CBI Shocks Nation: Senior Tax Officer Arrested in Major Scandal!

CBI Arrests Senior IRS officer Amit Kumar Singhal in Corruption Case

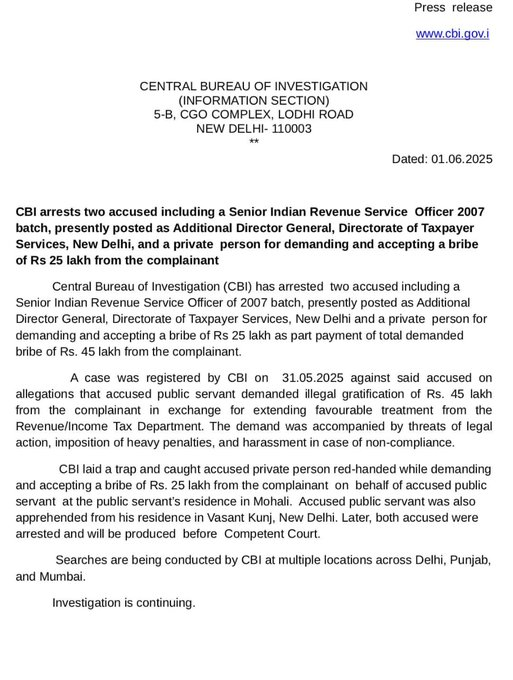

In a significant development, the Central Bureau of investigation (CBI) has apprehended a senior Indian Revenue Service (IRS) officer, Amit Kumar Singhal, who was serving as the Additional Director General in the Directorate of Tax Payer Services, New Delhi. This arrest, reported on June 1, 2025, has raised alarms about integrity in public service and has placed the spotlight on corruption within government ranks.

Background of the Case

Amit Kumar Singhal, an officer of the Indian Revenue Service, is known for his role in overseeing tax collection and taxpayer services in India. His position in the Directorate of Tax Payer Services made him a critical player in the enforcement of tax compliance and the management of taxpayer grievances. However, the recent arrest signifies a troubling trend of corruption among high-ranking officials in the Indian tax administration.

The CBI has not only arrested Singhal but has also detained a private individual in connection with the case. While details about the private person remain scarce, the investigation suggests that there may have been collusion between Singhal and external entities, potentially including businesses or individuals seeking favorable tax treatment.

Implications of the Arrest

The arrest of a senior IRS officer is indicative of the broader crackdown on corruption in India. The CBI’s actions highlight the agency’s commitment to holding public officials accountable and restoring public trust in governmental institutions. Such high-profile arrests can serve as a deterrent to other officials who may consider engaging in corrupt practices.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Moreover, the case sheds light on the challenges faced by the Indian tax administration. With a vast economy and diverse taxpayer base, ensuring compliance and reducing corruption remains a top priority for the government. The arrest of Singhal could prompt a reevaluation of policies and oversight mechanisms within the Directorate of Tax Payer Services.

Public and Media Reaction

The news of Singhal’s arrest has sparked considerable discussion on social media platforms and news outlets. Many users have taken to platforms like Twitter to express their opinions on the matter, with hashtags such as #BreakingNews trending. Public sentiment appears to be largely in favor of the CBI’s actions, with many applauding the agency’s efforts to tackle corruption in high places.

Media coverage has focused on the implications of this arrest for the Indian Revenue Service and the broader implications for governance in India. Analysts suggest that the incident could lead to increased scrutiny of IRS officials and may prompt further investigations into potential corruption within the department.

The Role of the CBI

The Central Bureau of Investigation is India’s premier investigative agency, tasked with tackling corruption and serious crimes. The CBI operates under the jurisdiction of the Ministry of Personnel, Public Grievances and Pensions and has a mandate to investigate and prosecute cases of corruption involving public officials.

The agency’s involvement in this case underscores its role as a watchdog over public integrity. By arresting officials like Amit Kumar Singhal, the CBI aims to reinforce the message that corruption will not be tolerated and that there are consequences for those who abuse their positions of power.

Future Developments

As the investigation into Amit Kumar Singhal and the associated parties unfolds, it remains to be seen what further revelations may come to light. The CBI is likely to delve deeper into the financial transactions and relationships that may have contributed to the alleged corruption. This could potentially unveil a network of corrupt practices extending beyond Singhal himself.

In the coming weeks, updates from the CBI and related agencies will be closely monitored by the public and the media. The case could lead to significant policy discussions about the need for reform in the IRS and improved mechanisms for oversight and accountability.

Conclusion

The arrest of Amit Kumar Singhal by the CBI represents a pivotal moment in the fight against corruption within India’s tax administration. It raises critical questions about the integrity of public officials and the systems in place to prevent corrupt practices. As the investigation progresses, the implications of this case will likely resonate across the government and influence future efforts to combat corruption.

