news about the minting of USDC. With $200M USDC just minted at USDC Treasury and a total of $550 million minted today, it’s clear that there’s a lot of action happening behind the scenes. This could mean great opportunities for traders and investors looking to capitalize on the market’s movements.

So, what’s next? Keep your eyes peeled for market reactions, and don’t forget to stay informed about upcoming trends and developments in the crypto space. Happy trading!