This incident serves as a reminder of the importance of transparency and accountability in public service. Citizens expect their government officials to uphold the highest ethical standards, and the CBI’s actions signal a commitment to ensuring that those standards are maintained. As the narrative continues to unfold, the public will be watching closely to see how the situation develops and what measures will be taken to prevent similar occurrences in the future.

#BreakingNews | The Central Bureau of Investigation (CBI) has arrested a senior Indian Revenue Service Officer, presently posted as Additional Director General in Directorate of Tax Payer Services, New Delhi, identified as Amit Kumar Singhal and a private person identified as… pic.twitter.com/hNR6FFtSAX

— DD News (@DDNewslive) June 1, 2025

Breaking News: CBI Arrests Senior Indian Revenue Service Officer

The Central Bureau of Investigation (CBI) has made headlines by arresting a senior officer from the Indian Revenue Service, Amit Kumar Singhal, who is currently serving as the Additional Director General in the Directorate of Tax Payer Services in New Delhi. This incident has raised eyebrows and sparked conversations across various platforms, especially given the implications it carries for India’s tax administration and governance.

Who is Amit Kumar Singhal?

Amit Kumar Singhal has been a prominent figure in the Indian Revenue Service. His role as the Additional Director General places him in a critical position where he oversees tax policies and taxpayer services. With his extensive experience in handling various aspects of tax administration, his arrest raises significant questions about integrity and accountability within the service. You can find more about the CBI arrest of Singhal in detail through resources like [DD News](https://twitter.com/DDNewslive/status/1929045225768628336).

The Arrest: Details and Implications

The CBI’s action against Singhal comes amid ongoing investigations into corruption and misconduct within the tax department. While specific details surrounding the charges against him remain scarce, the arrest of such a high-ranking official signifies the agency’s commitment to rooting out corruption. This move could potentially lead to a broader investigation involving other officials within the Directorate of Tax Payer Services.

It’s crucial to understand that the CBI operates under strict legal frameworks, and their decision to arrest Singhal indicates substantial evidence against him. A private individual was also arrested alongside Singhal, suggesting that the investigation may involve additional parties who could have contributed to any alleged wrongdoing.

Public Reaction and Media Coverage

The arrest has been covered extensively in the media, with many outlets discussing its potential ramifications. Social media platforms, particularly Twitter, have seen a surge in conversations about the incident. The trending hashtag #BreakingNews highlights public interest and concern regarding the integrity of tax administration in India. Many are calling for deeper investigations and accountability measures to prevent future incidents.

The arrest has also reignited discussions about the effectiveness of the CBI in combating corruption. While many commend the agency’s proactive approach, others express skepticism about the outcomes of such arrests and whether they lead to meaningful reforms within the bureaucratic system.

Understanding CBI’s Role in Corruption Cases

The CBI is India’s premier investigative agency, often tasked with handling high-profile cases involving corruption, economic offenses, and organized crime. Its mandate includes enforcing laws related to corruption and ensuring that public officials are held accountable for their actions. The agency’s involvement in cases like Singhal’s underscores its crucial role in maintaining public trust in governance.

However, the effectiveness of the CBI has been a topic of debate. Critics argue that while the agency may successfully apprehend individuals, systemic issues within the bureaucracy often remain unaddressed. This raises questions about whether arrests lead to real change or simply serve as a means to placate public outrage.

The Broader Context of Tax Administration in India

India’s tax administration has been under scrutiny for years, with various reports highlighting issues of corruption and inefficiency. Taxpayer services are meant to simplify the process for individuals and businesses, ensuring compliance and fairness in tax collection. However, allegations of misconduct can erode public trust and lead to a perception of a system that favors the dishonest.

The arrest of a senior official like Amit Kumar Singhal can serve as both a warning and an opportunity for reform. It emphasizes the need for greater transparency within the tax system and the importance of rigorous oversight to ensure that those in power are held accountable.

Looking Ahead: What This Means for the Future

As the investigation unfolds, it will be interesting to see how the CBI handles the case against Singhal and the private individual involved. Will this lead to further inquiries into tax administration practices, or will it be a singular event without lasting consequences? The public and stakeholders in the tax system will be watching closely.

This incident may also prompt policymakers to consider reforms that strengthen the integrity of the tax administration. There is a growing recognition that systemic change is necessary to foster a culture of accountability and ethical governance.

In the coming weeks, the developments surrounding this case will likely influence public opinion and potentially lead to calls for broader reforms in tax administration and governance practices in India.

Conclusion: The Importance of Accountability

The arrest of Amit Kumar Singhal serves as a crucial reminder of the importance of accountability within public service. While the CBI’s actions may spark discussions about corruption in India, they also present an opportunity for meaningful change. Addressing systemic issues within the tax administration will require a concerted effort from all stakeholders, including government officials, the CBI, and the public.

As the investigation continues and more information becomes available, staying informed will be essential. Engaging with this issue is not just about one individual’s arrest; it’s about advocating for a system where integrity and transparency are prioritized, ensuring that public trust in governance is restored.

For the latest updates on this developing story, follow reputable news sources or check out the ongoing coverage on social media platforms.